Japan’s Q4 GDP Growth Misses Forecasts, Highlighting Weak Economic Rebound

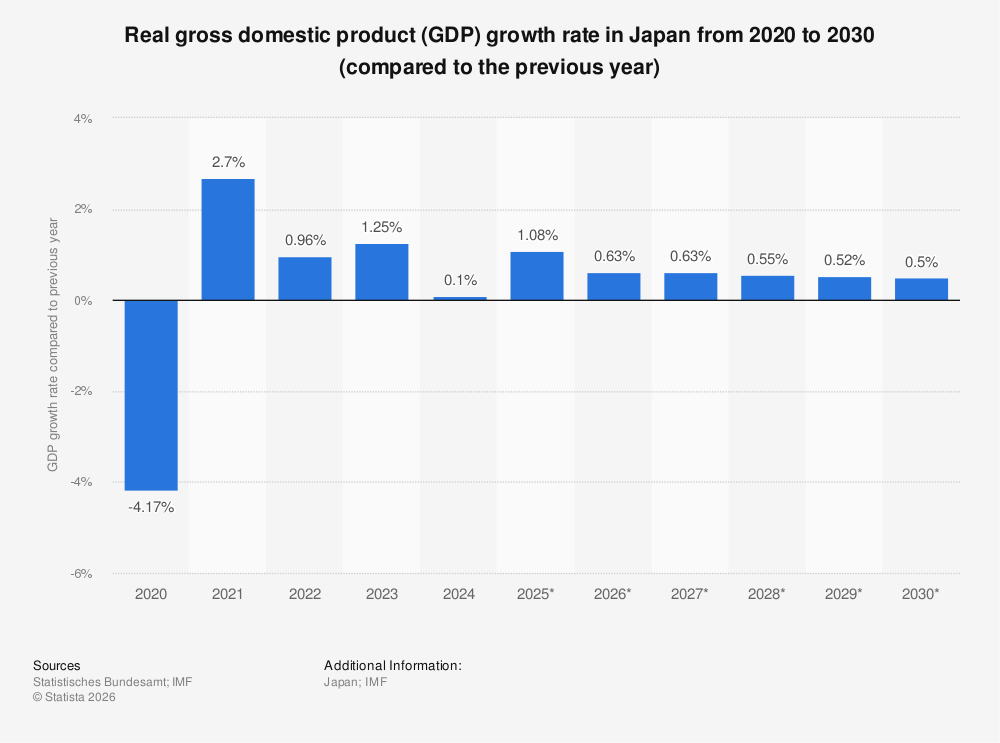

Japan’s economy showed mild growth in the fourth quarter of 2025, expanding by just 0.1% on a quarterly basis and 0.2% annualized — figures that came in well below economists’ expectations and underline persistent economic struggles. This slow pace of expansion narrowly prevented a technical recession following a contraction in the prior quarter, yet raises important questions about domestic demand, export performance, and the future direction of policy.

Japanese Economic Growth Barely Positive as Rebound Underwhelms

Japan’s latest economic data showed that GDP grew by 0.1% quarter-on-quarter in Q4 2025, a modest rebound from the 0.7% contraction in the previous quarter but significantly below the 0.4% growth forecast analysts had expected.

On an annualized basis, the economy expanded by just 0.2%, far short of the 1.6% economists had predicted. Japan narrowly avoided a technical recession due to this tiny uptick, as a continuation of contraction would have marked two consecutive quarters of negative growth.

Despite this slight bounce, the underperformance compared to forecasts suggests that the economic recovery remains fragile, with weak consumption and export demand contributing to the slow pace of growth.

Domestic Demand and Consumption Remain Weak

Private consumption — the largest component of Japan’s GDP — showed only minimal improvement in the final quarter, rising by about 0.1%, reflecting ongoing pressure from elevated living costs and muted consumer confidence.

Capital expenditure and business investment also remained sluggish, with companies hesitant to commit to large outlays amid global uncertainties and slow demand. Export performance weakened, partly due to slowing global trade and tariff pressures elsewhere.

This pattern points to an economy that is still trying to gain footing after earlier contractions, and highlights the need for stronger domestic drivers of growth.

Fiscal Policy and Government Measures in Focus

The weak GDP figures pose a test for Japan’s new government under Prime Minister Sanae Takaichi, who has pledged pro-growth fiscal policies, including increased public spending and potential tax adjustments to stimulate demand.

With exports lagging, Japan may rely more on domestic stimulus to offset global headwinds. Some analysts expect that fiscal support — including targeted relief for households and incentives for business investment — will be accelerated to provide momentum. This could mean larger supplemental budgets or tax breaks aimed at boosting consumer spending.

Monetary Policy: Bank of Japan Faces a Delicate Balance

The Bank of Japan’s policy stance remains critical to future growth prospects. Despite persistent inflation pressure, policymakers are cautious about further rate hikes given the underwhelming GDP performance.

Japan’s central bank lifted interest rates to multi-decade highs in late 2025, but the slow growth reading for Q4 may temper expectations for aggressive tightening in the near term. The BOJ must balance inflation control against the risk of further slowing growth, especially if wages and domestic demand fail to strengthen.

Market and Currency Reactions

Financial markets reacted to the GDP miss, with the Japanese yen weakening as investors reassessed expectations for monetary policy tightening. The currency’s slide reflects caution among traders and underscores concerns about Japan’s growth prospects.

Global markets also responded, with broader Asian equities subdued and cautious sentiment among investors amid mixed signals from economic data and policy outlooks. The weak growth print could influence risk assets and shape trading behavior in currency and bond markets.

Why This Matters Now

This latest GDP report arrives at a crucial moment for the global and Japanese economy. With slowing global growth, persistent inflationary pressure, and central banks worldwide recalibrating policy, Japan’s performance has implications beyond its borders.

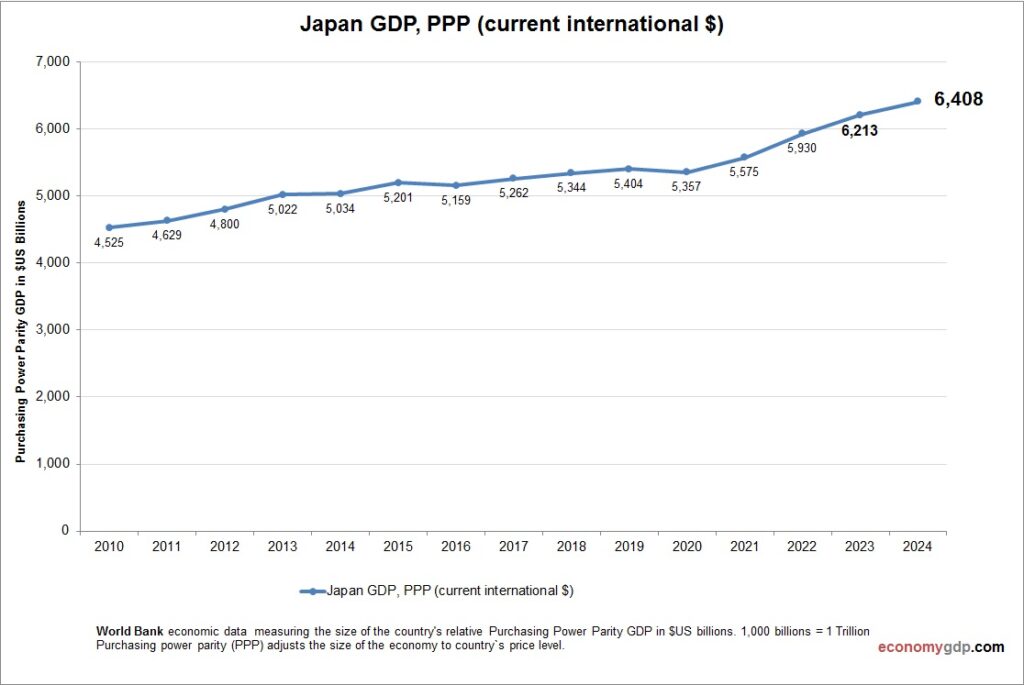

For investors and policymakers, Japan’s underwhelming rebound underscores structural challenges — such as an aging population and weak domestic demand — that have long shaped its economic trajectory. As the world watches, decisions on fiscal stimulus and monetary policy could significantly affect markets and confidence in future growth.

The Bottom Line

Japan’s economic comeback from prior contractions in 2025 has been extremely soft, with GDP growth in the final quarter falling short of expectations. While the country managed to avoid a recession on paper, the narrow margin and weak underlying details suggest that more support may be needed from both fiscal and monetary policymakers to sustain a meaningful recovery. Continued focus on consumption, investment, and export competitiveness will be essential in the coming quarters.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.