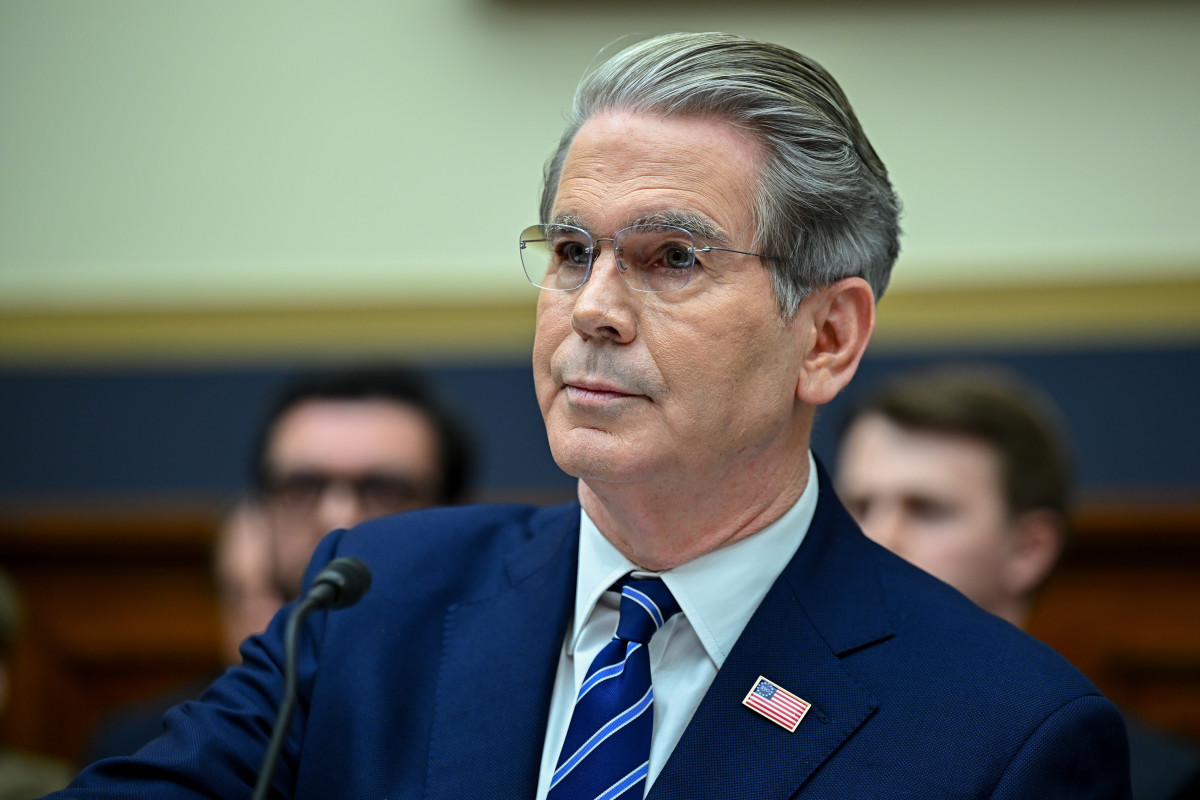

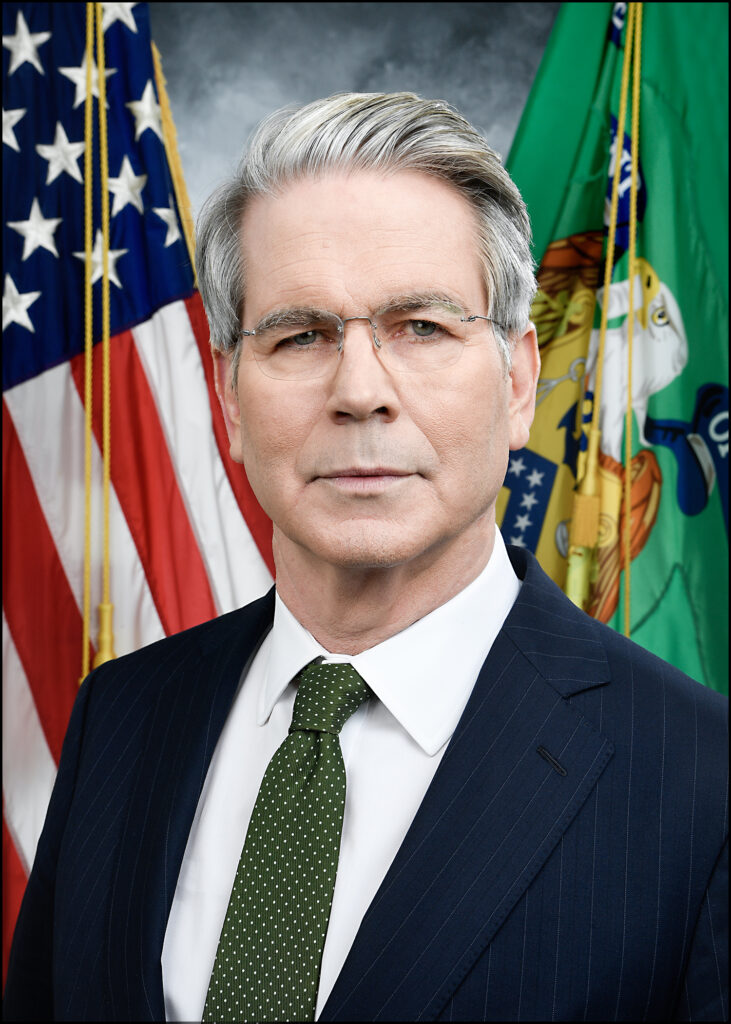

Treasury Secretary Bessent Warns Coinbase Is Blocking Critical U.S. Crypto Legislation

Treasury Secretary Bessent warns Coinbase is blocking major legislation as the fight over the Digital Asset Market CLARITY Act intensifies in Washington, D.C., placing the future of U.S. crypto regulation at a critical crossroads. In candid remarks to lawmakers, Secretary Scott Bessent said that resistance from Coinbase — the country’s largest crypto exchange — and similar industry actors is slowing progress on legislation that would bring clarity and oversight to a market worth trillions. This dispute shifts the narrative from innovation to political friction, raising questions about power, policy, and the future stability of digital finance.

The debate pits regulatory certainty against industry freedom, with broader implications for consumers, investors, and financial markets.

What the CLARITY Act Is and Why This Matters Now

The Digital Asset Market CLARITY Act is a long-anticipated bill in the U.S. Legislature designed to clarify how digital assets are regulated, without ambiguity between agencies such as the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC). Its goals include:

Defining how crypto tokens are categorized and overseen.

Establishing rules for stablecoins and other digital products.

Creating a compliance framework to protect consumers and prevent fraud.

Treasury Secretary Bessent argues that passing this bill now is essential to bring stability to an industry that has struggled under fragmented regulation for years, and that failure to do so could leave the U.S. behind global competitors.

However, Coinbase’s leadership says certain provisions could stifle innovation, restrict decentralized finance (DeFi) mechanisms, and limit how stablecoins can generate returns for users. Coinbase CEO Brian Armstrong has stated publicly that he would prefer no legislation to bad legislation, a stance that Treasury officials say effectively slows progress in Congress.

Coinbase’s Position Explained

Coinbase’s objections are not a flat rejection of regulation — rather, they highlight what the exchange believes are problematic clauses in the CLARITY Act draft:

Restrictions on yield-producing stablecoin programs.

Rules that could impede decentralized finance activity.

Language that might favor traditional banks over crypto innovators.

Industry leaders argue that innovation thrives when regulatory frameworks are clear but flexible, and that overly strict limits could shift capital and talent offshore. Coinbase’s stand has energized crypto advocates who fear the legislation might favor large financial incumbents over digital-native firms.

At the same time, Treasury officials see certain stablecoin rewards as risk factors that could pull deposits out of regulated banks, potentially affecting lending and economic stability.

Bipartisan Frustration in Congress

Treasury Secretary Bessent’s critiques are backed by frustration from key lawmakers across both parties. During recent hearings, Bessent warned that continued resistance could delay critical oversight and harm U.S. competitiveness in the global digital economy. Democratic Senator Mark Warner reportedly echoed concerns about legislative gridlock around crypto policy.

The standstill in the Senate Banking Committee — where crypto regulation must advance to succeed — has made headlines among finance and tech audiences alike, because it marks one of the highest-profile clashes between blockchain industry leaders and federal policymakers in recent years.

Market Impact and Industry Reactions

The political tug-of-war over the CLARITY Act comes at a time when crypto markets are feeling pressure from volatility, regulatory uncertainty, and declining prices. Some investors believe uncertainty in Washington contributes to bearish sentiment in digital assets, while others argue that regulation is urgently needed to foster mainstream institutional participation.

Industry figures have responded differently:

Some insiders see Coinbase’s stance as principled defense of innovation.

Other stakeholders argue that compromise is necessary to unlock broader adoption and legal certainty.

Bank lobby groups have pushed for strong stablecoin rules to protect deposit systems.

The outcome could have real consequences for how countries around the world approach digital currencies — potentially making the U.S. either a regulatory leader or a laggard in global crypto governance.

What Happens Next

With negotiations ongoing, both sides say they want workable legislation. Treasury officials are seeking to reopen discussions and find common ground that satisfies market integrity without curbing innovation. Industry representatives still hope to secure protections that preserve decentralized finance and consumer incentives.

The next weeks and months will be critical as congressional committees work toward a final text. There’s broad agreement among analysts that failure to achieve consensus will prolong uncertainty and could dampen investor confidence — while successful passage might bring a wave of new institutional capital into digital assets.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.