In a landmark moment that reshapes Wall Street’s view of retail, Walmart’s market valuation surpassed $1 trillion for the first time, cementing its position not just as America’s largest retailer but as a titan on par with Big Tech giants. This achievement — driven by stronger stock performance, expert strategy shifts, and fast-growing digital services — signifies a major shift in how the market values retail and tech integration. Why this matters now: It marks a turning point where traditional retail has earned a seat among the most valuable global corporations, influencing investor confidence and consumer markets alike.

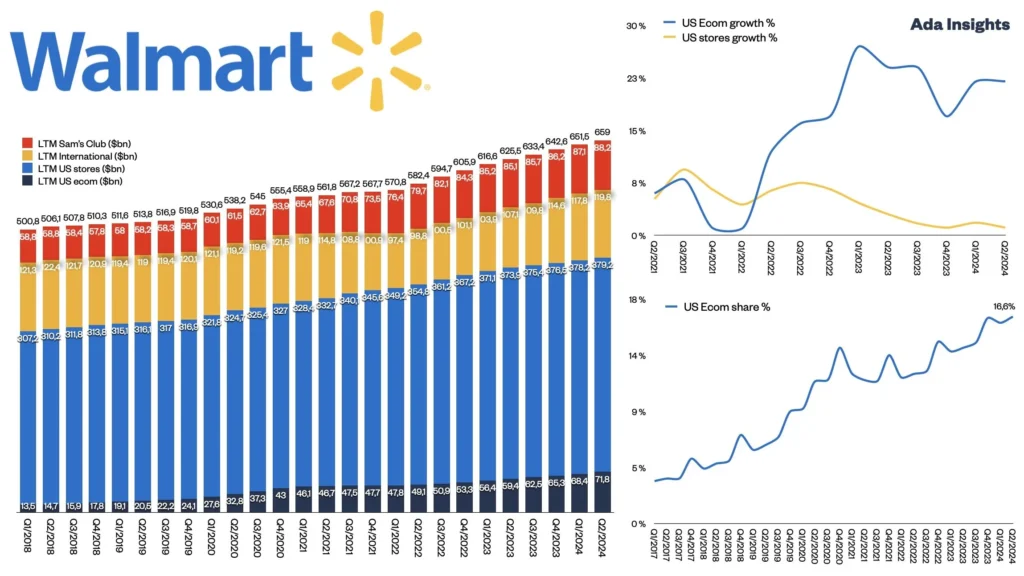

Walmart’s climb into the trillion-dollar club didn’t happen by chance — it reflects sustained growth in ecommerce, expanded delivery services, and strategic use of technology like artificial intelligence. As a result, financial analysts, traders, and industry leaders are closely watching what this means for the future of retail, competition with Amazon, and the broader stock market.

What Reaching $1 Trillion Really Means for Walmart

Surpassing $1 trillion in market value places Walmart in an exclusive club typically dominated by tech heavyweights like Nvidia, Alphabet, Microsoft, Apple, and Amazon — most of whom are known for high-growth tech earnings rather than traditional retail. But Walmart’s transformation shows Wall Street is now valuing retailers with scalable digital offerings and strong consumer loyalty.

This valuation milestone also reflects investors’ confidence in Walmart’s strategies beyond brick-and-mortar stores, including seamless ecommerce experiences, same-day delivery, and robust digital advertising revenues that contribute to an increasingly tech-centric revenue mix. The achievement signals broader optimism in the retail sector’s ability to compete with pure tech companies on growth and innovation.

How Walmart Made This Milestone Possible

Expanded Digital Services

Walmart’s investment in digital services, including its subscription program Walmart+ and AI-powered customer tools, has played a huge role in its stock rise. These initiatives have boosted online sales, helped expand delivery reach, and increased customer engagement across income segments.

Use of AI and Technology

Unlike its previous decades-long reliance on traditional retail models, Walmart now leverages artificial intelligence and automation across warehousing, inventory management, and online shopping interfaces — a strategy that has earned it market respect as a “tech-enabled retailer.” Partnerships with AI innovators and chatbot tools have enhanced shopping efficiency and helped boost sales at a time when many laid-off tech workers are tightening budgets.

Why the Market Is Watching Walmart’s Next Moves

Despite the impressive valuation, some Wall Street analysts have begun reassessing Walmart’s stock potential because of its high price relative to earnings — a signal that future performance must justify current optimism. For example, leading financial firms have recently moved Walmart off their “top pick” lists due to this valuation premium, though most analysts still rate the stock as a Buy.

Investors are now focusing on Walmart’s upcoming earnings reports and profitability in newer segments like digital advertising and e-commerce. Continued strong performance in these areas will be key to maintaining or exceeding the $1 trillion benchmark.

Broader Market Impact and Retail Dynamics

Walmart’s milestone arrives in a broader context where traditional retailers are increasingly valued for digital adaptability. Its stock performance has outpaced the S&P 500 over the past year, and its inclusion in major indices like the Nasdaq-100 highlights how much the market’s perception of Walmart has shifted.

This moment also sends a clear message to other retailers: success in 2026 and beyond will depend on blending physical retail advantages with advanced digital capabilities — especially AI-driven personalization, faster delivery options, and online convenience.

What This Means for Consumers and Investors

For consumers, Walmart’s surge underscores its continued dominance as a value destination — especially amid inflationary pressures, where lower-priced essentials remain in demand. The retailer’s broad income appeal means that it draws not just budget-conscious shoppers but also convenience-oriented customers who value fast delivery and online ease.

For investors, this milestone marks a validation of Walmart’s efforts to evolve beyond traditional retail margins into a diversified revenue engine where technology, e-commerce, and data-driven services play increasingly important roles. Sustained market leadership will depend on continued innovation, operational efficiency, and the company’s ability to drive profits across all segments.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.