How Executive Scandals Impact Stock Prices, Corporate Governance, and Investor Confidence in U.S. Markets

Executive scandals have a profound and measurable effect on U.S. financial markets — directly driving stock price declines, undermining corporate governance structures, and weakening investor confidence across retail and institutional segments.

In today’s high-velocity financial environment, news travels instantly through digital media, social platforms, and financial networks. When a top executive is accused of fraud, unethical behavior, or regulatory violations, the market reacts swiftly — often before the full facts are known — making this topic critically important right now.

Executive Scandals Impact Stock Prices: Core Explanation

When an executive scandal breaks, markets interpret the event as a signal of bigger risks within a company’s leadership, reporting practices, or ethical culture. These scandals often involve financial misreporting, fraud, ethical breaches, or criminal conduct attributed to CEOs, CFOs, or board members.

Empirical research shows that executive scandals can trigger immediate and steep declines in stock prices due to investor sell-offs and lowered confidence in future earnings prospects. For example, studies found that reported corporate misconduct cases can produce negative abnormal returns in the stock price shortly after the news goes public.

The severity of the impact is influenced by the scandal’s nature — financial fraud tends to hit valuations harder than non-financial misconduct due to direct implications for earnings quality and legal liabilities. Investor responses are also shaped by media coverage and the tone in which the news is disseminated.

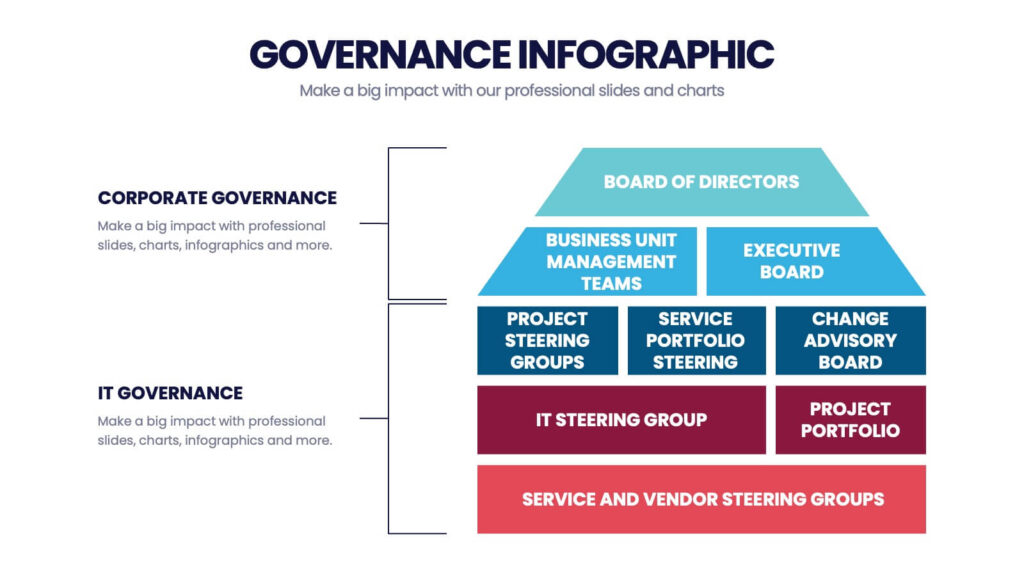

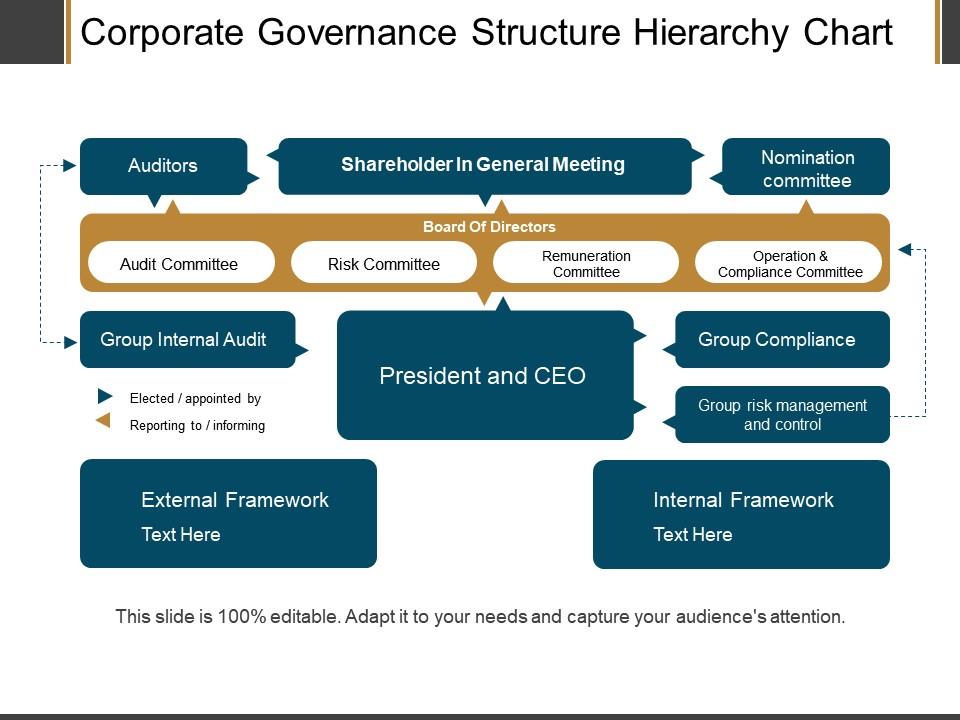

In addition to short-term price shocks, executive scandals can prompt long-term structural changes in corporate governance practices as boards and regulators attempt to rebuild trust and strengthen oversight.

How It Works / Step-by-Step

Step 1: Scandal Emerges and Public Attention Peaks

As a scandal involving executive misconduct hits headlines, financial news networks, investor forums, and social media amplify the event. This broad dissemination accelerates investor reactions.

Step 2: Stock Price Reaction and Market Adjustment

Upon news release, investors often sell shares to reduce exposure to potential losses, creating immediate downward pressure on the company’s stock price. Empirical evidence shows that the market’s initial reaction can produce cumulative abnormal returns that are significantly negative in the days following the announcement.

Step 3: Regulatory Inquiries and Legal Scrutiny

Scandals typically trigger regulatory investigations (by entities like the SEC) and potential legal actions. The anticipation of fines, sanctions, and compliance costs adds to investor uncertainty, prolonging volatility.

Step 4: Corporate Governance Erosion or Reinforcement

Executive scandals highlight weaknesses in corporate governance — especially when boards fail to detect or prevent misconduct. This scrutiny often leads to leadership changes, governance reforms, and enhanced risk controls in affected firms and, in some cases, across industries.

Step 5: Investor Confidence Shifts

Investor confidence doesn’t rebound immediately. Many long-term investors reassess their risk tolerance, while some retail investors may reduce future market participation altogether in response to perceived instability.

Benefits and Risks

While executive scandals predominantly introduce risk, they can sometimes produce beneficial outcomes in governance when handled properly:

Risk — Stock Price Damage

Scandals trigger sell-offs that drive down share prices, reduce market capitalization, and can create long-lasting negative performance trends.

Risk — Erosion of Confidence

Loss of trust among investors causes reduced liquidity in the affected stock and can deter new investments, especially from cautious retail investors.

Benefit — Governance Restructuring

In some cases, a scandal forces companies to restructure boards, adopt stricter compliance systems, and embrace transparent reporting — strengthening future resilience and potentially improving long-term valuation.

Benefit — Regulatory Improvements

High-profile corporate scandals have historically prompted regulatory reforms designed to increase oversight, transparency, and accountability — as seen in past legislation like the Sarbanes-Oxley Act.

Financial Impact or Cost Breakdown

Short-Term Market Losses:

Immediately after a scandal breaks, empirical studies show stock prices can experience a significant drop, on average several percentage points lower than expected before the announcement. The magnitude depends on the scandal’s severity and media reach.

Example — Wells Fargo Scandal:

When Wells Fargo faced fraud investigations related to account mis-selling, its shares experienced sustained downward pressure and investor backlash, impacting both institutional holdings and retail sentiment.

Cost of Legal & Regulatory Actions:

Companies caught in executive scandals often incur legal costs, fines, and settlements that can reach hundreds of millions of dollars, directly lowering profit margins.

Reputation and Liquidity Costs:

Reduced investor confidence often translates into lower trading volume, widening bid-ask spreads, and higher risk premiums — all of which can indirectly increase capital costs for the firm.

Long-Term Returns:

Persistent governance weaknesses revealed by scandals can lead to underperformance over multiple years, as investors assign higher risk discounts to the stock.

Comparison

Scandal-Affected vs. Stable Governance Firms

Companies with strong corporate governance frameworks generally see less severe stock price volatility when news events occur, due to greater investor trust and stronger internal controls.

Scandal Versus Economic Downturn:

While executive scandals can sharply impact individual firms, systematic economic downturns affect market-wide valuations. The former is firm-specific, but the latter impacts broader sectors or entire markets.

Expert Tips or Best Strategies

- Diversify to Mitigate Firm-Specific Shocks

Investors should diversify across industries and governance quality scores to reduce exposure to isolated executive scandal risks. - Monitor Governance Indicators

Regular review of corporate governance ratings, board independence metrics, and executive compensation policies can signal underlying risk levels before they manifest in scandals. - React Strategically — Not Emotionally

Short-term price drops may present buying opportunities for fundamentally strong companies that are actively addressing governance issues.

Frequently Asked Questions

Q: What immediate effect do executive scandals have on a company’s stock price?

A: Executive scandals often trigger immediate stock price declines because they signal increased risk, eroded trust in leadership, and potential legal or regulatory costs. Investors may sell shares preemptively, driving prices lower.

Q: Do executive scandals affect broader market confidence?

A: Yes. High-profile scandals not only impact the individual company but can also shake confidence in broader market integrity, reducing overall participation from risk-averse investors.

Q: Can strong corporate governance prevent stock price volatility?

A: Strong governance does not make a company immune to volatility, but it significantly reduces the probability of scandals and improves investor trust, which tends to stabilize stock performance.

Q: Are some industries more vulnerable to executive scandals?

A: Industries with complex financial reporting, heavy regulation, or high executive discretion can be more vulnerable, as they present more opportunities for misconduct to go undetected.

Q: How long does stock price recovery take after a scandal?

A: Recovery timelines vary widely. If governance reforms are effective and transparency increases, confidence may gradually return over months or years; if misconduct continues, recovery may be delayed indefinitely.

Q: Should individual investors sell immediately if a scandal breaks?

A: Not necessarily. Investors should assess the fundamental strength of the company, governance reforms underway, and broader market context before making decisions.

Executive scandals have a well-documented and significant impact on stock prices, corporate governance, and investor confidence in U.S. markets. They introduce risk, create valuation shocks, and often lead to intense scrutiny of leadership and governance frameworks.

While these events can weaken investor trust and push stock prices lower, they also present opportunities for governance improvements, regulatory enhancements, and more resilient market practices in the long term.

For investors, regulators, and corporate leaders alike, understanding these dynamics is essential for navigating today’s fast-moving markets with confidence and strategic clarity.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.