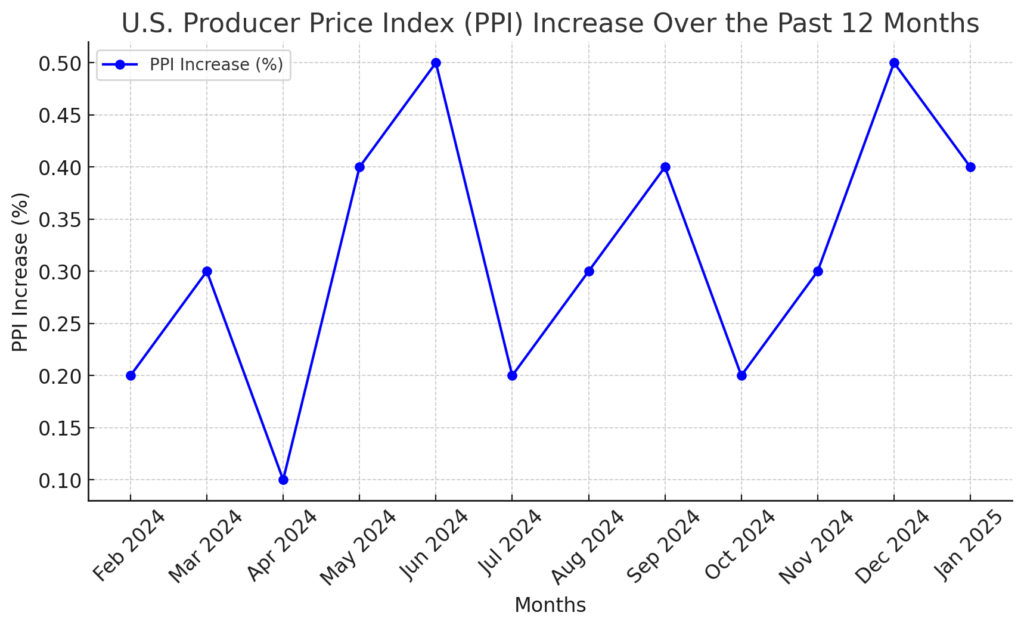

The latest economic data shows that U.S. Producer Prices Rise Slightly Above Expectations, raising concerns about inflationary pressures and potential effects on consumer spending. The Producer Price Index (PPI) for January 2025 increased by 0.4%, exceeding economists’ predictions of 0.3%, signaling continued price growth that could impact everyday Americans. This follows a 0.5% increase in December 2024, suggesting that inflation is still deeply rooted within the economy.

Understanding the Producer Price Index (PPI)

The Producer Price Index (PPI) is a key economic indicator that measures the average change over time in the selling prices received by domestic producers for their goods and services. This index is essential because it provides an early signal of inflationary pressures that could impact consumers in the months ahead.

Key Aspects of PPI

| Component | Explanation |

|---|---|

| Definition | Measures price changes from the perspective of producers |

| Impact on Consumers | Higher PPI leads to increased retail prices |

| Used By | Policymakers, economists, and businesses to assess inflation trends |

| Reported By | U.S. Bureau of Labor Statistics (BLS) |

When businesses face higher production costs due to increased prices of raw materials, energy, and labor, they often pass these costs on to consumers in the form of higher retail prices.

Key Drivers Behind the Rise in Producer Prices

The January 2025 increase in PPI was driven by several factors. Below is a mind map summarizing the main reasons for the unexpected rise:

Key Drivers of PPI Increase

|

--------------------------------------------------

| | |

Food Prices Energy Costs Service Sector Growth

- Egg prices ↑ 44% - Diesel ↑ 10.4% - Warehousing costs ↑

- Meat, dairy ↑ - Heating oil ↑ - Transportation fees ↑

- Avian flu impact - Fuel costs impact - Supply chain issues- Food Prices: A 44% surge in egg prices due to an avian flu outbreak contributed to a 1.1% rise in overall food costs.

- Energy Costs: Rising oil and gas prices led to a 1.7% increase in energy costs, with a 10.4% surge in diesel and heating oil prices.

- Service Sector Growth: Higher transportation and warehousing costs further pushed up production expenses.

Implications for Inflation and the Federal Reserve

With inflation continuing to show resilience, the Federal Reserve is now under pressure to reconsider its monetary policies. The current consumer inflation rate is at an 18-month high, and the Fed may delay interest rate cuts to prevent further economic overheating.

Key Implications:

- Delayed interest rate cuts – Analysts expect the Fed to maintain higher rates longer than initially planned.

- Increased borrowing costs – Higher rates mean more expensive loans for businesses and consumers.

- Stock market volatility – Inflation uncertainty could lead to fluctuating market conditions.

How This Affects Your Wallet

For the average American, the impact of rising producer prices means a direct increase in the cost of everyday essentials. Below is a breakdown of how different expenses are expected to rise:

| Category | Expected Impact |

| Grocery Bills | Increased costs for meat, dairy, and eggs |

| Fuel Costs | Higher gas and heating expenses |

| Retail Prices | More expensive consumer goods and services |

To combat these rising costs, households may need to consider cost-saving strategies such as:

- Buying in bulk

- Seeking discounts and coupons

- Reducing non-essential spending

What’s Next for the Economy?

While inflationary concerns persist, economic experts will closely monitor future PPI and CPI (Consumer Price Index) reports to determine whether price pressures continue or start stabilizing.

Conclusion

The U.S. Producer Price Index (PPI) increase of 0.4% signals continued inflationary pressures, affecting consumer prices across various sectors. As food, energy, and service costs rise, both consumers and policymakers must carefully navigate these economic challenges. Keeping an eye on future inflation trends and making informed financial decisions will be crucial for businesses and households alike.