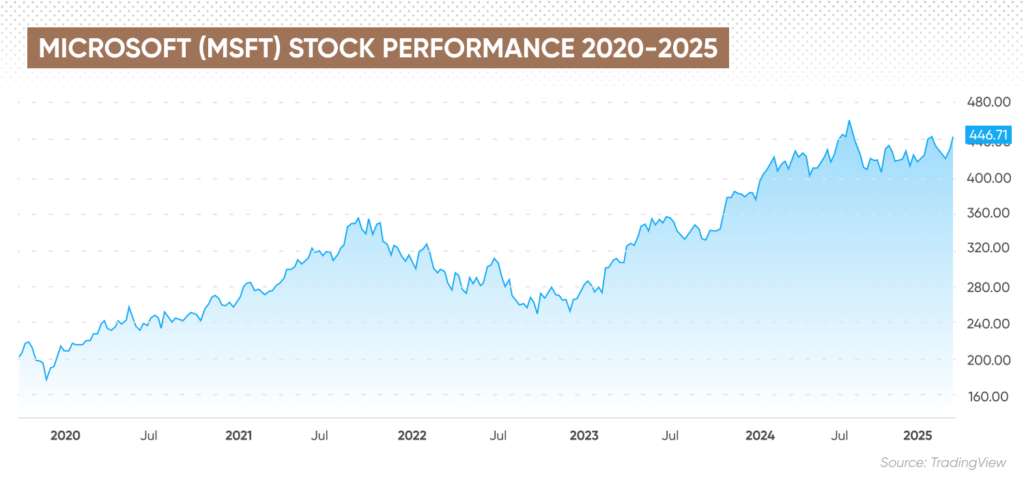

In a dramatic market turn, Microsoft’s stock plunged more than 10% on January 29, 2026, wiping out hundreds of billions of dollars in market value even after the company exceeded Wall Street earnings and revenue expectations. Investors reacted negatively because growth in its cloud segment slowed slightly and capital spending on artificial intelligence soared more than expected, fueling fear about near-term profitability. This event matters now because it highlights shifting investor priorities in Big Tech and tests confidence in Microsoft’s long-term AI strategy as competition accelerates.

Analysts noted Microsoft earned roughly $81.3 billion in revenue with strong net profits, but the market downturn shows that today’s investors prioritize sustainable cloud growth and efficiency over headline earnings beats. The heavy investment in AI infrastructure – while visionary – has made some question the pace of returns, triggering volatility in one of the world’s largest stocks.

Why This Industry Shift Matters Now

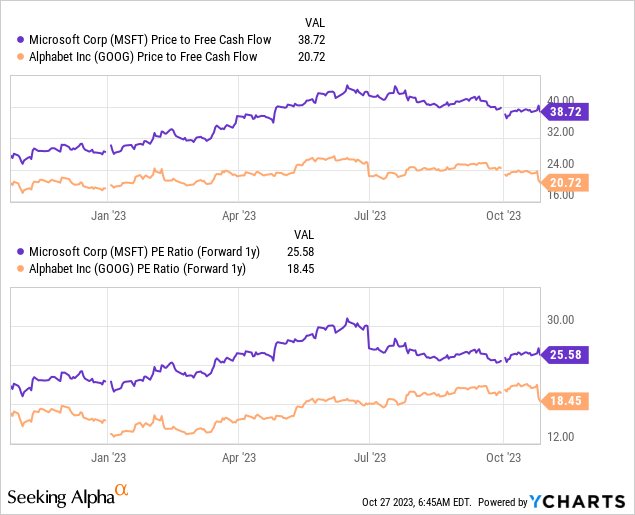

Tech giants like Microsoft are increasingly valued not just on profits, but on their ability to sustain high-growth divisions such as cloud and artificial intelligence. Microsoft’s slight deceleration in Azure cloud expansion and record AI capacity spending has ignited concerns that investors may be demanding more predictable growth rather than long-term promise alone. This shift in sentiment could reshape valuations across the sector and influence investment strategies in the coming quarters.

Microsoft’s Latest Quarter: What Investors Saw Versus What They Expected

In its fiscal second quarter of 2026, Microsoft reported a 17% year-over-year revenue increase to $81.3 billion — comfortably above expectations — and a strong earnings per share performance. The company’s net income was robust, and non-GAAP EPS topped projections by a solid margin.

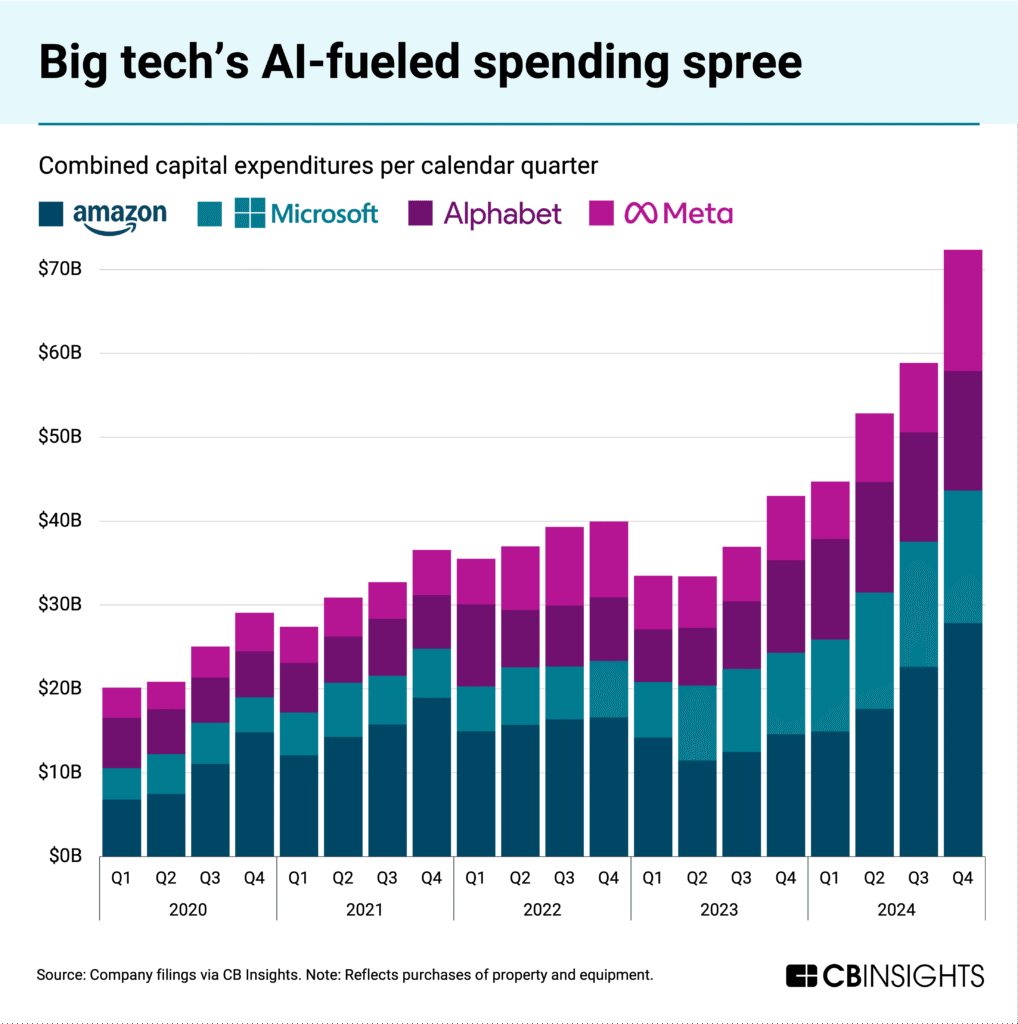

Yet, the market’s reaction revealed a disconnect: the stock fell sharply even after a strong reporting quarter. Investors focused on a less-impressive 39% growth rate in the Azure cloud division, slightly below the previous quarter’s growth trend, and on capital expenditures reaching unprecedented levels, signaling heavier spending on AI data centers and infrastructure.

This highlights a new theme in Big Tech investing where “growth quality” matters as much as growth magnitude. Investors want to see cloud expansion continue at high rates and AI investments begin translating into faster monetization, not just increased spending.

Cloud and AI: Double-Edged Sword for Microsoft’s Valuation

Microsoft’s cloud business crossed a major milestone by exceeding $50 billion in revenue for the quarter, a rare achievement for any company in the sector. Its remaining performance obligations – long-term contracts indicating future revenue – also surged to over $625 billion, with nearly half attributed to agreements tied to AI applications and partnerships.

However, heavy investment — particularly in AI chips and data center capacity — has raised questions about short-term profits and return on capital deployed. Even as Microsoft expands capabilities, costs have soared, which some investors see as constraining near-term earnings growth.

This spending strategy reflects a belief that AI infrastructure leadership will determine long-term winners in tech, yet it also exposes the company to market skepticism in an environment where profit margins and cloud momentum are heavily scrutinized.

Market Impact: More Than Just Microsoft

The broader market felt Microsoft’s decline on January 29: the Nasdaq Composite slid, pulled down by weakness in one of its largest constituent stocks, and mixed performances in other sectors underscored shifting investor sentiment across tech.

While Microsoft’s share drop was significant, analysts remain divided. Some believe the plunge represents an overreaction and that the company’s long-term strategy is intact, given its leadership in cloud services and AI tools integration. Others warn that if cloud growth continues to decelerate or AI investments fail to pay off soon, valuations could adjust further.

What This Means for Investors and the Tech Sector

For long-term investors, Microsoft’s fundamentals remain strong: strong revenue growth, a powerful enterprise software ecosystem, an expanding cloud footprint, and deep engagement in AI. Yet, market sentiment has shifted toward shorter-term performance signals, especially in high-valuation tech names.

This event also reflects a broader dynamic in global markets: Big Tech stocks are no longer guaranteed robust valuations simply because of earnings beats. Investors now critically evaluate how companies balance growth, spending, and profitability — particularly in rapidly evolving fields like AI and cloud computing. This underscores a new era of market discipline, where execution speed and scalability impact valuations as much as innovation prowess.

Microsoft’s Future in Focus

In summary, Microsoft’s recent earnings and market cap drop reveal a crucial inflection point between growth expectations and reality in the AI-era tech market. While financial results were strong by conventional standards, investor concerns over cloud growth moderation and rising infrastructure costs have sparked a sharp reassessment of the company’s stock valuation. This episode demonstrates that in today’s market, visionary investments must quickly translate into measurable financial performance — or risk rapid repricing.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.