In a dramatic turn on the global billionaire leaderboard, Amazon founder Jeff Bezos saw his net worth climb by roughly $5.7 billion, driven by a surge in Amazon’s stock price after strategic business changes were announced earlier this week. This rise pushed Bezos back into the top echelons of the world’s wealthiest individuals and highlights how market movements and corporate decisions can significantly impact personal fortunes in real time.

Bezos’ latest wealth uptick came as shares of Amazon.com Inc. (NASDAQ: AMZN) rallied on investor optimism tied to strategic cost restructuring — including the closure of physical retail units — and renewed focus on its online delivery and digital infrastructure.

What Happened: A Fresh Spike in Billionaire Wealth

The recent surge in Jeff Bezos’ personal wealth stems from a meaningful appreciation in Amazon’s share price. After the company announced plans to discontinue several physical store formats and redirect resources to its high-growth areas, investors responded positively, driving the stock upward. As Amazon shares climbed, Bloomberg’s billionaire index reflected a significant boost in Bezos’ net assets.

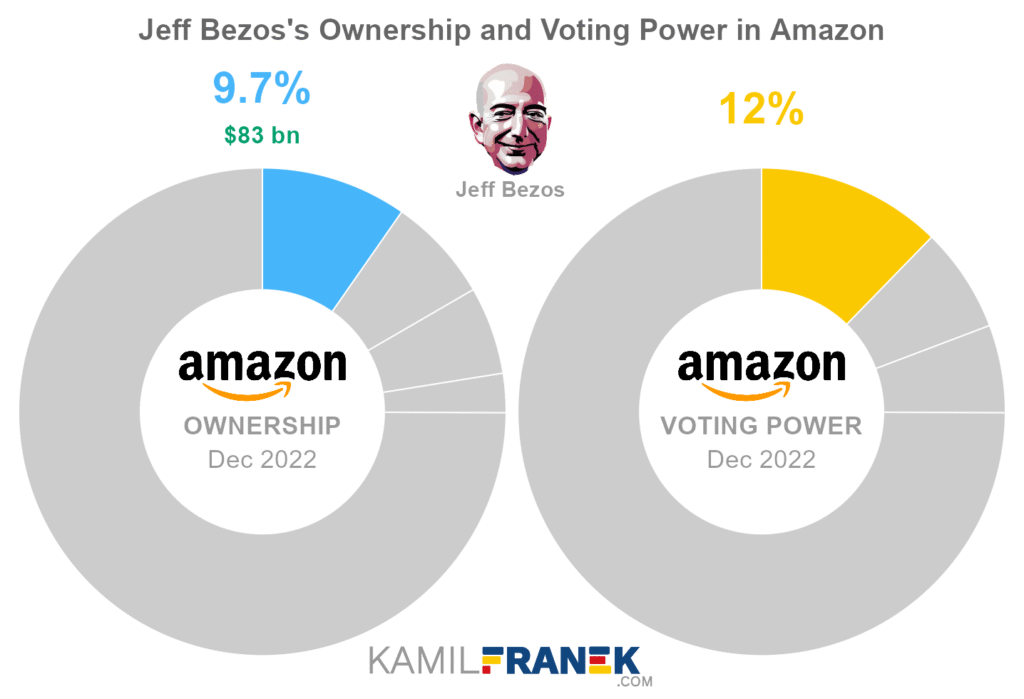

Stocks are living indicators of investor confidence. When a major corporation like Amazon signals strategic realignment, it can influence markets almost instantaneously — and since Bezos retains a substantial stake in Amazon, his personal fortune moves in tandem with stock fluctuations.

Why This Matters Now: Context in the Billionaire Rankings

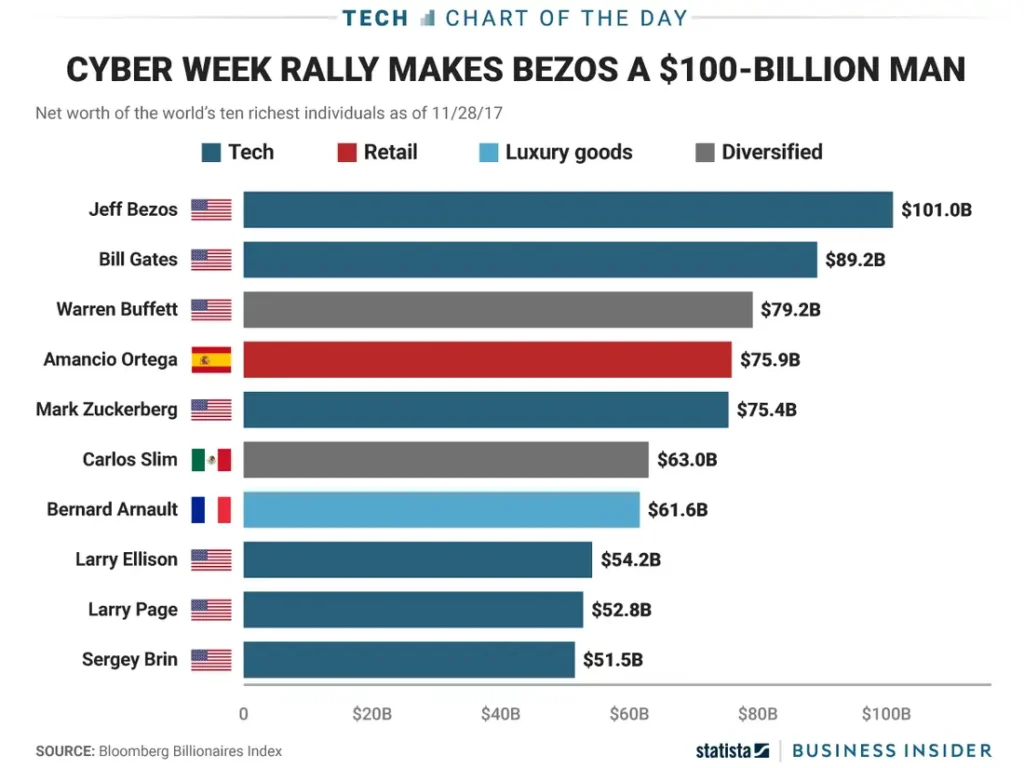

This latest wealth jump doesn’t just enhance Bezos’ bank account — it impacts the global billionaire hierarchy at a time of rapid reshuffling. Over the past months, powerful tech leaders, including Larry Page, Sergey Brin, and Mark Zuckerberg, have seen their positions shift due to stock performance and wider macroeconomic forces.

For example, newer reports from Forbes and Bloomberg indicate that at certain points in 2026, Google co-founders overtook Bezos in overall ranking, fueled by strong performance in AI-related businesses and broad stock market gains.

Why Amazon’s Strategy Shift Is Impactful

Amazon’s decision to close its physical retail locations and scale back certain brick-and-mortar ventures reflects a broader focus on profitable, scalable businesses such as online sales, cloud computing (AWS), and logistics. In essence, the market responded because the company appears to be trimming what wasn’t working and reinforcing what is working.

This strategy could mean:

- Higher cost efficiency.

- Stronger profit margins.

- Renewed investor confidence.

And since Bezos’ wealth is tied almost entirely to stock performance, this type of market affirmation feeds directly into his personal net worth.

Broader Market Influencers: Billionaires in Flux

Bezos isn’t alone in seeing his net worth swing dramatically — Elon Musk, Larry Page, Sergey Brin, and Mark Zuckerberg have all seen large net worth increases or shifts due to varying tech and macro trends. For example, Elon Musk’s net worth recently exceeded historic milestones, while Google co-founders have surged as Alphabet’s valuation climbed on strong AI momentum.

This reinforces that billionaire rankings are increasingly tied to tech stock performance and innovation narratives, which investors often read as predictors of future returns.

Why This Matters to Investors and the Public

For professional investors and everyday market watchers alike, the rise in Bezos’ wealth serves as a reminder that:

- Stock price movements aren’t abstract — they materially affect real fortunes.

- Strategic corporate decisions (like shutting unprofitable segments) matter because they influence both short-term trading behavior and long-term investor confidence.

Additionally, because Amazon is one of the largest components in major indices like the S&P 500, moves in AMZN shares can have broader ripple effects across retirement portfolios, mutual funds, and global benchmarks.

What’s Next for Bezos and Amazon

While billionaires’ net worth figures often attract headlines, these movements reveal bigger narratives about corporate strategy, investor behavior, and market psychology. Amazon’s renewed focus on core growth areas may continue to draw investor interest, which could further influence Jeff Bezos’ wealth in the weeks and months ahead.

Investors should continue monitoring:

- Amazon’s quarterly earnings.

- Broader tech sector momentum.

- AI and cloud computing growth trends.

Each of these factors could continue to reshape the billionaire landscape — and Bezos remains squarely in the spotlight.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.