Meta Stock Price: Big Tech AI Spending Surge Shakes Nvidia, Microsoft, Alphabet, and Meta Stocks

Why Nvidia, Microsoft, Alphabet, and Meta Platforms Stocks Are the Big Tech Story Investors Can’t Ignore — In a technology market reshaped by artificial intelligence and heavy spending on AI infrastructure, the stocks of Nvidia, Microsoft, Alphabet (Google’s parent), and Meta Platforms have become central to investor attention because these tech giants are redefining future growth. NVIDIA recently stood out in a headline article about a must-buy stock next to NVIDIA, Microsoft, and Alphabet for the $3 trillion-plus club, while investors are weighing whether Meta Platforms’ climb is fully justified or overrated. Returns, fundamental drivers like AI investment, and valuations are at the center of academic and market debates — and this matters now because markets have just turned cautious amid heavier capital expenditures that are pressuring stock prices and broader tech indexes

Across the major tech names — Nvidia, Microsoft, Alphabet, and Meta Platforms — strong growth is intertwined with massive spending on AI and cloud infrastructure. Investors and analysts are split on whether these companies can sustain that growth once elevated expectations are baked into current stock prices.

Why Big Tech’s AI Investments Are Driving Market Leadership

Tech giants have been doubling down on artificial intelligence infrastructure, pouring hundreds of billions of dollars into data centers, custom AI chips, cloud computing, and capabilities that promise to define the next decade of innovation. According to global IT research, AI-related spending remains one of the top drivers of technology market growth in 2026, with data center systems and software markets ballooning significantly.

For Nvidia, this AI boom has been transformational. It became one of the highest valued companies in history, driven by soaring demand for its AI GPUs and platforms. NVIDIA’s dominance has made it a cornerstone of many top stock portfolios, with analysts identifying it as a compelling buy as part of the elite group of massive tech growth stocks.

Microsoft, while also a leader in enterprise technologies and AI services, has seen its stock price pressured as investors digest significant capital spending and evaluate short-term returns versus long-term positioning. Alphabet, after long being perceived as a laggard in generative AI tools, has surprised markets with strong revenue in its cloud and AI ecosystem, buoyed by widespread adoption of its Gemini model.

Meta Stock Price, Platforms: Growth Story or Valuation Question?

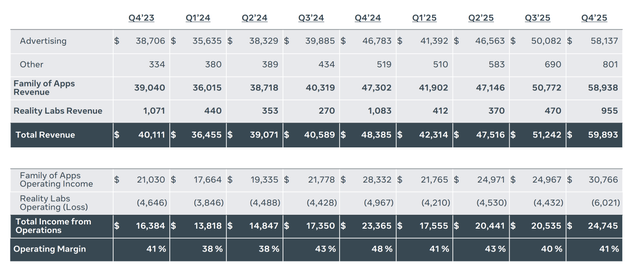

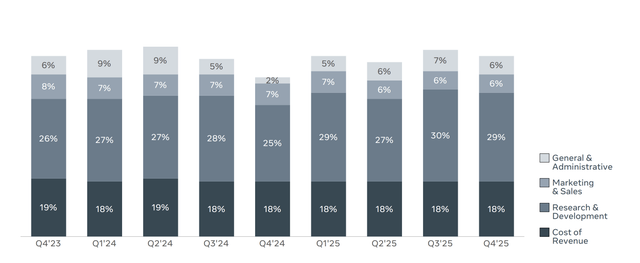

Meta Platforms has engaged in aggressive capital expenditures to build out AI infrastructure, much like its peers. Supporters highlight that its AI-driven advertising tools and recommendation systems are beginning to deliver measurable results — boosting engagement and ad conversion rates. Recent earnings and business expansion have reassured some investors, resulting in rising share prices.

However, other analysts argue that Meta’s stock rally is not fully justified yet. They point to ongoing skepticism around its valuation relative to growth prospects, considering heavy investments and the shadow of past overspending episodes like the Metaverse push. These critics question whether the current stock price truly reflects the pace at which Meta can realize long-term returns from its AI strategy.

The comparison between Meta and giants like Microsoft or Alphabet illustrates a broader valuation debate — one where enthusiasm for AI prospects meets a reality check on margins, execution risk, and competitive differentiation.

Market Sentiment Shifting as Investors Rerate Tech Stocks

Wall Street’s recent trading session reflected investor caution, with major indices down as heavy tech stocks gave back gains. Alphabet’s announcement of steep capital spending plans for AI and cloud infrastructure, meant to more than double its capex for 2026, rattled markets even amid strong revenue and user growth. Microsoft and Amazon shares also suffered from investor reassessment of near-term profitability as growth-oriented spending rises across the sector.

This reevaluation follows broader market signals that macroeconomic and sector fundamentals are now more important than hype. A recent market analysis shows that many AI stories are facing scrutiny as investors demand clearer evidence that elevated spending will translate into revenue and profitable returns beyond near-term guidance.

In simple terms, the narrative for AI stocks is shifting from “everyone wins” to “who can deliver concrete returns first.” This pivot is happening at a point when technology spending is at record levels, which makes analysis and stock selection more crucial than ever for investors.

The Impact on Investors, Portfolios, and Innovation Leadership

For long-term investors, the big tech names still represent some of the most formidable secular growth opportunities thanks to their leadership in cloud computing, AI infrastructure, and digital ecosystems. NVIDIA remains the poster child for AI-related market expansion. Microsoft’s deep enterprise software footprint and Azure cloud growth continue to appeal to institutional investors. Alphabet’s strong cloud adoption and AI integration position it to compete closely with its peers. Meta’s evolving mix of advertising and AI features keeps it in the conversation for future innovation.

Yet, this era also highlights the rising importance of disciplined capital allocation and realistic valuation expectations. As tech companies grow ever larger, investors are demanding performance, not just promises. And this shift represents a historical moment in global markets where the balance between innovation fervor and return-on-investment discipline will determine the next decade’s market leaders.

“Subscribe to trusted news sites like USnewsSphere.com for continuous updates.”