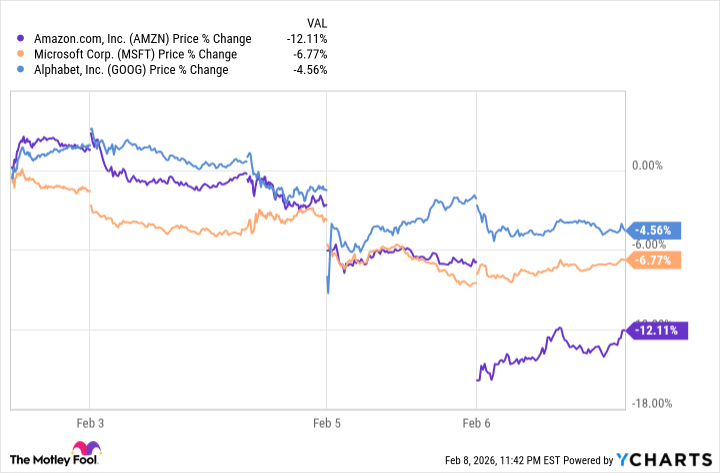

AI Frenzy Cooling and Smart Money Moves Now – The huge excitement around artificial intelligence (AI) stocks that pushed mega-cap tech names to record valuations is now facing a market reset in 2026. Tech giants like Amazon, Microsoft, and Alphabet have seen share price weakness as investors pause to reassess whether sky-high expectations are justified, with volatility rippling through global markets. AI-linked stocks that fueled 2025’s momentum are now under scrutiny for slowing execution on profitability and heavy spending that could pressure earnings in the near term.

Why this matters now: Markets are no longer simply rewarding AI stories—they’re demanding evidence that the technology is converting massive capital spending into real profits. That pivot from hype to performance is driving a correction that analysts describe as sentiment-driven rather than fundamentally broken. This shift has implications for retirement accounts, index returns, and hedge fund strategies across the globe.

AI Stock Sell-Off: What’s Happening and Why

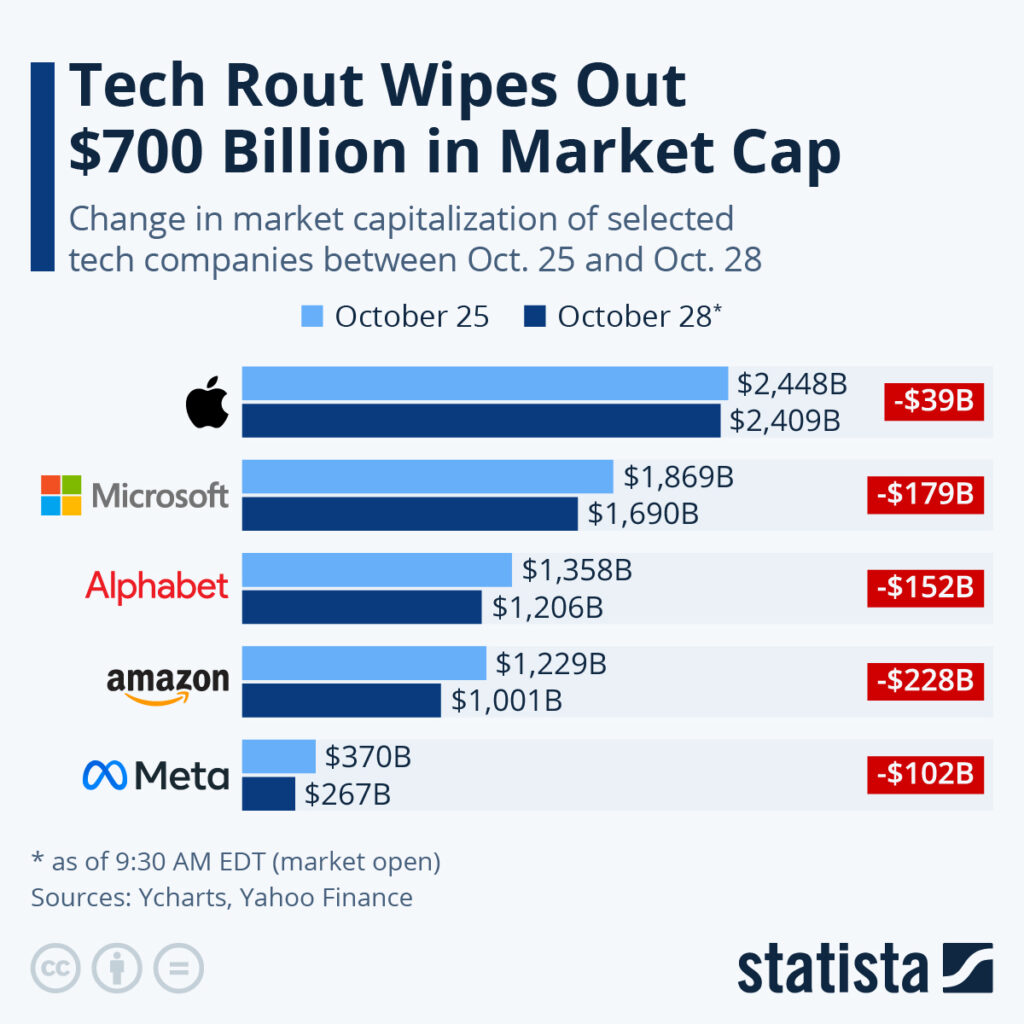

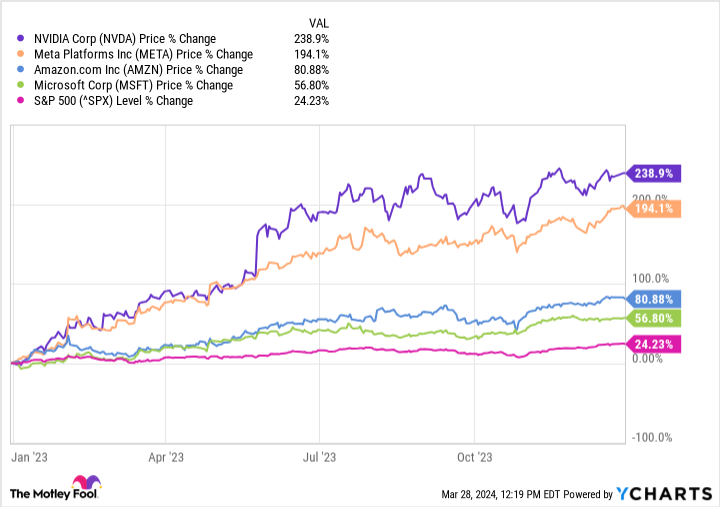

In early 2026, many technology and AI-linked stocks that outperformed markets in recent years have retreated sharply. Investors are becoming wary of inflated valuations and uncertain near-term returns. Companies with massive AI capital expenditures are particularly under pressure. Analysts on Wall Street note that the enthusiasm that drove these stocks higher might have outpaced the pace of real earnings growth, leading to a broader revaluation.

This has manifested in some high-profile share price declines. Amazon’s stock, for instance, has underperformed peers, partly due to market concerns over the profitability of aggressive investments in cloud infrastructure and AI. Other mega-caps tied to AI initiatives have also seen share downturns as investors weigh near-term uncertainties against long-term promise.

Financial Markets Feel AI Fear Spillover

The AI correction isn’t limited to pure software or cloud giants. Broader sectors and markets are feeling ripple effects:

- Indian IT stocks and indexes have plunged amid fears that generative AI could disrupt the outsourcing and services model that has driven growth in the sector, showing concern even in Asia’s largest tech markets.

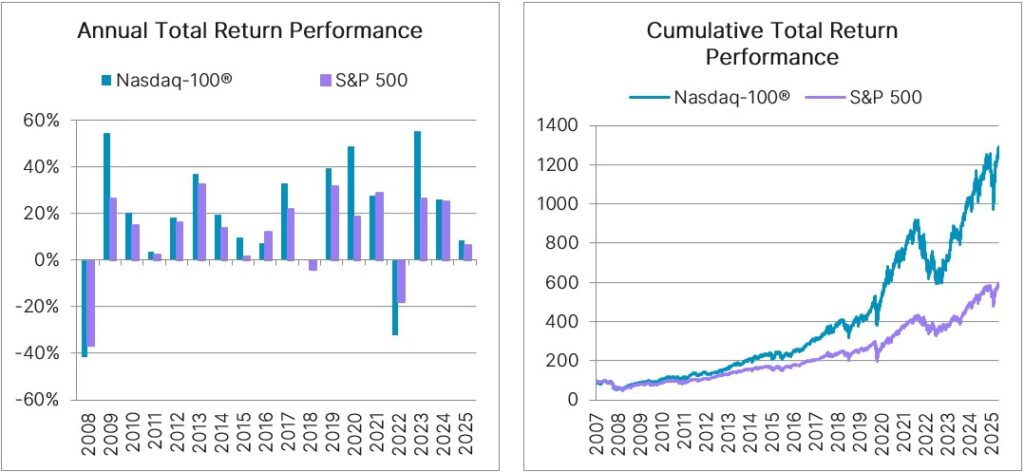

- Global markets, including U.S. benchmarks like the Nasdaq Composite and European equities, have experienced volatility tied to growing uncertainty about AI’s real-world demand and cost pressures.

This broad reaction highlights how entrenched AI has become within global market psychology and sentiment, turning what was a leading growth narrative into a potential source of near-term risk.

Analyst Views: Bubble, Chill, or Opportunity?

Market analysts are currently divided on whether this represents the beginning of a deeper downturn or merely a “cooling off” period.

Bearish sentiment: Some financial strategists worry that AI valuations resemble past bubbles—such as telecom in the late 1990s—where excessive optimism led to overvaluation and eventual painful corrections. Concerns focus on the gap between expectations for AI revenue and actual profits.

Bullish counterpoint: Other experts argue that the sell-off is exaggerated and sentiment-driven, not based on fundamental weakness in the tech business models. They maintain that AI will ultimately augment existing software and enterprise services rather than supplant them, meaning current declines could be a buying opportunity for patient investors.

Strategic Investing in an AI-Driven Market

For investors looking to navigate this shifting landscape:

- Stay disciplined on fundamentals: Companies with strong balance sheets, recurring revenue, and diversified business lines are better positioned to weather short-term volatility in AI sentiment.

- Avoid hype-only plays: Stocks whose valuations are purely narrative-driven rather than supported by clear profit paths may face further corrections.

- Look for AI that complements core business: Firms using AI to drive efficiency gains, new product lines, and clearer profit visibility often hold long-term value beyond the hype cycle.

In this environment, analysts often recommend a diversified approach rather than concentrated bets solely on narrow AI themes.

Why This Matters to Investors and Markets

The 2026 market shift is significant because AI isn’t just a technology trend—it now represents a substantial portion of market valuation. A shift in investor focus from future potential to present performance has exposed weaknesses in optimism-driven price bubbles, forcing both retail and institutional investors to reprice risk. This transition affects pension funds, index funds, and individual portfolios, making it one of the most important market dynamics of the year.

Moreover, as AI adoption matures and real revenue streams become clearer, the current volatility may eventually give way to renewed confidence—but only for those companies that demonstrate sustainable profitability and effective commercial AI integration.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.