Five months after Nvidia and OpenAI announced an unprecedented $100 billion investment partnership, negotiations appear to have stalled, raising questions about the future of AI infrastructure funding and strategic alliances in the industry. What was once billed as a transformative mega-deal is now facing skepticism, internal pushback, and slowing momentum. This matters now because the outcome could reshape how AI companies finance massive compute expansion — a core ingredient for future breakthroughs and global competition.

What the Original Plan Was and Why It Mattered

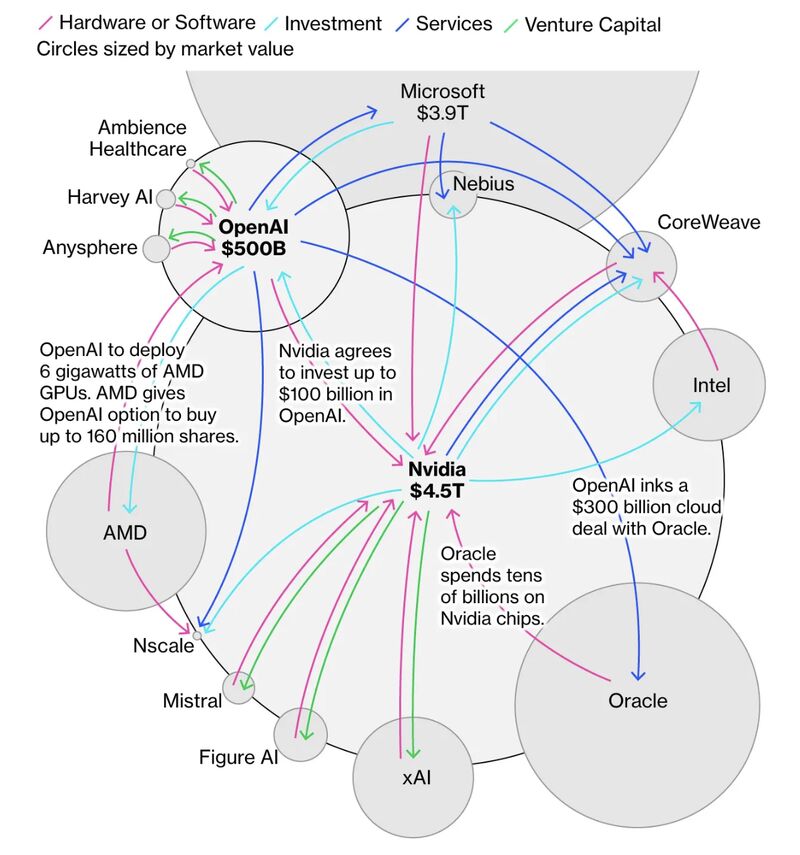

In September 2025, Nvidia and OpenAI revealed a memorandum of understanding for what could have been one of the largest private investments in tech history. The outline called for Nvidia to invest up to $100 billion in OpenAI, with Nvidia helping finance and equip new AI data centers using its advanced GPUs and systems. The plan aimed to deploy at least 10 gigawatts of AI compute capacity, equal to more power than several U.S. power plants combined.

The investment was meant not just as capital but as a strategic backbone for OpenAI’s ability to build, train, and deploy massive AI models — the kind that power services like ChatGPT, DALL-E, and next-generation multimodal AI applications. For Nvidia, it was also a way to lock in a long-term customer and anchor demand for its chips amid rising competition from AMD and custom silicon developers.

Why this matters now: The AI race — between companies like Google, Anthropic, Microsoft, and Meta — is increasingly defined by access to vast computing infrastructure. A breakdown or reshaping of this $100 billion plan could shift financial power, alliances, and technological advantage in the industry.

Why the Plan Fizzled — Internal Doubts and Strategic Rethinks

Reports in early 2026 indicate that Nvidia’s original $100 billion proposal has not moved past preliminary stages and may never materialize in the form first announced. According to people familiar with the matter, Nvidia executives have expressed internal doubts about the deal’s size and structure, leading to stalled negotiations. Some sources suggest Nvidia officials privately criticized OpenAI’s business discipline and questioned parts of the agreement.

At the same time, OpenAI has been quietly exploring alternatives to Nvidia’s hardware, including deals with AMD and broader use of other cloud providers’ systems. This diversification strategy adds complexity to the partnership, making a one-size-fits-all investment scheme less attractive.

The Wall Street Journal and other outlets report that Nvidia might scale back to a much smaller investment — likely in the tens of billions rather than $100 billion — as part of a broader funding round OpenAI is pursuing with other major investors.

What Nvidia Says — Denials and Clarifications

Despite media reports of friction, Nvidia’s leadership has publicly pushed back on claims that the partnership has fallen apart. CEO Jensen Huang told reporters that it would be “nonsense” to suggest he was unhappy with OpenAI and stressed that Nvidia still plans to invest significantly, though he reaffirmed the original $100 billion figure was never a legally binding commitment.

Included in these statements is confirmation that Nvidia may participate in OpenAI’s upcoming funding round or potential IPO, albeit on terms that reflect current market and strategic realities rather than an open-ended commitment.

What This Means for OpenAI and the Broader AI Sector

For OpenAI, the shift from a giant single-partner investment to a broader fundraising effort could be both a risk and an opportunity. On one hand, scaling back Nvidia’s initial pledge may increase uncertainty about future capital for AI infrastructure. On the other hand, OpenAI’s ongoing negotiations with sovereign wealth funds, SoftBank, Amazon, and others suggest a diversified financial base that isn’t dependent on one company’s backing.

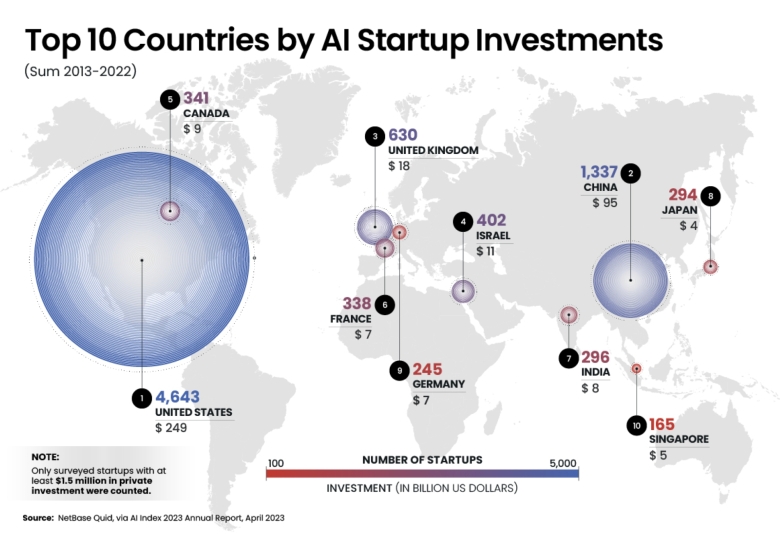

This broader trend also reflects a wider funding shift in the AI market, with firms like Anthropic and Google doubling down on their infrastructure strategies, and cloud providers exploring new partnerships to service the growing demand for compute power.

Competitive and Strategic Impacts

The reworking of this Nvidia-OpenAI deal highlights the intense strategic competition in AI hardware and cloud ecosystems. NVIDIA’s dominance in GPUs has been challenged by alternative chips and cloud-based compute offerings, leading AI developers to spread risk by engaging multiple suppliers. The competitive landscape also makes investors more cautious about speculative mega-deals, shifting focus toward profitability and scalable revenue models.

For Nvidia, this adjustment may signal a more balanced approach — backing major AI players while also protecting its financial strength in an increasingly volatile sector. This shift likely resonates with investors who expect sustainable returns rather than headline-grabbing commitments that are hard to justify financially.

While the $100 billion headline figure may not materialize as first promoted, the legacy of the attempted deal is already shaping AI’s funding ecosystem. NVIDIA will likely invest tens of billions in AI infrastructure partnerships, potentially in coordination with others, and OpenAI will continue to raise capital from a broader investor group to fuel its ambitious growth plans.

The future of AI infrastructure funding is evolving from single-giant bets to broader syndicates and multi-partner models — a shift that could influence how the next generation of AI capabilities is built and deployed globally.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.