Palantir Technologies’ latest earnings report confirmed it beat analysts’ predictions in the fourth quarter of 2025, powered by explosive demand from both commercial and government clients — especially across U.S. businesses. Who: Palantir Technologies (NASDAQ: PLTR), the AI and data analytics software specialist. What: Q4 2025 revenue jumped approximately 70% year-over-year to about $1.4 billion, surpassing Wall Street expectations with higher margins and net income growth. Why: Strong U.S. commercial deals and government contracts helped drive results, along with anticipated AI-related software adoption. Impact: Shares climbed in after-hours trading, analysts upgraded stock ratings, and the company issued optimistic 2026 guidance. Why this matters now: Palantir’s performance comes amid broader tech valuation concerns, yet it defied the trend — suggesting resilience and leadership in enterprise AI software.

Revenue Spike Highlights U.S. Commercial Demand and Government Contracts

Palantir’s reported revenue of about $1.41 billion in Q4 outperformed estimates of approximately $1.34 billion, and its earnings per share of $0.25 topped consensus expectations. This marked a significant 70% annual increase, underscoring rapid business expansion.

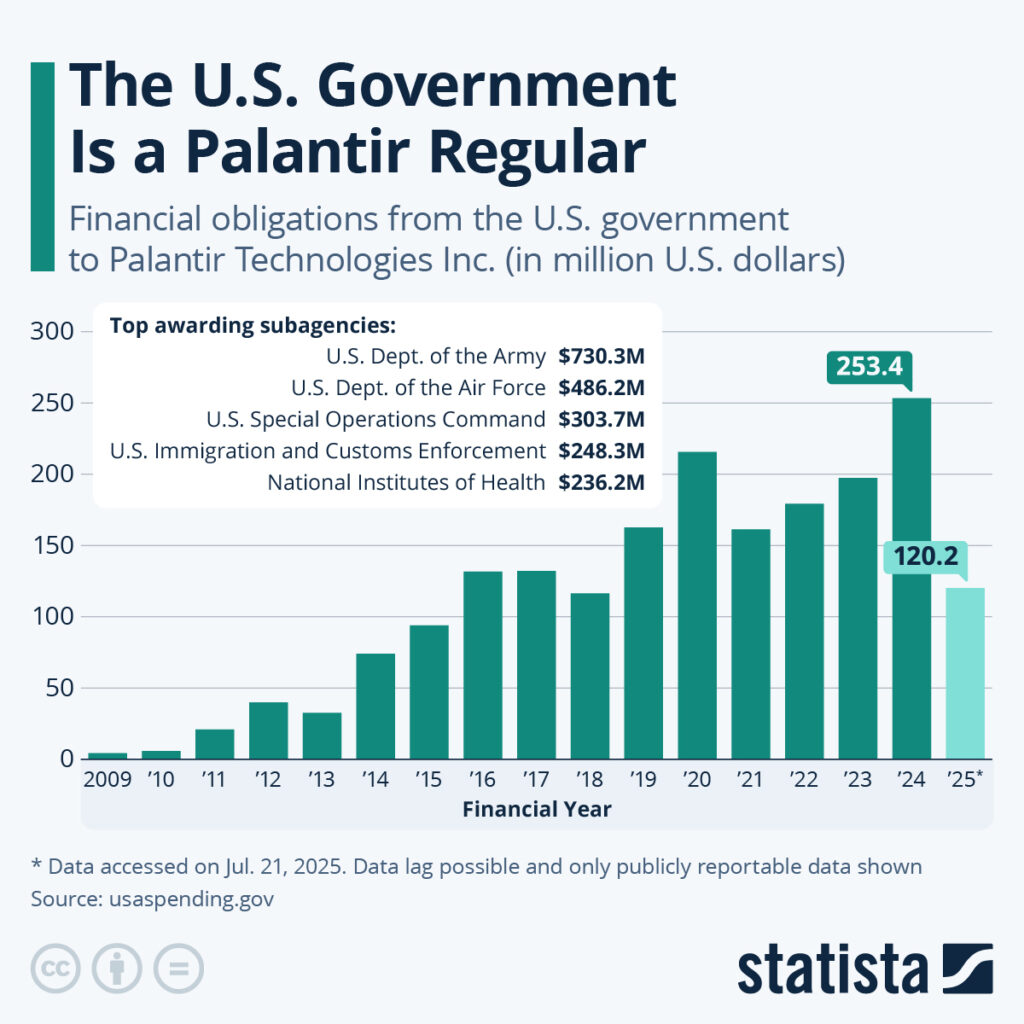

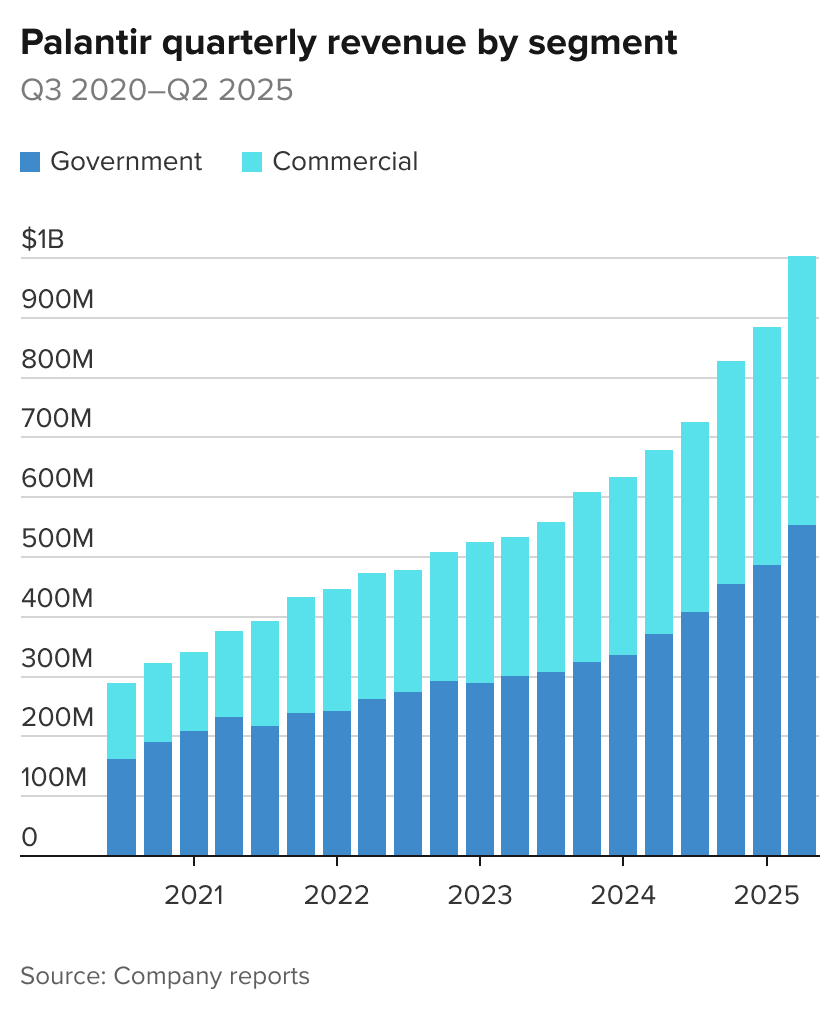

Much of this growth came from the U.S. commercial sector, where revenue more than doubled compared to the previous year. Palantir also saw a strong rise in government revenue, demonstrating balanced demand from both enterprise and public sectors. These results reflect the company’s ability to sell large-scale analytics and operational software into higher-value contracts — including several substantial agreements with U.S. defense and intelligence organizations.

This surge in sales and profitability helped Palantir achieve its highest quarterly revenue yet, reinforcing investor confidence and boosting its Rule of 40 score — a key performance metric combining growth and profitability that’s closely watched by institutional investors.

Stock Reaction and Analyst Upgrades Signal Renewed Investor Confidence

Investors responded enthusiastically to the robust earnings release, pushing Palantir’s stock higher in after-hours trading. While the broader software sector has experienced volatility amid worries about stretched AI valuations, Palantir stood out with tangible results.

Notably, several analysts have adjusted their outlooks following the earnings beat. One prominent financial firm upgraded Palantir’s stock rating to “Outperform,” citing the company’s improving valuation and strong momentum in both government and commercial sales. Other analysts see recent price dips as buying opportunities, projecting further upside over the next 12 months.

Despite these positive signals, some market observers still caution that Palantir’s valuation remains elevated compared to peers, and that high expectations could pose risks if future growth slows. However, the current trend indicates renewed investor confidence rooted in real performance rather than speculation.

AI Adoption and Enterprise Software Demand Driving Growth

A key theme emerging from the Q4 report is Palantir’s strong positioning in enterprise-level AI and analytics solutions. As organizations increasingly prioritize data-driven decision-making, Palantir’s platforms — particularly its Foundry and AIP (Artificial Intelligence Platform) — are attracting widespread adoption.

Unlike some technology firms that still rely on consulting-heavy revenue models, Palantir’s growth is tied to scalable software platforms. This shift appeals to CIOs and CTOs seeking AI solutions that can integrate complex data, streamline workflows, and automate insights at scale — a trend that analysts believe will persist through 2026.

Looking ahead, the company guided toward 2026 revenue growth projections that exceed expectations, highlighting confidence in continued demand from U.S. commercial clients and expanded government contracts. Estimated growth rates for U.S. business segments are particularly strong, reinforcing Palantir’s strategic focus on this core market.

What This Means for Investors and Market Positioning

For investors, Palantir’s results present a complex but appealing picture. On the one hand, the company’s ability to beat estimates and expand its U.S. footprint speaks to underlying strength; on the other, elevated valuation multiples and broader market rotation mean careful analysis is needed before initiating new positions.

Market sentiment among institutional analysts leans increasingly bullish, with multiple firms lifting price targets or reaffirming buy ratings on the stock. Meanwhile, the retail investing community remains active, reflecting ongoing interest in AI-driven equities.

Overall, Palantir’s performance repositions it as one of the more compelling enterprise AI stocks — blending real profitability, strong U.S. demand, and forward-looking guidance. As cloud, data analytics, and AI adoption continue to accelerate, Palantir aims to capture a growing share of this emerging market.

Broader Implications for the Tech Sector and AI Adoption

Palantir’s strong performance has implications beyond its own stock price. In a market where investors frequently question elevated tech valuations, Palantir demonstrated that growth backed by tangible sales to businesses and governments can outweigh speculative pressure.

The increasing focus on AI adoption across Fortune 500 companies, federal agencies, and defense contractors highlights a broader shift in technology investment patterns — one where enterprise impact and real revenue growth take precedence. Palantir’s Q4 performance showcases how companies that bridge AI innovation with existing operational infrastructure can thrive even in challenging market environments.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.