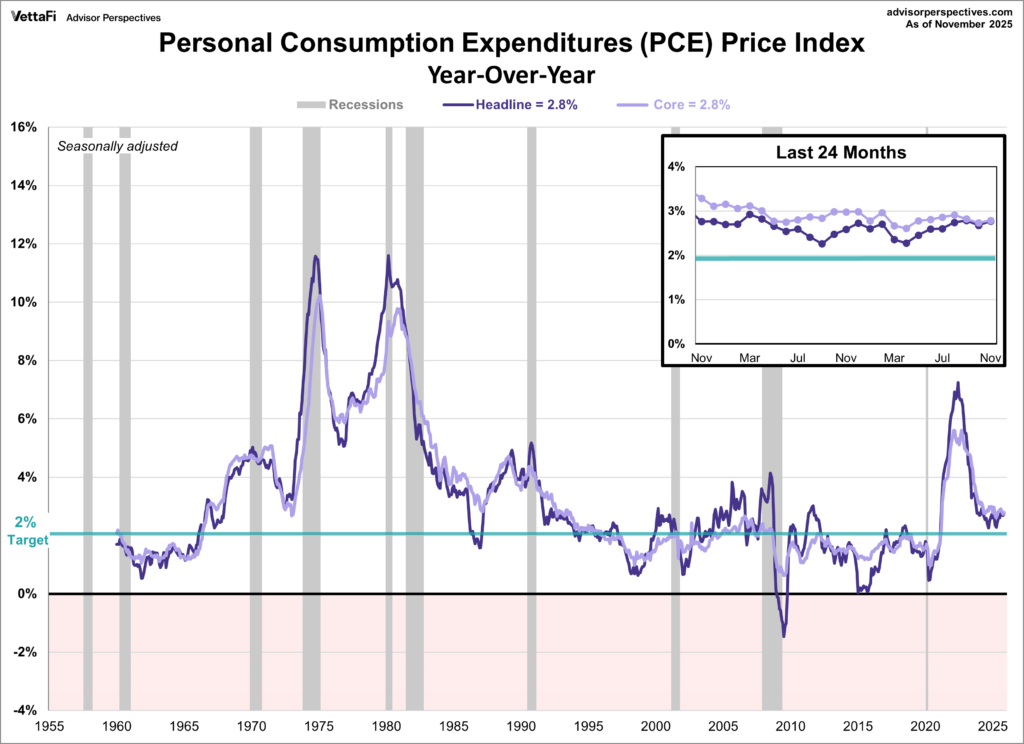

The U.S. Personal Consumption Expenditures (PCE) price index – the Federal Reserve’s preferred inflation gauge – accelerated in December 2025, with headline inflation climbing more than experts predicted and core inflation hitting its highest level since early 2025. This shift occurred alongside slowing economic growth, creating a complex picture for policymakers, markets, and everyday Americans.

What the December inflation data shows and why it matters now

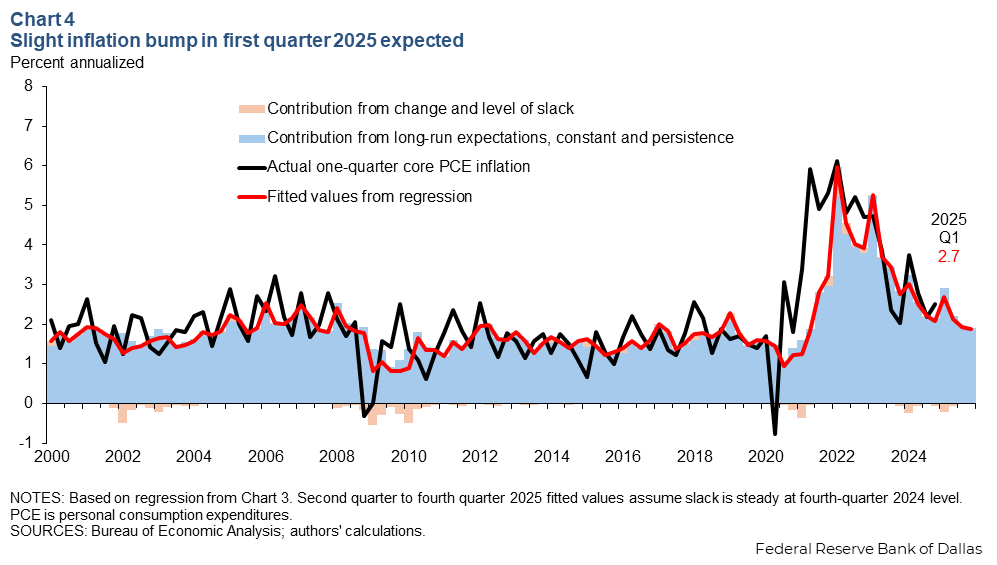

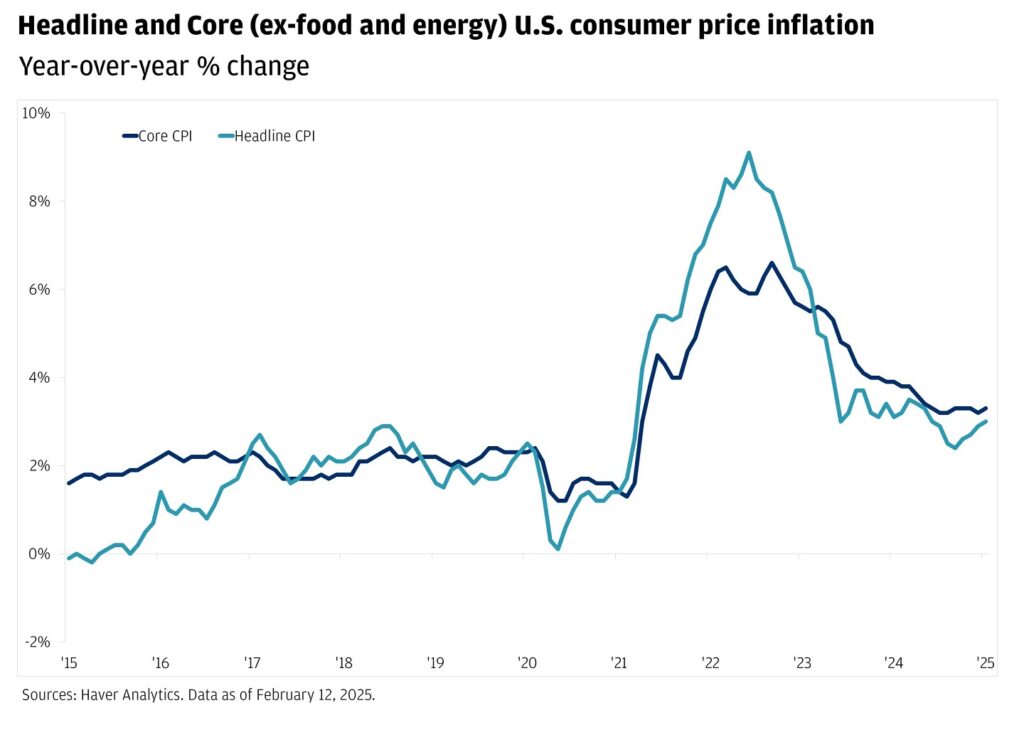

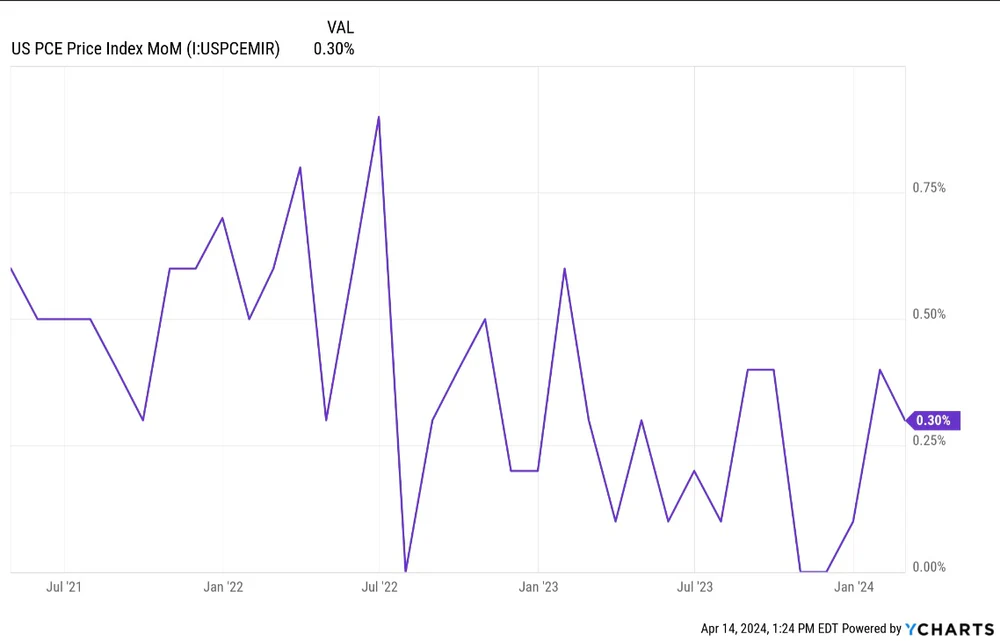

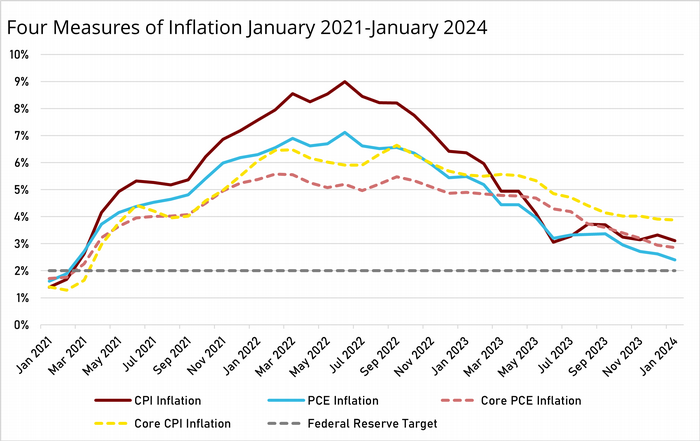

The December 2025 PCE price index increased by about 0.4% for the month, lifting the annual headline inflation rate to around 2.9% year-over-year — above expectations and higher than November’s reading. At the same time, core PCE inflation, which excludes volatile food and energy costs and is closely watched by the Fed, rose to 3.0% annually, its most elevated level in nearly a year.

This outcome matters now because inflation remains above the Federal Reserve’s 2% target, suggesting price pressures are more persistent than many policymakers hoped. Elevated prices affect consumer wallets, borrowing costs, and interest rate decisions, all of which determine how fast households and businesses can recover or grow their spending.

Consumer prices: what rose and what didn’t

December’s inflation data shows the price increases were not limited to one category, with both goods and services showing gains. Price increases in furniture, clothing, and groceries were notable, while energy price growth varied across sectors. Personal spending also kept rising, but personal savings declined, indicating consumers may be spending more of their income to keep up with costs.

Historically, when inflation stays high while consumers spend more and save less, it can signal increased financial pressure for households — especially for lower-income families whose budgets are more sensitive to price changes.

Federal Reserve dilemma: sticky inflation vs. slowing growth

While inflation remains stubborn, the overall economy showed signs of slowing growth toward the end of 2025. Fourth-quarter economic data indicated GDP growth was notably weaker than earlier estimates due in part to a prolonged government shutdown, although some underlying demand was steady.

For the Federal Reserve, this presents a dilemma: should it hold interest rates steady to tame inflation, or begin cutting rates to support slower growth? Many analysts now believe the Fed is more likely to pause rate cuts, keeping borrowing costs elevated longer than previously anticipated, since inflation data did not show clear signs of a sustained decline toward the 2% target.

Impact on markets and everyday Americans

Financial markets and investors quickly responded to the inflation report. Stocks and bond yields can fluctuate when new inflation data arrives because pricing expectations change for interest rates. Some sectors rallied as traders priced in a slower timeline for rate cuts, while precious metals like gold and silver saw volatility as investors reassessed inflation risks.

For Americans, the persistence of inflation means everyday purchases continue to cost more compared to pre-pandemic levels. High inflation erodes savings and can make loans more expensive, even if interest rates remain unchanged for now. Consumers may feel some relief if service costs, such as rents, begin to cool in future months, but current data shows there’s still pressure across multiple categories.

Why this inflation report matters for the rest of 2026

Economists and policymakers agree that inflation readings like December’s have real consequences for the U.S. economy. Persistent inflation may influence wage negotiations, corporate pricing strategies, and investment decisions throughout 2026.

Importantly, core inflation staying above target means that analysts and central bankers are now cautious about expecting rate cuts in the near term. Some experts suggest these reports could push those projections from early 2026 into a later timeline, affecting everything from mortgage rates to business growth plans.

What economists are watching next

Looking ahead, economists will be closely watching January and February inflation data, along with consumer spending and labor market trends, to determine whether the December rise was temporary or part of a broader trend. Markets, consumers, and businesses tend to adjust their strategies quickly based on this evolving information — making the next PCE reports critical.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.