US Dollar Crashes, Hitting a Four-Year Low as IMF Warns of Global Sell-Off in Treasuries — In a dramatic plunge that has rippled through currency markets worldwide, the US dollar has slumped to its lowest level in four years, triggering alarm among investors and prompting global reserve managers to reassess their reliance on American assets. The collapse has been fueled by heightened economic uncertainty, political rhetoric signaling tolerance for a weaker greenback, and data from international institutions showing a retreat in the dollar’s share of global currency reserves. Major analysts and central banks are now watching whether this represents a deeper structural shift in the global monetary system or a cyclical downturn in one of the world’s most influential currencies.

The Dollar’s Sharp Slide and Market Reaction

The US dollar’s decline this week marked its lowest point against a basket of major currencies since early 2022, driven by both market psychology and real economic indicators. Traders responded to comments by US President Donald Trump, who described the dollar’s value as “great” even as it fell sharply, a stance that markets interpreted as tacit acceptance of further depreciation. This shift emboldened currency dealers to continue selling the greenback, exacerbating the drop.

This weakness in the dollar comes after an extended period in which it had previously been supported by expectations of US economic resilience and higher interest rates. However, shifts in fiscal policy, uncertainty over federal monetary strategy, and debate over the Federal Reserve’s independence have sapped confidence. Multiple strategists now suggest that foreign investors, once steady buyers of US Treasuries, are increasingly wary of holding dollar-denominated assets in an environment where the currency’s purchasing power is jeopardized.

Amid this decline, safe-haven alternatives such as gold have surged, with prices reaching historic highs as investors look to hedge against currency risk. This response underscores broader concerns in global markets that extend beyond simple fluctuations in exchange rates, touching on trust in economic policy and the perceived value of traditional reserve assets.

IMF Reports Global Dollar Reserve Share Falling

A central theme echoing through financial circles is the International Monetary Fund’s reporting on the dollar’s diminishing share in global foreign-exchange reserves. While the dollar has long dominated global holdings, new IMF data highlights a meaningful decrease in the percentage of reserves allocated to US dollars by central banks around the world.

In recent quarters, this share has fallen significantly from historical highs, marking the lowest proportion seen in decades. This trend reflects a gradual diversification of reserve portfolios, as major economies seek to manage risk by increasing allocation to other currencies and assets. Gold, for instance, has seen notable accumulation as a buffer against currency valuation concerns.

Though the dollar remains preeminent, this structural shift signals that confidence in its singular dominance may be waning. We emphasize that this reallocation is not purely driven by currency depreciation alone, but also by geopolitical considerations and strategic reserve-management policies in emerging and developed markets alike.

Sell-Off of US Treasuries and Investor Behavior

The continuing depreciation of the dollar has had spill-over effects on the US Treasury market, long considered one of the safest corners of global finance. Traditionally, investors have flocked to Treasury securities as a stable store of value, particularly in times of uncertainty. But an increasingly fragile dollar and rising fiscal deficits have raised questions about whether Treasuries can continue to command the same appeal.

Reports indicate that some central banks and sovereign wealth funds have reduced their Treasury holdings, reallocating capital to other sovereign securities, corporate credit, or diversified bond portfolios. Others maintain exposure, but are hedging against the currency risk inherent in dollar-denominated bonds. Analysts argue this trend reflects a broader recalibration of global capital flows, where investors balance the yield advantages of US debt with the growing risks posed by dollar volatility.

The possible sell-off scenario becomes more acute when major economies engage in policies that de-emphasize dollar accumulation — whether implicitly through market behavior or explicitly through diplomatic and economic strategy. Such a sell-off, even if gradual, could create feedback loops that further depress the dollar and amplify Treasury yields.

Trump Administration’s Role and Policy Implications

Political rhetoric has played a significant role in shaping market perceptions of the dollar’s trajectory. President Trump’s repeated statements suggesting comfort with a weaker dollar have provided psychological cover for traders advocating dollar short positions. Many economists believe these comments signal a broader shift in focus from strong currency policy to export-boosting measures that favor a weaker exchange rate.

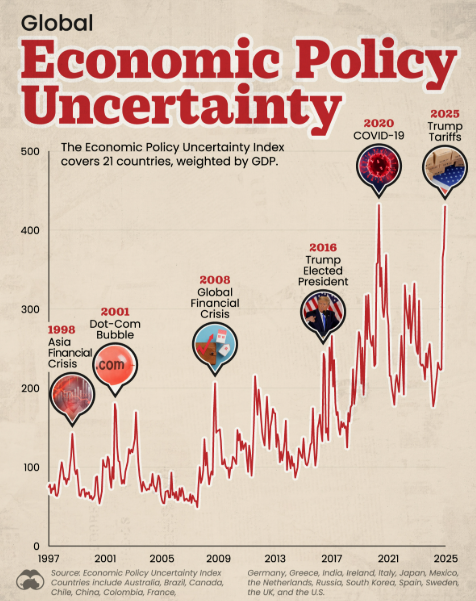

At the same time, threats to tariff policy, trade disputes with major partners, and tensions over central bank independence have shaken confidence in the consistency of US economic management. When investors perceive a lack of coherent long-term strategy, they tend to reduce positions in assets tied to that uncertainty — in this case, the US dollar and associated securities.

Critically, while a weaker dollar can help boost export competitiveness and improve trade balances, it also makes imports costlier, which could feed inflationary pressures at home. Central bank experts caution that overshooting on currency depreciation could have unintended consequences for global purchasing power and domestic price stability.

Global Market Impacts and Alternative Currencies

The dollar’s weakness has rippled across foreign exchange markets, providing strength to several major currencies. The euro, yen, and British pound all climbed against the dollar as traders repositioned funds. In many emerging markets, local currencies and commodity-linked assets have benefited from capital flows leaving dollar-dominant positions.

Beyond traditional fiat currencies, gold’s ascent stands out — with prices climbing to all-time highs as investors seek refuge from fiat currency risk. This surge highlights the renewed appetite for tangible stores of value amid currency devaluation fears.

Some analysts argue that this dynamic is part of a broader move toward financial diversification rather than outright abandonment of the dollar. Many reserve managers are still reluctant to replace the greenback entirely, given its deep liquidity, network effects, and entrenched role in global trade. Even so, the rise in non-dollar assets suggests that the era of unquestioned dollar dominance is evolving, paving the way for a more multipolar currency landscape.

What Comes Next: Risks and Scenarios

As the world watches these developments, a number of potential scenarios lie ahead. If the dollar continues to weaken, policymakers might feel pressure to intervene — diplomatically or via monetary policy — to restore confidence. Some economists believe that coordinated action with global partners could stabilize the currency temporarily, but others warn that such efforts might only mask deeper confidence issues tied to fiscal policy and structural imbalances.

Alternatively, if the dollar finds support through stronger economic data, interest rate adjustments, or enhanced fiscal credibility, it could rebound — although such a reversal would depend on addressing underlying concerns that have driven investor skepticism.

What is clear is that the currency landscape is undergoing notable shifts, with investors, central banks, and policymakers grappling with a more complex set of variables than in previous decades. Whether this marks a turning point in global financial architecture or a temporary cyclical adjustment remains to be seen, but the implications are far-reaching.

A Turning Point for the Global Dollar

The US dollar’s plunge to a four-year low, combined with the IMF’s warnings and shrinking global reserve share, signifies a moment of heightened scrutiny for the world’s primary reserve currency. Investor confidence is being tested, capital is reallocating toward alternative assets, and policymakers face tough choices in navigating fiscal strategy and monetary credibility.

For readers tracking the future of the global economy, this moment represents both a challenge and an opportunity — whether for reassessing investment strategies, understanding the dynamics of international monetary influence, or contemplating a more diversified financial order.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.