President Trump’s 25% Tariff on EU Imports Sends Shockwaves Through Global Markets

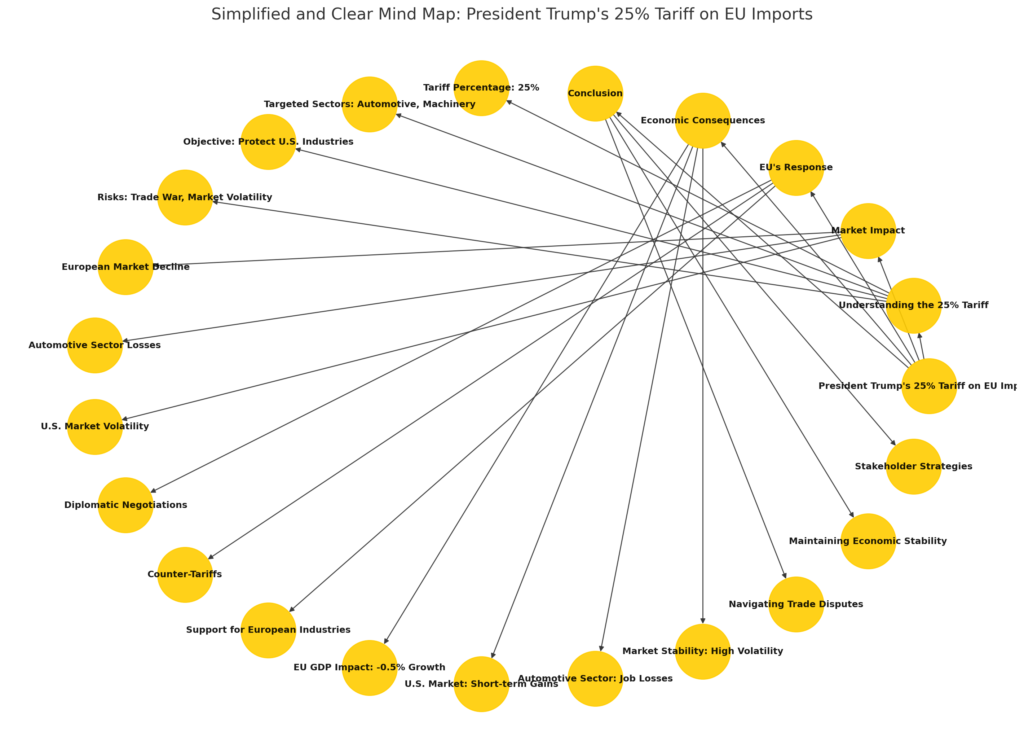

President Trump’s 25% tariff on EU imports has sent shockwaves through global markets, igniting widespread concerns about trade disruptions and economic instability. The tariff, primarily aimed at European automotive imports, has not only unsettled financial markets but also heightened the risk of a potential trade war between the United States and the European Union.

Understanding the 25% Tariff: What It Means for Global Trade

The 25% tariff imposed by President Trump on European Union imports is a significant move in international trade policy. The primary target of these tariffs is the automotive sector, which forms a considerable part of EU exports to the United States. This decision aims to protect American industries and reduce trade deficits, but it also introduces complexities in global trade dynamics.

Key Components of the Tariff:

| Component | Details |

|---|---|

| Tariff Percentage | 25% on selected EU imports, mainly automobiles. |

| Targeted Sectors | Automotive, machinery, and other industrial goods. |

| Objective | Protect U.S. industries, reduce trade deficits. |

| Potential Risks | Trade war, market volatility, economic slowdown. |

Additional Data on Trade Volumes

- EU Automotive Exports to the US: Valued at $47 billion annually.

- Overall EU Exports to the US: Approximately $450 billion per year.

- U.S. Imports from EU (All Goods): Account for 15% of total U.S. imports.

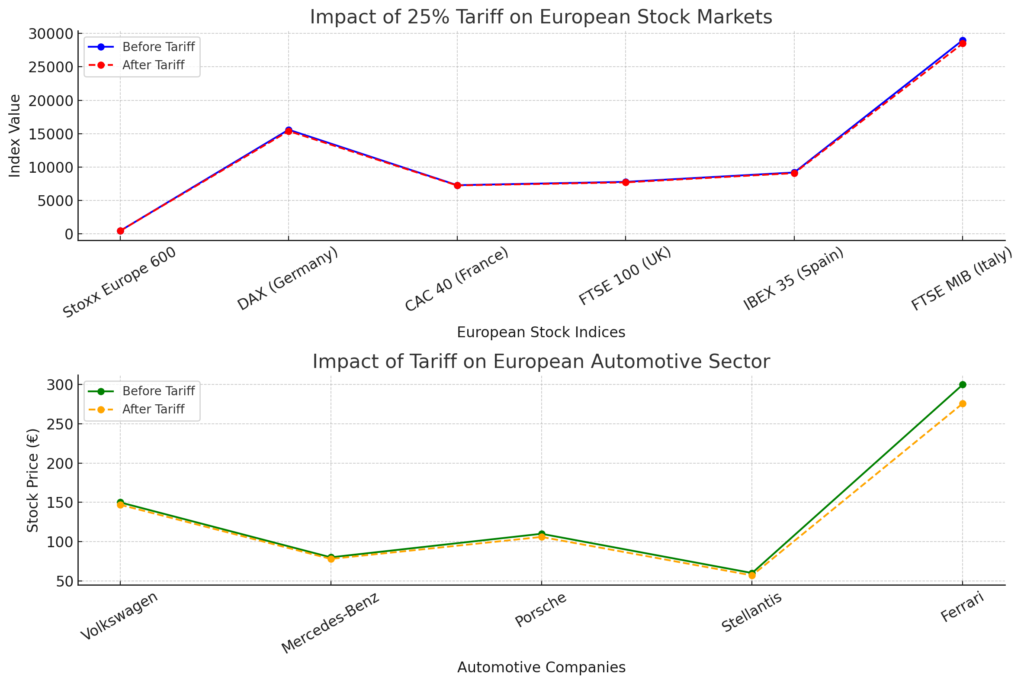

The announcement of the tariffs immediately triggered a downturn in European stock markets. The Stoxx Europe 600 index dipped by 0.5%, with Germany’s DAX and France’s CAC 40 declining by 1.2% and 0.5%, respectively. Automotive giants such as Volkswagen, Mercedes-Benz, Porsche, and Stellantis faced significant losses, with Ferrari experiencing a steep 7.9% drop. The ripple effect extended to the U.S., causing volatility in the S&P 500, Nasdaq, and Dow Jones.

Market Reactions to the Tariff Announcement

S&P 500, Nasdaq, Dow Jones affected

European Market Decline

Stoxx Europe 600: -0.5%

DAX: -1.2%

CAC 40: -0.5%

Automotive Sector Losses

Volkswagen: -1.8%

Mercedes-Benz: -2.6%

Porsche: -3.6%

Ferrari: -7.9%

U.S. Market Volatility

European leaders have strongly opposed the tariffs, with Italy’s Confindustria calling them an “attack on European companies and jobs.” The European Commission has vowed to retaliate firmly, indicating that countermeasures might be implemented to safeguard European economic interests. The bloc’s response aims to mitigate potential economic damage and protect key industries from the adverse impacts of these trade barriers.

How the EU Plans to Respond:

Support for European Industries: Financial aid and policy support to mitigate losses.

Diplomatic Negotiations: Engaging in trade talks with the U.S.

Counter-Tariffs: Possible tariffs on American goods.

Economic Consequences: A Closer Look

Economists warn that the tariffs could negatively impact both the U.S. and EU economies. The Kiel Institute highlighted that the EU’s economic growth could shrink by 0.5% if retaliatory measures are enacted. The automotive industry, deeply integrated with global supply chains, stands to be one of the hardest-hit sectors, potentially leading to increased production costs, reduced consumer demand, and job losses on both sides of the Atlantic.

Economic Impact Comparison:

| Economic Indicator | European Union | United States |

| GDP Growth | Potential drop by 0.5% | Possible short-term boost |

| Automotive Sector | Job losses, production cuts | Increased domestic sales |

| Market Stability | High volatility | Short-term gains, long-term risk |

Conclusion: Navigating the Trade Dispute

The imposition of a 25% tariff on EU imports by President Trump marks a critical juncture in U.S.-EU trade relations. As markets brace for further developments, the potential for economic turbulence remains high. Stakeholders and policymakers must carefully navigate this complex situation to minimize disruption and maintain economic stability.