The Federal Reserve held its key interest rate steady at 3.50%–3.75% in its first policy meeting of 2026, saying inflation remains above target and the labor market shows mixed signals — a decision that matters now because it sets the tone for markets, borrowing costs, and U.S. economic growth for months ahead. This widely expected move balances inflation control and economic support without surprising Wall Street or Main Street yet again.

Why this Matters Now

Investors, borrowers, and everyday Americans are watching closely because a pause in rate cuts affects mortgage rates, credit card costs, stock valuations, and confidence in economic momentum — and policymakers have signaled that further action depends on incoming data.

Steady Rates, Changing Signals: What the Fed Announced

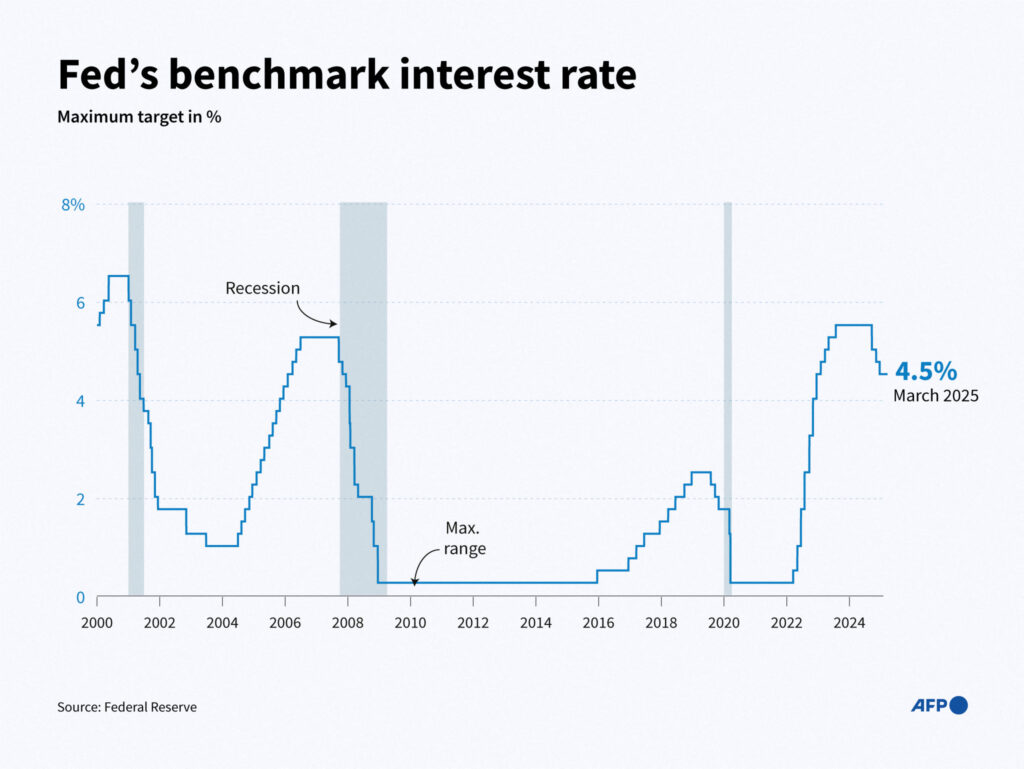

At the January 28, 2026, Federal Open Market Committee (FOMC) meeting, the Federal Reserve kept its benchmark federal funds rate unchanged at a range of 3.50% to 3.75%. The formal statement said that inflation remains somewhat above the Fed’s 2% goal and that policymakers will continue to carefully assess incoming economic data before adjusting policy again.

While most officials supported keeping rates steady, two Fed governors dissented, preferring an additional rate cut. This internal split shows that while there’s general agreement on holding the line for now, differences remain over how to respond to inflation and labor market signals.

What Powell Said at the Press Conference

At the news conference following the rate decision, Fed Chair Jerome Powell reiterated that the central bank remains data-dependent and not on a preset path for cuts or hikes. He highlighted strength in parts of the economy but acknowledged that inflation pressures and hiring trends are still evolving.

Economic Context: Inflation, Jobs, and Markets

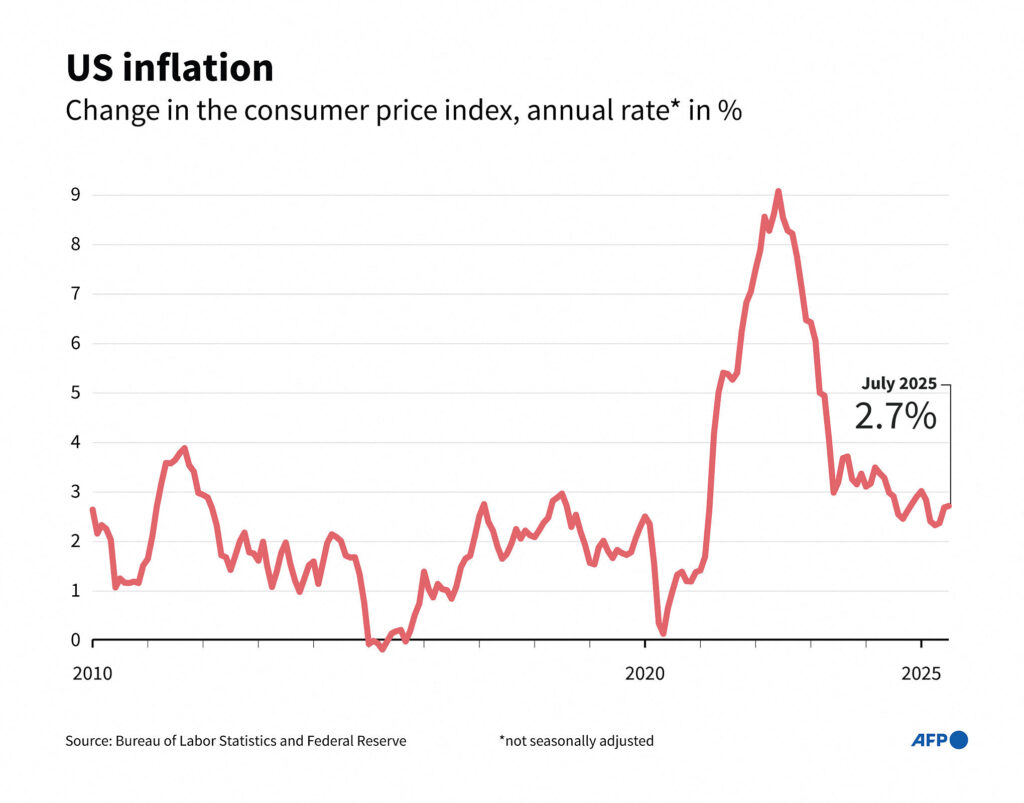

Inflation Still Elevated:

Prices in the U.S. are running above the Fed’s target of 2%, with recent readings closer to 2.7–2.8%. While some inflation metrics are improving, the persistence of higher prices in services and goods bought by consumers remains a concern.

Labor Market Signals Mixed:

Employment growth has been modest, and consumer confidence fell sharply in January to its lowest level since 2014, partly reflecting worries about job availability and inflation. These conditions make it harder for the Fed to decide when and how much to change interest rates next.

Significance for Markets

U.S. stocks ended higher on the Fed’s decision as investors interpreted the steady rate as supportive of stable growth, at least in the near term. Similarly, bond yields and currency movements reflected a cautious but optimistic stance from markets that the Fed won’t tighten further soon.

Political and Institutional Pressures Behind the Scenes

The Fed’s choice comes amid unusual political scrutiny and legal pressure on Chair Powell from the Trump administration and ongoing federal probes — a dynamic that has drawn attention to the independence of the central bank. Powell has reinforced that monetary policy decisions are based on economic data, not political pressure.

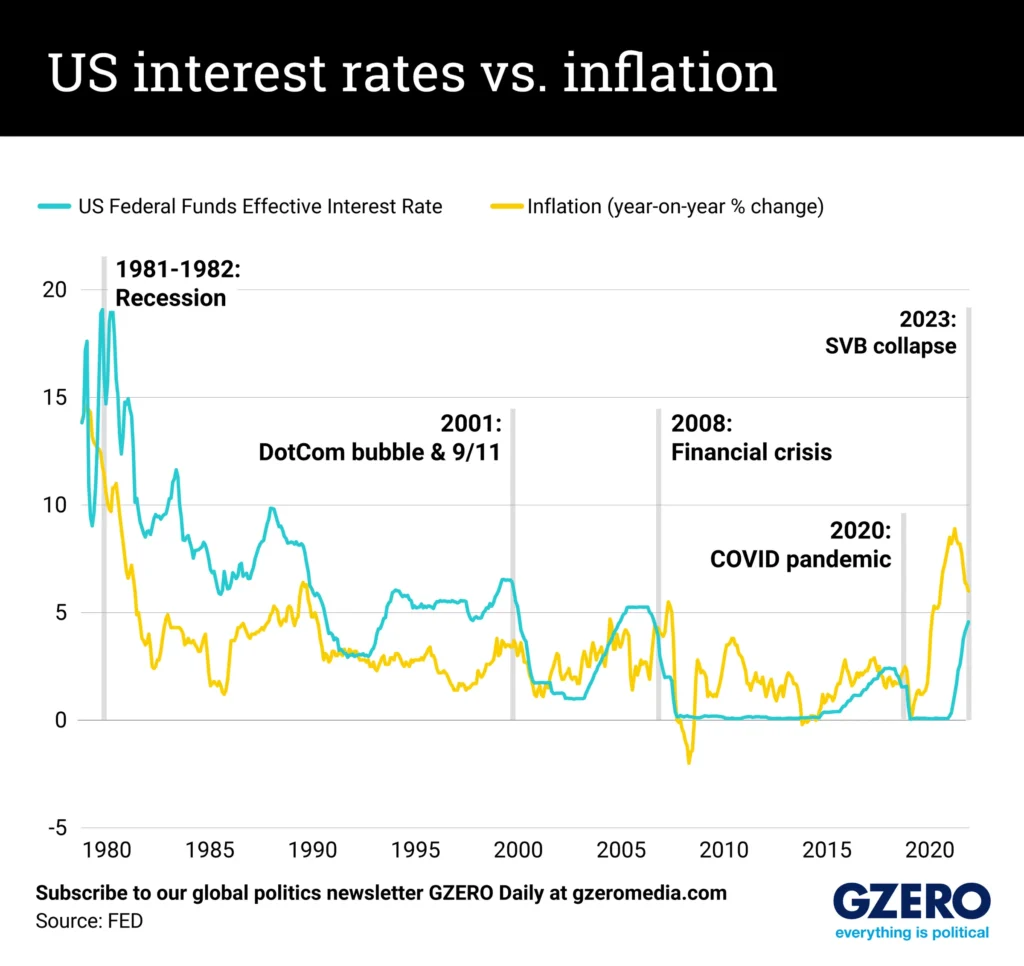

Why Central Bank Independence Matters

Federal Reserve independence ensures decisions about interest rates are guided by economic conditions — not political cycles — boosting credibility and investor trust. Markets generally view a non-politicized Fed as a positive factor for long-term economic stability.

Who Voted and What’s Next for Monetary Policy

The FOMC vote was 10-2 in favor of holding rates unchanged. The two dissenters — Governors Stephen Miran and Christopher Waller — voted for another cut, highlighting differing views on the timing and size of future policy shifts.

When Will Rates Change Next?

Economists and market watchers now expect the next rate decision at the Fed’s March 2026 meeting, where further guidance could be given depending on inflation trends, labor data, and global economic conditions. If inflation continues moving toward the Fed’s goal and jobs data softens, cuts could resume later in the year

Impact on Everyday Americans and Investors

Borrowing Costs:

Holding rates steady means mortgage rates, auto loans, and personal loans may not fall immediately, potentially keeping borrowing costs high for households. This could also influence business investment decisions.

Investment Strategies:

Investors are watching for signs of whether stock markets, bonds, or currencies will react as new data arrives. Stable rates often encourage risk assets like stocks unless inflation spikes unexpectedly.

Long-Term Outlook

If inflation continues to cool and job growth remains steady, the Fed may ease rates later in 2026 to support sustainable growth without risking price instability. But for now, the pause highlights uncertainty — and the need to monitor economic signals closely.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.