AMD’s strong fourth-quarter 2025 earnings beat expectations on both revenue and profits, with robust growth in AI and data-center demand, yet the stock fell on mixed forward guidance and investor caution.

AMD Posts Record Revenue and Earnings That Top Analyst Expectations

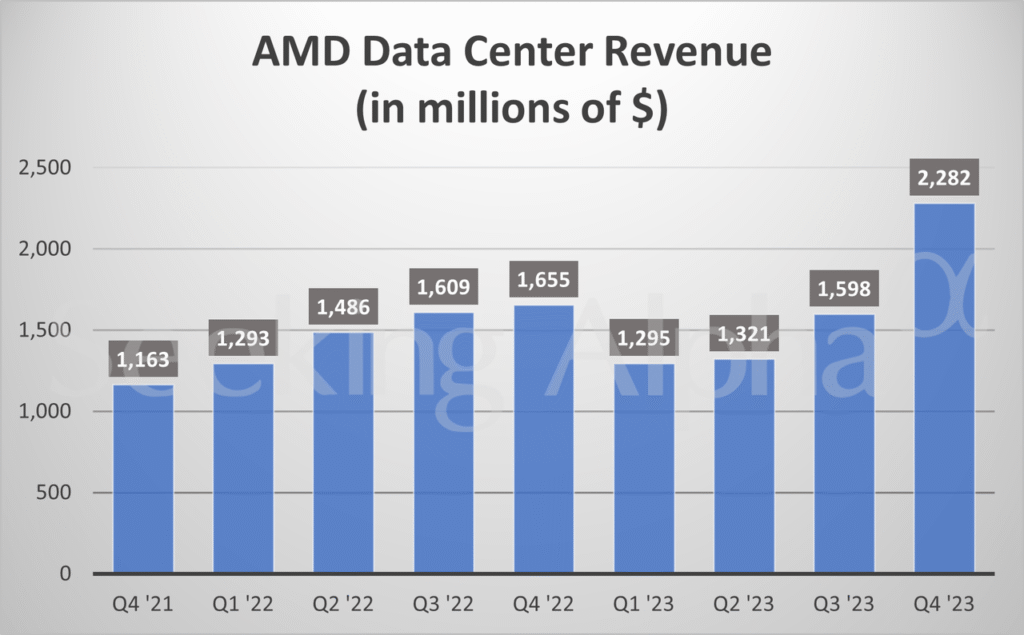

Advanced Micro Devices (NASDAQ: AMD) released its financial results for the fourth quarter and full fiscal year 2025, showing a record $10.27 billion in quarterly revenue — up about 34% year-over-year — and profits that significantly exceeded Wall Street estimates. Net income and earnings per share also climbed sharply compared with the prior year, reflecting accelerated demand across key segments.

AMD’s diversified product lineup — including EPYC server CPUs, Ryzen PCs, and Instinct AI accelerators — contributed to broad-based growth. Data-center revenue alone jumped nearly 39%, underscoring the company’s success in winning business from cloud infrastructure builders and enterprise customers. Gross margins expanded, and full-year results closed 2025 at an all-time high.

Despite this strong performance, the company’s stock saw downward pressure in extended trading, a dynamic we explain in more detail below.

Why AMD Shares Fell Even After a Strong Quarter

Investors initially expected AMD’s results to include standout blowouts in both AI chip demand and forward guidance. While Q4 revenue beat expectations, the company also forecast Q1 2026 revenue of roughly $9.8 billion, which represents a modest sequential decrease from Q4 — even if still above consensus estimates. This mixed outlook sparked caution among traders.

Part of the guidance includes $100 million in projected MI308 AI chip sales to China, which helped boost revenue — but raised questions about how sustainable that growth is absent recurring China demand. Excluding China AI sales, some analysts believe data-center revenue would have narrowly missed expectations, intensifying investor hesitation.

Additionally, AMD’s stock had rallied strongly leading into earnings, so some profit-taking pressure was expected regardless of results. It’s also notable that some investors might have hoped for even more aggressive future guidance, especially given the rapid growth of AI computing.

Data-Center and AI Hardware Sales Lead Growth

A big driver of AMD’s revenue strength was its data-center business, where demand for both EPYC server CPUs and AI-dedicated Instinct GPUs soared. As enterprises expand infrastructure for machine learning, cloud computing, and advanced analytics, AMD’s products are increasingly adopted alongside those of competitors.

The company’s AI accelerator sales to China — especially of the MI308 platform — gave an unexpected lift in Q4 and helped push the overall numbers ahead of most estimates. This indicates global appetite for AI hardware remains robust, even amid broader economic concerns.

Gaming and PC segments also posted strong year-over-year revenue growth, with consumer demand for performance CPUs and GPUs contributing to overall results. Those gains came from a richer mix of high-end Ryzen and Radeon products.

Full-Year Performance and Long-Term Momentum

AMD closed 2025 with another record year overall — nearly $34.6 billion in total revenue, up more than 30% from the prior year. Operating income and free cash flow hit new highs, highlighting the company’s ability to scale profitably across multiple product lines.

CEO Dr. Lisa Su emphasized that AMD enters 2026 with “strong momentum” backed by accelerated adoption of high-performance computing platforms — particularly in areas tied to artificial intelligence workloads.

Strategic partnerships with major cloud providers and enterprise customers, plus a growing presence in AI-optimized systems, also support AMD’s long-term growth thesis. Broader product launches at CES 2026 reinforce that roadmap.

Competitive Landscape: Nvidia and Beyond

Despite AMD’s strong results, Nvidia remains the dominant force in the AI GPU market. NVIDIA’s scale and market share in high-end AI accelerators continue to overshadow competitors, including AMD. Investors gauge AMD’s progress against that backdrop, which influences stock reactions and market confidence.

Other rivals like Intel face supply challenges that provide AMD with opportunities to capture share in segments where Intel has struggled — notably high-performance CPUs for servers. AMD’s outsourcing strategy with TSMC helps it avoid some of those production bottlenecks.

What This Means for Investors and the Tech Sector

For investors, AMD’s earnings season provides a nuanced view: the company delivered robust growth and strong fundamentals, yet market expectations for hyper-accelerated AI expansion still shape stock performance. Analysts and algorithms now evaluate not just absolute results but forward signals and competitive positioning relative to peers.

Longer term, AMD’s execution across CPUs, GPUs, AI accelerators, and system solutions suggests it will remain a key player in the semiconductor ecosystem — especially as global technology demand continues to hinge on artificial intelligence, cloud computing, and data center scaling.

AMD’s Q4 2025 earnings topped expectations and revealed clear momentum across its core businesses, but a slightly softer forward outlook and investor positioning sent the stock lower. While markets digest these nuances, AMD’s broad product strategy and AI relevance still position it for future growth.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.