Microsoft delivered a stronger-than-expected fiscal second-quarter performance, reporting $81.3 billion in revenue and $30.9 billion in net profit, while investors reacted nervously to rising AI infrastructure costs and cloud growth trends. Microsoft (NASDAQ: MSFT) posted robust earnings. Revenue and profits beat Wall Street forecasts. Strong demand for cloud and AI services lifted results. Shares fell after hours as markets grappled with heavy spending and future expectations. Why this matters now: In a moment when Big Tech’s AI investments are under intense scrutiny, this report shows Microsoft’s core businesses remain resilient — yet the future depends heavily on long-term AI profitability and capital discipline.

Surpassing Wall Street Expectations and Expanding AI Reach

Microsoft’s October–December quarter results surpassed analyst estimates, with revenue increasing about 17% compared with the year-ago quarter. Analysts had forecast around $80.3 billion, but the company’s actual revenue came in stronger at $81.3 billion, reflecting sustained enterprise demand and cloud adoption across industries. Net income rose to $30.9 billion, or $4.14 per share, signaling both top-line strength and profitability in spite of heavy investments.

A notable factor in the results was the impact of Microsoft’s investment in OpenAI, contributing a one-time accounting gain that boosted reported profits significantly. Even excluding this accounting nuance, the company’s core technology offerings — especially cloud computing and productivity solutions — continued to perform above expectations.

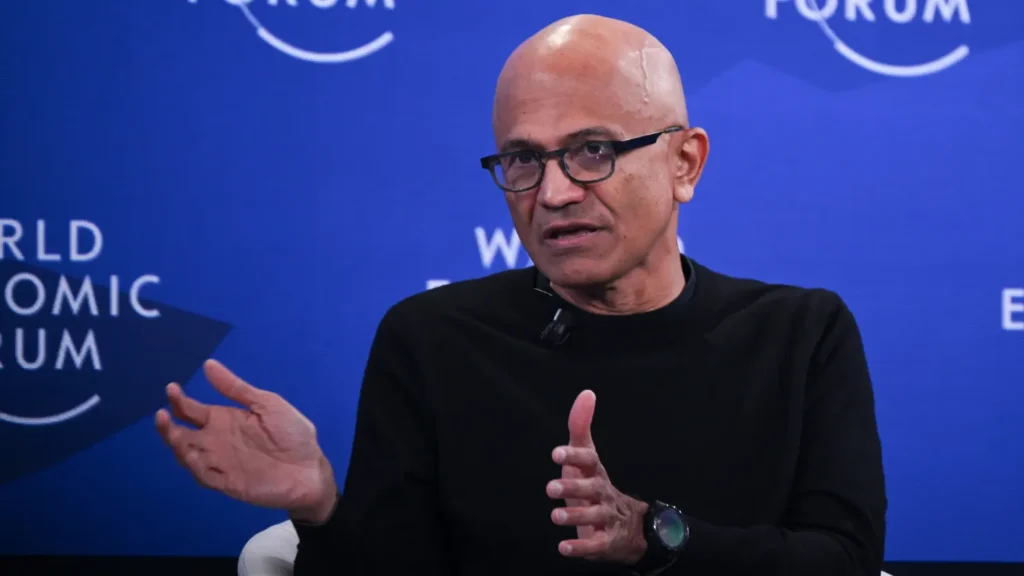

Microsoft’s Chief Executive Satya Nadella emphasized that AI is still in its early stages, stressing that expanding infrastructure and customer readiness for AI tools remain long-term priorities for the company.

Cloud, Azure, and AI: Growth Engines That Still Defy Convention

The company’s cloud business remains the standout performer, with Microsoft Azure posting nearly 39% growth in revenue year-over-year — beating expectations and confirming the platform’s elevated position in global enterprise cloud adoption. Altogether, Microsoft Cloud revenue topped $50 billion for the quarter, a milestone that underscores how essential cloud services have become for business transformation.

Under the broader cloud umbrella, productivity tools and enterprise services such as Microsoft 365 subscriptions, LinkedIn, and Dynamics 365 all contributed to the quarter’s strong performance. The continued rise in cloud usage — especially for AI-powered products — reflects how businesses are integrating advanced technologies to streamline operations.

However, some segments, such as More Personal Computing, which includes Windows devices and Xbox hardware, recorded flat or declining performance, signaling the uneven nature of growth across Microsoft’s portfolio.

Investor Reaction: Shares Slide Amid Capital Spending and Cloud Concerns

Despite the strong earnings beat, Microsoft’s stock declined in after-hours trading, down roughly 5–7% immediately following the earnings release. The market’s muted response stemmed primarily from concerns about Microsoft’s record capital expenditures, which soared to $37.5 billion — a jump of about 66% year-over-year — mainly due to investments in AI data center capacity and cutting-edge computing hardware.

Investors were also cautious because Azure’s growth rate, while impressive, showed signs of slowing slightly, which some analysts interpreted as a harbinger of more tempered cloud growth ahead. This has fueled a broader debate among market watchers about how quickly AI investments will translate into sustainable profits.

In the midst of this, Microsoft’s commercial performance obligations — a forward-looking measure of contracted future revenue — doubled to $625 billion, demonstrating robust demand and long-term business commitments even as market sentiment remains cautious.

OpenAI’s Role and Microsoft’s Strategic Position

Microsoft’s investment strategy continues to emphasize its partnership with OpenAI, in which it owns around 27% stake by value. This relationship has become a key differentiator in the AI arms race, especially against peers like Google and Amazon. Microsoft retains commercial rights to OpenAI products through 2032, ensuring long-term access to breakthrough technologies powering services like Copilot and custom enterprise AI tools.

However, reliance on OpenAI also poses risks. Roughly 45% of Microsoft’s future cloud backlog is tied to AI-related commitments, underscoring how deeply the company’s future expectations are intertwined with the success of its AI collaborations. While this signals optimism about AI’s potential, it also raises questions about risk concentration and competition from rivals like Google’s Gemini and Anthropic’s Claude.

Looking Ahead: Guidance and Market Expectations

For the third quarter of fiscal 2026, Microsoft projects revenue between approximately $80.65 billion and $81.75 billion, suggesting steady growth but with an emphasis on balancing profit with sustained investment in AI and cloud infrastructure. The company also anticipates continued Azure revenue expansion, albeit at a pace slightly below its recent peak.

CEO Nadella reiterated that Microsoft is focused on maximizing value per watt per dollar in AI compute efficiency — a strategic emphasis that may help drive more sustainable profitability over time. However, macroeconomic uncertainty and growing competition in cloud and AI services remain challenges that the company must navigate.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.