SMCI: Super Micro Computer Inc. reported stunning financial results that beat expectations, delivered record revenue driven by booming AI demand, and raised its 2026 annual revenue forecast — news that underscores its growing role in the global AI infrastructure market. Super Micro’s Q2 FY 2026 revenue soared to approximately $12.7 billion, far above forecasts, fueled by unprecedented demand for servers optimized for artificial intelligence workloads, while full-year revenue guidance jumped to at least $40 billion from a prior target of about $36 billion. This remarkable performance echoes growing confidence in the company’s ability to capitalize on the ongoing AI boom.

Why this matters now: The tech sector, especially AI infrastructure, is rapidly expanding, making Super Micro a central play for investors and enterprises alike. Its strong Q2 results not only reflect demand for GPU-accelerated systems but also signal resilience and leadership in supplying compute power that fuels AI growth worldwide. With cloud, data center, and hyperscale customers scaling their AI workloads, Super Micro’s performance has broader implications for tech supply chains and AI adoption.

Record Revenue Fueled by AI Demand and Server Sales

In its most recent quarter, Super Micro Computer achieved revenue of roughly $12.7 billion, representing roughly more than double the growth compared to the previous year, decisively beating Wall Street’s expectations and signaling robust market demand for its advanced servers and systems used in computing tasks like machine learning, large language model training, and high-performance AI processing.

This surge was driven by a spike in orders for servers designed specifically for AI tasks, including those that integrate GPUs from leading chipmakers such as Nvidia and AMD, which have become essential for training and running generative AI models. Nearly 90 percent of Super Micro’s sales in the quarter came from AI-related systems, underlining how central AI has become to its revenue stream.

Despite the strong top-line growth, gross profit margins were reported lower than the prior quarter, largely due to shifts in customer mix and supply chain pressures. This emphasizes that while demand is surging, cost and pricing dynamics remain critical factors for profitability.

SMCI: 2026 Outlook: A Bold Forecast Amid Growth

One of the most significant takeaways in the earnings release was Super Micro’s decision to raise its full-year revenue forecast to at least $40 billion, up from an earlier estimate of $36 billion. This represents strategic confidence in its product portfolio and market opportunity, particularly in AI server and data center infrastructure sales.

The company also provided forward guidance for the next quarter, expecting at least $12.3 billion in revenue, which once again exceeds analysts’ estimates. This strong forward outlook reinforces the broader expectation that demand for AI-optimized computing solutions will remain resilient throughout the year.

Investors responded positively to this outlook, with Super Micro’s shares rising more than 5% in after-hours trading following the announcement, reflecting appreciation for its execution and long-term prospects in the AI ecosystem.

Strategic Partnerships and Market Position

Super Micro’s earnings highlight its strategic relationships with major players in the AI and semiconductor sectors. By aligning closely with partners such as Nvidia and AMD, Super Micro ensures access to cutting-edge processor technologies that are vital for AI workloads. These collaborations also help the company accelerate the deployment of innovative server solutions that many cloud providers and enterprise customers need today.

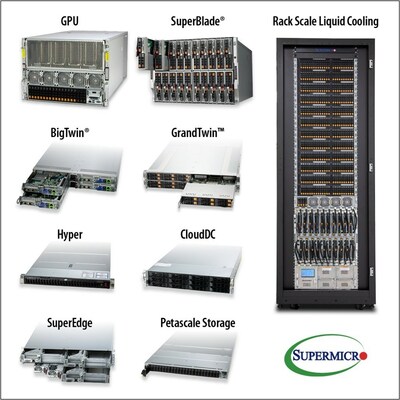

The company’s product portfolio emphasizes not only traditional rack servers but also next-generation systems designed for liquid cooling, high-density GPU deployment, and efficiency optimization — all of which are becoming must-haves for hyperscale AI deployments.

Challenges and Broader Market Context

While Super Micro’s recent performance is impressive, several challenges remain. Margin compression due to supply chain constraints, tariff impacts, and increasing costs highlights operational pressures. Additionally, the company is heavily reliant on a few large customers — with one major client accounting for a significant portion of Q2 revenue — which could present concentration risks if demand patterns shift.

In the broader market landscape, Super Micro’s success coincides with global trends in AI investments, where tech giants and cloud providers are pouring capital into building AI infrastructure at record rates. This dynamic creates both an opportunity and competition for firms like Super Micro to expand their footprint while navigating supply chain headwinds and pricing pressure.

Investor and Industry Impact

For investors, Super Micro’s strong earnings and raised forecast solidify its positioning as a leading AI infrastructure provider. Its ability to outperform expectations and set higher revenue targets could attract institutional interest and reaffirm confidence in its growth trajectory. Analysts and market watchers will likely continue to highlight Super Micro as a key indicator of strength in the AI hardware segment.

For the industry, these results matter because they reflect broader adoption of AI technologies that require powerful compute backends — infrastructure that Super Micro helps build. As enterprises shift more workloads toward AI, demand for systems like Super Micro’s is expected to remain strong.

Looking Ahead: Sustaining Growth in a Competitive Market

Super Micro’s outlook suggests that demand for AI systems shows no immediate signs of slowing, positioning the company well for future quarters. Continued innovation in server design, expansion into new markets, and strategic partnerships will likely be critical factors in sustaining growth.

As the world continues to embrace AI and data-driven technologies, companies that provide the backbone — such as Super Micro — stand to benefit from long-term secular trends. Industry observers will be watching closely to see whether the company can translate its recent momentum into sustained profitability and market leadership.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.