SanDisk Stock Explodes After AI Memory Demand Sparks Massive Earnings Surprise and Wall Street Frenzy

SanDisk’s stock has rocketed after it crushed quarterly earnings forecasts and confirmed that artificial intelligence (AI)-driven demand for memory and data storage is booming, sending its shares sharply higher and making it one of the strongest performers in the S&P 500. Analysts believe this trend could reshape the storage market for years as AI data centers gobble up flash memory faster than companies can produce it.

This matters now because AI systems require massive amounts of high-performance storage, and SanDisk — a leader in NAND flash memory — is positioned at the center of this demand surge, with Wall Street investors rewarding that shift with aggressive upgrades and rising price targets.

Earnings Beat and Bullish Forecasts Propel Shares Higher

SanDisk’s latest quarterly results stunned Wall Street, with revenue and earnings far above consensus estimates. The company reported revenue topping $3 billion, far exceeding expectations, and delivered adjusted earnings per share that beat analysts’ forecasts by wide margins. This earnings surprise triggered a sharp rally in SanDisk’s stock, with shares climbing more than 20% in early trading.

Management didn’t just report strong results — it also issued an exceptionally optimistic forecast for the next quarter, with projected revenue and profit guidance well above expectations. That forward guidance helped fuel further buying interest from investors who see SanDisk’s business growing rapidly alongside the expansion of AI infrastructure.

AI Memory Demand: The Core Driver Behind Growth

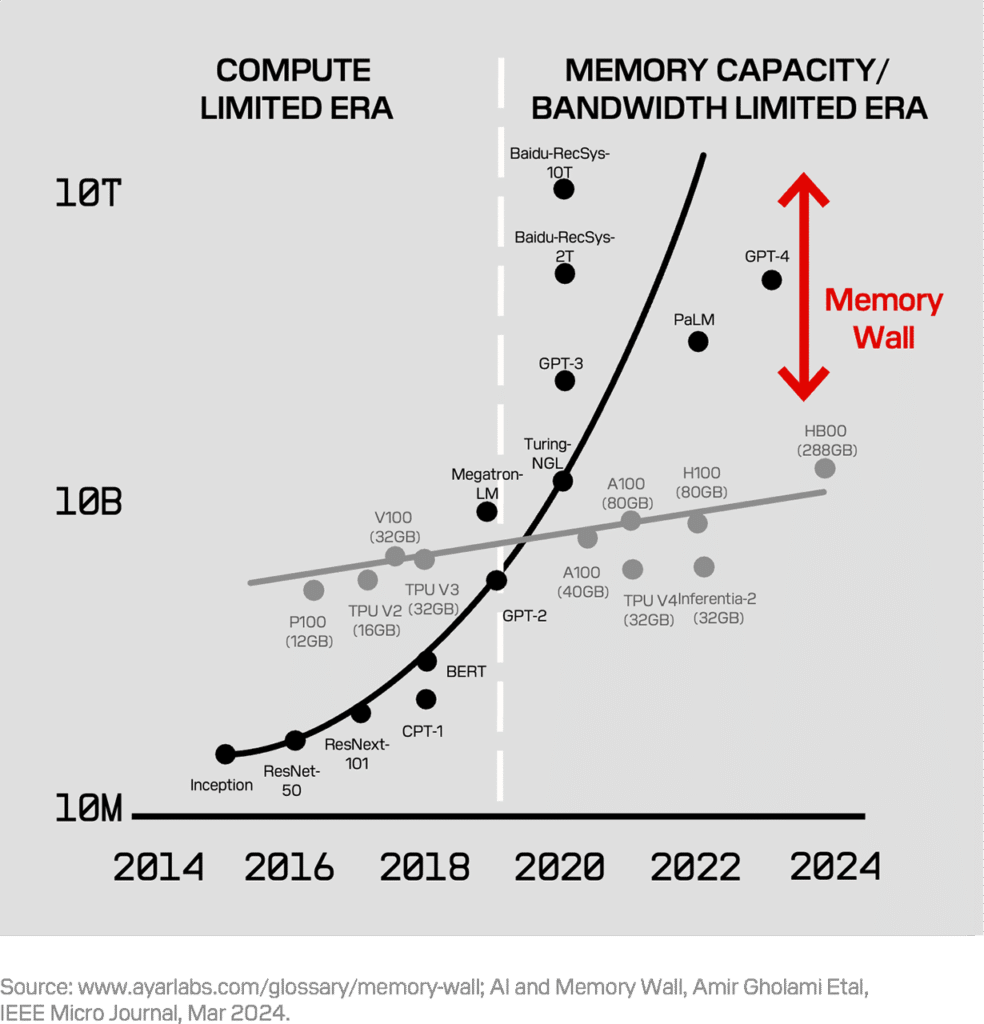

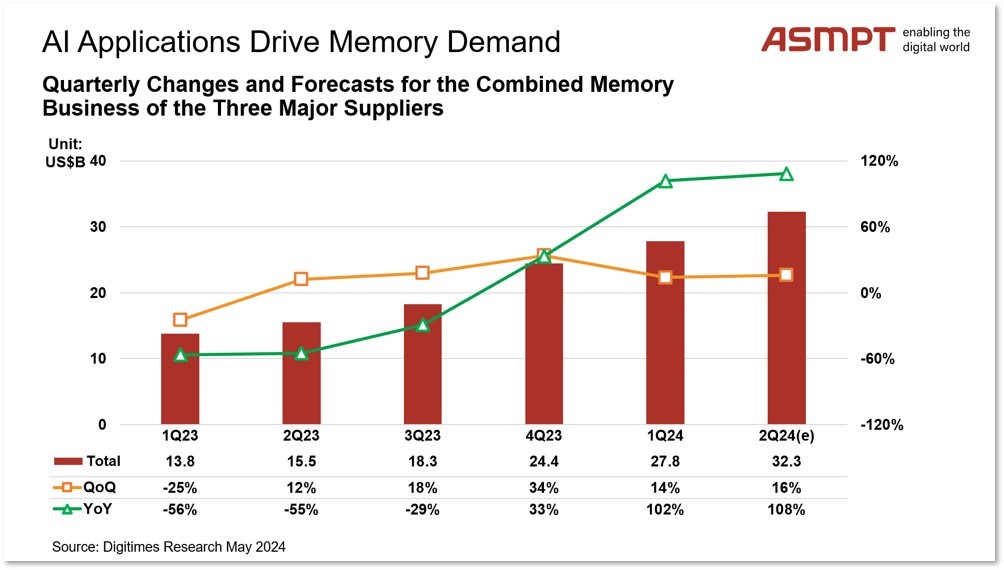

At the heart of SanDisk’s surge is the rapid growth in demand for AI-related memory storage. Modern AI workloads — especially in data centers that power services like large-language models and machine learning platforms — require vast amounts of high-speed flash memory. Analysts note that this demand has tightened memory supply chains, pushing prices higher and allowing companies like SanDisk to enjoy better margins and stronger pricing power.

This isn’t just about selling more products — it’s a structural shift: AI data centers require memory at orders of magnitude beyond past needs. That structural change has lifted SanDisk and other storage vendors out of a sluggish period into a robust cycle of growth.

Global Memory Shortage Supports Price Power

The enormous demand for AI hardware has also contributed to a broader memory supply squeeze worldwide, spanning 2024 to 2026, as major producers shift capacity toward high-margin AI memory production. This has resulted in price increases for flash memory and other memory types like DRAM, benefiting suppliers but putting pressure on consumers and OEMs.

For SanDisk, the tight market supply has translated into opportunities to command stronger prices and secure long-term supply deals with major partners and hyperscale cloud providers, reinforcing confidence in sustained demand.

Analysts Lift Price Targets as Investors Rush In

Following the earnings beat and strong forecast, multiple Wall Street analysts have raised their price targets on SanDisk shares, with some suggesting valuations that imply significant upside potential from current levels. One notable price target cited in recent coverage reached the $700 range, signaling strong investor conviction in the company’s future prospects.

Many analysts have labeled the stock a “buy,” and this bullish sentiment has helped attract fresh institutional capital and momentum traders, amplifying the stock’s rise.

Broader Sector Impact and What Comes Next

SanDisk’s performance is not isolated — other storage and data infrastructure companies are also benefiting from the AI boom. Broad trends show that the rising demand for memory and storage from AI workloads is lifting shares across the semiconductor memory segment.

However, investors and analysts caution that maintaining this growth will depend on how long supply remains tight and whether AI demand continues at its current pace. SanDisk’s ability to secure long-term partnerships, invest in capacity expansion, and manage supply constraints will be critical to sustaining its momentum in the quarters ahead.

As storage demand tied to artificial intelligence grows — and earnings continue to outperform expectations — SanDisk’s story remains one of the most significant in tech markets today, and is likely to keep attracting attention from investors and AI watchers alike.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.