China Declares Full-Scale Cryptocurrency Crackdown, Sending Shockwaves Across Global Markets

China is moving aggressively to tighten its grip on digital currencies, announcing new rules that ban unauthorized offshore yuan-pegged stablecoins, broaden restrictions on foreign crypto exchanges, and cast a wider net over asset tokenization and speculative cryptocurrency activities. This development comes as Beijing strengthens its financial sovereignty and prioritizes its Digital Currency Electronic Payment (e-CNY) system over private crypto alternatives.

In the first 120 words, who / what / why / impact context:

- Who: China’s central bank (PBOC) with seven regulatory agencies.

- What: A sweeping crackdown expanding the existing cryptocurrency ban to include offshore stablecoin issuance and foreign exchange access for cryptocurrency services.

- Why: Authorities aim to protect monetary sovereignty, clamp down on unregulated financial risks, prevent money laundering, and promote the official e-CNY digital yuan.

- Impact: The move reverberates through global crypto markets, affects foreign exchanges operating in China, and limits innovation outside Beijing’s consent.

Why this matters now: As digital assets gain broader adoption worldwide, China’s regulatory shift directly challenges decentralized finance trends and sets a hard line that could reshape how crypto markets function globally.

Expanded Restrictions on Cryptocurrency: What China Just Announced

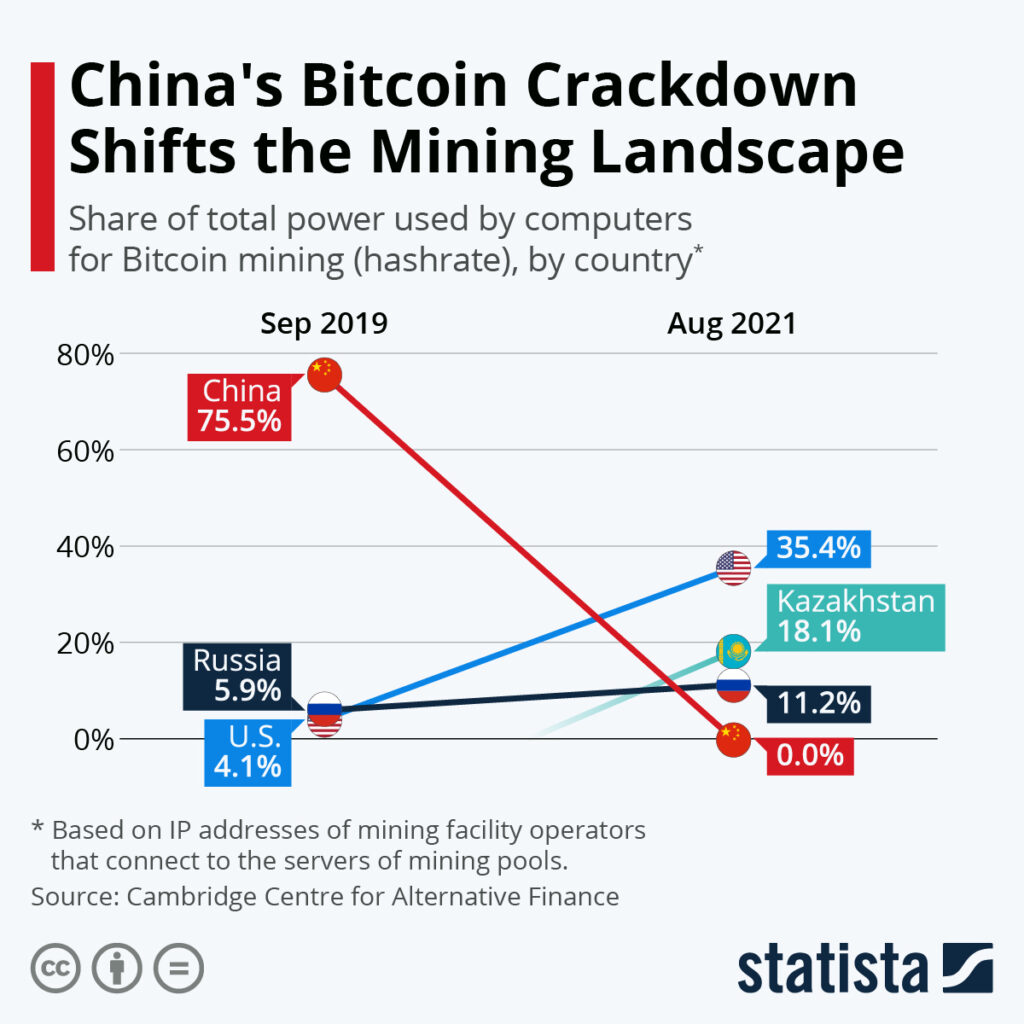

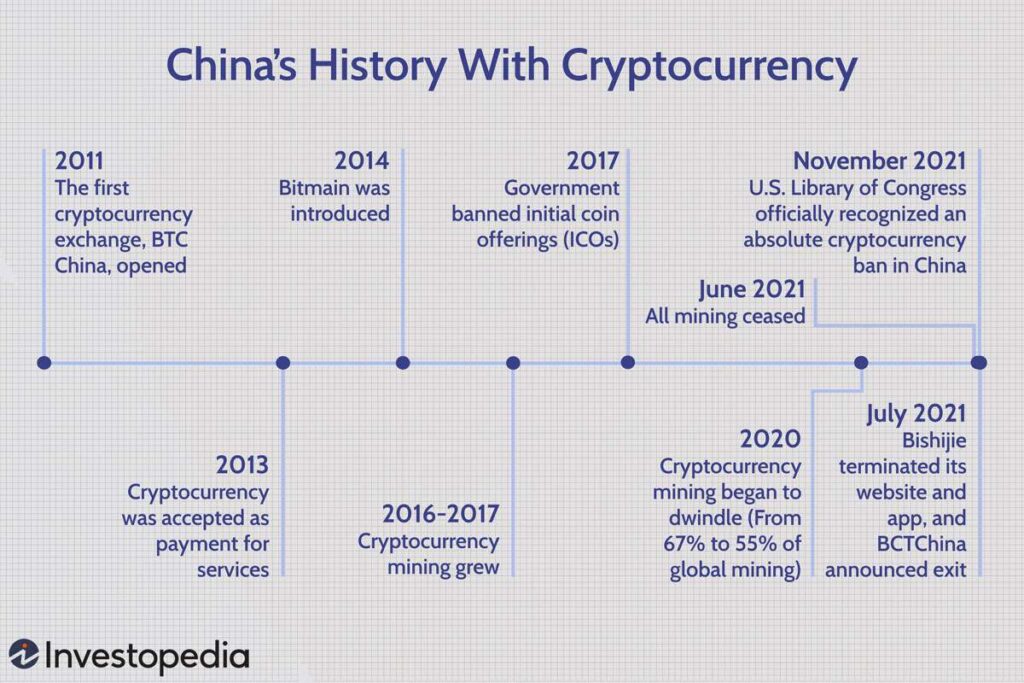

In early February 2026, China’s financial regulators issued a unified notice that significantly broadens the nation’s already strict stance on cryptocurrencies. While China has banned local trading of cryptocurrencies like Bitcoin and Ethereum since 2021, the new directive goes further — targeting offshore issuance of yuan-linked stablecoins and foreign exchange–related crypto services without explicit approval from authorities.

Stablecoins are digital tokens whose value is tied to traditional assets — in this case, the Chinese yuan (Renminbi). Regulators argue that private stablecoins can mimic the functions of official money and undermine policy controls when they circulate outside mainland oversight.

Alongside this, China’s notice also broadens enforcement to cover real-world asset (RWA) tokenization, effectively regulating how physical world assets (like securities or property rights) are converted into blockchain tokens — unless conducted within government-sanctioned infrastructure.

Impact on Foreign Exchanges and Global Crypto Firms

One of the most consequential shifts in policy is the tightening of access by foreign digital asset exchanges into China. Overseas platforms — from global centralized exchanges to decentralized finance protocols — are now explicitly limited from offering crypto services to Chinese citizens, even from abroad.

This means that:

- Foreign exchanges can no longer operate quasi-legal access points into China’s market without approval.

- Stablecoins tied to the yuan, if unapproved, are effectively illegal internationally.

- Global crypto firms must adapt, or risk enforcement as regulators view unauthorized issuance and services as illegal financial activity.

For international exchanges and asset issuers, this presents a clear message: compliance with Chinese financial rules is mandatory if they want future access or partnerships within China’s ecosystem. Analysts see this as part of Beijing’s strategy to limit foreign influence in its financial system and channel digital finance development into state-aligned frameworks.

Why China Is Doubling Down On Control

China’s regulators have consistently labeled cryptocurrencies as non-legal tender and financially risky, associating them with illicit fundraising, fraud, and destabilizing capital flight.

Unlike Western regulators, who are exploring regulated stablecoin frameworks integrated into traditional banking systems, China is:

- Prioritizing its digital yuan (e-CNY) as the only state-backed digital currency.

- Closing legal loopholes that allow offshore token issuance tied to the yuan.

- Enforce a unified crackdown that treats unauthorized crypto activities as illegal.

For Beijing, digital currency innovation must stay under government control to prevent what it views as systemic financial risk. Foreign stablecoins — especially those tied to the yuan — are seen as a challenge to monetary sovereignty and regulatory effectiveness.

Global Market and Investor Reactions

Crypto markets have reacted to the announcement with increased volatility, especially as regulatory certainty in China has tightened. Bitcoin and other major cryptocurrencies experienced downward pressure around the news, partly due to uncertainty about investor access and future demand.

Meanwhile, analysts predict that markets outside China — particularly in North America and Europe — may see increased interest from crypto firms seeking regulatory certainty. Countries like the United States and Hong Kong are currently developing frameworks that balance innovation with oversight, contrasting sharply with China’s prohibition-first approach.

What This Means for the Future of Crypto

China’s latest move is a defining moment in global cryptocurrency regulation. By strengthening its ban and bringing offshore tokens under its regulatory perimeter, Beijing is sending a clear signal: Digital finance in China must operate within its strict framework or not at all.

For investors, platforms, and global markets, this represents:

- A regulatory watershed that could accelerate divergence between Chinese markets and global norms.

- A continued risk premium on assets exposed to Chinese policy.

- A potential shift in geographic focus for crypto innovation and capital.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.