Ethereum Price Plunges as Crypto Selloff Deepens, Triggering Fear, Debate, and a Potential Buy Opportunity

Ethereum’s price continues to fall sharply in early 2026, dropping below critical support levels as the broader crypto market enters a deep selloff, shaking investor confidence and triggering large liquidations. What’s worse, institutional flows are turning cautious, spot ETFs are seeing redemptions, and technical indicators remain bearish, raising fresh questions about whether this is a short-term dip or a prolonged downturn that could redefine the outlook for ETH and the entire crypto ecosystem.

The sell-off comes as Bitcoin and other major cryptocurrencies also face heavy losses, driven by market fear, rising macro pressure, and a shift toward safer assets. While some analysts spot potential buy signals, others warn that prices could slip further before stabilizing. This matters now because crypto markets are deeply interconnected with macro investment sentiment, institutional flows, and leverage dynamics that can rapidly reshape prices across the board.

Why Ethereum Price Is Falling: Market Sentiment and Liquidity Pressures

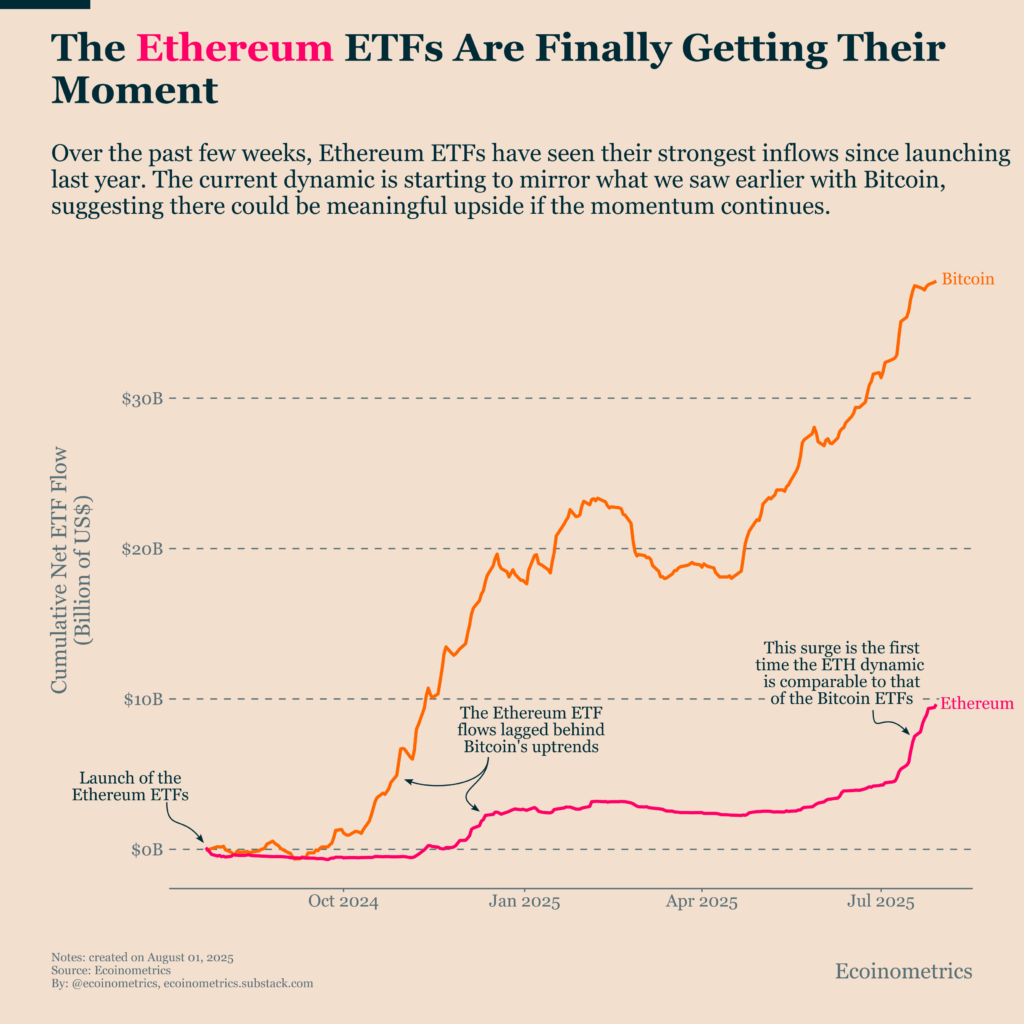

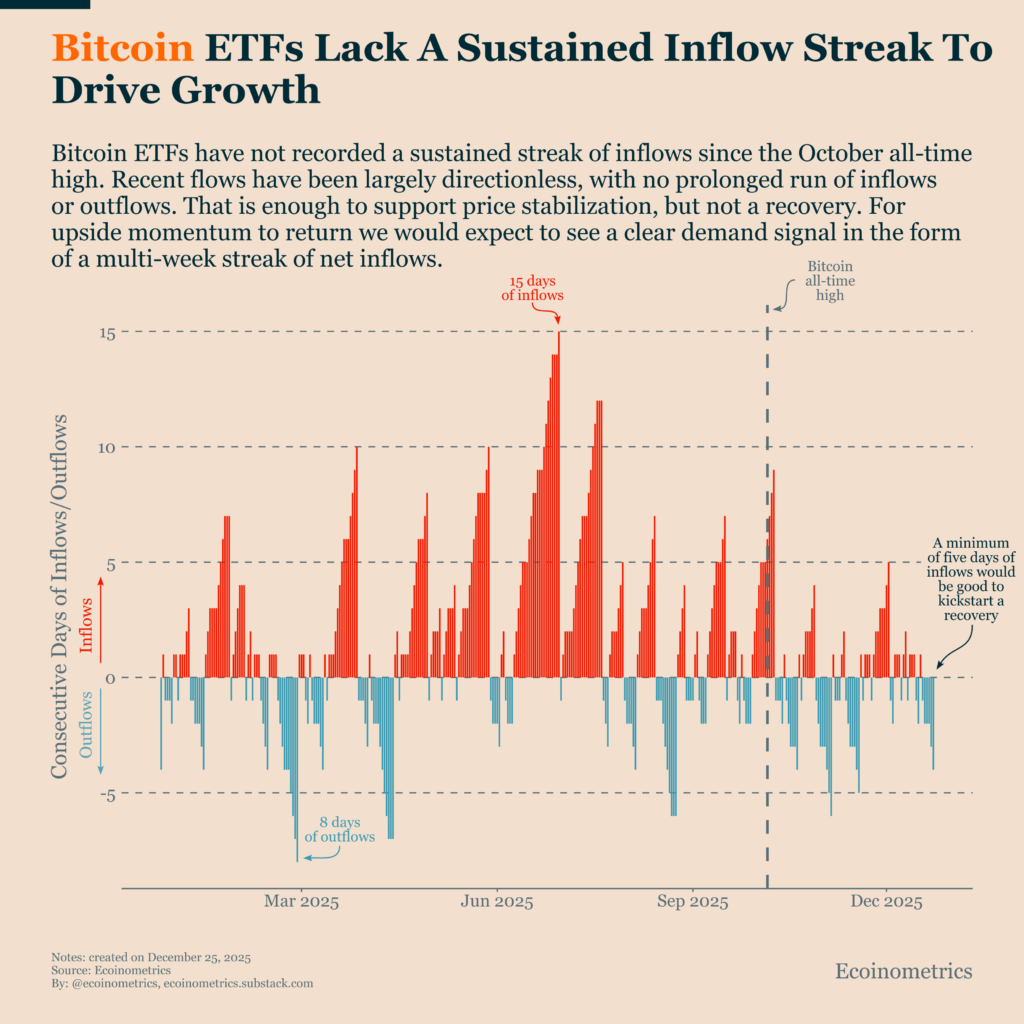

Ethereum’s recent slide has been driven by a powerful combination of market-wide risk reduction and specific sell signals in crypto trading. Investors are exiting positions amid rising macro uncertainties — including expectations of tighter monetary policy — and a broad rotation out of risk assets and into safer stores of value. Spot exchange-traded products for Ethereum and Bitcoin have seen net outflows, highlighting waning institutional confidence and shrinking speculative positioning.

The broader cryptocurrency market has also seen heavy liquidations, with billions wiped out in leveraged ETH and BTC positions over recent days — a dynamic that can sharply accelerate downturns. When derivatives markets unwind on falling prices, forced selling amplifies losses, pushing prices even lower.

Technical structures that once suggested stabilization have now broken, placing ETH below key moving averages and invalidating potential reversal charts, signaling that bearish price action may continue in the short term.

Expert Perspectives: Bearish Risks and Buy Signal Debates

Some market technicians argue that Ethereum is in “sell-the-rips” territory until it decisively recovers major moving averages, meaning rallies are being viewed as opportunities to reduce exposure rather than signals for strong upward momentum. This framework suggests that until ETH reclaims key resistance levels, downside risk remains elevated.

However, a segment of analysts sees contrarian signs that could hint at a long-term buying opportunity, albeit only if certain technical conditions improve. Oversold indicators on the Relative Strength Index (RSI) and weakening selling pressure on the charts suggest that some support levels might hold, providing a foundation for eventual rebounds — but this is far from a confirmed reversal.

Investors should therefore remain cautious: while a deep selloff historically precedes sharp rebounds at major cycle bottoms, relying on any single indicator without broad market confirmation is risky.

Macro Pressure: Broader Market Stress and Investor Behavior

Ethereum’s weakness isn’t occurring in isolation. The entire broader crypto space — including Bitcoin, XRP, and other large altcoins — has been swept up in red across multiple trading sessions, driven by risk-off behavior in both institutional and retail arenas. Loss of confidence in technology stocks and rising expectations for higher interest rates have dampened risk appetite, pushing capital toward safer assets like gold and U.S. Treasury products.

ETF flows — often viewed as institutional confidence barometers — have seen substantial withdrawals. Bitcoin ETFs posted weekly outflows in the hundreds of millions, while Ethereum-linked funds also retraced, reflecting tactical rather than conviction-driven allocation by large players.

This alignment of macro pressure with crypto selloffs compounds the decline, reinforcing the bearish narrative until evidence of a sustained trend reversal emerges.

Short-Term Outlook: Support Levels and Potential Recovery Zones

On the downside, analysts have identified critical price levels that, if broken, could accelerate further losses. Ethereum’s breach of near-term supports has technicians eyeing lower potential price floors — possibly stretching toward historically significant zones — before meaningful stabilization occurs.

Conversely, if Ethereum can reclaim resistance near $2,800 to $3,000, that could flip sentiment and encourage renewed accumulation from longer-term holders, particularly if accompanied by renewed institutional flows.

Market participants should watch trading volume, ETF flow data, and macro indicators to gauge whether a renewed bullish phase is viable or if risk remains skewed to the downside.

What This Means for Investors and the Crypto Ecosystem

For long-term holders of Ethereum, this period underscores the importance of disciplined risk management, a focus on structural developments rather than short-term price action, and an awareness that high volatility is inherent to crypto markets. While this downturn may feel intense, periods of accumulation often follow extended selloffs — but only once broader confidence returns.

For traders, short-term risk remains heightened until technical indicators align with improved macro sentiment and positive network fundamentals. Institutional interest, technical patterns, on-chain data, and macro signals will collectively determine whether this phase marks a late-cycle correction or a pronounced market reset.

Why this matters now: Ethereum’s recent decline signals a broader shift in risk appetite affecting digital assets. Markets are highly sensitive to macroeconomic expectations, ETF flows, and technical breakdowns, meaning this selloff could have implications for crypto investment strategies throughout 2026 and beyond.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.