Every American’s personal security may be at stake after allegations emerged that a copy of the federal government’s Social Security database could have been mishandled — potentially exposing hundreds of millions of Social Security numbers and related personal data. This matters now because if true, the breach reaches beyond any previous record leak, raising the specter of identity theft risks that last a lifetime. Experts warn that unlike credit cards, Social Security numbers can’t easily be changed, meaning victims could face unprecedented long-term consequences.

How Did This Alleged Breach Happen?

Sources now reporting on this event indicate that the Department of Government Efficiency (DOGE) — a lesser-known federal tech unit — may have created a copy of the Social Security Administration’s master database and stored it in a cloud system that lacked standard security controls. According to a protected whistleblower disclosure, oversight safeguards were bypassed, and sensitive data was placed on servers without enough monitoring. This alleged mishandling might have put the personal data of over 300 million Americans at risk.

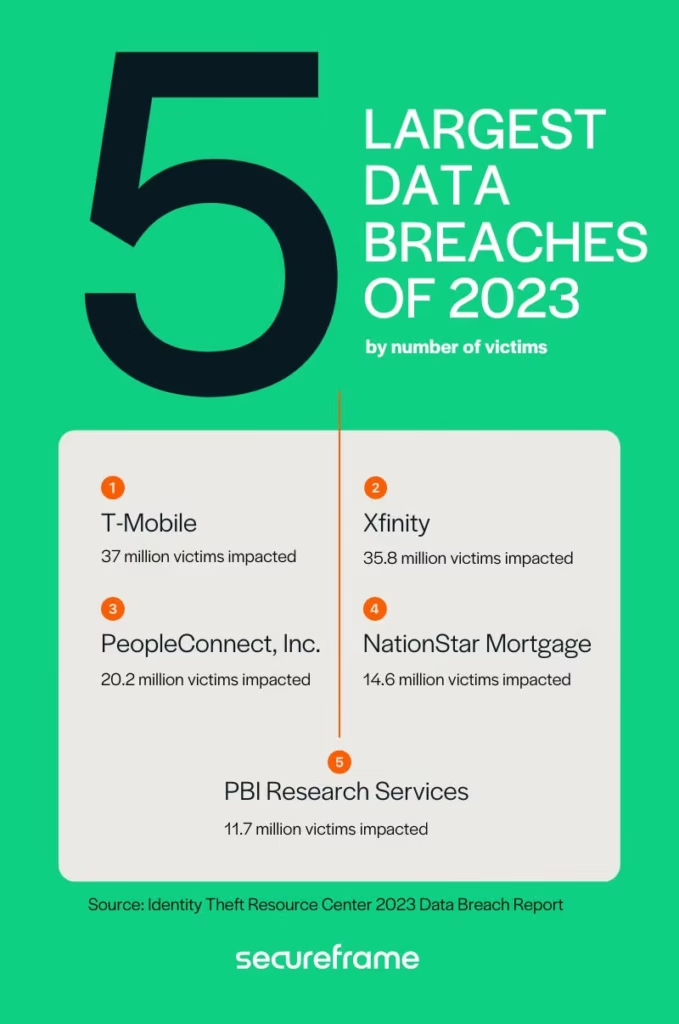

Earlier reporting on similar large breaches shows data brokers have previously exposed billions of personal records, including Social Security numbers, dates of birth, addresses, and phone numbers — demonstrating that data of this nature is extremely valuable and dangerous if improperly managed.

Critically, Social Security officials have publicly contested the most extreme claims, stating the core Social Security database has not been breached in an unauthorized way. They contend internal reviews show the original system remained secure, though investigations continue.

What Kind of Personal Data Could Be Involved?

This isn’t just a list of nine-digit numbers. Analysts and sources suggest that the compromised dataset may include names, Social Security numbers, dates of birth, addresses, phone numbers, financial identifiers, and even family member information. When all this data is combined, it becomes a master key that identity thieves can use to impersonate victims, open credit accounts, file fraudulent tax returns, and access government benefits illegally.

Breaches of this size — comparable to the 2024 National Public Data incident that allegedly contained nearly 2.9 billion records — are especially concerning because they involve multiple types of personal data that are the most attractive targets for cybercriminals.

Why This Matters Now for Every American

Why this matters now: Unlike most breaches where changing a credit card number minimizes risk, the exposure of a Social Security number can follow a person for life. SSNs are used for banking, employment, government benefits, credit applications, medical records, and tax filings. There’s no system for rapidly replacing or invalidating these identifiers on a massive scale, which means every compromised record could be exploited indefinitely.

Experts warn that this alleged breach could enable widespread identity theft and fraud long into the future if malicious actors gain access. Even the chance that such a vulnerability exists is enough to demand urgent action — both from federal authorities and the public.

How You Could Be Impacted Personally

If your Social Security number has been exposed, the ramifications extend beyond banking. Fraudsters can use your identity to:

- Take out loans in your name

- Open credit cards and lines of credit

- File fraudulent tax returns and claim refunds

- Apply for government benefits pretending to be you

- Open medical accounts and incur bills in your name

This makes identity theft easier and far more dangerous than breaches involving only passwords or email addresses.

What Security Experts Advise You Do Now

While government investigations continue, cybersecurity specialists and consumer advocates suggest the following protections:

- Freeze your credit with all three major bureaus — Equifax, Experian, and TransUnion — so new accounts can’t be opened without your approval.

- Place fraud alerts on your credit files to ensure lenders verify your identity before issuing credit.

- Monitor financial accounts and credit reports regularly for suspicious activity.

- Use reputable ID monitoring services to track whether your data appears on the dark web.

- Report identity theft immediately at IdentityTheft.gov if you see evidence of misuse.

Because of the permanent nature of SSNs, swift action is critical — whether or not you have received direct notification.

The Government and Investigations Underway

Multiple federal and oversight bodies — including the Office of Special Counsel and Government Accountability Project — are investigating the allegations and the handling of federal databases. Lawmakers have demanded answers and transparency as public concern rises. Some senators have reacted strongly, demanding accountability for any improper data transfers.

As of now, no definitive evidence of a hacker breach into the main Social Security system has been confirmed, but the allegations’ implications alone are prompting increased scrutiny of federal cybersecurity practices.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.