Wall Street Rally Continues: Can the Stock Market Sustain Its Record-Breaking Streak in 2024?

The Wall Street rally has been the talk of the financial world, with the stock market continuing its record-breaking streak as we head into 2024. Investors are riding high on the wave of optimism, but the big question remains: Can this momentum be sustained? In this article, we’ll dive deep into the factors driving the rally, analyze expert predictions, and explore whether the stock market can maintain its upward trajectory in the coming year.

Table of Contents

What’s Fueling the Wall Street Rally?

The stock market’s impressive performance in 2023 has been fueled by a combination of factors, including strong corporate earnings, easing inflation, and the Federal Reserve’s decision to pause interest rate hikes. Tech giants like Apple, Microsoft, and Nvidia have led the charge, with their stocks hitting all-time highs. Additionally, the AI boom and advancements in renewable energy have created new growth opportunities, attracting both institutional and retail investors.

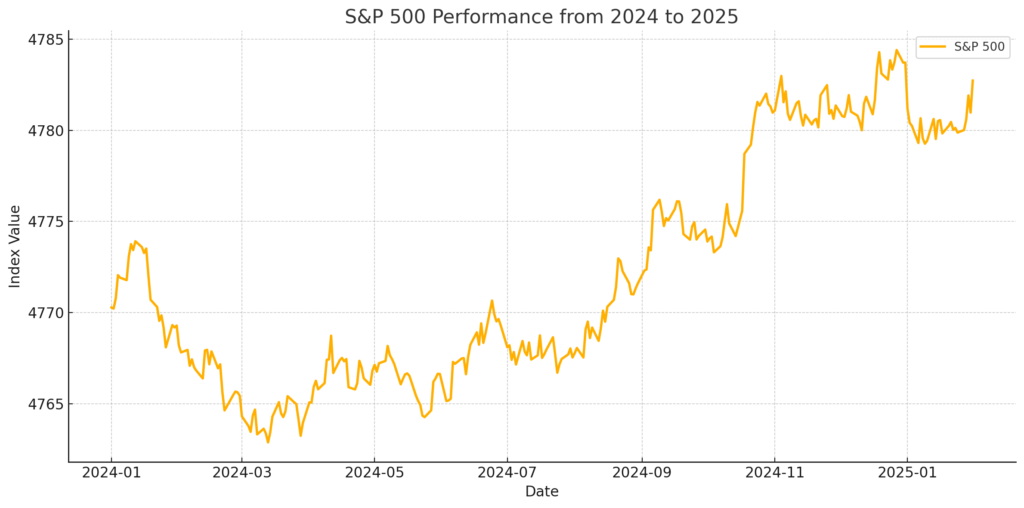

According to a recent report by CNBC, the S&P 500 has surged by over 20% this year, while the Nasdaq Composite has gained nearly 35%. This bullish trend has left many wondering if the market is overvalued or if there’s still room for growth.

Expert Predictions for 2024

Financial analysts are divided on what 2024 holds for Wall Street. Some experts believe the rally will continue, driven by strong economic fundamentals and technological innovation. Others caution that geopolitical tensions, rising debt levels, and potential recessions in key global markets could dampen investor sentiment.

Goldman Sachs predicts that the S&P 500 could reach 5,200 points by the end of 2024, representing a 9% increase from current levels. However, Morgan Stanley warns that volatility could increase as the market adjusts to changing economic conditions.

Key Trends to Watch in 2024

- AI and Tech Dominance: The artificial intelligence sector is expected to remain a major driver of growth, with companies investing heavily in AI-driven solutions.

- Interest Rate Decisions: The Federal Reserve’s monetary policy will play a crucial role in shaping market dynamics. Any hints of rate cuts could boost investor confidence.

- Election Year Impact: The 2024 U.S. presidential election could introduce uncertainty, potentially affecting market stability.

Can the Rally Be Sustained?

While the current rally is impressive, sustaining it will depend on several factors. Corporate earnings will need to remain strong, and inflation must continue to ease. Additionally, global economic conditions, such as China’s recovery and Europe’s energy crisis, will play a significant role in determining the market’s direction.

Conclusion

The Wall Street rally has been a beacon of hope for investors in 2023, but the road ahead is uncertain. While there are reasons to be optimistic, caution is advised as we navigate the complexities of 2024. By staying informed and keeping an eye on key trends, investors can make better decisions and potentially capitalize on future opportunities. [USnewsSphere.com]