Microsoft Shares Slide as AI Spending Surges, Investor Doubts Grow, and Google Regains Tech Momentum

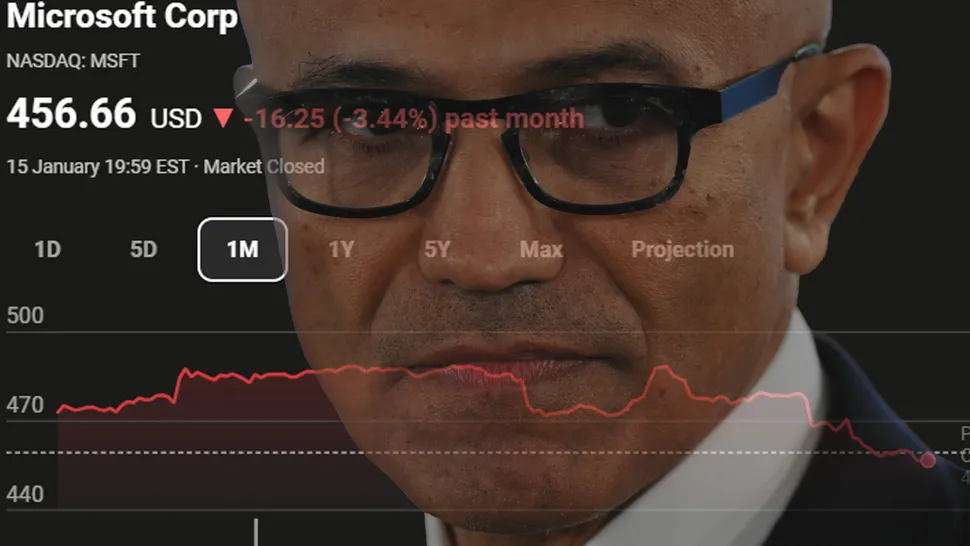

Microsoft’s stock has dropped around 10% over the last three months, wiping out earlier gains as investors grow nervous over ballooning AI infrastructure spending, slowing enthusiasm for generative AI products, and renewed investor confidence in Google’s AI strategy. This slump reflects deeper concerns about return on AI investments and competitive pressure in the booming AI sector.

What matters most: heavy capital expenditure on AI data centers is burdening Microsoft’s margins, some AI products have underwhelmed users, and Alphabet’s recent AI successes are drawing investor interest away from Microsoft. Why this matters now: the AI market’s future is influencing stock prices across tech giants, with investors reallocating capital based on perceived leadership in next-generation technology.

What’s Driving the 10% Stock Slide

Despite strong fundamentals, Microsoft’s stock performance has shown a notable decline in recent months. The company revealed an unprecedented $35 billion in capital expenditure (CapEx) on AI data center infrastructure in Q1 2026, signaling that costs tied to AI build-outs are climbing rapidly. Investors worry that profits from those investments may not materialize soon, placing pressure on the stock’s valuation.

Market observers also point out that enthusiasm around generative AI hype has cooled after a period where AI investment was seen as a near-guaranteed growth trigger. Broad market sentiment about the sustainability of AI-driven growth has shifted, affecting not just Microsoft but other AI-heavy names as well.

Microsoft’s AI Strategy Under Scrutiny

One factor undermining confidence has been the mixed reception to Microsoft’s AI products, including consumer tools like Microsoft Copilot. Reports of imperfect performance and real-world “hallucinations” have dampened early optimism and contributed to skepticism about how quickly Microsoft’s AI offerings will gain large-scale adoption.

While Microsoft remains strong in regulated enterprise sectors — with Azure and Microsoft 365 deeply entrenched — its consumer AI traction has lagged, particularly compared with Google’s rapidly evolving AI ecosystem. Copilot’s integration into everyday workflows has been modest, prompting investors to reassess growth assumptions.

Google’s AI Momentum Fuels Competitor Gains

At the same time, Alphabet (Google’s parent company) has surged ahead in AI leadership, helping push its valuation above $4 trillion and lifting investor confidence in its AI direction. Google’s Gemini AI models and broad integration across search, mobile devices (including third-party partnerships like with Apple), and cloud services demonstrate a full-stack AI approach that has impressed Wall Street.

This competitive backdrop matters greatly: as Google makes headlines with integrated AI strategies and record valuation gains, Microsoft’s AI narrative appears comparatively less compelling, prompting funds to shift toward what they view as bigger future winners in the AI race.

Investor Sentiment and Market Reaction

Stock traders and analysts suggest that the current downtrend reflects not just tech-specific issues but broader market reevaluations. Morgan Stanley and other analysts note that while Microsoft’s AI investments are substantial, the short-term effect on margins and returns is a valid concern for investors weighing risk versus near-term earnings.

However, not all analysts are bearish. Some see the dip as a buying opportunity, pointing out Microsoft’s dominant position in cloud computing and long-term enterprise AI adoption, which could support a recovery in share price if adoption accelerates.

Broader Tech Market Trends Influencing Microsoft

The current shift in sentiment isn’t happening in isolation. Across the tech sector, AI investment continues to balloon, raising questions about an “AI bubble” where companies are investing heavily without guaranteed returns. Speculative behavior tied to AI stock valuations may be prompting more cautious investor strategies.

Moreover, capital markets have begun reacting to margin pressure from deep AI infrastructure spending, which can compress profits in the near term even as revenue streams grow. This tension between growth and profitability is shaping stock valuations for Microsoft and its AI-centric peers.

Why This Matters to Investors and the Tech Industry

This stock slide highlights a turning point in how investors value AI-focused companies. The initial frenzy that propelled AI stocks to historic highs is now giving way to more discerning evaluations based on profitability timelines, competitive dynamics, and real-world adoption rates.

For Microsoft, the current challenge is clear: balance heavy AI spending with tangible growth, and sharpen its competitive edge against Google’s expanding AI ecosystem. Success or failure in this balancing act could reshape leadership in the next phase of the tech industry.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.