Trump Greenland Text Triggers Stock Sell-Off as Markets React to Political Shock

Trump Greenland stock sell-off dominated global market headlines after a private text message attributed to Donald Trump reignited geopolitical uncertainty involving Greenland, rattling investors and triggering a broad equity pullback. Stocks slid as traders reassessed political risk, policy unpredictability, and renewed concerns about U.S. foreign strategy.

Who: Global investors and U.S. markets

What: Sharp stock sell-off

Why: Political uncertainty tied to Greenland comments

Impact: Risk assets fall, volatility jumps

Why this matters now: Markets are already fragile amid inflation and election-year tension

Market Reaction After Trump-Linked Message Surfaces

U.S. equities fell sharply after reports circulated that a message linked to Donald Trump referenced Greenland and broader geopolitical positioning. While details of the text were limited, the symbolism alone was enough to move markets, highlighting how sensitive investors remain to political risk during an already unstable period.

The Dow, S&P 500, and Nasdaq all posted losses as traders rotated out of risk assets. Defensive sectors briefly outperformed, while technology and multinational stocks led declines due to fears of diplomatic friction and trade uncertainty.

Why Greenland Still Moves Global Markets

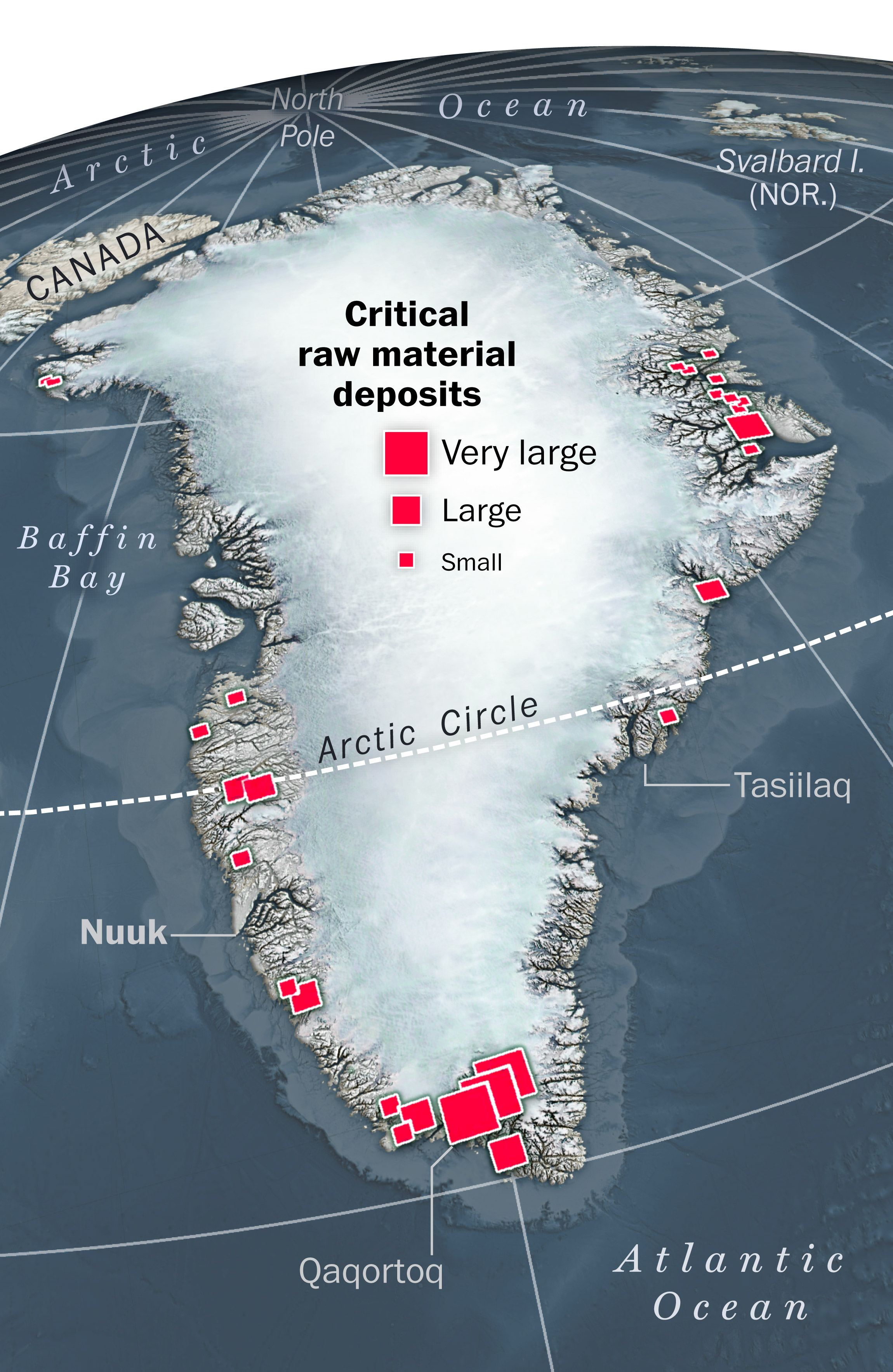

Greenland may appear remote, but it holds strategic military, shipping, and mineral importance. Located between North America and Europe, the territory plays a critical role in Arctic security, NATO logistics, and rare-earth supply chains essential for clean energy and defense technology.

Any renewed U.S. interest—especially framed unpredictably—raises alarms among allies and markets. Investors fear that sudden diplomatic shifts could trigger retaliation, sanctions, or trade disruptions, all of which directly affect corporate earnings and global growth projections.

Investor Anxiety in an Election-Sensitive Market

Markets are particularly vulnerable right now. With inflation still uneven, interest rates elevated, and election-year volatility increasing, any unexpected political signal can amplify sell-offs. The Trump-Greenland headline arrived at a moment when positioning was already stretched.

Portfolio managers responded by trimming exposure, increasing cash holdings, and hedging with volatility instruments. The move wasn’t driven by fundamentals alone—but by uncertainty, which markets consistently price as risk.

Nobel Peace Prize Talk Adds Another Layer of Uncertainty

The controversy deepened after renewed public discussion around Trump and the Nobel Peace Prize, a topic that has historically coincided with sharp political debate. While symbolic, such narratives influence perception, diplomacy, and market psychology.

For investors, symbolism matters. When global leadership signals become unpredictable, capital tends to retreat temporarily. This reaction is less about ideology and more about stability and forecasting confidence.

How This Sell-Off Compares to Past Political Shocks

Historically, markets often overreact to political headlines before stabilizing. Similar episodes—ranging from trade-war tweets to surprise foreign policy announcements—have produced short-term volatility followed by selective recovery.

However, today’s environment is different. Higher interest rates mean less liquidity to cushion shocks. That makes even modest uncertainty more powerful than in previous cycles.

Investors now face a choice: treat this as noise or as an early warning of deeper political-economic friction.

What Investors Are Watching Next

Traders and institutions are now monitoring three critical signals:

First, whether U.S. officials or allies clarify or de-escalate rhetoric related to Greenland. Diplomatic reassurance could quickly calm markets.

Second, upcoming inflation and employment data will determine whether economic fundamentals can override political noise.

Third, volatility indices and bond yields will show whether risk aversion is temporary or structural.

If uncertainty persists, analysts warn that markets could see further downside, especially in globally exposed sectors.

Why This Matters Now for Everyday Investors

This episode underscores a key reality: markets are no longer driven by earnings alone. Political messaging, symbolism, and perception can move billions of dollars in minutes.

For long-term investors, the takeaway is not panic—but awareness. Understanding how geopolitical narratives intersect with market structure helps investors manage risk, avoid emotional decisions, and stay positioned for recovery once clarity returns.

The Trump Greenland stock sell-off is a reminder that politics and markets are deeply intertwined, especially in periods of global uncertainty. While the long-term impact remains unclear, the immediate reaction shows how quickly confidence can shift.

Investors should stay informed, diversified, and disciplined—because in today’s markets, clarity is currency.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.