Stanley Druckenmiller has once again made headlines with his cautious outlook on the stock market, despite the growing optimism among corporate leaders. As investors navigate an unpredictable financial landscape, Druckenmiller’s concerns over rising bond yields and potential market imbalances offer a sobering contrast to the bullish sentiment echoed by many CEOs. With the economy showing signs of strength, business leaders are expressing confidence in revenue growth and expansion, yet seasoned investors remain wary of hidden risks that could derail market stability.

Table of Contents

Understanding the delicate balance between optimism and caution is crucial for anyone looking to make informed investment decisions. In this blog, we’ll dive deep into Druckenmiller’s perspective, analyze why CEOs are feeling more positive than ever, and explore what this means for your investment strategy. Whether you’re an experienced investor or just starting, gaining insights from both sides of the economic spectrum will help you navigate the stock market with confidence.

Let’s explore the factors shaping today’s financial landscape and uncover actionable insights to help you stay ahead in these uncertain times.

Druckenmiller’s Concerns Over Market Risks

Stanley Druckenmiller, renowned for his keen market insights and successful investment strategies, has raised red flags regarding the current state of the U.S. economy. Despite the stock market experiencing a period of sustained growth, Druckenmiller highlights potential threats such as:

- Rising Bond Yields: He warns that the increasing yields may reduce the attractiveness of equities compared to fixed-income assets, making stocks less appealing.

- Economic Overheating: As economic activity strengthens, inflationary pressures could drive interest rates higher, which may dampen corporate earnings and valuations.

- Market Bubble Concerns: Druckenmiller is skeptical of the prolonged market rally, suggesting it could lead to a potential correction.

He recently stated, “The earnings yield versus bond yield ratio is the most unattractive it has been in 20 years,” highlighting how the current economic conditions make broad market investments riskier.

Why CEOs Are More Optimistic Than Ever

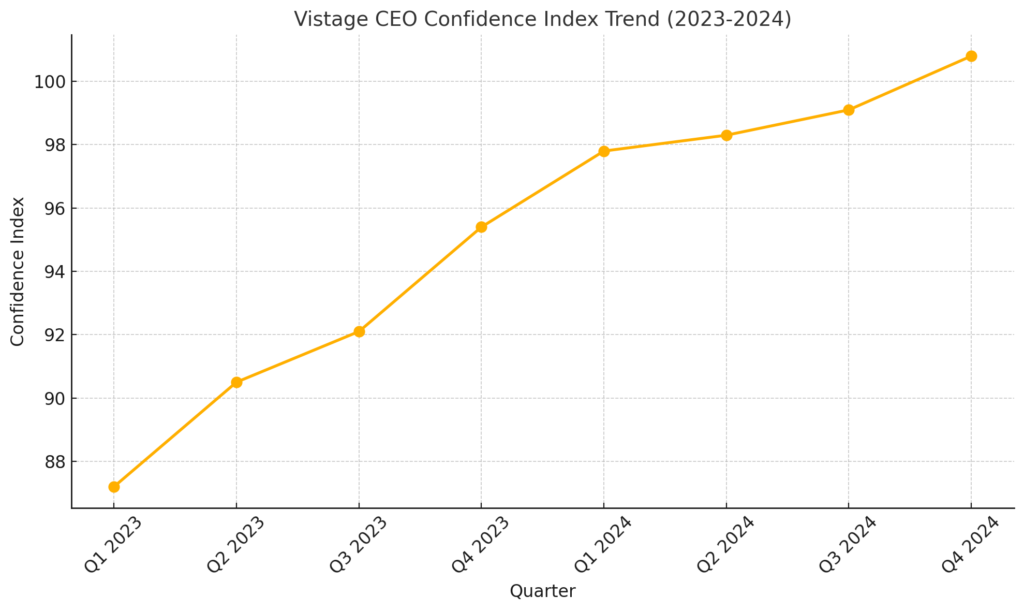

On the flip side, CEO optimism has surged in recent months, reflecting confidence in pro-business policies and anticipated growth in the post-pandemic economy. According to the Vistage CEO Confidence Index, which climbed to 100.8 points in Q4 2024, business leaders remain upbeat due to:

- Revenue Growth Expectations: Over 76% of CEOs anticipate higher revenue in the coming year, driven by increasing consumer demand and business expansions.

- Economic Policy Positivity: Many executives believe that recent policy changes will foster business-friendly environments.

- Expansion Plans: More than half of surveyed companies (55%) expect to increase hiring and capital expenditures.

Despite Druckenmiller’s reservations, many business leaders believe the U.S. economy is poised for long-term expansion, supported by robust corporate earnings and consumer spending.

What This Means for Investors

With such divergent views from seasoned investors and corporate executives, what should individual investors consider?

- Diversification Is Key: Balancing portfolios with a mix of equities, bonds, and alternative assets can help manage potential risks.

- Monitor Interest Rates: Keeping a close eye on Federal Reserve policies and inflation trends will be crucial in navigating market uncertainties.

- Long-Term Focus: While short-term volatility may arise, focusing on strong fundamentals and future growth opportunities remains essential.

In conclusion, navigating the complexities of the stock market in 2025 requires a balanced perspective between optimism and caution. While CEOs remain confident about revenue growth and economic expansion, seasoned investors like Stanley Druckenmiller urge vigilance, citing concerns over rising bond yields and potential market instability. By staying informed about market trends, monitoring economic indicators, and adopting a diversified investment strategy, you can make more informed decisions that align with your financial goals.

As you reflect on Druckenmiller’s insights and the growing optimism among business leaders, consider how you can apply these perspectives to your own investment approach. Whether you are planning long-term financial moves or assessing short-term opportunities, understanding both sides of the economic outlook will empower you to stay ahead in an ever-changing stock market landscape.

We’d love to hear your thoughts—do you share Druckenmiller’s caution, or do you align more with CEO optimism? Leave a comment below and share your insights. Don’t forget to subscribe for the latest updates and expert insights to stay informed and confident in your financial journey. Remember, staying informed is the key to making smarter investment decisions and securing a prosperous financial future. [USnewsSphere.com]