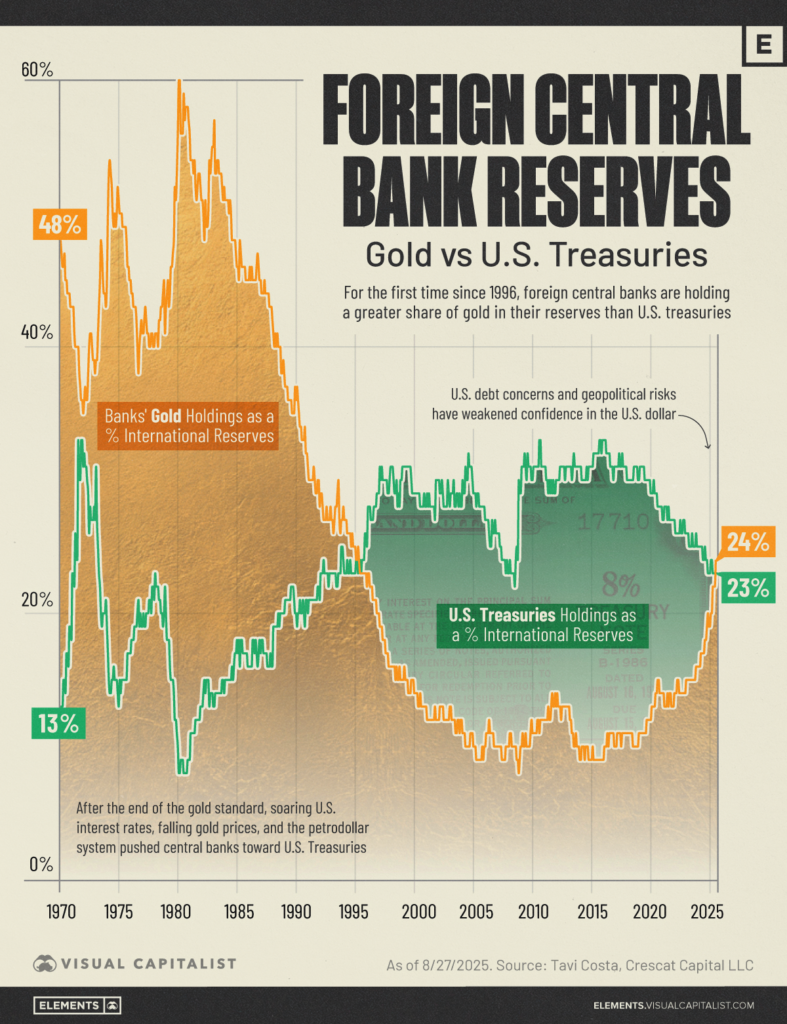

Gold has officially overtaken the U.S. dollar — long regarded as the cornerstone of global finance — to become the largest foreign reserve asset held by central banks around the world, marking a momentous pivot in global monetary dynamics. The accumulated value of official gold holdings now exceeds U.S. Treasury bond reserves by central banks globally for the first time in nearly 30 years.

This historic milestone didn’t occur overnight. It reflects years of rising gold prices, aggressive bullion purchases by key nations, and growing concerns over fiat currency volatility — especially the role of the U.S. dollar as the pre-eminent reserve currency. What was once considered a “barbarous relic” is now arguably the most trusted store of value on Earth — and this repositioning is reshaping global financial architecture in profound ways.

Why Gold’s Rise Matters: A Fresh Foundation for Global Reserves

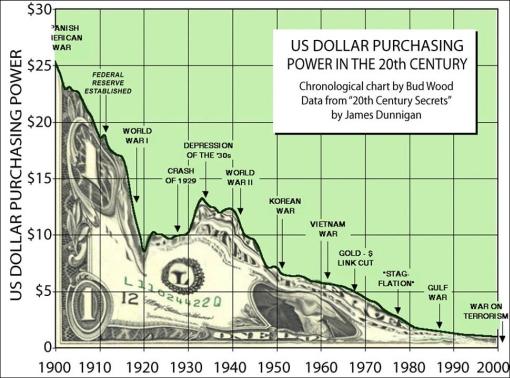

For more than half a century, the U.S. dollar has dominated global reserves, buoyed by the strength of the American economy, deeply liquid Treasury markets, and its central role in international trade. Even after the dollar severed its link to gold in 1971 under the Nixon administration — a move that finalized the shift to fiat money — it remained the world’s chief reserve currency.

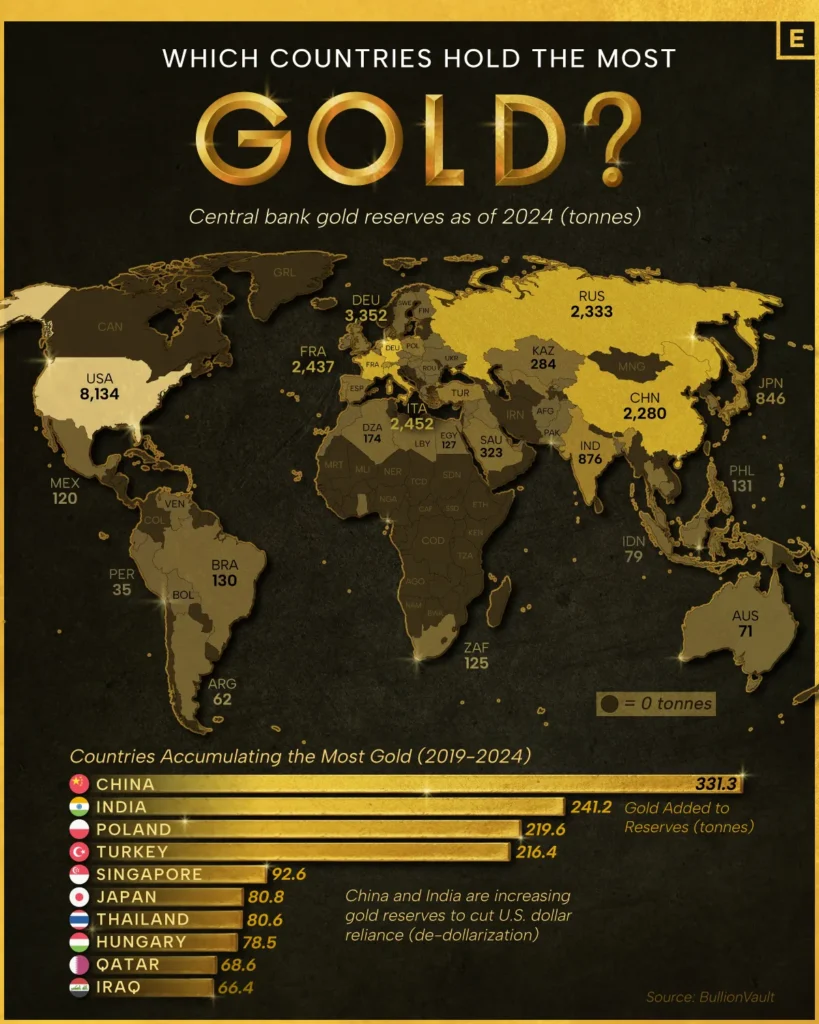

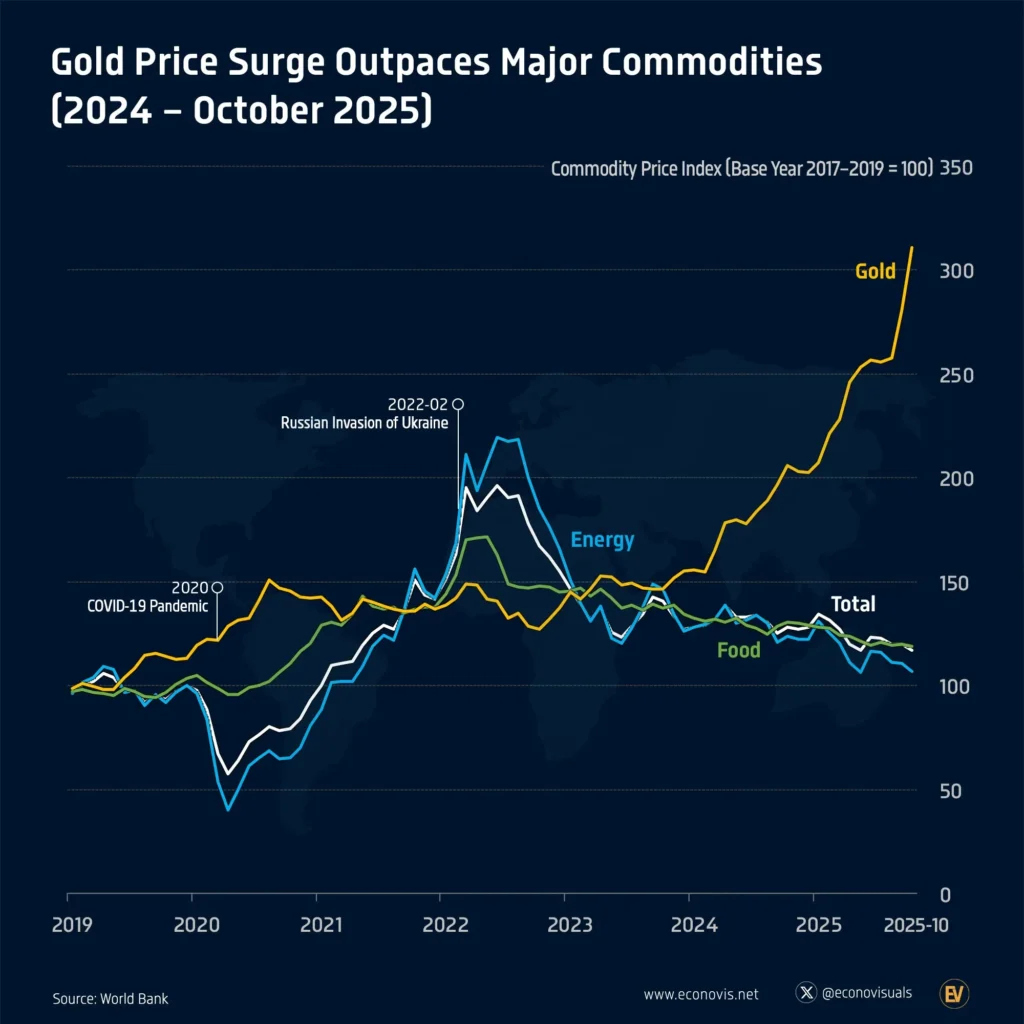

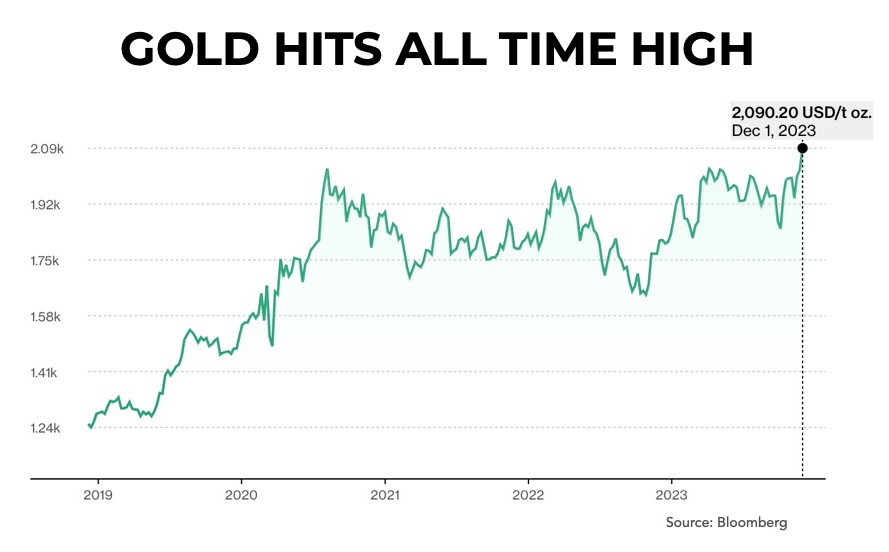

But according to recent data from the World Gold Council, this long-standing hierarchy has now grown more complex. Central banks around the world hold roughly 36,000 metric tons of gold, and due to the dramatic ascent in gold prices — which spiked by more than 60% in the last year alone — the aggregate value of gold reserves now surpasses the value of U.S. Treasury bonds held abroad. This milestone places gold ahead of U.S. debt as the largest foreign official reserve asset for the first time in nearly three decades.

This does not mean the dollar is instantly obsolete — far from it — but the shift reflects a potent trend: central banks are diversifying and hedging reserves against geopolitical and financial risk more aggressively than at any time since the Bretton Woods era.

What’s Driving the Surge in Gold Reserves?

1. Record-High Gold Prices

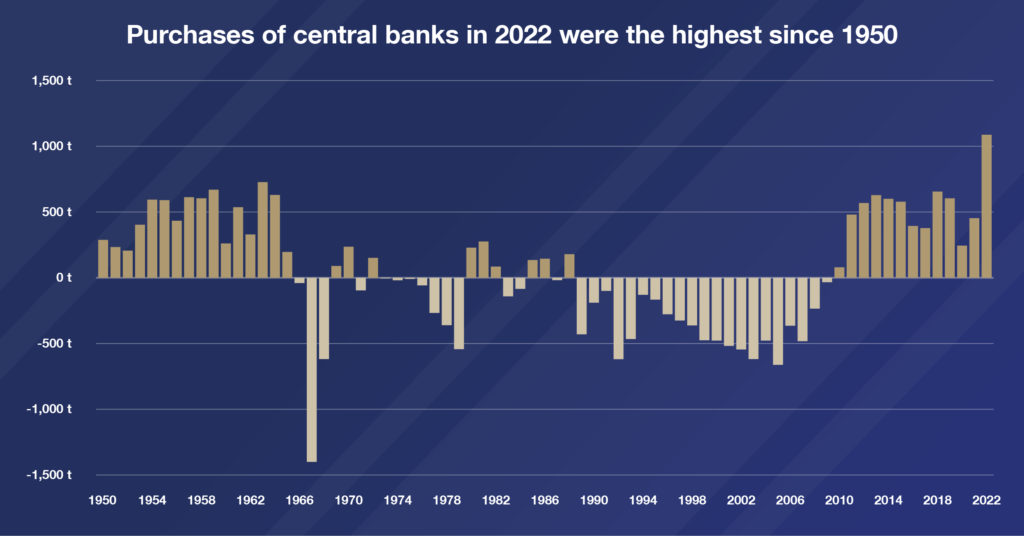

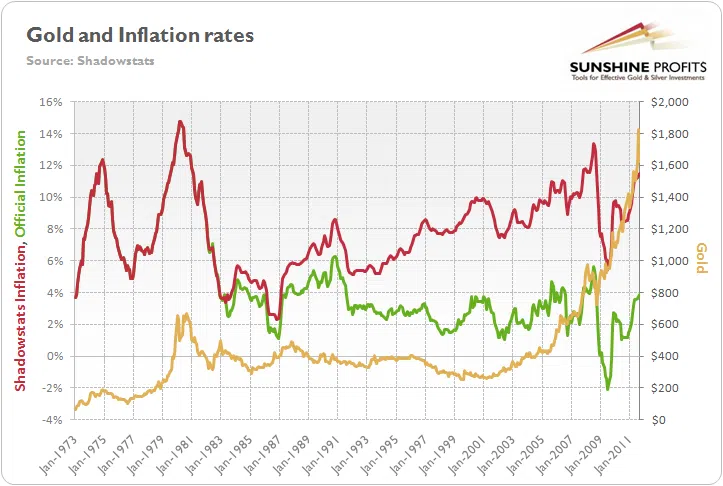

Gold has experienced an unprecedented rally. In recent years, geopolitical tensions, inflationary pressures, and rising systemic uncertainty have pushed gold prices to multi-year highs. Investors have flocked to metals as a safe haven, while central banks have bought large volumes to reduce dependency on volatile fiat assets.

2. Geopolitical Risk and De-Dollarization

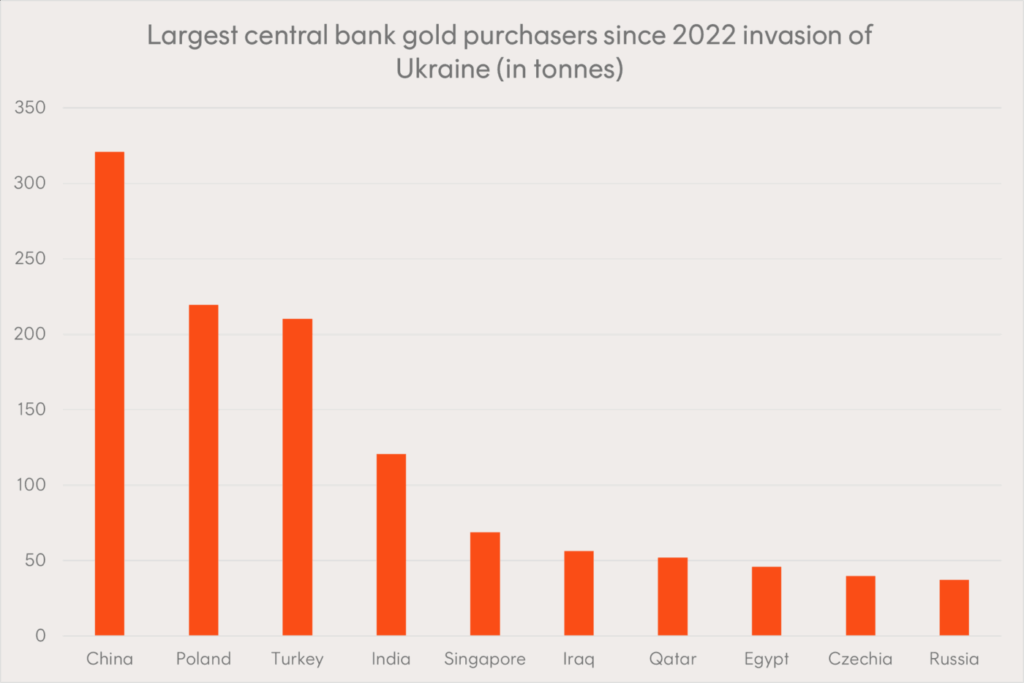

Episodes such as sanctions, trade disputes, and shifting alliances have spurred nations to rethink their dependency on U.S. currency and Treasury instruments. Some experts characterize this as a form of de-dollarization — not necessarily an abrupt abandonment of the dollar, but a conscious diversification away from it. Countries are reducing their concentration of U.S. debt and adding hard assets like gold to insulate themselves against potential market disruptions or policy shifts in the United States.

3. Central Bank Accumulation

Data shows that central bank gold purchases have reached some of the highest levels in modern history, with notable increases from developing economies and major players in Asia. These purchases reflect a strategy to safeguard national wealth, reduce currency risk, and build financial resilience in an uncertain world.

Implications for the U.S. Dollar and Global Monetary Policy

Although gold now tops U.S. Treasury holdings in total value, the dollar’s role as the global reserve currency isn’t disappearing overnight. The dollar still accounts for a significant portion of official foreign exchange reserves, and its use in international trade and finance remains dominant.

However, the symbolic and financial impact of gold’s rise cannot be understated. It signals a growing multipolar financial system where confidence in fiat currencies — particularly during periods of economic stress — is more fragile than in previous decades. Large holdings of gold act as a hedge against currency depreciation, inflation, and systemic risk, offering an anchor of stability in times of uncertainty.

Financial strategists, including Nobel-linked economists and institutional analysts, warn that the nature of reserve assets is shifting from pure fiat currencies toward more balanced portfolios that include hard assets like gold. This trend is likely to influence future monetary policy decisions, currency reserve strategy, and even global trade practices.

Expert Reactions and Market Forecasts

Global financial leaders have expressed mixed views. Some economists argue that gold’s ascendancy marks only a temporary hedge against short-term instability, while others believe it reflects a deeper structural rebalancing in international finance. Analyst consensus suggests that gold’s appeal stems not just from bearish sentiment on fiat currencies, but also from its inherent qualities: liquidity, universal acceptance, and historical resilience.

Billionaire investor Ray Dalio has pointed out that gold’s rise acts as a broader warning signal about fiscal and monetary pressures worldwide, highlighting concerns about currency depreciation and economic vulnerability. Dalio suggests that shifts like these deserve careful attention from investors and policymakers alike.

Meanwhile, some central banks continue accumulating gold at a breakneck pace, suggesting confidence that the metal will play a more significant long-term role in reserve portfolios than it has in decades.

What This Means for Investors and the Global Economy

The change in reserve status is not merely symbolic — it has practical implications for investors, policymakers, and everyday citizens. The rising value of gold has influenced asset allocation strategies across global markets, driving demand for related financial instruments such as gold ETFs, bullion, and related futures.

For governments, the move signals a desire to diversify risk and mitigate dependence on any single currency. Whether this leads to a more balanced reserve structure — where gold, multiple currencies, and other assets play complementary roles — remains to be fully determined, but the trend is unmistakable.

For consumers and retail investors, the renewed emphasis on gold underscores its enduring value as both a hedge and a reserve asset, reminding markets that, even in the digital age, hard assets still matter.

A Historic Turning Point in the Global Financial Order

The emergence of gold as the world’s largest foreign reserve asset represents a profound shift in global economic dynamics. Central banks’ accumulation of gold, combined with geopolitical unpredictability and sustained price rallies, has reshaped reserve management in ways few could have predicted just a decade ago. While the U.S. dollar continues to play a central role in global finance, gold’s ascendance reaffirms the need for diversified portfolios and adaptive financial strategies in an increasingly complex world.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.