When gold and silver prices crashed sharply on Friday following President Trump’s nomination of Kevin Warsh as Federal Reserve Chair, markets worldwide reeled from one of the most violent precious metal sell-offs in decades. Gold tumbled more than 10% from record highs, and silver plunged by over 30% in a single session — movements not seen since the historic Silver Thursday crash in the 1980s.

This matters now because the Fed’s leadership signals shifts in monetary policy expectations, which directly affect global asset prices, investor behavior, currency strength, and inflation outlooks.

The immediate market reaction saw U.S. stock indexes dip, the dollar surge to multi-month highs, and traders unwinding long positions in precious metals — a dramatic reversal from the strong rally that had pushed gold and silver to historic peaks earlier this month.

Why This Crash Happened — Hawks, Dollars & Margin Calls

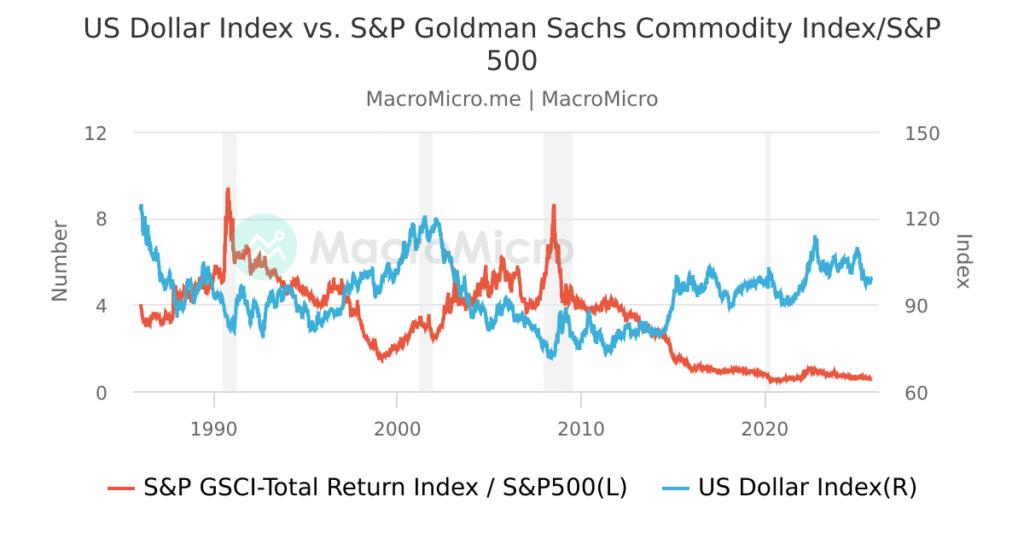

The key catalyst behind the meltdown was Kevin Warsh’s nomination — traders viewed him as a hawkish Fed leader more likely to prioritize inflation control and hold higher interest rates for longer, rather than pursuing aggressive rate cuts. A stronger dollar erodes the appeal of non-yielding assets like gold and silver, prompting a wave of selling.

In simple terms, a rising U.S. dollar makes commodities priced in dollars more expensive for foreign buyers and reduces speculative demand. As a result, markets saw forced liquidations and margin calls, which amplified the sell-off in both bullion and futures markets.

Silver was hit especially hard, sliding more than 30% and marking its worst day since March 1980 — a drop that evoked comparisons to Silver Thursday, when prices once spiraled from record highs into catastrophic loss territory.

Price Moves That Shocked Investors

Across global markets on January 30–31, the sell-off unfolded in dramatic fashion:

- Silver futures plunged over 30% to near $78 per ounce — a level not seen in decades.

- Gold dropped more than 10%, moving sharply lower from just above $5,000 per ounce after recent historic highs.

- The U.S. Dollar Index posted one of its biggest one-day gains in recent history, reinforcing downward pressure on commodities.

These moves forced many investors to reassess positions held during the metals’ prior ascent, with heavy profit booking contributing to the momentum of the sell-off.

Who Is Kevin Warsh and Why His Nomination Mattered

Kevin Warsh, a former Federal Reserve Governor and economist, is widely regarded as a policy-focused leader who may uphold central bank independence. Market expectations had been tilted toward a more dovish Fed, potentially lowering rates to fuel growth — a stance that typically weakens the dollar and boosts gold and silver.

With Warsh’s nomination, those expectations flipped dramatically, triggering a quick re-pricing of monetary policy risk. For precious metals, which thrive when inflation fears and weakening currencies dominate sentiment, that change was devastating.

What This Means for Traders, Investors & Markets

The crash is more than a headline — it has real-world impacts:

For Traders

- Volatility surged: Rapid sell-offs triggered stop-loss orders, accelerating price declines.

- Margin pressure: Futures market participants faced liquidation and tightening liquidity.

For Investors

- Long-term holders who bought during the recent rally saw sizable unrealized losses.

- Analysts now debate whether this is a temporary correction or the start of a broader trend reversal.

Market Sentiment

- Confidence in risk assets briefly softened, and some safe-haven interest shifted back to cash and bonds.

- Equity indices felt pressure as traders recalibrated risk and yield expectations.

Why This Matters Now & What Could Happen Next

This event underscores how monetary policy expectations and leadership choices at the Federal Reserve have outsized influence on global asset prices — especially commodities.

Here’s why it matters:

- A strong dollar and higher yields generally reduce demand for gold and silver.

- Central bank strategy now plays a central role in the next phase of market direction.

- Trader psychology has shifted from speculative inflows toward risk-off positioning.

Looking forward, analysts say stabilization could occur if prices consolidate and traders adjust to the new monetary policy outlook. However, ongoing uncertainty in the macroeconomic landscape means volatility is likely to persist.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.