Amazon Stock Slides After Q4 Earnings as $200 Billion AI Spending Plan Raises Investor Concerns

Amazon’s Q4 earnings report revealed who, what, why, and immediate market impact: the company beat sales expectations yet fell short on profit and forecast, while unveiling a mammoth $200 billion capital spending plan for 2026 focused on AI, chips, robotics, and satellites — sparking a sell-off in its stock and investor anxiety.

This matters now because Amazon’s results reflect a broader shift in Big Tech: investors are demanding not just revenue growth, but profitable returns from sky-high AI investment. Amazon’s guidance and spending expectations are shaping how Wall Street values AI-driven growth versus near-term profitability.

Revenue Growth vs. Profit Miss: What the Numbers Reveal

In the December quarter, Amazon posted $213.4 billion in revenue, marking a strong year-over-year increase driven by solid holiday sales and growth across divisions. Specifically:

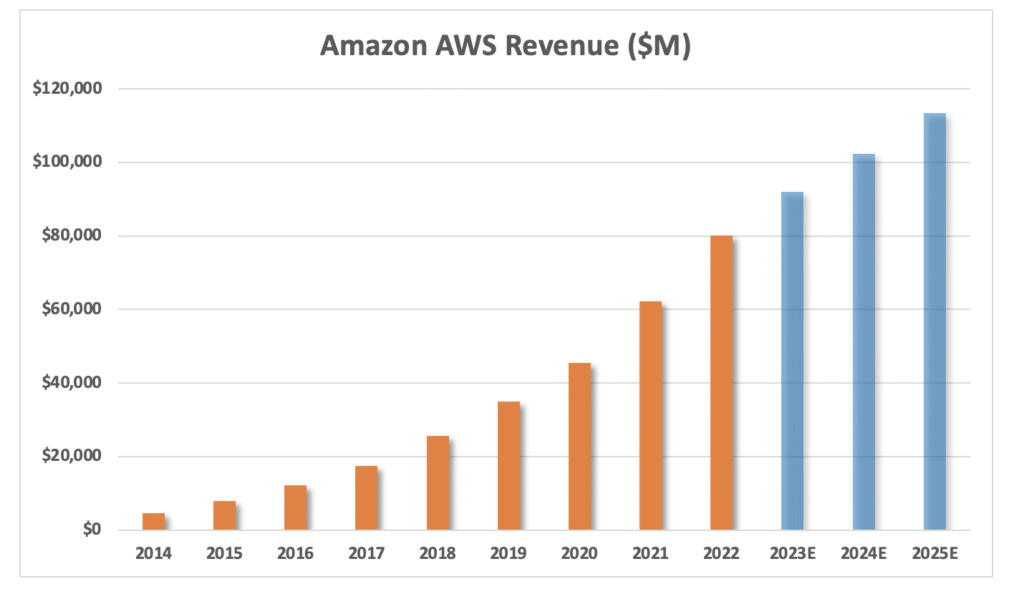

- AWS (Amazon Web Services) surged ~24% year-over-year, its fastest growth in over a year, showing Amazon’s cloud business remains a powerful profit engine.

- Advertising revenue — another key profit contributor — saw healthy expansion.

Yet the company reported $1.95 earnings per share (EPS), missing analyst forecasts by a narrow margin — enough to shift investor sentiment to cautious.

Profit matters to markets. While strong top-line performance keeps Amazon competitive, shareholders watch earnings closely for signs of both growth and financial discipline.

$200 Billion Spending Plan: Vision or Risk?

The defining headline from Amazon’s report was the forecast that it will spend approximately $200 billion in capital expenditures in 2026 — a 50% increase over 2025’s CapEx levels.

This investment is aimed at:

- Scaling AI infrastructure and custom chips

- Building new data centers

- Expanding robotics and automation

- Launching low-earth orbit satellite systems

According to CEO Andy Jassy, this scale of investment is required to win in the next decade of technology competition.

However, Wall Street’s reaction was negative, with Amazon’s stock price sliding as much as 10% in after–hours trading. This reflects investor skepticism about the near-term return on such enormous spending, especially as profit growth lags and the macro environment remains uncertain.

Investor Concerns and Market Reaction

The market sell-off highlights several investor worries:

- Profit expectations missed — even by a small margin — can weaken confidence in growth-oriented stocks.

- CapEx far above consensus estimates unsettled traders who prefer more predictable capital deployment.

- Comparisons to rival tech giants such as Microsoft and Google show Amazon’s AI strategy is among the most aggressive — but not yet backed by matching near-term revenue returns.

Because investors are increasingly looking at return on capital — not just revenue growth — Amazon’s strategy places it at the center of a broader debate over how tech giants should balance innovation with profitability.

Operational Highlights Behind the Headlines

Despite the mixed financial reaction, Amazon is not slowing down operationally:

- It reported double-digit growth across retail and AWS segments.

- AWS expanded its cloud services footprint and custom chip integrations with partners.

- Consumer experiences like faster delivery and broader e-commerce services continued to grow.

These factors remind investors that Amazon’s long-term business momentum remains intact even if short-term earnings and stock performance fluctuate.

What This Means for Investors and the Industry

Amazon’s report is a bellwether for the tech sector:

- It shows the AI investment arms race has entered a new phase where spending expectations are massive and investor tolerance is lower.

- Cloud computing growth is still a significant profit driver, but investors want clearer paths to sustainable margin expansion.

- Market reaction to earnings reports may increasingly hinge on capital allocation strategy over revenue alone.

For long-term investors, the message is clear: Innovation at scale requires tolerance for volatility, but not at the expense of profitability.

Looking Ahead: Forecasts and Expectations

Amazon provided guidance for Q1 2026 revenue between $173.5 billion and $178.5 billion — aligning with analyst expectations — yet projected lower operating income than hoped.

This cautious earnings outlook underscores how the company’s investment decisions are being weighed against short-term performance metrics — a balancing act that will shape investor sentiment through 2026.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.