The financial landscape in the United States is set for a significant transformation as U.S. banks anticipate regulatory rollbacks amid new administration policies. These policy changes are expected to ease banking regulations, alter capital requirements, and introduce a more favorable environment for financial institutions. The Trump administration has prioritized deregulation, with key modifications already in progress that could impact bank operations, consumer protections, and the integration of cryptocurrency.

Understanding the Key Regulatory Changes Affecting U.S. Banks

To make it easier for readers to understand, here’s a detailed breakdown of the key regulatory changes, their implications, and how they could reshape the financial sector.

| Key Regulatory Changes | Description | Potential Impact on Banks & Consumers |

|---|---|---|

| Loosening Capital and Liquidity Requirements | Review and possible revision of the Supplementary Leverage Ratio (SLR) rule, allowing banks to hold less capital against U.S. Treasuries. | Banks may have more flexibility in lending and investment, but market stability concerns remain. |

| Scaling Back CFPB Authority | The Consumer Financial Protection Bureau (CFPB) faces reduced power, limiting its role in investigating and enforcing financial regulations. | Less oversight may benefit banks but could reduce consumer protection and increase financial risks. |

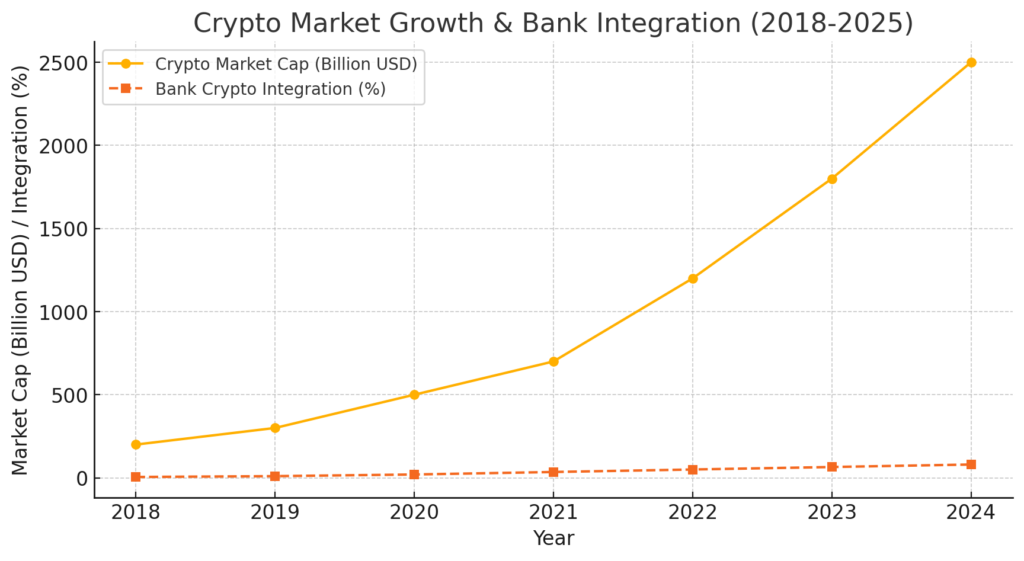

| Cryptocurrency Integration | The SEC has eased restrictions on banks holding and dealing in digital assets. | Increased participation in the crypto market could stabilize digital asset transactions and attract institutional investors. |

1. Loosening Capital and Liquidity Requirements

One of the administration’s focal points is revisiting the Supplementary Leverage Ratio (SLR) rule, which mandates banks to hold additional capital against government securities and central bank deposits.

- What is the SLR Rule?

- It requires banks to maintain a minimum capital level relative to their total assets.

- Originally introduced to prevent financial crises and ensure banks had enough reserves.

- Why Is It Being Reviewed?

- Financial institutions argue that the rule unnecessarily restricts bank lending.

- Easing the rule would increase banks’ flexibility in handling government securities.

- Potential Consequences:

- Positive: Banks will have greater lending capacity, supporting economic growth.

- Negative: Lower reserves could increase financial instability in volatile markets.

2. Scaling Back Consumer Financial Protection Bureau (CFPB) Authority

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in overseeing financial institutions and protecting consumers. However, new policies have significantly curtailed its powers.

- What Changes Are Happening?

- The administration has reduced CFPB’s ability to impose fines and enforce regulations.

- Banks will face fewer compliance obligations.

- How This Affects Consumers:

- Positive: Reduced bureaucracy might encourage financial innovation and lower banking costs.

- Negative: Weaker consumer protection could expose people to unfair financial practices.

- Industry Experts’ Viewpoint:

- Some banks see this as a win for operational efficiency.

- Consumer advocacy groups worry about reduced oversight leading to higher fraud risks.

3. Cryptocurrency Integration and SEC Policy Shift

As cryptocurrencies gain mainstream adoption, the SEC has relaxed restrictions on banks holding digital assets, allowing them to offer crypto custody services.

- What This Means for Banks:

- They can now provide crypto-related services without facing regulatory hurdles.

- This could encourage more institutional investment in cryptocurrencies.

- Market Impact:

- Positive: More stability in the cryptocurrency market as banks provide secure storage.

- Negative: Regulatory uncertainties could still pose risks for banks entering the crypto space.

- Future Implications:

- More banks might adopt digital assets as part of their service offerings.

- Enhanced security frameworks may be developed to protect consumers from crypto-related fraud.

4. Future Outlook and Implications

The coming months will be crucial in determining how these policy shifts reshape the U.S. banking sector. Here’s a mind map of how different stakeholders are affected by these changes:

Regulatory Rollbacks

│

┌──────────────────┴──────────────────┐

│ │

Financial Institutions Consumers

│ │

- Increased profits - Less protection

- Greater lending capacity - Potential for unfair practices

- Expansion into crypto - Changes in loan/credit policies- Long-Term Predictions:

- If deregulation continues, banks could experience higher profits but may also face increased scrutiny during economic downturns.

- Consumers should stay informed about their rights as financial regulations evolve.

Read the full Reuters report on U.S. banking regulations for additional insights.