Why Trump’s Decision to Raise Tariffs on South Korea Matters Now

President Donald Trump has announced that the United States will increase tariffs on South Korean imports from 15% to 25%, citing delays by South Korea’s legislature in approving a major bilateral trade agreement — a move that has rattled markets and reignited trade tensions between two longtime allies. This significant escalation addresses who is affected (U.S. and South Korean exporters), what has changed (higher tariffs on autos, lumber, and pharmaceuticals), why the U.S. claims the increase is justified (alleged failure to enact trade deal terms), and the economic and diplomatic impact on global supply chains and investor confidence.

Trade Deal Delay and Rising Tariff Stakes

The U.S.–South Korea tariff dispute stems from a 2025 trade framework in which South Korea pledged to invest about $350 billion in American industries, open markets wider to U.S. goods, and lower certain tariff barriers in exchange for reduced U.S. duties on Korean exports.

President Trump’s announcement late last month came via social media and official statements, asserting that Seoul’s National Assembly had stalled on enacting the deal into law, causing the U.S. to revert tariffs to the higher 25% level previously threatened. These tariffs now target major export sectors, including automobiles, lumber, and pharmaceuticals — areas where South Korea holds significant market share and competitive advantage.

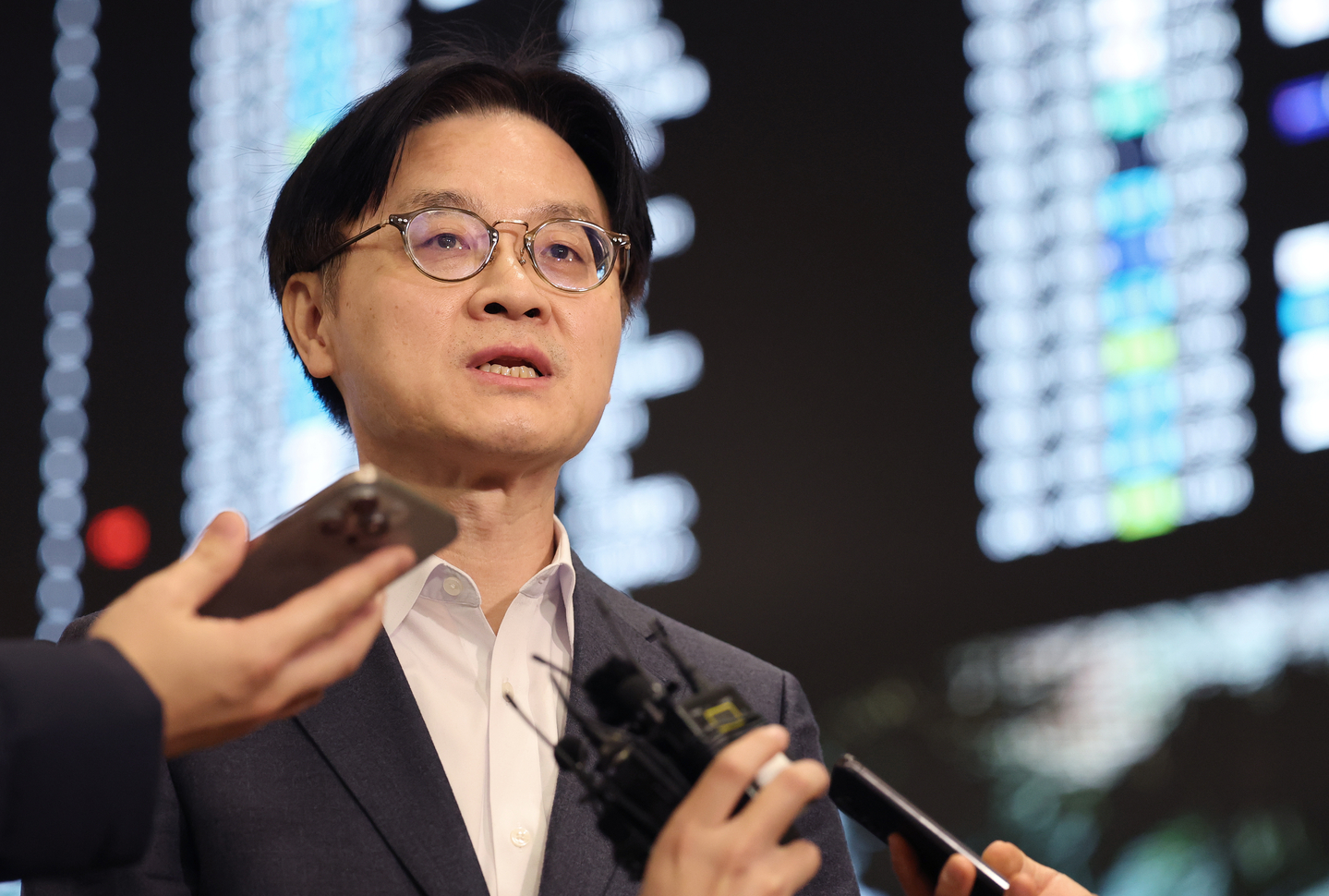

Seoul’s Diplomatic Effort and Policy Response

In response to this shift, South Korean officials have scrambled to smooth relations with Washington. Despite intensive diplomatic efforts — including high-level talks between Korea’s Trade Minister and U.S. Commerce Secretary Howard Lutnick — initial meetings have yet to yield tangible breakthroughs, and both sides have ended discussions without agreement. South Korea has emphasized its willingness to implement the trade deal and accelerate legislative action, even as it clarifies that the tariff threat is not connected to other domestic regulatory issues, such as oversight of tech firms like Coupang.

The strategic negotiation effort highlights Seoul’s delicate balancing act: showing resolve in defending its economic interests while avoiding a full diplomatic rupture with Washington. South Korea has reiterated it is committed to honoring the investment and market opening pledges linked to the tariff reduction deal.

Economic Ripple Effects and Market Reactions

Markets have already reacted to the tariff escalation. South Korean automaker stocks experienced volatility, with investors using early price drops as buying opportunities — signaling mixed signals in financial markets. Some investors interpreted the uncertainty as temporary, while others are bracing for longer-term impacts on trade volumes and corporate earnings.

There are broader economic concerns, too. Higher tariffs on key export segments may worsen South Korea’s trade balance, weaken its currency pressure, and disrupt supply chains that are tightly integrated with U.S. buyers. Analysts warn that such tariff spikes could have a chilling effect on investor sentiment in the region and slow global trade momentum if other nations adopt retaliatory measures.

Strategic Geopolitical Implications

This tariff dispute goes beyond economics — it has broader geopolitical implications. The United States and South Korea are key security allies in the Indo-Pacific, particularly amid rising tensions with China and North Korea. Trade conflict at this level could strain cooperation on defense and regional strategy if unresolved or prolonged. South Korea’s status as a leading tech manufacturer and critical partner in semiconductor supply chains adds further weight to the stakes, influencing global national security and industrial policies.

Supporters counter that enforcing trade agreements and protecting domestic manufacturing bases justifies tough measures. Either way, the resolution of this standoff could set a benchmark for future U.S. trade policy with other partners.

Global Trade Community Watches Closely

International markets and trade policymakers are watching closely. Other U.S. trade partners may see parallels in how the Trump administration enforces agreements, and a successful negotiation could influence how future trade deals are structured and ratified worldwide. Meanwhile, South Korea’s economic resilience — buoyed by a strong export start to 2026 in semiconductor and other sectors — offers some offset to immediate tariff pressure, but uncertainty continues to cloud outlooks.

As Seoul and Washington prepare for follow-up talks, the global business community will be assessing both political messaging and the practical effects on cross-border commerce. Whether this dispute ends in a compromise or a longer period of elevated tariffs, it has already become a defining story in U.S. trade policy and international economic relations in 2026.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.