EU Eyes Massive €93bn Counter-Tariffs After Trump’s Greenland Trade Threat — Why This Matters Now

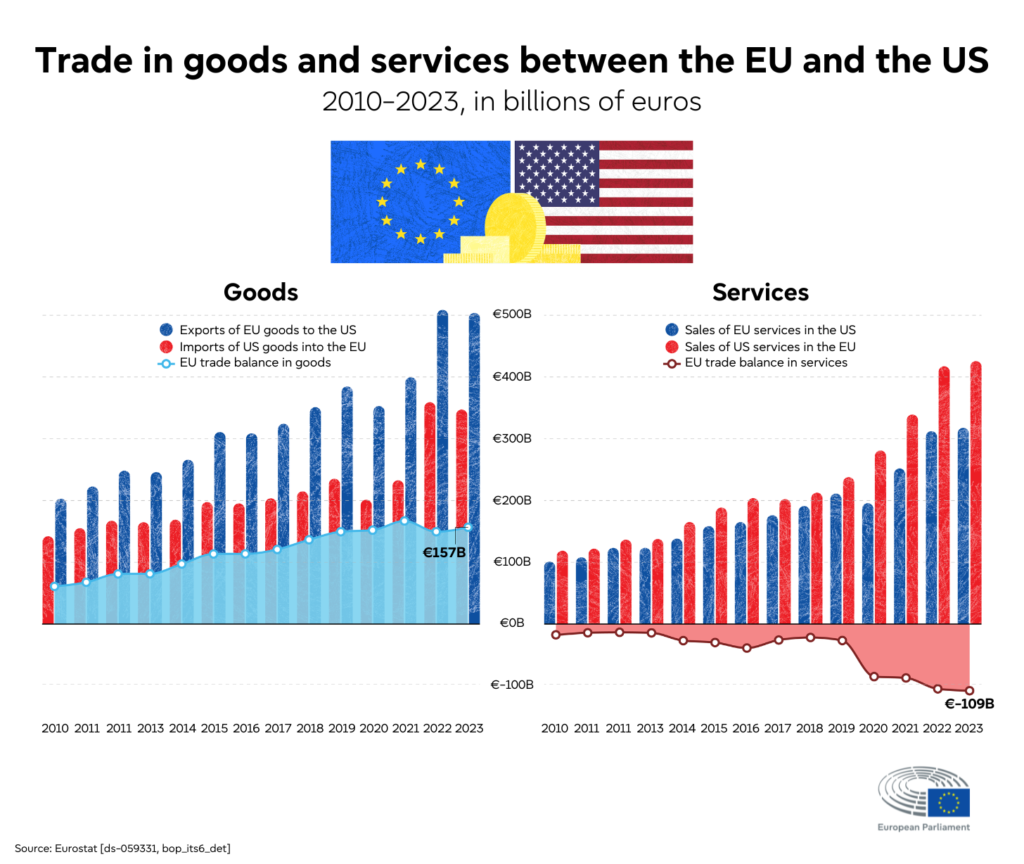

The EU is preparing to hit back with approximately €93bn in retaliatory tariffs against the United States after U.S. President Donald Trump threatened to impose steep trade duties on several European allies over their opposition to his bid for control of Greenland, a strategic Arctic territory. This trade standoff has immediate global impact on markets, diplomatic relations, and NATO unity, and could reshape transatlantic economic ties for years.

European capitals warned that Trump’s tariff threats not only risk fracturing longstanding alliances but could also trigger a full-blown trade war that sends shockwaves across global markets and investor confidence. Many economists see this episode as a defining flashpoint in U.S.–EU relations at a time when trade cooperation is crucial amid geopolitical volatility. Why this matters now: the threat of tariffs looming over critical European economies and the specter of escalating counter-measures means that transatlantic trade — and by extension global supply chains — may be entering a new era of strain.

EU Pushes Back Over Trump’s Greenland Tariff Ultimatum

In January 2026, President Trump publicly threatened additional tariffs of 10% on goods from eight European nations starting February 1, with plans to raise them to 25% by June unless the U.S. achieves some form of deal on purchasing Greenland — a move widely criticized as unconventional and coercive.

European Union leaders responded strongly, issuing joint statements condemning the tariff threats as undermining transatlantic unity and warning that such actions could spiral into broader economic conflict. Countries affected include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and the United Kingdom. EU officials argue that issues involving Greenland’s security and status should be handled via diplomatic and NATO channels, not trade coercion.

This sharp exchange has prompted emergency discussions among EU ambassadors and calls for an extraordinary summit to determine how best to coordinate a unified response. Officials are considering not only tariffs but also restrictions on U.S. companies operating in the EU market if Washington proceeds with its punitive plans.

EU: Tariffs and Transatlantic Tension: Economic Threat or Diplomatic Leverage?

The looming threat of €93bn in EU counter-measures reflects broader concerns over how economic tools are being used as leverage in geopolitical disputes. Many analysts warn that if either side deploys significant tariffs, it could destabilize global trade flows and lead to higher costs for businesses and consumers on both continents.

Financial markets have already reacted to the uncertainty. Stocks and risk assets have seen volatility, while investors shifted toward safe-haven currencies and assets, signaling that even the threat of tariff escalation — without full implementation — is enough to reverberate through markets worldwide.

European leaders, including French President Emmanuel Macron, have urged the EU to use its Anti-Coercion Instrument, a regulatory tool designed to defend against economic pressure from third countries — sometimes nicknamed the EU’s “trade bazooka.” Although rarely invoked, this policy could form part of the bloc’s defense if the situation deteriorates further.

Impact on NATO, Sovereignty, and Global Alliances

Beyond economics, this dispute touches on core issues of sovereignty and alliance loyalty. Greenland, an autonomous part of the Kingdom of Denmark, has long been a strategic partner in Arctic defense and research, especially within NATO frameworks. European officials argue that Trump’s approach jeopardizes trust within the alliance and sets a troubling precedent for how security concerns are addressed.

In response, many European nations have reiterated their commitment to NATO and rejected any notion of selling or transferring control of Greenland to the United States. Public protests in Greenland and Denmark have erupted, with thousands rallying against U.S. attempts to influence the island’s future through military or economic pressure.

The situation also complicates the future of a proposed EU–U.S. trade agreement, originally expected to normalize relations and reduce tariff barriers. The crisis may stall or derail progress on that front, raising questions about transatlantic cooperation at a time when strategic unity was seen as imperative.

Market and Global Trade Risks Ahead

Should Europe impose counter-tariffs or other economic restrictions, industries ranging from automotive to agriculture could be directly affected on both sides of the Atlantic. Technical trade experts warn that prolonged tariff battles increase costs for manufacturers, disrupt supply chains, and weaken economic growth prospects. A full escalation could see tit-for-tat measures that reverberate across international markets.

Governments outside the EU and the U.S. are also monitoring the situation, recognizing that wider global trade dynamics could shift depending on how this conflict unfolds. Many developing markets, already coping with inflationary and geopolitical pressures, could feel secondary effects from disrupted trade routes or altered investment flows.

What Comes Next: Diplomatic, Economic, and Strategic Stakes

With leaders huddling for emergency talks and summits planned, the coming days are critical. Media consensus suggests that Europe is transitioning from caution to a more assertive stance — and that both sides are aware the world is watching closely. How this dispute is resolved could redefine U.S.–EU relations for the foreseeable future, and likely shape global trade policy well beyond the Arctic.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.