Canada and South Korea have signed a new trade memorandum of understanding (MoU) aimed at boosting cooperation in the automotive sector, critical minerals, and future mobility — a move that comes as Canada faces increasing trade pressure from the United States and a rapidly shifting global auto market.

In January 2026, senior ministers from Canada and South Korea met in Ottawa to seal an agreement that goes beyond conventional trade terms and sets the stage for new automotive investment, battery manufacturing expansion, and deeper economic collaboration. The pact underscores why diversification of Canada’s trade partnerships matters now, especially as U.S. tariff threats loom large over North American industries.

This development is significant for automakers, workers, global supply chains, and policymakers alike — and it reflects a broader shift in Canada’s trade strategy away from over-dependence on the United States.

Canada’s Auto Industry at a Crossroads: New Partnerships and Pressures

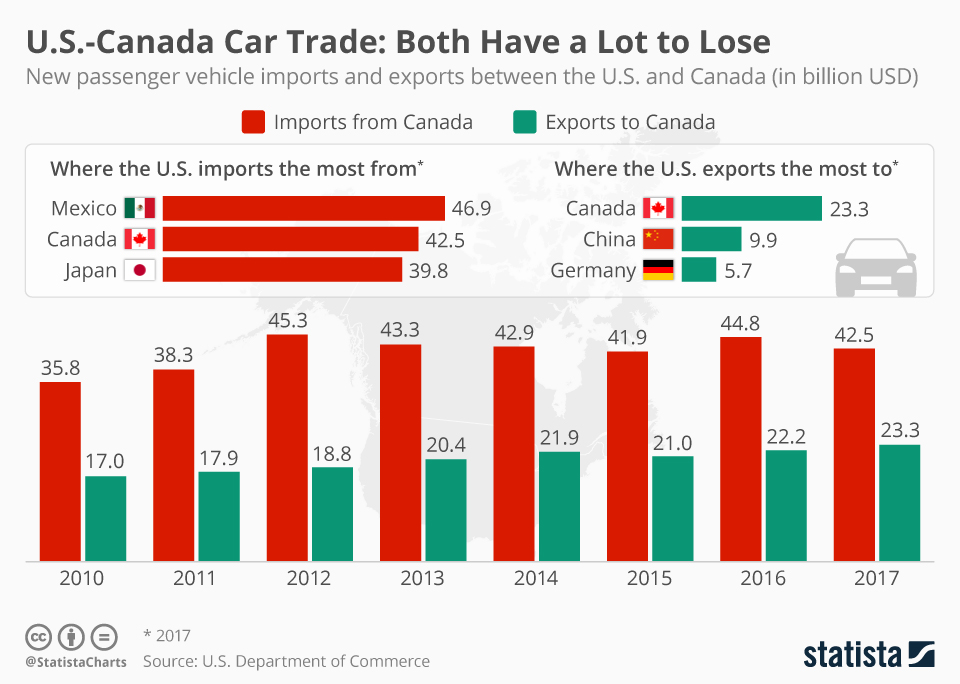

Canada’s automotive sector has long been tied to U.S. markets through the USMCA (United States–Mexico–Canada Agreement). But in recent months, Canada has faced serious trade tensions with the U.S. as Washington has threatened steep tariffs and revived protectionist trade measures.

The new MoU with South Korea signals a strategic pivot. Under this framework:

- Canada and South Korea will boost cooperation on future vehicle manufacturing, particularly for electric vehicles (EVs) and advanced automotive technologies.

- Discussions include bringing Korean automotive production to Canada, which could translate into new factories, jobs, and investment.

While no specific investment figures have been disclosed yet, officials from both countries described the pact as a step toward building a resilient automotive supply chain and capturing emerging opportunities in EVs and battery manufacturing.

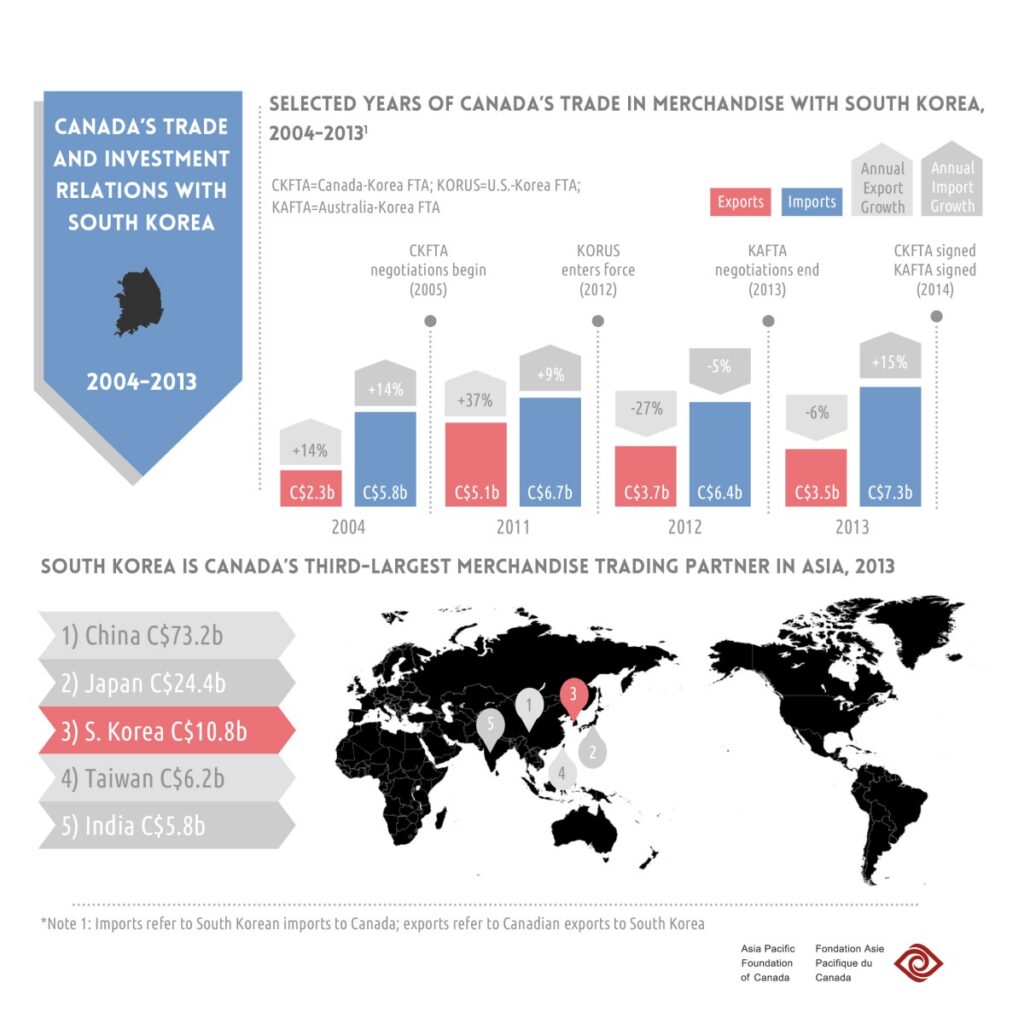

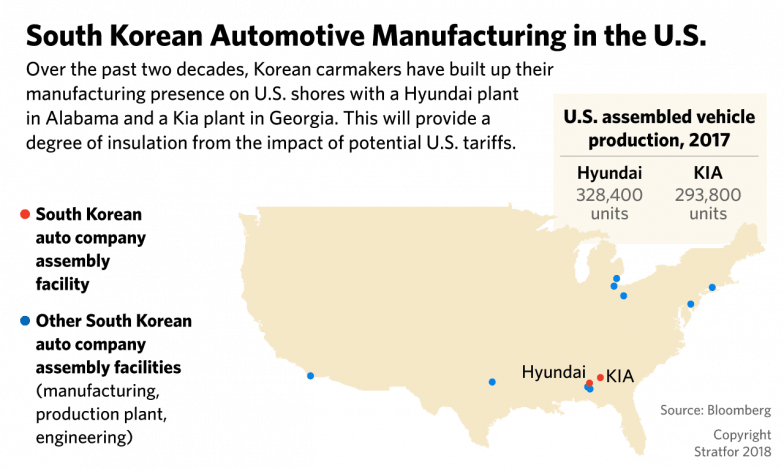

This collaboration also aligns Canada with a longtime Asian partner with deep expertise in global auto markets. South Korean automakers — notably Hyundai and Kia — rank among the top globally and have been expanding their footprint in North America.

A Broader Trade Strategy: Critical Minerals, Batteries, and Energy

The agreement isn’t limited to cars. It also covers critical minerals and battery supply chain collaboration, areas of growing importance as the world transitions to cleaner energy and electrification. Canada possesses abundant reserves of essential materials like nickel, lithium, and cobalt — all crucial for EV batteries — while South Korea stands as a major player in battery tech and processing.

This part of the pact is geared toward:

- Strengthening joint ventures and investments in battery materials processing and recycling.

- Supporting strategic sectors like artificial intelligence and mobility innovation.

- Diversifying export markets beyond the U.S. to sustain long-term economic growth.

For Canada, this means a clear strategy to build domestic industry advantages and future-proof its economy against outside shocks.

Why This Matters Now: U.S. Tariffs and Market Pressures

One of the key reasons this Canada–South Korea MoU matters today is because it comes at a time of rising trade tensions with the U.S. In late January, U.S. President Donald Trump announced plans to raise tariffs on South Korean goods, including autos, from 15% to 25%, citing delays in ratifying trade deals.

These moves have already rattled global markets, driving volatility in South Korean automaker stocks and forcing companies to rethink pricing and export strategies.

Meanwhile, Canada has also faced U.S. threats of tariffs on its products after reducing tariffs on Chinese electric vehicles — a decision aimed at diversifying trading partners but criticized by some U.S. auto industry leaders.

In this context, Canada’s deal with South Korea is not merely commercial but geopolitical. It signals Ottawa’s intent to hedge against U.S. trade unpredictability by strengthening ties with other advanced industrial economies. Such moves could spread risk, attract foreign direct investment, and create new pathways for Canadian industry growth.

Impact on Workers, Consumers, and the Auto Market

For Canadian workers and consumers, this agreement could yield several positive outcomes:

- Job creation in manufacturing and related sectors, especially if South Korean firms establish facilities or supply chains in Canada.

- Increased access to EV and future-mobility products, potentially at more competitive prices as production expands domestically.

- Stronger resilience against abrupt policy shifts in major markets like the U.S.

However, some challenges remain. The automotive market is already facing pressure from slow EV adoption, evolving regulatory standards, and competition from Chinese and U.S. manufacturers. Canada’s pivot must navigate these trends while ensuring local industries thrive rather than merely adapt.

What Comes Next: The Road Ahead for Canada and South Korea

The MoU signed in Ottawa is the beginning of a longer journey. The Canada–Korea Industrial Cooperation Committee, established under this agreement, will oversee future initiatives and explore joint projects in advanced mobility and AI, making this a multi-sector collaboration rather than a simple auto deal.

Both countries have indicated they will pursue future investment talks and could soon move toward formalized agreements or joint ventures that could reshape North American industry participation.

One thing is clear — this pact is not a one-off event. It represents a broader trend in global trade where nations diversify partnerships, especially when traditional ties face pressure from changing political and economic landscapes.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.