BRICS Bank to Launch First Rupee-Denominated Bond, Targeting $500M; RBI’s Smart Currency Strategy Signals Major Global Shift

In a landmark development for global finance and emerging market influence, the BRICS-backed New Development Bank (NDB) will issue its first Indian rupee-denominated bond — targeting around $400–500 million — marking a pivotal step in elevating the Indian currency’s global role and aligning with the Reserve Bank of India’s (RBI) evolving currency strategy.

This move, expected by March 2026, positions the rupee alongside other internationally issued currencies like the Chinese yuan and South African rand previously used by NDB, and reflects a broader push by BRICS nations toward local currency financing, deeper financial integration, and reducing dependency on the U.S. dollar.

What makes this story especially compelling is that it combines BRICS strategic currency evolution with India’s intensifying pursuit of currency internationalisation — something that global investors and financial institutions are watching closely as a possible signal of a reshaping international monetary landscape.

BRICS Bank’s First Rupee Bond: A Historic Financial Milestone

The New Development Bank, established by the BRICS nations — Brazil, Russia, India, China, and South Africa — was created in 2015 to support sustainable development projects while reducing global reliance on the U.S. dollar.

Now, after years of planning and discussions with Indian regulators, the NDB is set to issue rupee-denominated bonds in India’s domestic market, representing the first time this multilateral lender is raising capital in Indian currency within India itself. The targeted sum of $400–500 million (approximately ₹4,000–₹4,500 crore) is expected to be raised through bonds with three- to five-year maturities.

This issuance has been described by sources as part of a strategy to align financing more closely with the currencies of the markets it serves, giving investors local currency exposure, and boosting bond market depth in India.

Most importantly, experts see this issuance not just as a funding vehicle, but as a symbolic structure that reinforces the internationalisation of the Indian rupee — a long-time policy objective of Indian policymakers.

Why This Matters: The Push Toward Currency Internationalisation

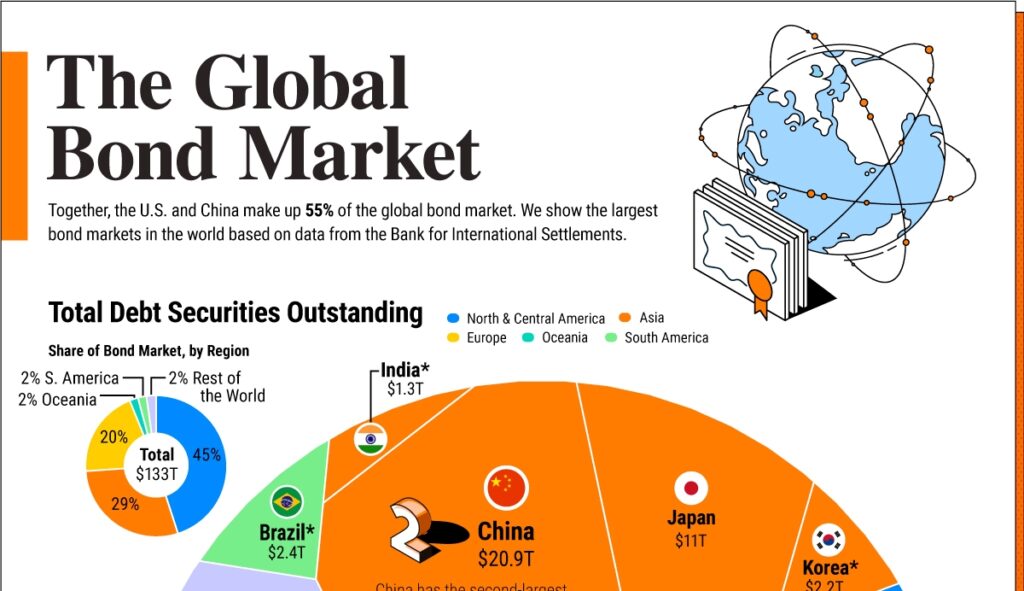

For many years, the U.S. dollar has dominated global international trade, finance, and reserve currency status. However, emerging powers — particularly those within the BRICS alliance — are increasingly exploring alternative currency mechanisms to support trade and investment outside the traditional dollar system.

The issuance of a rupee-denominated bond by NDB has at least three important implications:

- Expanding the rupee’s global use cases beyond domestic transactions;

- Attracting foreign institutional interest in Indian financial instruments;

- Contributing to a gradual reduction in reliance on the U.S. dollar for multilateral project financing.

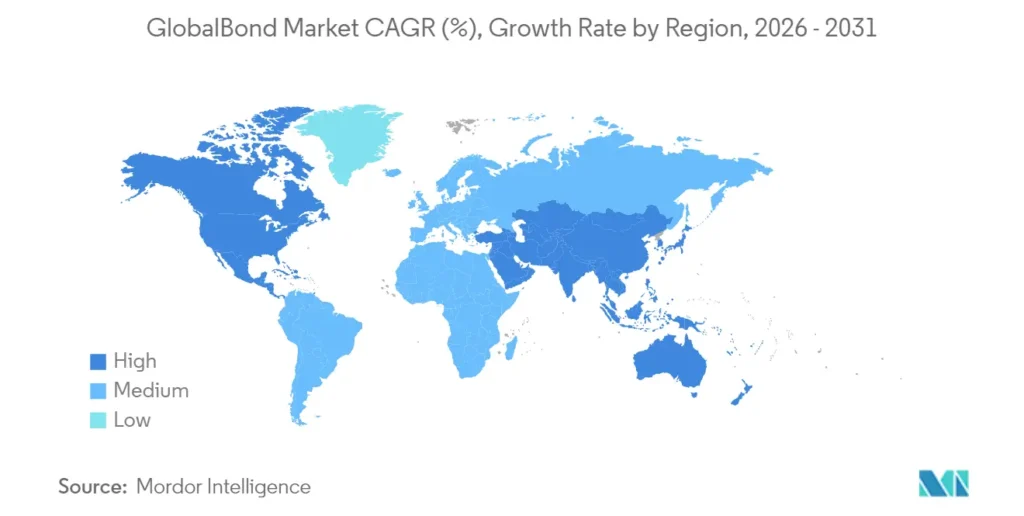

By adding the rupee to its portfolio of financing currencies, NDB acknowledges India’s growing economic footprint and supports the currency’s broader acceptance outside domestic borders — a critical signal for global investors focused on emerging market growth.

The BRICS Bank rupee bond benefits India and the Indian economy:

• Strengthens the Indian rupee’s global credibility and accelerates currency internationalisation.

• Reduces long-term dependence on the US dollar in trade and multilateral financing.

• Attracts foreign institutional investment into India’s domestic bond market.

• Deepens and expands India’s sovereign and corporate debt ecosystem.

• Lowers currency risk for Indian infrastructure and development projects.

• Enhances India’s strategic influence within the BRICS financial system.

• Supports RBI’s long-term smart currency diversification strategy.

• Boosts India’s position as a global emerging market investment hub.

• Encourages cross-border trade settlements in rupees.

• Improves liquidity and global demand for Indian financial instruments.

• Strengthens India’s financial resilience against global currency shocks.

• Aligns India with the global dedollarization movement without destabilising markets.

• Builds long-term investor confidence in India’s macroeconomic stability.

• Promotes sustainable infrastructure financing in local currency.

• Positions India as a key architect of the evolving multipolar financial order.

RBI’s Strategic Play: Backing the Rupee’s Global Journey

The Reserve Bank of India is not a passive observer in this evolution. Over the last year, the RBI has taken steps to expand the global footprint of the Indian currency — not only through support for this bond issuance but also by deepening digital and cross-border payment systems.

In January 2026, reports revealed that the RBI proposed linking BRICS members’ central bank digital currencies (CBDCs) to facilitate cross-border trade and tourism payments — another measure designed to reduce intermediaries and lower reliance on the dollar system.

Although linking CBDCs remains complex and will require multi-national technical and policy alignment, such discussions are a clear sign that India is seriously engaging with digital currency ecosystems as a complement to traditional monetary reform — and doing so with the support of the central bank.

These strategies show a nuanced and pragmatic approach by the RBI, blending traditional finance, digital innovation, and long-term policy goals to elevate the rupee’s role — domestically and globally.

Global Financial Markets and Investor Response

Investors watching the BRICS bond issuance see more than just another bond sale. Market strategists believe that instruments like these will attract interest from emerging market funds, institutional investors, and global capital seeking exposure to non-dollar assets.

Analysts have noted that such rupee-denominated instruments appeal to investors targeting emerging economies and interested in diversification beyond U.S. debt markets. Given the current volatility in global currency markets — including intermittent weakness in the rupee — some investors are interpreting this issuance as a strategic opportunity rather than a risk signal.

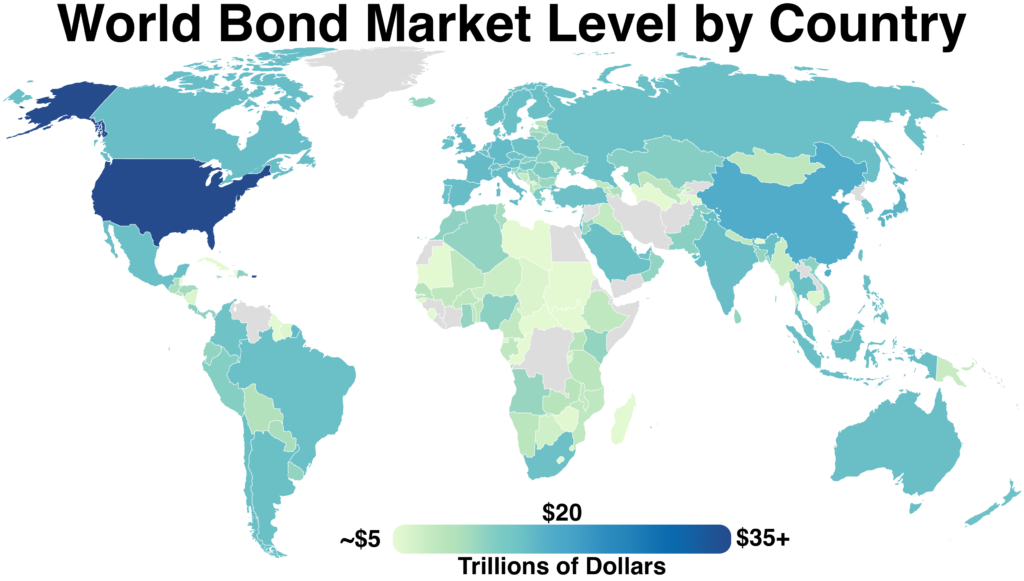

Moreover, the bond issuance is expected to add liquidity to India’s domestic capital markets, encouraging broader participation from both domestic pension funds and international asset managers who may previously have focused heavily on U.S. or euro-denominated securities.

Although full regulatory approval is reportedly still under review, financial circles consider this one of the most significant shifts in emerging market bond markets in recent years.

Connection to De-Dollarisation and Emerging Market Cooperation

The rupee bond must be understood within the larger context of dedollarization — a term for reducing dependency on the U.S. dollar in international trade and finance.

BRICS countries have increasingly explored local currency trade settlements, currency swap arrangements, and multilateral financing instruments to lower traditional dependencies. India, for example, has existing agreements enabling bilateral trade in rupees with several nations and connects its Unified Payments Interface (UPI) to other countries’ payment systems to facilitate easier settlements.

In many ways, the NDB’s rupee bond is more than a fund-raising exercise; it is a symbol of deeper economic cooperation among BRICS and a shared interest in strengthening emerging market currencies and reducing the overdominance of any single global currency.

Understanding the Broader Financial Narrative

The Britain-based World Bank and its affiliates have previously issued rupee-linked bonds — widely known in markets as “masala bonds” — to attract global investment into Indian infrastructure projects.

These instruments carried Indian currency risk for investors but engaged global capital in India’s growth story. The NDB’s move amplifies that trend, but with a multilateral bank at the helm and deeper geopolitical implications.

This is not just a financial instrument — it’s a strategic development in the narrative of currency diversification and emerging market empowerment.

A New Chapter in Global Finance and Currency Strategy

The BRICS Bank’s plan to launch its first rupee-denominated bond is more than a milestone — it’s a reflection of shifting global financial dynamics, where emerging markets are crafting solutions to long-standing structural imbalances in international finance.

With India’s central bank actively supporting this initiative and pushing broader strategies in digital currency integration and cross-border settlements, the Indian rupee is poised to play an increasingly influential role on the world stage. While challenges remain — including regulatory approvals and global investor sentiment — this development marks a strategic pivot toward local currency empowerment and diversified global finance.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.