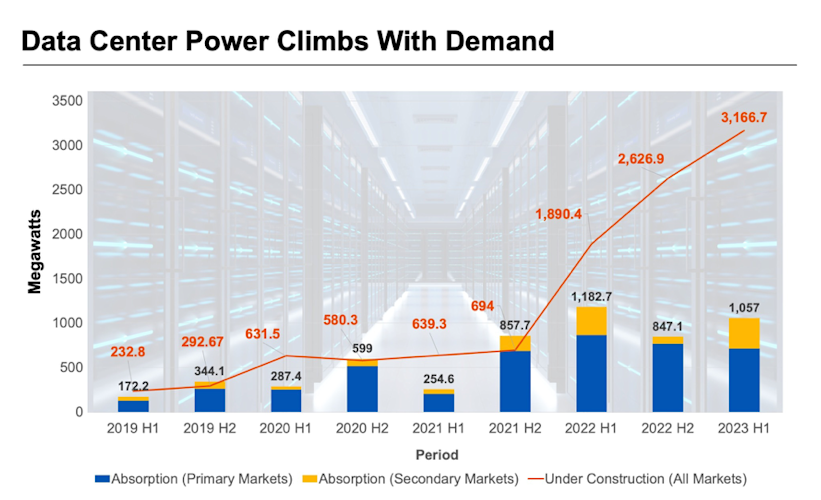

Artificial intelligence (AI) infrastructure demand has pushed Western Digital’s entire 2026 hard disk drive (HDD) production capacity to be sold out before March even begins, outpacing forecasts and squeezing supply for consumer and enterprise storage alike. The surge — driven by massive data center build-outs that require vast amounts of storage — has triggered supply crunches, price hikes, and trend shifts in the storage market, making this one of the most consequential hardware supply stories of 2026. Why this matters now is simple: shortages could ripple across PCs, servers, and data centers, affecting prices and availability for years.

AI Growth Is Straining Global Storage Supply

Western Digital, one of the world’s largest HDD makers, confirmed that all HDD units for the calendar year 2026 are already booked through major deals with AI and cloud computing customers. CEO Irving Tan said Western Digital has no remaining production capacity for consumer HDD orders this year, with long-term agreements extending into 2027 and even 2028 with top clients. This unprecedented early sell-out reflects the explosive pace at which AI data centers are expanding and locking in future supply.

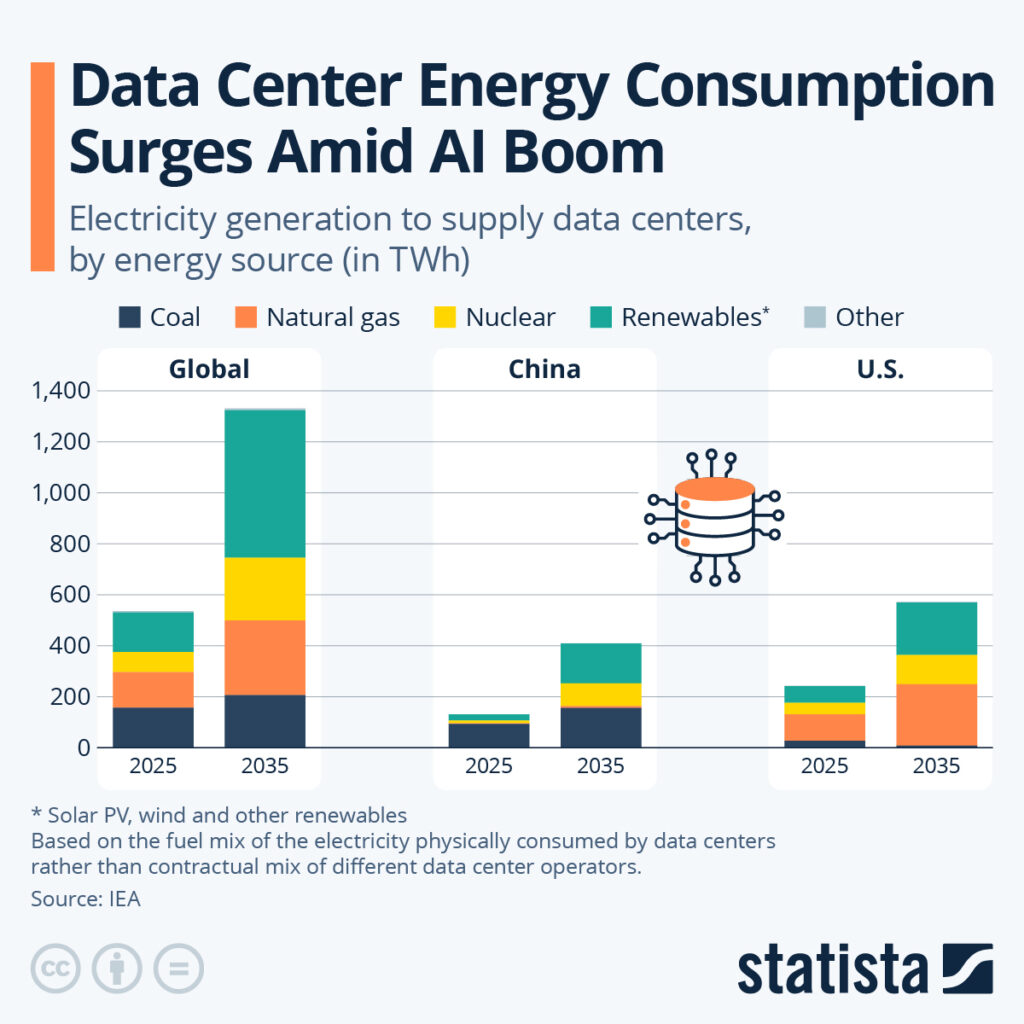

AI data centers consume enormous amounts of storage because training large models, storing datasets, and running inference tasks require many petabytes to exabytes of data — far more than typical enterprise servers. This shift toward AI-optimized storage allocations means traditional PC HDD buyers are now competing with some of the largest tech companies on earth for the same hardware.

Long-term deals for HDD capacity also include pricing terms and quantity guarantees, giving AI customers priority and leaving limited inventory available on broad retail channels. These arrangements are reshaping how storage manufacturers forecast production and allocate future supplies.

Major Price Increases and Supply Chain Stress

With demand far exceeding supply, HDD prices have climbed sharply. Industry observers report that contract prices for hard drives have posted their biggest quarterly rise in over two years, as buyers rush to secure remaining capacity. Some market commentators expect this trend to continue into 2027, especially if AI build-outs remain a priority.

PC and consumer tech markets are already feeling pressure. Enthusiasts, small businesses, and system builders report longer wait times and higher prices for high-capacity HDDs, particularly those suited for NAS systems and content archiving. Although AI data centers typically use higher-density enterprise drives, the scarcity is spilling over into the broader storage ecosystem.

A related component shortage — DRAM memory and NAND flash — has exacerbated this trend. A global memory supply shortage tied to AI infrastructure demand has driven up DRAM and flash prices, further squeezing manufacturers’ ability to meet broader market needs. This memory crisis has seen some prices rise by 200–400%, magnifying the cost pressures on PCs and servers alike.

How the HDD Market Has Shifted

Traditionally, hard drives were the backbone of consumer storage and low-cost data retention. But as AI data centers dwarf other segments in storage consumption, their purchasing power now dominates the market. Western Digital’s consumer HDD share has reportedly fallen to as low as 5% of its total revenue, with cloud and enterprise customers accounting for most sales.

This shift reflects a broader transformation: storage manufacturers are investing more in high-capacity, high-efficiency drives designed for hyperscale data centers rather than desktop or gaming systems. These developments have also pressured competitors like Seagate to expand capacity and new technologies to meet demand.

Analysts warn that if this trend continues, consumer and small business buyers may face limited options or higher costs for years. The overbooking of HDD capacity could create a gap between supply and demand that persists through 2027–2028, depending on manufacturing growth and technology transitions such as the adoption of new recording techniques like HAMR (Heat Assisted Magnetic Recording).

What This Means for Consumers and Businesses

For everyday users, a shortage of HDDs could have several downstream effects:

- Higher storage prices: Retail hard drives may cost more as suppliers prioritize enterprise orders.

- Longer lead times: Availability for mainstream storage products may decline.

- Shift to alternative storage: Some may turn to SSDs (solid-state drives), though SSDs are themselves under pressure from AI demand and supply constraints.

These market dynamics could slow PC upgrades, impact hobbyist builders, and raise costs for businesses that rely on local storage solutions.

For larger tech companies, securing multi-year supply deals provides stability but also drives consolidation, with AI infrastructure giants effectively commanding the majority of key storage production capacity. This may deepen the divide between hyperscale operators and typical buyers.

The Bigger Picture: AI’s Growing Footprint in Tech Supply Chains

The broader technology supply chain is undergoing a structural shift as AI expands. Memory shortages affecting DRAM and flash chips, as well as dedicated AI accelerators and GPUs, are now common industry talking points. Many suppliers are redirecting capacity toward high-margin AI components, sometimes at the expense of consumer electronics supplies.

Major tech investments in AI data centers — projected to total hundreds of billions of dollars by 2026 — are reshaping not just storage markets but also semiconductor priorities, global manufacturing footprints, and pricing strategies across hardware categories.

As this trend accelerates, industry watchers expect storage manufacturers to respond with new capacity expansions, innovative technologies, and strategic partnerships designed to meet both traditional and AI-driven demand. But in the short term, shortages and price volatility remain central concerns.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.