Are AI stocks still a smart investment in 2026? For U.S. investors, the short answer is yes — but with important caveats. Artificial intelligence continues to be a dominant long-term economic and technological theme that can drive gains but also carries volatility and sector concentration risk.

This topic matters now because 2026 has brought massive investment into AI technologies across sectors — from semiconductors and data centers to software and cloud infrastructure — shaping markets more than almost any other trend this year. Major firms are ramping up AI capital expenditures, which boosts growth prospects but also raises valuation concerns and potential bubbles.

In this expert guide, you’ll learn how AI stocks are performing today, the risks and rewards they present, strategies for investing wisely in 2026, and how they compare to alternative investment options — all with a focus on practical, data-driven insight for U.S. investors.

Core Explanation

Artificial intelligence isn’t a single company or product; it’s a broad category of technologies that enable machines to learn, adapt, and assist or replace human effort in tasks. This makes AI both an investment theme and a transformative economic force.

First, AI stock performance has been mixed. Some names tied closely to AI growth, such as Nvidia and semiconductor players, have delivered outstanding returns over recent years due to strong demand for AI chips and enterprise compute infrastructure. Others — even within traditional “Magnificent Seven” tech stocks — are seeing pullbacks or valuation pressure as investor sentiment shifts.

Second, the AI sector’s growth is rooted in multi-industry adoption. It includes cloud computing, networking, chip manufacturing, and software platforms. AI’s impact extends beyond tech, touching sectors like industrial automation and data center logistics. Experts point to these broad applications as supporting continued interest in the space.

Finally, 2026 is a turning point for many investors: after years of high valuations and momentum investing in AI stocks, professionals are emphasizing a more balanced and informed approach focused on earnings quality, capital expenditure sustainability, and valuation discipline.

How It Works / Step-by-Step

Understand Themes Driving AI Stocks

AI is more than language models or chatbots; it’s an ecosystem. Data centers, semiconductor design, cloud infrastructure, networking hardware, and enterprise AI applications drive revenue streams for companies positioned in the AI theme. This macro-theme perspective is critical because individual company performance often depends on how broadly AI is adopted across markets.

Identify Core Investment Segments

U.S. AI-related stocks fall into several segments:

- Chipmakers and AI hardware — companies producing GPUs, ASICs, and other processors for AI workloads.

- Cloud and infrastructure — firms powering AI deployment and storage.

- Software and platforms — companies building AI tools and enterprise services.

- Adjacent sectors — companies in industries benefiting from AI adoption (e.g., industrial automation, logistics, networking).

Evaluating each segment helps investors understand where growth may be concentrated.

Analyze Financials and Valuation

Before investing, examine earnings growth, profitability trends, and balance sheets. AI investments often feature high earnings volatility and premium valuations, so focusing on quality fundamentals helps separate companies with solid profitability from speculative bets.

Diversification and Risk Management

Because the AI sector can exhibit significant price swings, diversifying across multiple AI stock categories or using thematic ETFs can reduce risk. Dollar-cost averaging and portfolio hedging techniques can help manage volatility while maintaining exposure to growth over the long term.

Benefits and Risks

Benefits

Strong Long-Term Growth Potential

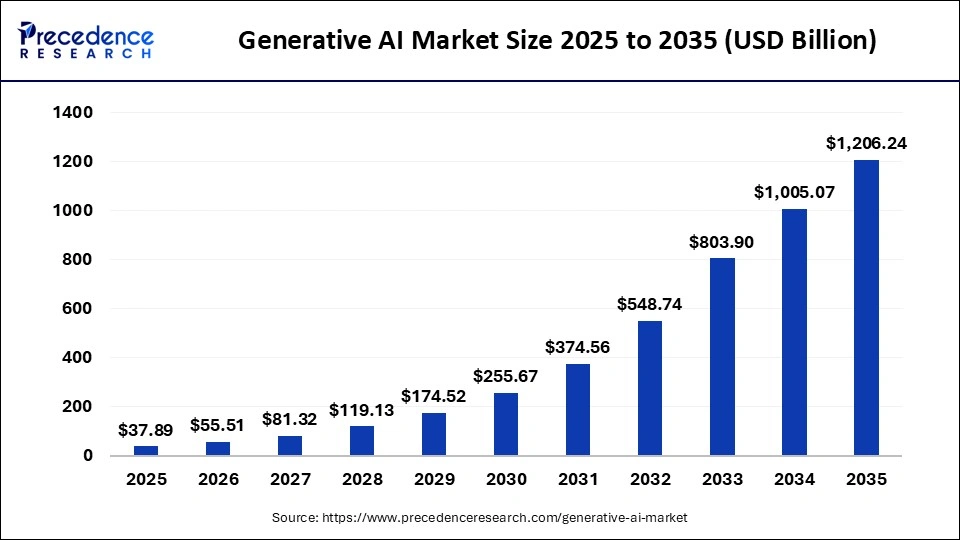

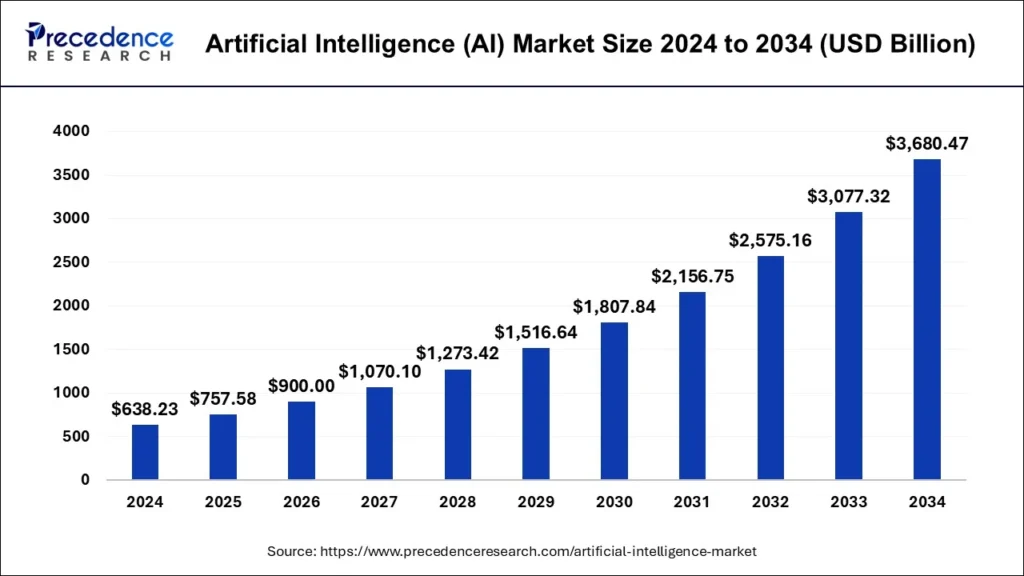

AI is expected to continue evolving, creating opportunities for companies involved in computing power, automation, and data analytics. Analysts forecast expanded market value across sectors as enterprise AI adoption grows.

Broader Economic Integration

Unlike past technology trends limited to specific industries, AI affects multiple markets — from healthcare to finance, manufacturing to cloud services — providing diversified growth avenues.

Innovation-Led Gains

Companies investing heavily in AI today may secure larger market share tomorrow, especially those with proprietary technology or first-mover advantage on key platforms and services.

Risks

Valuation and Bubble Concerns

AI stocks have soared to high valuations, which may not be justified by near-term earnings. Some analysts warn this could indicate bubble-like dynamics, especially if enthusiasm outpaces sustainable profit growth.

Concentration Risk

Much of AI stock performance is tied to a handful of mega-cap companies, making portfolios vulnerable if these names underperform or face regulatory/legal challenges.

Market Sentiment Volatility

Investor sentiment around AI can swing sharply due to macroeconomic changes, interest rate shifts, or fear of overinvestment, leading to swift price corrections.

Financial Impact or Cost Breakdown

Example: AI Sector Returns

Hypothetical illustration based on recent performance trends:

- NVIDIA’s AI-related segments have delivered multiyear returns in the hundreds of percent, reflecting strong demand for AI chips.

- Broader tech ETFs that include AI players have delivered moderate returns in the low double digits, showing the benefit of diversified tech exposure.

Valuation Metrics to Watch

- Price-to-Earnings (P/E) ratio: Leading AI stocks often trade above the broader market average, reflecting future growth expectations.

- Price-to-Sales (P/S) ratio: High ratios may signal overvaluation if not supported by revenue momentum.

Investment Cost Considerations

Investors should account for transaction fees, tax implications, and potential long-term holding-period costs when buying and selling AI stocks. The cost of capital and execution also matter, especially for active traders versus long-term buy-and-hold investors.

Comparison

AI Stocks vs. Traditional Tech

AI stocks often have higher growth potential than traditional technology firms that don’t leverage advanced machine learning or compute infrastructure. However, they also tend to show higher valuation multiples and earnings volatility.

AI Thematic ETFs vs. Individual Stocks

AI ETFs provide built-in diversification and lower concentration risk compared with picking individual stocks. They are suitable for investors seeking broad exposure without company-specific performance risk.

Expert Tips or Best Strategies

Tip 1: Focus on Fundamentals

Don’t chase hype. Look at revenue growth, earnings consistency, R&D spending, and profit margins. Quality fundamentals can help identify companies likely to weather downturns.

Tip 2: Use Diversification to Manage Risk

Rather than overexposure to a single company or segment, balance your portfolio with diverse AI-related stocks or ETFs to cushion against sector swings.

Tip 3: Think Long Term

AI is a secular trend. While short-term opportunities exist, patient investors who hold quality positions over the years can benefit from compounding as adoption increases.

FAQ Section

What Makes AI Stocks Different from Other Tech Investments?

AI stocks are distinguished by their direct involvement in artificial intelligence technologies — from hardware that processes AI workloads to software platforms that deliver AI-driven services. Unlike traditional tech stocks that might rely on legacy software or products, AI stocks often benefit from rapid adoption curves and transformational industry impact, but also face higher volatility and future earnings uncertainty.

Are AI Stocks Riskier Than the Broader Market?

Yes, AI stocks typically carry higher risk due to valuation premiums and rapid innovation cycles. While these stocks can deliver significant gains, prices can fluctuate more sharply based on news, earnings, and broader economic indicators. This makes them more suitable for investors with a balance of risk tolerance and long-term focus.

Should Beginners Invest Directly in Individual AI Stocks?

For beginners, investing directly in individual AI stocks can be challenging due to company-specific risk and the technical complexity of evaluating AI businesses. Many financial experts recommend starting with AI-focused ETFs to gain diversified exposure without needing to research each company in depth.

How Do AI Stocks Fit into a Retirement Portfolio?

When allocating for retirement, investors often aim for diversification and capital preservation. AI stocks can play a role in a growth-oriented portion of a retirement portfolio, but should be balanced with bonds, index funds, and other stable assets to mitigate risk over long time horizons.

Is There a Risk of an AI Bubble Bursting?

Some analysts have raised concerns about elevated valuations in the AI sector and the potential for bubble-like dynamics if investor optimism vastly outpaces actual earnings growth. Key indicators, like sustainability of capital expenditures and earnings quality, help investors gauge bubble risk and adjust strategies accordingly.

How Can Investors Track AI Stock Performance Efficiently?

Investors can use market indices, thematic ETFs, and financial analytics tools to monitor AI stock performance. These instruments provide aggregated insights into the sector’s overall health and trends, offering a comprehensive picture without needing to follow individual stock tickers every day.

AI stocks remain a compelling investment theme for U.S. investors in 2026, driven by ongoing technological adoption, robust capital expenditures, and structural demand across sectors. While outstanding growth opportunities exist, they also come with significant valuation and volatility risks that require disciplined, research-based investing.

Successful investing in AI stocks in 2026 means balancing optimism with financial prudence, embracing diversification, and maintaining a long-term perspective as the technology evolves and reshapes markets.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.