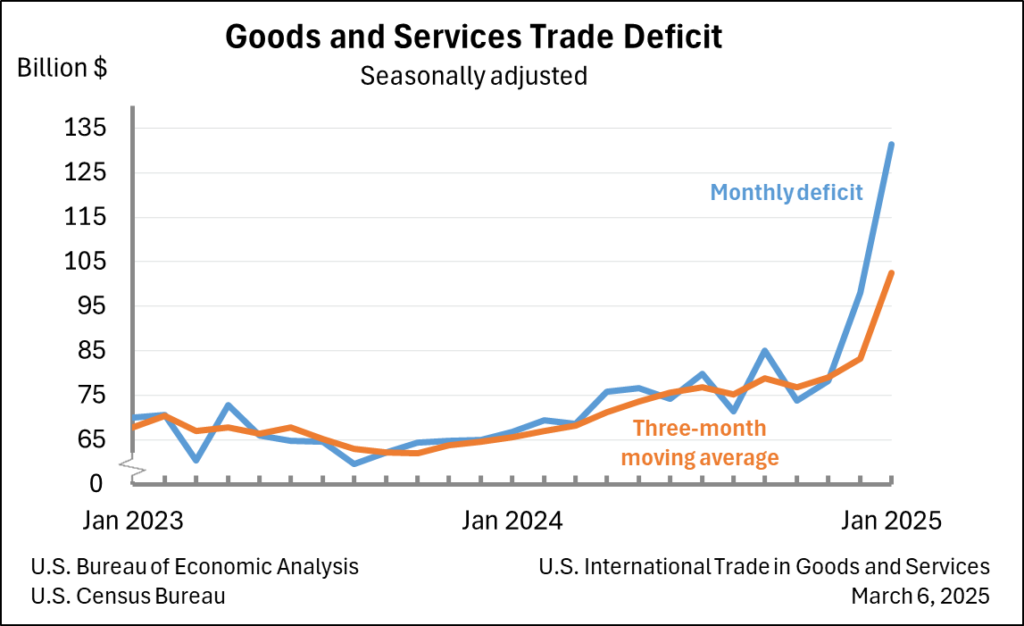

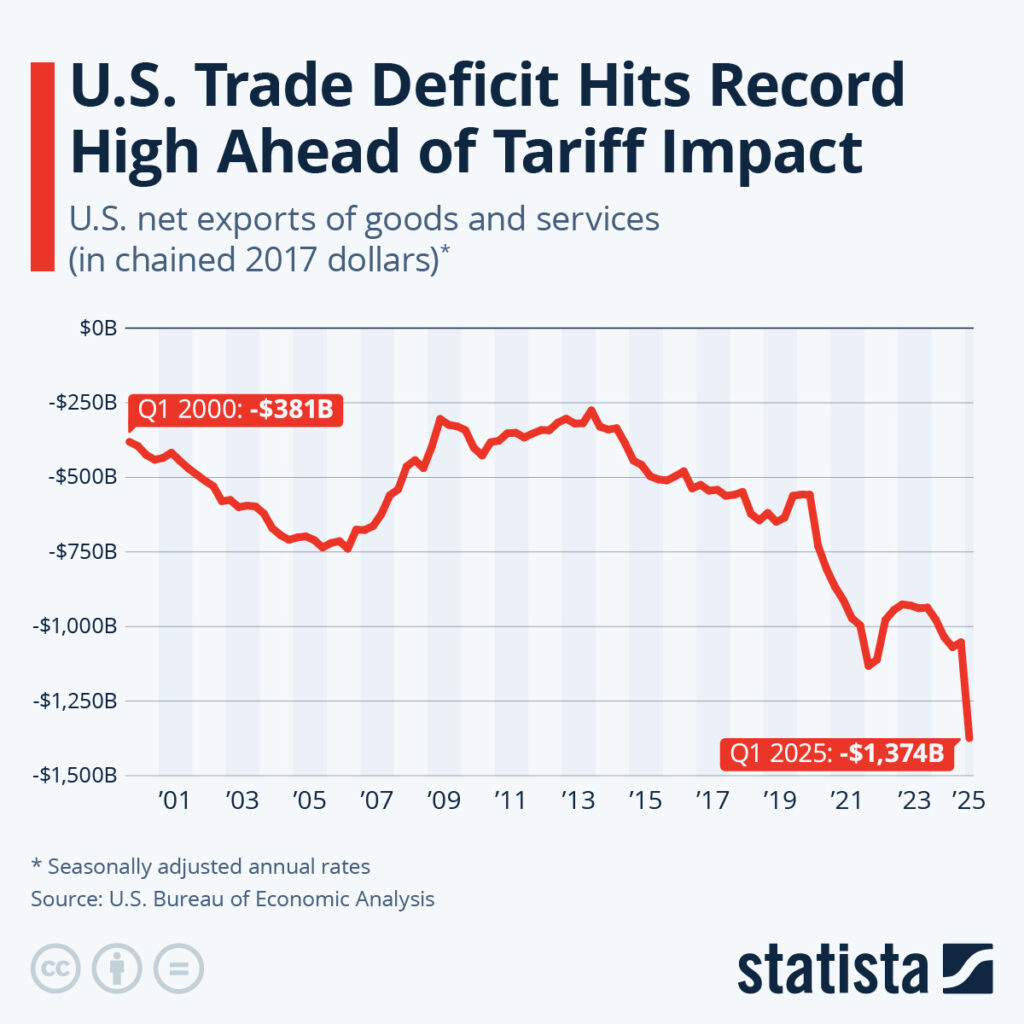

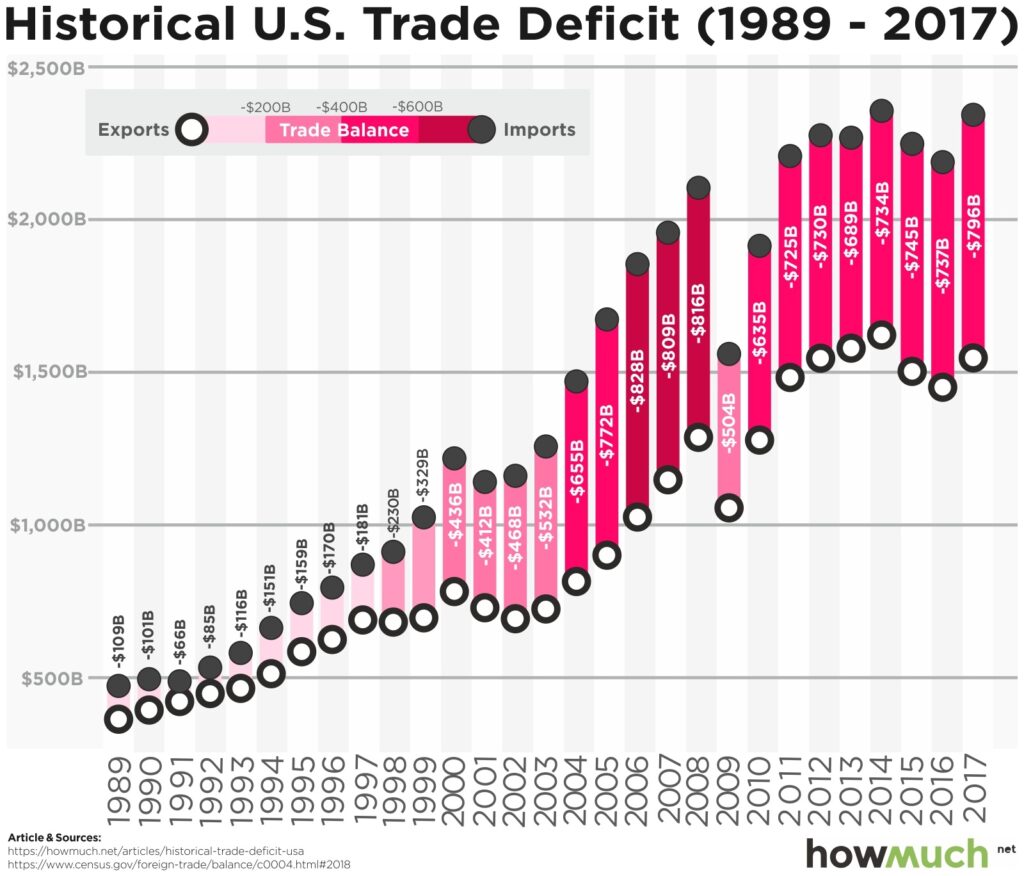

The US trade deficit widened by the most in nearly 34 years in November 2025, jumping 94.6% to about $56.8 billion, a stark shift from October’s level and a key signal about the strength and structure of the American economy. This sharp increase — the largest since March 1992 — was propelled by surging imports, especially capital goods like computers and semiconductors, while exports dropped significantly, raising questions about growth, consumer demand, and policy effectiveness.

This matters now because trade balances influence GDP growth, commodity prices, jobs, and international competitiveness. With U.S. policymakers grappling with inflation, tariffs, and global supply-chain changes, understanding this widening gap helps investors, businesses, and consumers anticipate future economic trends and policy shifts.

What Caused the Trade Deficit to Expand So Dramatically?

The November data showed a substantial rise in imports — up roughly 5 % month-on-month to around $348.9 billion — with goods imports climbing 6.6 % to roughly $272.5 billion. Capital goods such as computing equipment and semiconductors led this surge, reflecting elevated investment in technology and artificial intelligence sectors. Consumer goods — notably pharmaceuticals — also rose, offsetting sharp declines in some industrial supplies.

On the other side, exports fell by 3.6 % to approximately $292.1 billion, with goods exports dropping 5.6 %. Key declines were seen in industrial supplies, precious metals, and crude oil. Even though services exports reached record highs, they weren’t enough to counterbalance the fall in goods exports. This combination widened the goods trade deficit to about $86.9 billion.

Why Imports Have Surged — And What It Reveals

The uptick in imports points to several deeper shifts in the U.S. economy:

- Tech and capital investment: Rising demand for machinery, computers, and semiconductors suggests ongoing corporate investment in automation, data centers, and AI infrastructure — a trend that can boost long-term productivity but temporarily expands the trade gap.

- Consumer demand resilience: Even with inflation pressures and monetary tightening, U.S. consumers continue to import high-value goods, reflecting underlying economic strength and persistent demand for foreign products.

- Supply chain reconfigurations: As global firms adjust sourcing away from China toward Mexico, Vietnam, and other partners, U.S. import patterns reflect broader shifts in international trade flows.

This surge in imports — particularly of complex goods — indicates that while the U.S. economy remains digitally advancing, it also remains deeply integrated into global supply chains that drive domestic consumption and investment alike.

Why Exports Declined and the Broader Implications

Exports fell largely due to weakening shipments of industrial supplies, metals, and energy products — areas often sensitive to global demand and price cycles. For example:

- Crude oil and materials: Lower volumes and pricing pressures diminished export value for key commodities.

- Pharmaceutical products: A pullback in this category affected overall goods export figures.

While services exports — including travel, financial, and intellectual property services — hit new highs, the stronger decline in goods weighed heavily on overall export figures. This imbalance suggests that U.S. export performance remains vulnerable to global economic slowdowns, exchange rate shifts, and competitive pressures abroad.

Economic Growth and Policy Expectations

The widening trade deficit has consequences for how economists view GDP growth projections. Trade contributes directly to GDP, so a larger deficit subtracts from overall economic output, potentially tempering earlier expectations for strong fourth-quarter 2025 growth. While some forecasts from institutions like the Atlanta Federal Reserve anticipated above-5% growth, major Wall Street banks have lowered projections closer to 3%.

Federal monetary policy, tariffs, and fiscal behavior will remain in focus, as policymakers balance inflation control with growth support. Additionally, shifts in tariffs and trade policy — including ongoing tariff impacts from U.S. measures and global reactions — continue to affect trade flows and investment decisions.

Impact on Jobs, Consumers, and Households

The trade balance increasingly influences sectors beyond trade statistics:

- Jobs: While import-heavy industries like logistics and technology see hiring boosts, export-oriented manufacturing may face headwinds due to weaker global demand.

- Consumers: Imported goods often provide cost advantages and product variety, yet currency shifts or trade barriers can feed into higher prices for end consumers.

- Businesses: Companies reliant on international markets may reassess supply chains, contract terms, and pricing strategies in light of volatile trade outcomes.

Understanding these relationships gives households and investors a clearer view of how macroeconomic trends translate into everyday economic outcomes.

What Comes Next: The Road Ahead for U.S. Trade

Moving forward, several key trends will shape the trade picture:

- Technology investments will continue to drive higher imports, particularly in data, computers, and infrastructure equipment.

- Global demand conditions, especially in Europe and Asia, will influence U.S. export performance.

- Trade policy and tariffs — both ongoing negotiations and possible new measures — could alter costs, competitiveness, and bilateral trade flows.

In the near term, economists will watch subsequent months of trade data closely to gauge whether November’s widening was an outlier or a sign of deeper structural shifts.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.