Urban Outfitters Surges Ahead: Joins Elite Stocks with 95-Plus Composite Rating

Urban Outfitters has made a significant leap in the stock market, securing an impressive 96 IBD Smart Select Composite Rating, surpassing 96% of all stocks based on key performance metrics. This achievement highlights the company’s strong financial health, strategic positioning, and robust earnings growth, making it one of the top-performing retail stocks in the USA.

Understanding Urban Outfitters’ Market Surge

To provide a better understanding of why Urban Outfitters’ stock is soaring, let’s break it down into key components. Below is a structured table that outlines the essential factors contributing to this growth:

| Key Factors | Description |

|---|---|

| High Composite Rating | Urban Outfitters now holds a 96 Composite Rating, outperforming 96% of stocks. |

| Strong Financial Growth | Revenue grew 10% to $1.64 billion, and EPS surged 51% in Q4 2024. |

| Stock Buy Point | Analysts highlight a buy point at $60.90 with potential for further gains. |

| Industry Leadership | Ranks above Lululemon Athletica and TJX Companies in apparel retail. |

| Strategic Expansion | Strengthening e-commerce operations and managing inventory effectively. |

| Investment Potential | Multiple analysts raising price targets due to the company’s strong performance. |

Financial Performance and Growth: Breaking Down the Numbers

Urban Outfitters’ Q4 earnings report demonstrated remarkable progress, with a 51% increase in earnings per share (EPS)—marking the second consecutive quarter of accelerated earnings growth.

- Revenue Growth: The company reported a 10% increase in revenue, reaching $1.64 billion.

- E-commerce Growth: Strong online sales contributed significantly to revenue.

- Inventory Management: The company successfully avoided overstocking, leading to higher profitability.

- Brand Expansion: Popular brands like Anthropologie and Free People are driving sales and customer loyalty.

This data shows why Urban Outfitters has become a top retail stock choice for investors in 2025.

Stock Market Momentum and Investor Confidence

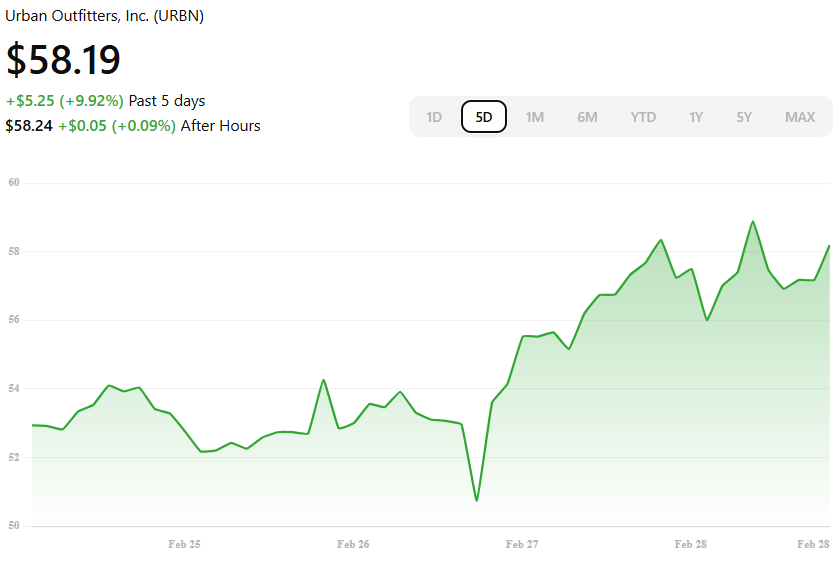

Despite broader market fluctuations and significant losses in tech stocks like Nvidia and Tesla, Urban Outfitters remains a resilient force in the stock market.

- Buy Point: Currently, the stock is forming a flat base with a buy point at $60.90.

- Investor Sentiment: Analysts suggest monitoring for a breakout with heavy trading volume.

- Market Resilience: Unlike volatile tech stocks, Urban Outfitters maintains steady retail stock growth.

- Analyst Ratings: UBS analyst Jay Sole maintained a Neutral rating on the stock with a $60 price target.

Industry Leadership and Competitive Edge

Urban Outfitters has established itself as a leader in the Retail-Apparel/Shoes/Accessories industry, ranking above competitors like Lululemon Athletica and TJX Companies. Here’s why:

| Competitive Advantage | How Urban Outfitters Stands Out |

| Brand Strength | Strong appeal among young consumers with trend-focused offerings. |

| Diverse Retail Chains | Houses multiple successful brands like Anthropologie and Free People. |

| Pricing Strategy | Balances affordability and exclusivity, attracting a broad customer base. |

| E-commerce Expansion | A well-optimized online shopping experience boosts digital revenue. |

| Marketing Excellence | Effective social media and influencer collaborations drive engagement. |

Analysts from Robert W. Baird raised their price target from $60 to $62, citing the company’s steady financial growth and promising market trajectory.

Key Growth Drivers for Urban Outfitters

- Expanding Digital Presence – The company has strengthened its e-commerce operations, attracting more online shoppers and driving higher revenue.

- Strategic Inventory Management – Effective stock management has improved profit margins, reducing unnecessary markdowns.

- Brand Strength – The company’s multiple brands, including Anthropologie and Free People, continue to perform well, catering to diverse consumer segments.

- Economic Resilience – Urban Outfitters has shown the ability to thrive even in economic uncertainty, maintaining strong sales numbers and customer engagement.

Conclusion: The Future of Urban Outfitters Stock

Urban Outfitters’ rise to a 96 Composite Rating reflects its outstanding financial performance and strong market position. The company’s focus on digital expansion, brand strength, and strategic financial planning suggests that it is well-positioned for continued growth. Investors looking for a promising retail stock should keep a close eye on its future earnings reports and stock movement. If the current trend continues, Urban Outfitters could be one of the most lucrative retail investments in 2025.