Nvidia’s Q1 FY2026 earnings report showcases the company’s robust growth, driven by unprecedented demand for AI infrastructure, even as it navigates geopolitical headwinds.

1. Record-Breaking Revenue Fueled by AI Demand

In Q1 FY2026, Nvidia reported a remarkable revenue of $44.06 billion, surpassing analyst expectations of $43.32 billion. This 69% year-over-year increase underscores the surging demand for AI-driven solutions. The data center segment was the primary contributor, generating $39.1 billion—a 73% rise from the previous year.

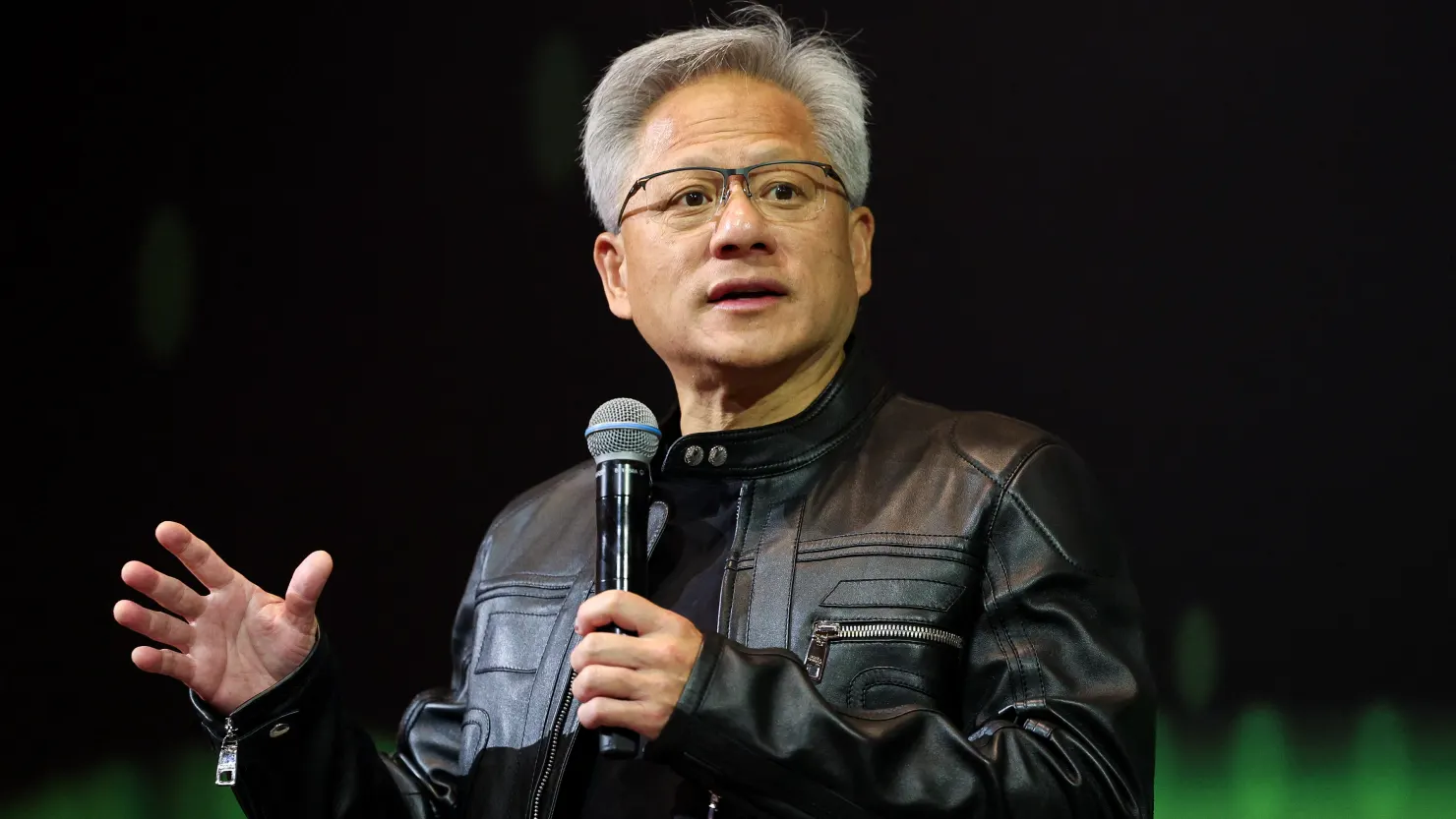

CEO Jensen Huang highlighted the explosive growth in AI inference demand, noting that the Blackwell chip now accounts for nearly 70% of data center compute revenue. This rapid adoption reflects Nvidia’s pivotal role in the AI revolution.

2. Navigating Geopolitical Challenges and Export Restrictions

Despite the stellar performance, Nvidia faced significant challenges due to U.S. export restrictions on its H20 chips to China. The company incurred a $4.5 billion charge from unsold inventory and missed an additional $2.5 billion in potential revenue from China. Looking ahead, Nvidia anticipates an $8 billion revenue loss in Q2 due to these restrictions.

Huang expressed concerns over these policies, emphasizing the importance of open markets for AI development. He warned that continued restrictions could prompt China to develop its own hardware ecosystem, potentially impacting U.S. tech competitiveness.

3. Strategic Global Expansion and Diversification

To mitigate risks and tap into new markets, Nvidia is expanding its global footprint. The company has established AI partnerships in Saudi Arabia and Taiwan and is building a quantum research lab in Boston.

Additionally, Nvidia’s automotive sector is gaining traction. The DRIVE AGX Orin platform, adopted by major automakers like Toyota and Hyundai, contributed $570 million in Q4 FY2025 revenue, marking a 27% sequential increase.

4. Financial Outlook and Market Position

For Q2 FY2026, Nvidia projects revenue of approximately $45 billion, slightly below market forecasts, reflecting the anticipated impact of export restrictions. Despite this, the company’s strong product pipeline and global engagements suggest a robust long-term outlook.

Nvidia’s stock responded positively to the earnings report, rising over 5% in after-hours trading. Analysts maintain a bullish stance on the company’s future growth, especially in AI-related infrastructure.

5. Conclusion: Nvidia’s Resilience Amid Challenges

Nvidia’s Q1 FY2026 performance underscores its resilience and strategic agility. While geopolitical challenges pose short-term hurdles, the company’s focus on innovation, global expansion, and diversification positions it well for sustained growth in the AI era.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.

[USnewsSphere.com / bi.]