Netflix, Warner Bro, and Paramount acquisition talks are dominating Hollywood and Wall Street conversations as speculation grows that Netflix could pursue a blockbuster merger with legacy studios to secure its long-term dominance in global streaming. While no formal deal has been announced, the seriousness of the discussion itself signals a turning point for the entertainment industry.

The streaming market is no longer in its experimental phase. Growth has slowed, competition has intensified, and profitability—not subscriber count—is now the primary metric investors care about. In that environment, consolidation is no longer optional; it is becoming inevitable.

Why Netflix is being linked to Warner Bros and Paramount

Netflix has long positioned itself as the disruptor that dismantled traditional Hollywood economics. But even disruptors evolve. Analysts increasingly argue that acquiring a legacy studio could provide Netflix with something it still lacks: a century-deep content vault, established franchises, and institutional relationships across theaters, sports, and global licensing.

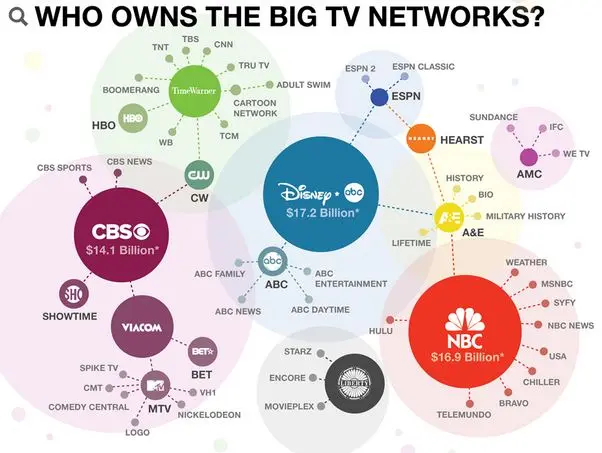

Warner Bros and Paramount both own iconic intellectual property that continues to generate revenue decades after release. From superhero universes to classic television libraries, these studios hold assets that would be prohibitively expensive—and time-consuming—for Netflix to replicate organically.

Media analysts are focusing less on whether consolidation will happen and more on who moves first. Netflix, with its balance sheet strength and global reach, is frequently cited as the most capable buyer if regulatory hurdles can be managed.

Reed Hastings’ long-term strategy and the evolution of Netflix

Reed Hastings has repeatedly emphasized that Netflix’s goal is not simply to be a streaming service, but to become the default global entertainment platform. That ambition requires scale not just in subscribers, but in ownership of premium storytelling brands.

Earlier in Netflix’s history, Hastings rejected acquisitions, arguing that creativity thrived best when built internally. But recent interviews and investor calls suggest a more pragmatic tone. As competition tightens, owning proven franchises reduces risk and stabilizes long-term revenue.

Industry insiders note that Netflix’s expansion into advertising-supported tiers, gaming, and live events signals a company preparing for a much broader entertainment ecosystem—one where legacy studios could fit naturally.

Marc Randolph’s perspective on blockbuster media consolidation

Marc Randolph has openly acknowledged that the streaming wars have entered a “maturity phase.” According to Randolph, the era of endless subscriber growth is over, replaced by a survival-of-the-strongest environment where consolidation is logical.

From a strategic standpoint, Randolph has suggested that owning established studios could allow Netflix to smooth earnings volatility and compete more effectively against diversified rivals. This aligns with trending opinion pieces across the news that describe the industry as mirroring the telecom consolidation wave of the early 2000s.

Randolph’s commentary has fueled speculation not because it confirms a deal, but because it reflects a mindset shift inside Netflix’s founding leadership—one that Wall Street is watching closely.

Why Warner Bros Discovery and Paramount are vulnerable

Warner Bros. Discovery and Paramount Global both face structural challenges that make them potential consolidation targets rather than long-term standalone winners.

Warner Bros Discovery carries significant debt following its merger, forcing aggressive cost-cutting and content restructuring. Paramount, meanwhile, has struggled to scale its streaming service profitably while maintaining its legacy TV and film businesses.

Both companies own incredibly valuable brands but lack the global direct-to-consumer reach that Netflix already has. A merger could unlock synergies, but it would also raise serious antitrust questions in the U.S. and abroad.

Regulatory hurdles and antitrust realities

Any Netflix acquisition of a major Hollywood studio would face intense regulatory scrutiny. U.S. antitrust regulators have taken a tougher stance on consolidation across technology and media sectors, particularly where consumer choice could be reduced.

However, legal experts note that streaming remains a fragmented market when viewed globally. Netflix still competes with Disney, Amazon, Apple, regional broadcasters, and emerging international platforms. That complexity could weaken arguments that a merger would create a monopoly.

Trending legal commentary suggests that regulators may allow consolidation if companies can demonstrate consumer benefits such as lower prices, broader access, and increased content investment.

What this means for creators, talent, and Hollywood jobs

For creators, consolidation is a double-edged sword. On one hand, Netflix’s data-driven approach and global distribution could give Warner Bros or Paramount content unprecedented reach. On the other hand, fewer buyers often mean reduced negotiating power for writers, directors, and actors.

Talent agencies and unions are closely watching these developments. Recent labor disputes have already highlighted tensions between traditional studios and streaming platforms over residuals, transparency, and creative control.

Industry insiders believe that if Netflix were to acquire a major studio, it would need to reassure creators that innovation and artistic diversity would not be sacrificed for algorithm-driven efficiency.

Investor reaction and Wall Street expectations

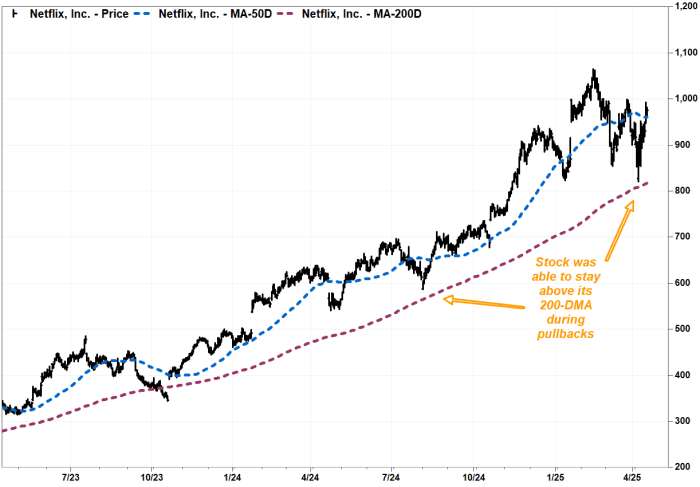

Wall Street has responded cautiously but with clear interest. Netflix investors generally favor disciplined spending and predictable margins, while studio acquisitions introduce integration risks and regulatory uncertainty.

Still, analysts point out that long-term investors increasingly value content ownership over licensing flexibility. Owning franchises outright protects Netflix from rising licensing costs and strengthens its negotiating position worldwide.

Any acquisition would likely be structured carefully—possibly through asset purchases or joint ventures rather than a full merger—to minimize risk and regulatory backlash.

How this could reshape the global streaming landscape

If Netflix successfully acquired or partnered deeply with Warner Bros or Paramount, the ripple effects would be global. Regional streamers could struggle to compete for premium content, accelerating consolidation outside the U.S. as well.

Competitors like Disney and Amazon would likely respond with their own strategic moves, potentially reigniting merger talks across Europe and Asia. The result could be a smaller number of massive entertainment platforms controlling most premium content worldwide.

Why this story matters right now

This moment represents a structural inflection point for entertainment. The streaming wars are no longer about growth at any cost; they are about sustainability, ownership, and long-term power.

Netflix, Warner Bros, and Paramount acquisition talks capture that transition perfectly. Whether or not a deal happens, the discussion itself confirms that the industry’s rules have changed—and that consolidation will define the next decade of media.

For readers, investors, and creators alike, understanding this shift is essential to understanding where entertainment is headed next.

Conclusion: The future of Hollywood is being renegotiated

Netflix, Warner Bros, Paramount acquisition speculation is more than rumor—it is a signal that Hollywood’s business model is being rewritten in real time. As streaming matures, the lines between disruptors and incumbents continue to blur.

Netflix’s next move, whether acquisition or strategic partnership, will shape global entertainment economics for years. And as Google trends indicate, audiences are hungry not just for content, but for clarity about who controls the stories they love.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.