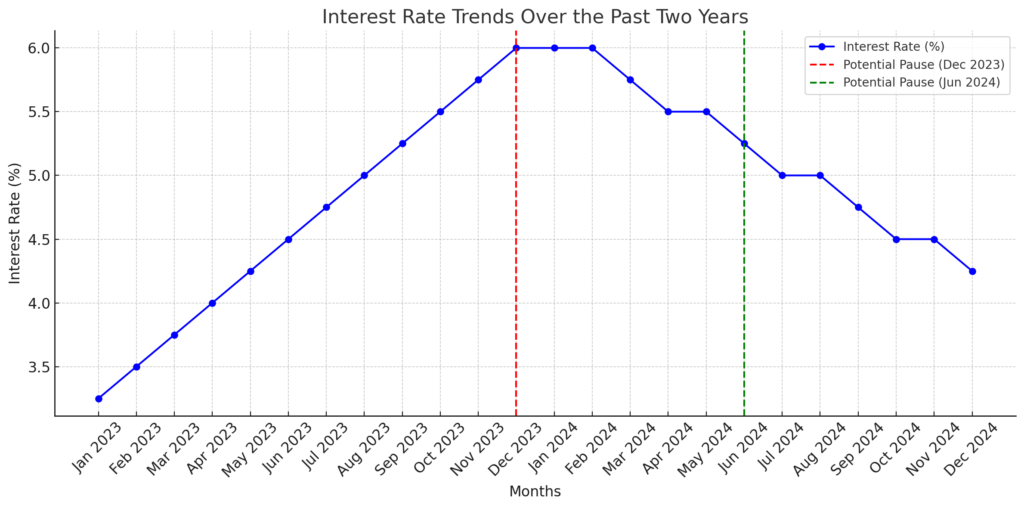

The Federal Reserve has recently signaled a potential pause in interest rate hikes, citing economic uncertainty as a primary factor. After a series of rate increases aimed at curbing inflation, policymakers are now weighing the evolving economic landscape before making further decisions. This potential shift has sparked widespread discussion among economists, investors, and everyday consumers alike.

The Rationale Behind the Pause

Over the past year, the Federal Reserve has aggressively raised interest rates to combat inflation, which reached historic highs in the wake of the COVID-19 pandemic and global supply chain disruptions. However, recent data indicates a slowdown in inflation, coupled with concerns about economic growth and labor market stability.

Key considerations influencing the Fed’s potential pause include:

- Slowing Inflation: Recent reports suggest that inflation is cooling down, with the Consumer Price Index (CPI) showing modest improvements. This could alleviate pressure on the Fed to continue its aggressive stance.

- Labor Market Trends: While the job market remains relatively strong, signs of weakening demand for labor could influence the Fed’s next move.

- Global Economic Uncertainty: Ongoing geopolitical tensions, particularly in Europe and Asia, have created economic uncertainties that the Fed must take into account.

- Consumer Spending Patterns: A decline in consumer spending, often seen as a key driver of economic health, may indicate a broader slowdown.

Market Reactions and Expert Opinions

Financial markets have responded cautiously to the Fed’s signals. Stock indices experienced slight gains following the announcement, as investors anticipate a less aggressive monetary policy approach.

According to economic analysts at ING, a prolonged pause in rate hikes may be necessary to ensure economic stability. They note that while inflation is easing, the broader economic outlook remains fragile.

What This Means for Consumers

For consumers, a pause in interest rate hikes could provide some relief. Mortgage rates, credit card interest, and loan payments have surged in recent months due to the Fed’s tightening policies. A pause could stabilize borrowing costs and encourage spending.

However, financial experts recommend that individuals remain cautious, as the Fed could resume rate hikes if inflation resurfaces. It’s advisable for consumers to take advantage of current rates by refinancing high-interest debt and exploring investment opportunities.

Future Outlook and Potential Scenarios

Looking ahead, the Federal Reserve’s decision-making will depend on economic data trends in the coming months. If inflation continues to decline, the pause may extend, allowing the economy to adjust without further monetary tightening. Conversely, any unexpected inflationary pressures could prompt the Fed to resume hikes.

Conclusion

In conclusion, the Federal Reserve’s potential pause in interest rate hikes presents both opportunities and challenges for the economy. While it offers a much-needed breather for borrowers and businesses, the uncertainty surrounding inflation and economic growth keeps stakeholders on edge. Staying informed about Federal Reserve interest rates is crucial for making well-informed financial decisions.

As the situation continues to unfold, consumers and investors should remain adaptable, keeping an eye on key indicators such as inflation rates, employment data, and market reactions. Whether the Fed continues to hold or resumes hikes, understanding the broader economic context will help you stay ahead.

We’d love to hear your thoughts—how do you think this potential pause will impact your financial decisions? Share your insights in the comments below! Don’t forget to explore our related posts for more updates on the latest Federal Reserve interest rates and economic trends.