How Taiwan’s Defense Spending Could Impact US Semiconductor Stocks and Tech Markets is a critical search topic for investors, analysts, and tech industry followers today. With Taiwan poised to increase military expenditures amid rising regional tensions, the implications extend far beyond geopolitics—especially to global semiconductor supply chains and US stock markets.

This matters now because Taiwan isn’t just a geopolitical flashpoint—it is the world’s semiconductor powerhouse. Taiwan’s defense strategy, alongside its semiconductor industry decisions, can significantly influence stock prices from semiconductor manufacturers to major US tech firms that rely on chip supply continuity and global market confidence.

Taiwan’s Strategic Position: Core Explanation

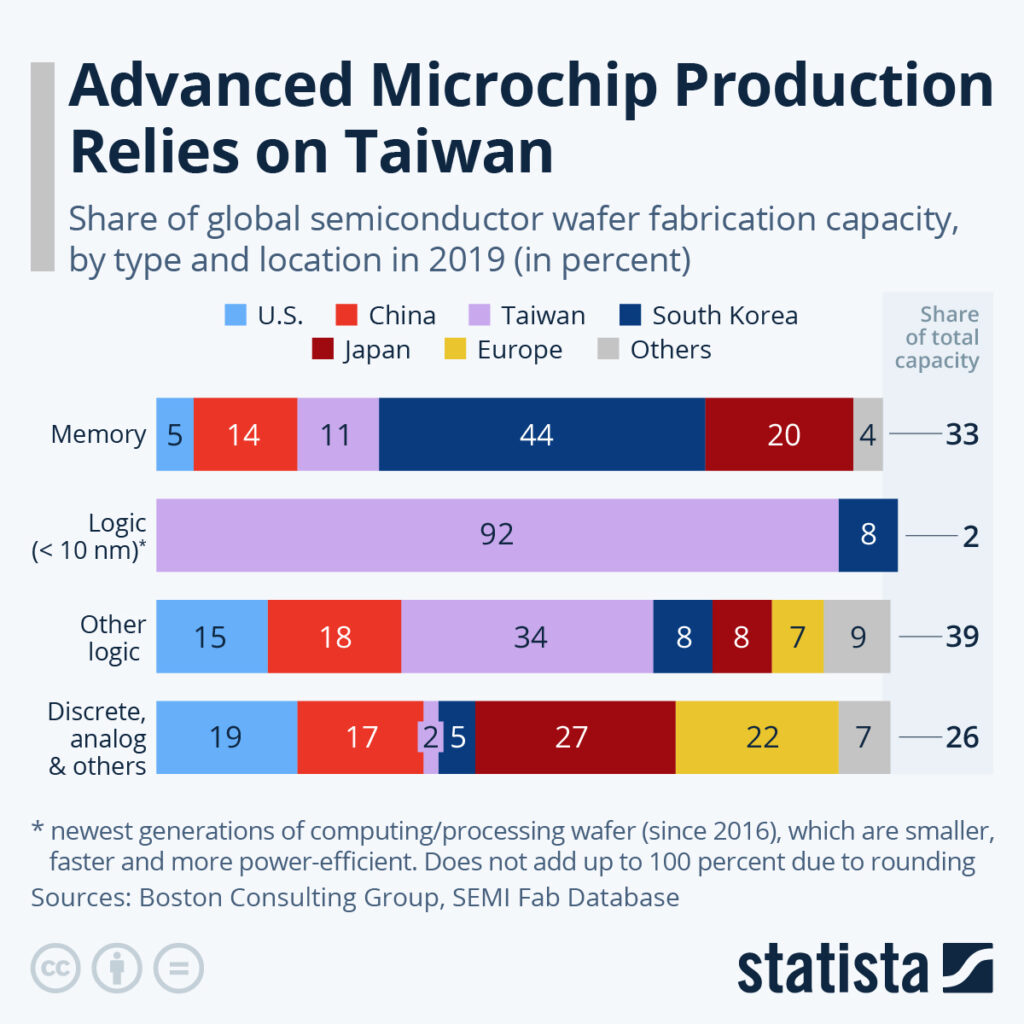

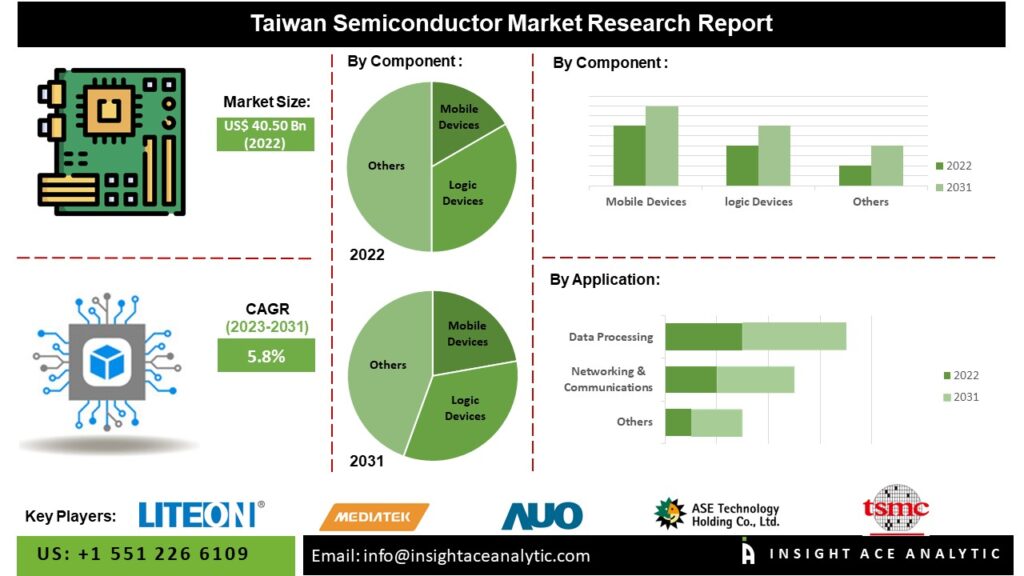

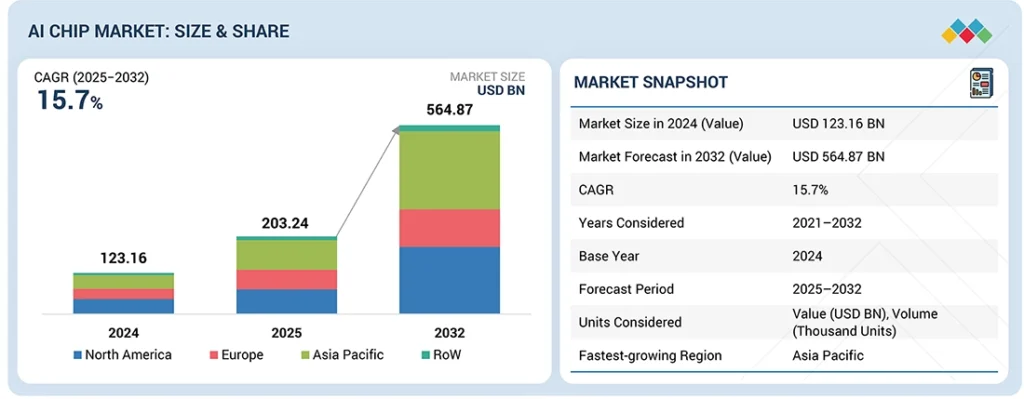

Taiwan’s semiconductor sector isn’t just economically vital—it’s foundational to global technology ecosystems. Companies like Taiwan Semiconductor Manufacturing Company (TSMC) lead advanced chip production, creating the logic processors that power artificial intelligence, smartphones, cloud data centers, and quantum computing ambitions worldwide. Taiwan accounts for around 60–90% of the world’s advanced semiconductors, forming a “silicon shield” that underscores both economic and geopolitical significance.

At the same time, Taiwan faces growing pressure from China, prompting discussions about boosting military readiness and defense expenditures. Recent government debates reflect concerns that delays in approving a $40 billion defense budget could undermine deterrence and compromise collective security in the region.

This blend of defense urgency and semiconductor centrality has created a unique risk-return calculus for global markets. Investors evaluating chip stocks must now factor in geopolitical defense dynamics—not just financials and demand curves. In many ways, Taiwan’s defense spending and strategic posturing aren’t separate from tech markets, but deeply intertwined.

How It Works: Step-by-Step

Defense spending influences markets through several interconnected mechanisms:

1. Risk Perception and Market Volatility

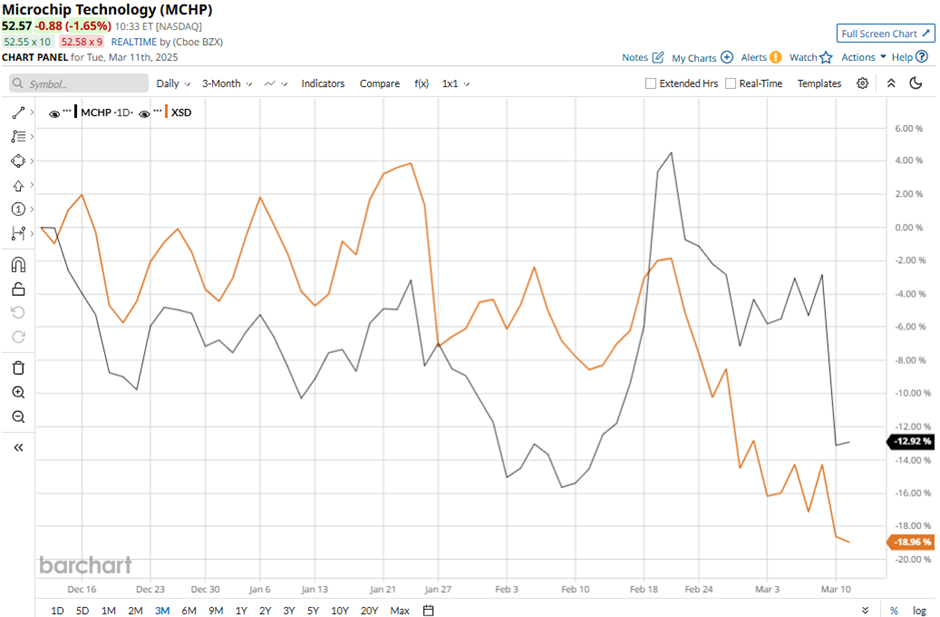

When Taiwan signals enhanced military spending, global investors interpret that as heightened geopolitical risk. Risk perception can dampen confidence in long-term semiconductor supply chains, causing sell-offs or volatility gyrations in technology indexes and stocks that rely on stable chip production. Higher risk aversion typically increases volatility premiums, affecting stock valuations.

2. Strategic Supply Chain Realignments

US policymakers have been actively encouraging semiconductor manufacturing in the United States—partly to reduce strategic overdependence on Taiwan’s fabs. This has included negotiations to bring Taiwanese investment to U.S. soil while simultaneously striking trade deals that eased tariffs to stimulate chip-related logistics. Taiwan pledged roughly $250 billion in investments in U.S. industries, including semiconductors, energy, and AI production.

3. Investment Flows and Capital Expenditure Decisions

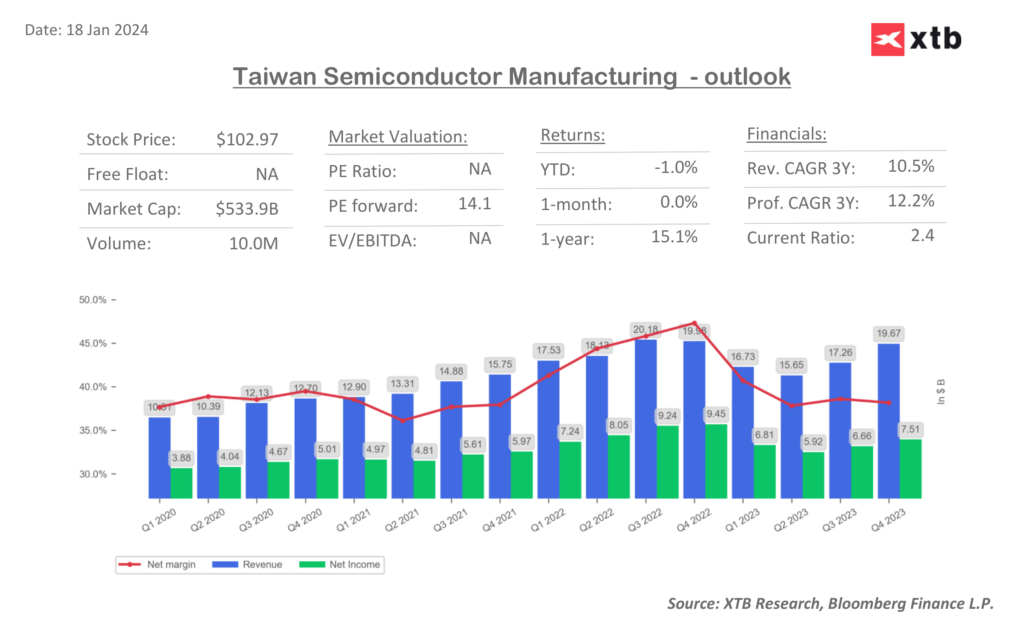

Defense geopolitical stress can accelerate or delay capital allocation decisions by firms like TSMC or United Microelectronics Corporation (UMC), which play influential roles in shaping global semiconductor industry health. Investors closely monitor these capex plans, pricing expectations into US-listed ADRs (American Depositary Receipts) and affected tech stocks.

4. Impact on US Domestic Policy and Incentives

US semiconductor policy, like the CHIPS and Science Act, is designed to offset overseas risk by subsidizing domestic manufacturing. Changes in Taiwan’s defense spending patterns can indirectly alter how aggressively US firms plan domestic expansions, with implications for long-term earnings projections and policy allocation.

These steps make clear how Taiwan’s defense landscape feeds directly into financial and strategic market behavior.

Benefits and Risks of Taiwan’s Defense Spending for Markets

Enhanced Market Awareness and Risk Pricing

One benefit of Taiwan’s defense responsiveness is heightened market transparency. Investors are more attuned to geopolitical variables and better equipped to price risk into stock valuations. This can reduce sudden shocks, as markets gradually adjust expectations rather than reacting abruptly.

Supply Chain Resilience Incentives

Defense concerns incentivize diversification of semiconductor supply chains. US firms may accelerate domestic manufacturing, reducing future dependency on Taiwan or China. This could benefit US manufacturing stocks, tech equipment providers, and materials companies, driving sustained investor interest.

Counterparty Risk and Geopolitical Uncertainty

The foremost risk is that escalating defense commitments signal an increasing probability of conflict. A conflict over Taiwan would severely disrupt semiconductor supply chains and devastate technology markets globally, possibly sparking sharp declines in companies heavily dependent on Taiwanese chips.

Stock Market Volatility and Sector Divergence

Tech stocks—especially those closely linked to chip demand like Nvidia, AMD, or Apple—could experience heightened divergence. While defensive tech sectors might attract flows, others might see pullbacks due to concerns over supply chain continuity.

Financial Impact: Cost Breakdown and Market Implications

Taiwan’s defense budget increases could reshape capital flows and influence investment performance in key markets:

Market Capital Impacts

- Semiconductor Stocks: Rising defense risk premia may temporarily suppress valuations, as investors demand higher returns for perceived risk. Stock betas could rise, increasing the cost of capital for chip firms.

- Tech Giants: Companies like Nvidia and Apple, whose products rely on Taiwanese fabs, could see wider trading ranges and tighter correlations with US treasury yields and risk assets.

Real Economic Cost

- Taiwan’s defense spending is estimated in the tens of billions. For example, a $40 billion budget—and future pushes toward 3–5% of GDP—means significant allocation of resources away from other domains such as social infrastructure or technology R&D.

Global GDP Influence

Research indicates that disruption of Taiwan’s semiconductor base in a severe geopolitical event could cost the global economy multiple trillions due to lost output in sectors from automotive to AI services.

Effective market analysis must account for these financial multipliers.

Comparison: Domestic US Production vs. Taiwan Dependence

Taiwan’s semiconductor export dominance contrasts sharply with US domestic capacity:

Taiwan:

- Produces roughly 60–90% of advanced logic chips globally.

- Industry is deeply embedded within Hsinchu Science Park and similar clusters, reinforcing local supply density and innovation.

US Domestic Production:

- Increasing but still nascent relative to Taiwan’s output scale.

- CHIPS Act incentives and Taiwanese investment inflows are strengthening capacity, but are years from parity.

While US efforts could improve supply chain resilience, the transition remains costly and long-dated.

Expert Tips or Best Strategies for Investors

Diversify Holdings

Investors should diversify portfolios across regional exposures and across cyclical vs defensive tech stocks, mitigating country-specific risk.

Monitor Policy Signals

Tracking defense and trade policy changes between the US and Taiwan can offer early signals of market shifts. This includes tariff talks and investment announcements.

Consider Risk-Hedging Instruments

Sophisticated investors may use options or hedging vehicles to protect against downside risk in semiconductor-heavy indexes during periods of elevated geopolitical stress.

FAQ Section

What is Taiwan’s current defense spending trajectory?

Taiwan has been exploring increased defense budgets amid increased regional tensions and discussions about allocating upwards of several percent of GDP to security measures that also protect tech infrastructure hubs.

Why does Taiwan’s defense budget matter to US tech markets?

Taiwan’s defense posture influences risk perceptions and supply chain continuity. Because the island produces the majority of advanced semiconductors, instability can have direct effects on investors’ confidence in associated stocks.

Could Taiwan’s defense spending trigger a conflict?

Rising defense spending does not equal conflict, but it does signal heightened readiness. Such signals can increase market volatility and risk pricing.

How do US semiconductor policies intersect with Taiwan’s strategy?

US policies like the CHIPS and Science Act aim to reduce dependency on Taiwan by bolstering domestic manufacturing—an approach influenced by geopolitical assessments.

Can investors benefit from Taiwan’s tech dominance?

Yes. Sophisticated investors can benefit by identifying companies across the supply chain, including equipment makers, materials suppliers, and diversified tech firms less concentrated in a single region.

What long-term trends should investors watch?

Trends include the reshoring of chip production, US–Taiwan trade agreements, and capital expenditure cycles among leading semiconductor firms.

Taiwan’s defense spending has ramifications that extend deep into global tech markets and US semiconductor stocks. Its role as the central hub of advanced chip production makes it a pivotal component in global supply chains, and any shifts—whether through defense posture or capital allocation—will resonate across investor sentiment and valuations.

While increased defense budgets could heighten geopolitical risk perceptions, they also underscore Taiwan’s strategic importance and may accelerate supply chain diversification, benefiting long-term resilience. Market participants must balance these factors as they make informed decisions that account for risk, growth, and technological evolution.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.