Consumer Spending Fuels U.S. Economic Growth: A 2.8% Surge in Q3 2024

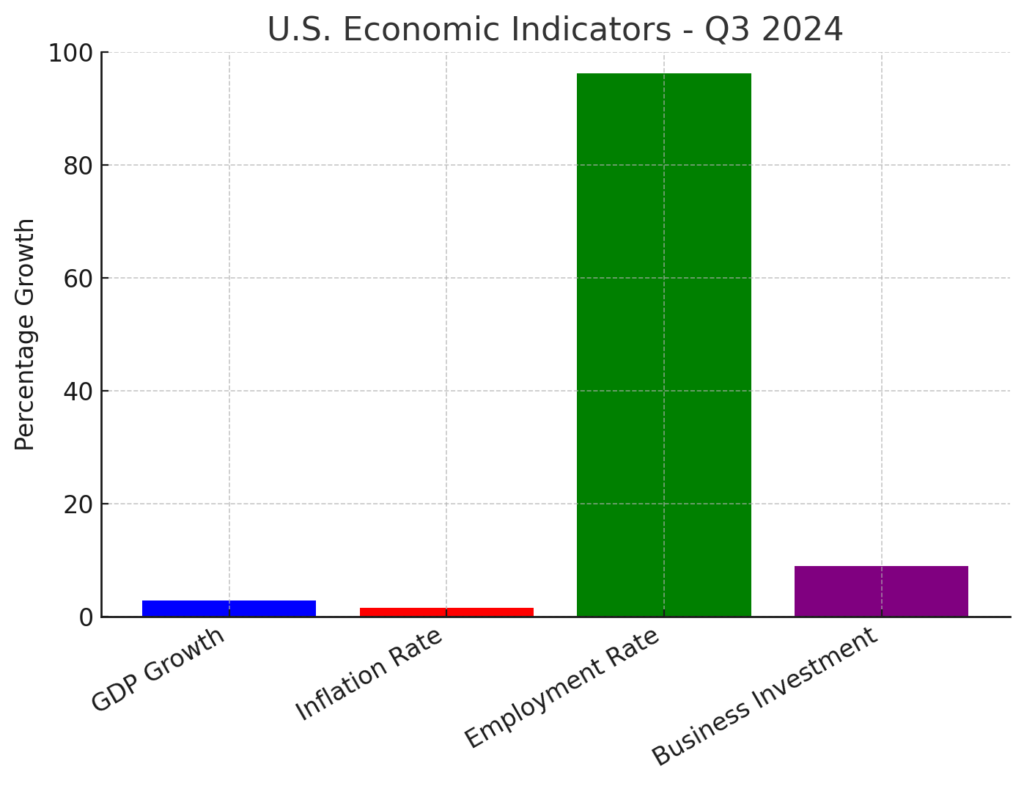

The U.S. economy saw significant growth in the third quarter of 2024, with GDP expanding at an impressive 2.8% annualized rate. A major driver behind this expansion was consumer spending, which surged by 3.7%, reinforcing its critical role in the country’s economic trajectory. As inflation continues to stabilize and the labor market remains strong, the economic outlook for the remainder of the year appears optimistic.

Table of Contents

Consumer Spending: The Backbone of Economic Growth

Consumer spending accounts for nearly 70% of the U.S. economy, making it a key indicator of overall economic health. In Q3 2024, American households increased their expenditures across various sectors, from retail and entertainment to housing and services. This rise in spending reflects growing consumer confidence, driven by steady job creation and wage growth.

Moreover, the Federal Reserve’s inflation gauge, the Personal Consumption Expenditures (PCE) index, showed a modest 1.5% annual increase in Q3, down from 2.5% in the previous quarter. This slowdown in inflation has encouraged consumers to spend more, further stimulating economic activity.

Labor Market Strength and Its Impact on Spending

A resilient labor market has been one of the key factors behind the surge in consumer spending. Unemployment rates have remained low, and job openings continue to rise in key industries such as technology, healthcare, and manufacturing. As a result, wage growth has provided Americans with more disposable income, allowing them to maintain or even increase their spending habits.

Businesses have also benefited from increased consumer demand, leading to higher revenues and improved economic sentiment across industries. Notably, the service sector saw a particularly strong rebound, with travel, dining, and entertainment industries experiencing a boost as Americans resumed pre-pandemic spending habits.

Investment Trends: Business and Export Growth

Beyond consumer spending, exports played a crucial role in Q3 2024’s economic growth, increasing at an 8.9% annual rate. However, business investment showed mixed results. While spending on equipment surged, investment in commercial real estate, particularly office spaces and warehouses, experienced a slowdown. This shift highlights how businesses are prioritizing productivity-enhancing assets over traditional brick-and-mortar expansions.

Federal Reserve’s Role in Sustaining Growth

In response to the evolving economic landscape, the Federal Reserve has taken measures to support growth while keeping inflation under control. Recent interest rate cuts aim to lower borrowing costs for both businesses and consumers, creating an environment conducive to continued economic expansion.

By maintaining a balance between encouraging spending and preventing overheating, the central bank plays a pivotal role in shaping the country’s economic future. Analysts anticipate that as long as inflation remains under control and the labor market stays strong, the U.S. economy will continue its upward trajectory in the coming months.

Conclusion: A Positive Outlook for the U.S. Economy

The 2.8% GDP growth in Q3 2024 underscores the resilience of the U.S. economy. With consumer spending driving this expansion, coupled with stable inflation and a strong job market, the outlook for the rest of the year remains promising. Businesses and policymakers alike will closely monitor economic indicators to ensure sustained growth in the coming quarters.

For further insights on economic trends and expert analysis, visit [AP News /USnewsSphere.com].