PayPal Stock Slides After Weak Q4 Earnings as Surprise CEO Change Shakes Investor Confidence

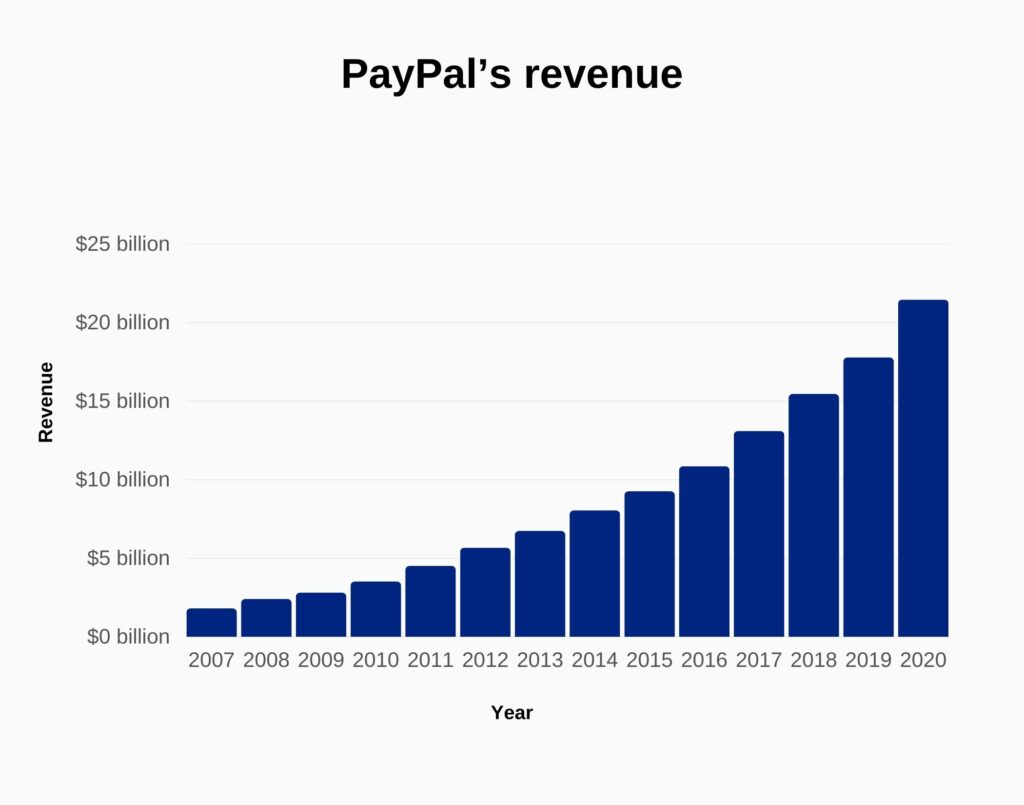

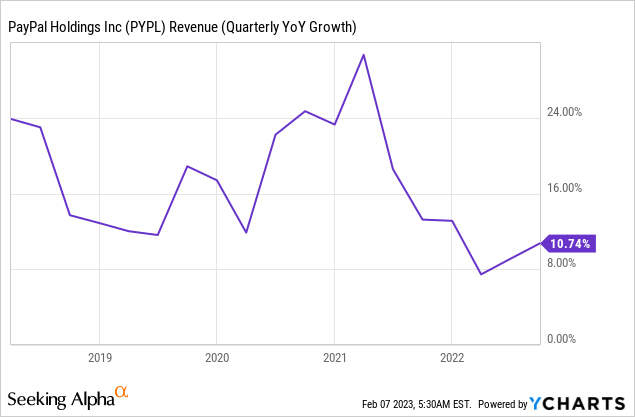

PayPal reported fourth-quarter 2025 results that missed Wall Street forecasts, triggered a sharp slide in its stock, and sparked a surprise leadership change — underscoring deep challenges within the digital payments giant at a time when consumer spending patterns are shifting, and competition is intensifying. This matters now because investors, merchants, and fintech watchers were betting on stronger growth entering 2026 — and the latest update fell short.

At the outset, PayPal’s earnings and revenue both underperformed expectations, its stock dropped dramatically, and the board announced the appointment of HP veteran Enrique Lores as the next CEO — a decision reflecting dissatisfaction with recent execution and growth metrics.

Earnings Snapshot: Missed Targets and Market Reaction

PayPal reported adjusted earnings per share (EPS) of $1.23 for Q4 2025, below analysts’ anticipated $1.29. Revenue came in at $8.68 billion, also short of forecasts near $8.78 billion.

Investors reacted harshly, sending the stock down around 16–20 % in pre-market and midday trading, marking one of the worst trading days in recent company history.

Industry observers pointed to soft retail spending, competitive pressure, and execution delays as key factors. PayPal itself acknowledged that some segments — particularly its branded checkout business — grew more slowly than expected, highlighting execution challenges ahead.

The company also announced its first quarterly dividend of $0.14 per share, a new move that could be seen as a strategic shift in capital return policy.

Leadership Shakeup: New CEO Takes the Helm

In a rare mid-cycle leadership change, PayPal’s Board of Directors named Enrique Lores — former CEO of HP Inc. and current board chair — as the next CEO and president, effective March 1, 2026.

This move came as CEO Alex Chriss was replaced amid concerns that PayPal had not executed with the urgency and clarity the board expected. In the interim, CFO Jamie Miller will serve as acting CEO until Lores arrives.

The leadership shift signals that PayPal’s board sees strategic and operational execution — not just financial performance — as the priority going into 2026 and beyond.

What Drove the Disappointment?

Several key factors contributed to PayPal’s underperformance:

- Branded checkout growth slowed significantly — rising only about 1% in Q4 — far below past trends, weakening profit potential in its core online payments segment.

- Softening consumer spending, especially in U.S. retail, limited transaction volumes in high-margin categories.

- Competition from Apple Pay, Google Wallet, Stripe, and other modern fintech platforms continues to erode PayPal’s historic dominance in digital payments.

Even as total payment volumes grew around 6–9 % year-over-year, the gains weren’t enough to offset disappointing top-line performance and investor concerns about future profitability.

Long-Term Growth and 2026 Outlook

In addition to the near-term miss, PayPal provided a subdued profit outlook for 2026, forecasting flat to slightly lower earnings rather than the moderate growth analysts had expected. This softer guidance further pressured the stock.

PayPal’s leadership highlighted investments in customer experiences, new payment innovations, and areas like buy now, pay later (BNPL) and digital wallets as strategic priorities, but acknowledged these efforts may weigh on near-term margins.

Venmo remained a bright spot in the results, with revenue rising strongly and total payment volumes expanding significantly, highlighting the importance of PayPal’s diversified platform.

Who This Impacts and Why It Matters

- Investors saw meaningful losses in PayPal shares, making the stock a key monitor for market watchers and portfolio strategists.

- Fintech competitors may benefit as PayPal recalibrates execution and strategy under new leadership.

- Merchants and partners reliant on PayPal’s checkout solutions may face delays in new product enhancements as the company reshuffles priorities.

This earnings release and leadership transition arrive at a time when digital payments are evolving rapidly, and consumer expectations are shifting — making PayPal’s near-term performance a bellwether for the broader fintech sector.

What Comes Next for PayPal?

With Enrique Lores set to take over and a strategic commitment to revitalize key growth vectors, several questions remain:

- Will PayPal’s new leadership accelerate innovation and competitive differentiation?

- Can branded checkout — historically a profitable engine — return to higher growth?

- How will macroeconomic pressures like consumer spending and interest rates shape transactional volumes?

Investors and industry watchers will be looking closely at upcoming guidance updates and early moves by the new CEO to answer these pivotal questions.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.