Netflix Stock Surges as Company Eyes $1 Trillion Valuation by 2030—Is Now the Time to Invest? The streaming giant’s stock jumped over 5% on April 15, 2025, after it revealed plans to double its revenue and reach a $1 trillion market cap by the end of the decade. With a current valuation of about $420 billion, Netflix’s bold 2030 vision is attracting massive investor interest across the USA.

Why Netflix Believes It Can Hit a $1 Trillion Valuation by 2030

Netflix is betting big on growth areas beyond just subscriptions. The company’s executive team laid out a roadmap focused on three key drivers:

- Global Ad Expansion: Netflix expects advertising revenue to grow from $1.5B (2024) to $9 billion by 2030

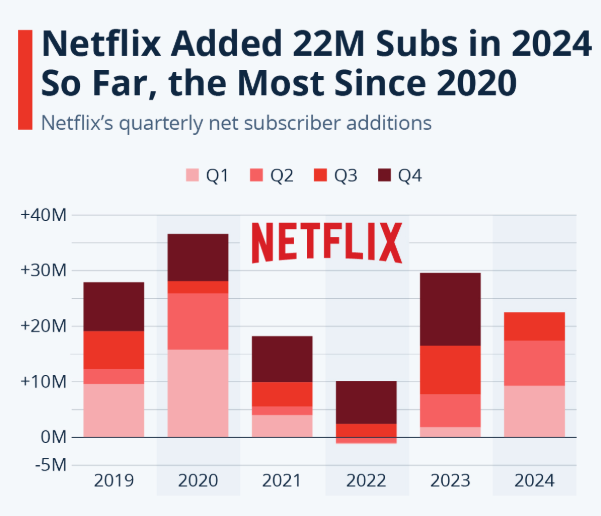

- Subscriber Growth: The platform has already surpassed 300 million global subscribers and targets 500M+ by 2030

- Pricing Power: Netflix plans to increase prices in Tier 1 markets like the USA without losing retention due to content exclusivity

Netflix’s Strategic Growth Plan to Reach $1 Trillion

| Growth Area | 2025 Estimate | 2030 Target | Strategy Highlights |

|---|---|---|---|

| Market Cap | $420 Billion | $1 Trillion | Revenue doubling, expanding monetization |

| Ad Revenue | $1.5 Billion | $9 Billion | New ad tiers, partnerships, and smart targeting |

| Subscriber Base | 300 Million+ | 500 Million+ | International markets, bundling deals |

| Average Revenue/User | $14/month (USA avg) | $20/month goal | Price optimization with exclusive content |

Analyst Reactions: Bullish Outlook from Wall Street

Top institutions including Bank of America and Morgan Stanley are backing Netflix’s roadmap:

- Bank of America issued a “Buy” rating with a $1,175 price target

- Analysts say Netflix is becoming one of the most resilient tech stocks during recessionary periods

- Investors view its mix of content, pricing control, and ad growth as a “long-term winner”

Big Opportunities vs Risks: What Investors Need to Know

Despite strong growth potential, Netflix will face intense competition and challenges:

Opportunities:

- Dominant share in original content globally

- Early entry into global ad-based streaming

- Expanding beyond entertainment (e.g., gaming, documentaries)

Risks:

- High production costs amid economic tightening

- Pressure from competitors like Disney+, Apple TV, YouTube

- Regulatory issues in emerging markets

What’s Fueling Netflix’s Push to $1 Trillion?

Netflix Growth Engine

│

├── Global Subscribers

│ └─ Expansion in Asia, Latin America, EU

│

├── Advertising Revenue

│ └─ $9B target by 2030

│

├── Content Leadership

│ └─ Original films, global language series

│

├── Strategic Partnerships

│ └─ Telecoms, Smart TVs, Studios

│

└── Investor Sentiment

└─ Bullish forecasts, price upgradesShould You Buy Netflix Stock in 2025?

With strong momentum and a clear long-term vision, Netflix offers an attractive option for long-term investors—especially those in the USA looking for tech-driven growth stocks.

Here’s a quick overview of Netflix stock performance in 2025:

| Date | Netflix (NFLX) Stock Price | Key Update |

|---|---|---|

| Jan 1, 2025 | $812.13 | Q4 2024 earnings beat |

| Mar 10, 2025 | $902.54 | 300M global subscribers milestone |

| Apr 15, 2025 | $976.28 | $1 Trillion valuation target news |

Conclusion: Netflix’s $1 Trillion Ambition Is More Than Just Hype

Netflix is no longer just a streaming service—it’s a global tech media company with a clear roadmap for massive expansion. While challenges remain, its combination of revenue innovation, content power, and investor trust makes it a potential $1 trillion market cap stock by 2030. This makes Netflix one of the most compelling U.S.-listed tech stocks to watch closely.

[USnewsSphere.com / in.]