How Trump’s Climate Rollback and Russia Deal Could Impact U.S. Energy Stocks and Oil Prices is a question that directly affects investors, retirement savers, energy executives, and everyday Americans watching gas prices. Policy shifts tied to environmental regulations and foreign energy diplomacy can reshape oil supply expectations, capital flows into energy companies, and long-term investment strategies across U.S. markets.

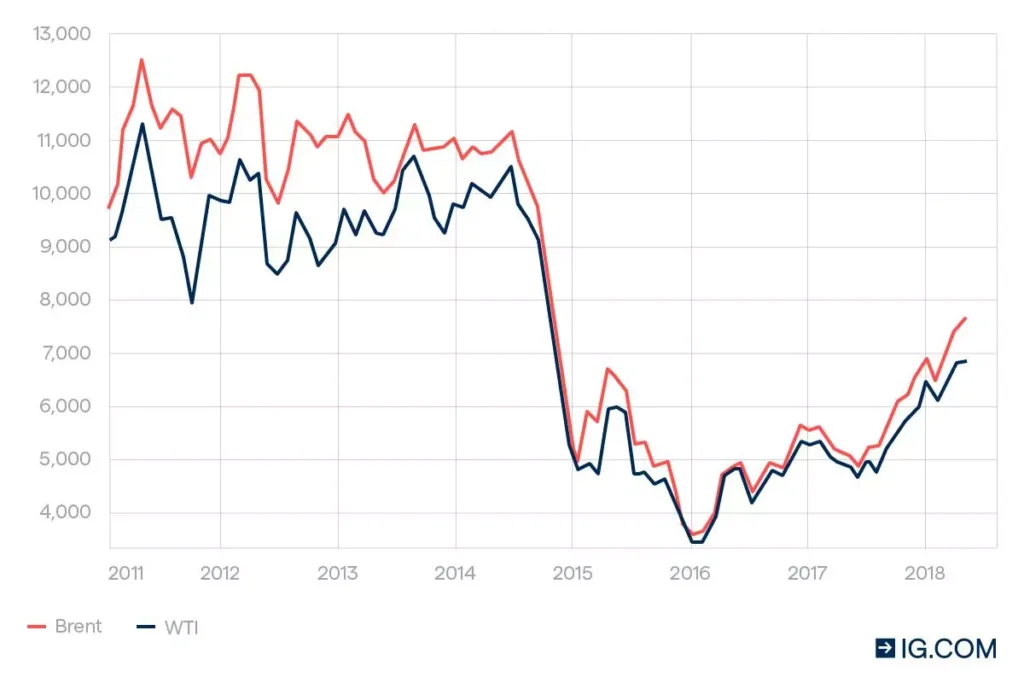

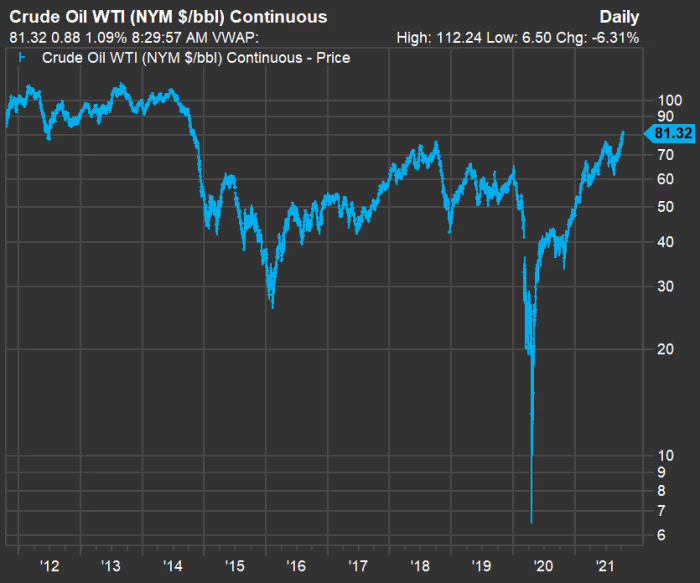

This topic matters now because energy policy is deeply connected to inflation, interest rates, federal regulation, and geopolitical stability. Any rollback of climate rules combined with a potential thaw in U.S.–Russia energy dynamics could alter global crude benchmarks like WTI and Brent, influence shale production, and move stock prices in sectors tied to oil, natural gas, pipelines, and renewable energy.

Core Explanation

Energy markets respond first to expectations, not outcomes. When policymakers signal climate deregulation—such as loosening methane emission rules, expanding federal drilling leases, or reducing EV incentives—investors immediately adjust forecasts for oil and gas supply. Increased domestic production often leads to downward pressure on oil prices in the short term, while improving margins for U.S.-based producers.

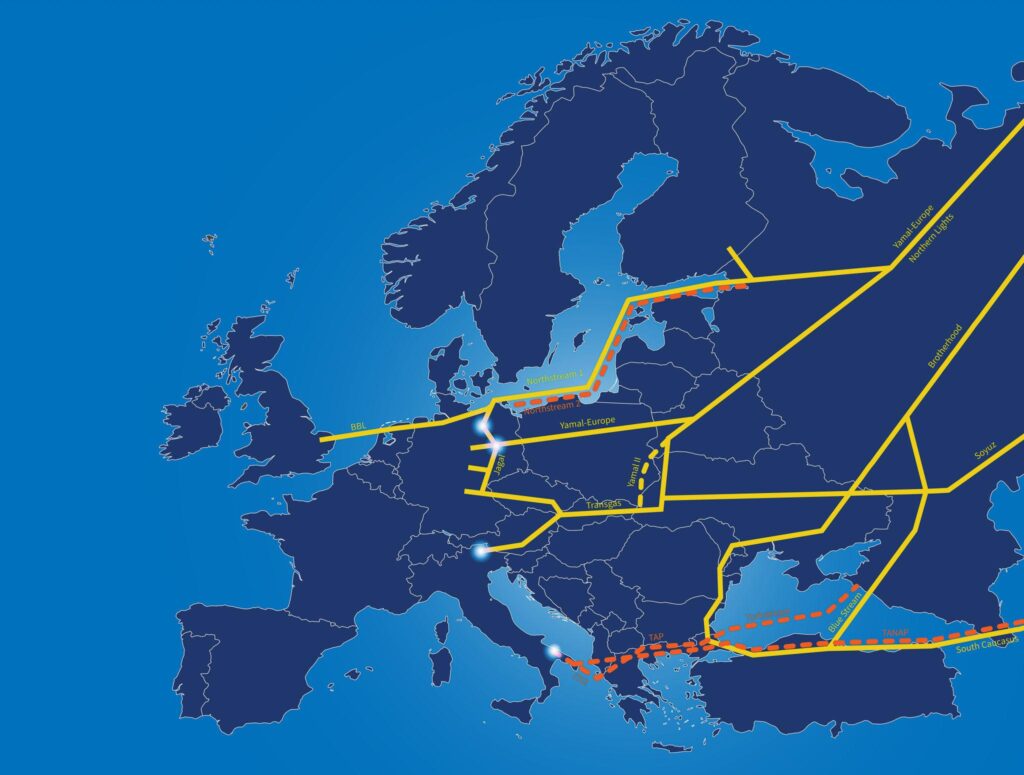

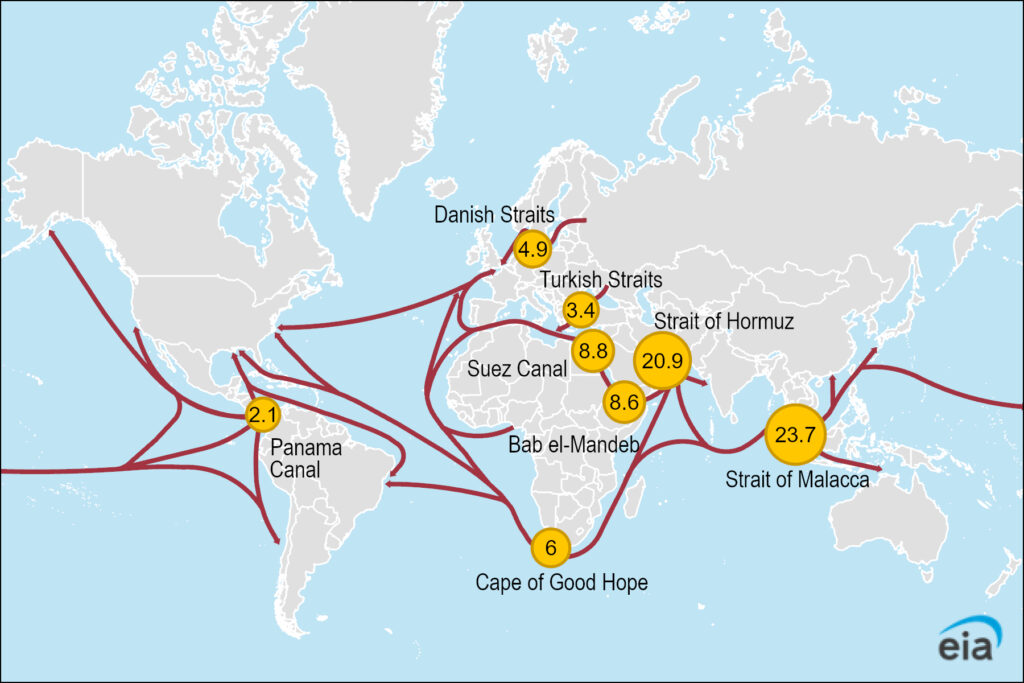

At the same time, U.S. relations with Russia remain a major variable in global oil pricing. Russia is one of the world’s largest crude exporters. Any deal that eases sanctions, alters export limits, or changes coordination with global producers could significantly increase supply in international markets. That supply shift influences benchmarks like WTI and Brent, which in turn affect U.S. energy stocks.

Markets are highly sensitive to geopolitical alignment. A softer U.S. stance toward Russian energy exports could lower global oil prices if supply rises. However, the reaction depends on OPEC+ coordination and domestic production discipline. Investors must consider not only policy announcements but also global supply elasticity and demand growth projections.

How It Works Step-by-Step

First, climate rollback policies typically reduce compliance costs for fossil fuel producers. Companies spend billions annually on environmental compliance, carbon mitigation technologies, and emissions reporting. Reduced regulatory burdens can increase profitability and cash flow, especially for mid-cap shale producers operating in regions like the Permian Basin.

Second, lower regulatory barriers may accelerate drilling permits and pipeline approvals. Faster project approvals shorten the time between capital investment and revenue generation. This boosts short-term production expectations, which markets often interpret as bearish for oil prices but bullish for energy company earnings.

Third, a Russia-related energy agreement could shift global crude flows. If sanctions ease or diplomatic barriers relax, additional Russian barrels could re-enter mainstream Western markets rather than being routed through alternative channels. Increased availability tends to suppress price spikes, which benefits consumers but pressures upstream oil producers.

Fourth, financial markets reprice risk premiums. Oil prices include geopolitical risk premiums tied to war, sanctions, and supply disruptions. If a U.S.–Russia agreement reduces perceived instability, part of that premium could evaporate, pulling prices lower even without a dramatic supply increase.

Benefits and Risks

One potential benefit is improved profitability for U.S. energy companies. Reduced environmental restrictions and lower operating expenses, which can increase earnings per share. Higher profits may translate into dividend growth, stock buybacks, and stronger returns for investors in retirement accounts and energy-focused ETFs.

Another advantage is lower gasoline and diesel prices for American consumers if global supply expands. Lower energy costs can reduce inflationary pressure, supporting broader economic growth and benefiting sectors such as manufacturing, transportation, and small business operations.

However, risks are substantial. Overproduction can crash oil prices, hurting highly leveraged shale firms. Many energy companies carry significant debt tied to drilling expansion. If oil falls below break-even levels—often between $45 and $60 per barrel for many U.S. shale operators—profit margins compress quickly.

There is also long-term regulatory uncertainty. Climate policy reversals can change again with new administrations. Investors face the risk of policy whiplash, which complicates capital expenditure planning and infrastructure investment.

Financial Impact or Cost Breakdown

To understand the financial impact, consider a hypothetical scenario. If oil prices fall from $85 to $70 per barrel due to increased global supply, a producer pumping 500,000 barrels per day would see daily revenue drop by $7.5 million. Over a year, that represents a revenue swing of more than $2.7 billion.

Conversely, if regulatory rollbacks reduce operational costs by $5 per barrel, that same producer could offset part of the price decline. On 500,000 barrels daily, that’s $2.5 million in daily cost savings—roughly $912 million annually.

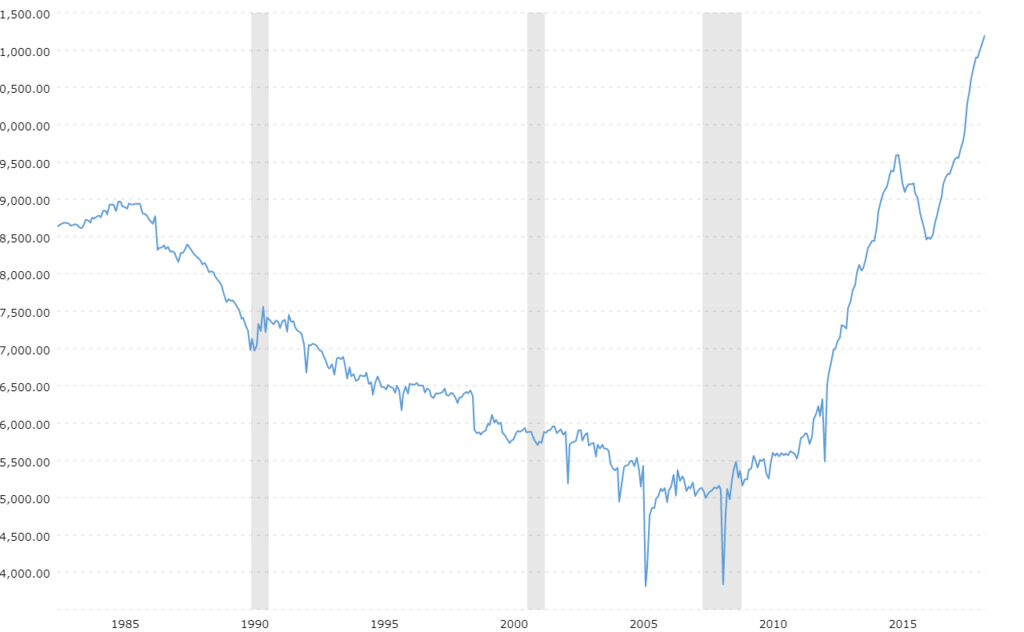

For investors, energy stock valuations often move with oil prices. A 10% change in crude can lead to 15–25% swings in smaller exploration and production stocks due to operating leverage. Large integrated firms may show less volatility because of diversified revenue streams, including refining and chemicals.

Oil ETFs and energy sector ETFs also amplify these movements. Retirement savers exposed to energy through index funds may see portfolio fluctuations tied directly to these policy shifts. Insurance companies, pension funds, and institutional investors often rebalance positions based on forward price curves.

Comparison

Compared to aggressive climate regulation, rollback policies generally favor traditional oil and gas companies while potentially slowing renewable investment momentum. Clean energy stocks could face capital flow reductions if fossil fuels regain a stronger policy advantage.

On the geopolitical side, a Russia deal contrasts sharply with continued sanctions and supply restrictions. Under strict sanctions, global oil prices typically carry a higher risk premium. Under diplomatic détente, price volatility may decline, but producer margins could tighten.

Investors must compare short-term profitability gains with long-term structural energy transition trends. Renewable energy adoption, EV expansion, and corporate decarbonization commitments remain powerful forces regardless of temporary regulatory shifts.

Expert Tips or Best Strategies

Diversification remains critical. Rather than concentrating solely on upstream oil producers, investors may consider integrated majors, pipeline operators, and energy infrastructure firms that generate stable fee-based income.

Monitor break-even levels. Companies with low production costs and strong balance sheets are better positioned to survive oil price volatility. Look for firms with low debt-to-equity ratios and consistent free cash flow generation.

Follow policy signals closely. Energy markets react to speeches, executive orders, and diplomatic developments quickly. Staying informed allows investors to adjust portfolios before major market repricing occurs.

FAQ Section

Could a climate rollback significantly lower U.S. gasoline prices?

A climate rollback alone does not automatically lower gasoline prices. Gasoline is influenced by global crude supply, refinery capacity, seasonal demand, and geopolitical risks.

However, if deregulation increases domestic production and coincides with expanded global supply from Russia, retail fuel prices could experience downward pressure, especially if inflation remains controlled.

Would U.S. energy stocks rise or fall under these policies?

Energy stocks may initially rise due to improved profit expectations from reduced regulatory costs. Investors often reward companies with stronger projected cash flows.

If oil prices fall significantly because of increased supply, stock gains may be offset. Smaller producers are typically more sensitive to price declines than diversified majors.

How would this affect renewable energy investments?

Renewable stocks may face headwinds if policy support weakens. Reduced federal incentives or slower decarbonization mandates can impact growth projections.

However, long-term global climate commitments and private-sector sustainability goals continue driving renewable expansion, even amid short-term policy shifts.

What role does Russia play in global oil pricing?

Russia is among the world’s largest crude exporters. Changes in its export capacity influence global supply balances and price benchmarks.

If sanctions ease or coordination changes, additional supply entering global markets could soften price spikes and reduce volatility premiums.

Are energy ETFs safer than individual oil stocks?

Energy ETFs provide diversification across multiple companies, reducing single-company risk. They are generally less volatile than small-cap exploration firms.

However, ETFs remain tied to oil price trends and sector-wide performance, meaning macroeconomic risks still apply.

Should retirement investors adjust portfolios based on policy changes?

Retirement investors should evaluate exposure levels and risk tolerance rather than react impulsively to headlines. Energy sector volatility can create both opportunities and drawdowns.

A balanced approach that includes diversified sectors, fixed income assets, and long-term growth investments can help mitigate policy-driven swings.

How Trump’s Climate Rollback and Russia Deal Could Impact U.S. Energy Stocks and Oil Prices ultimately depends on how supply, demand, and geopolitical risk premiums evolve together. Reduced regulatory burdens may boost corporate profitability, while increased global supply could moderate oil prices and influence stock valuations.

Investors must weigh short-term earnings gains against long-term structural energy transitions and policy uncertainty. Monitoring global production data, diplomatic developments, and regulatory changes will remain essential for navigating this evolving landscape. Energy markets are cyclical, politically sensitive, and deeply interconnected with the broader U.S. economy—making informed strategy more important than ever.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.