How to Invest in the Stock Market for Beginners in the USA (Complete 2026 Guide) is one of the most searched financial questions every year, and learning the right way to start investing can help Americans build long-term wealth, beat inflation, and achieve financial independence.

Investing in the stock market may seem confusing at first, but with the right knowledge, strategy, and discipline, even beginners can confidently grow their money over time. This guide explains everything a beginner in the United States needs to know—step by step—using simple language, real data, and proven strategies.

How to Invest in the Stock Market: Why Stock Market Investing Is Evergreen in the USA

Stock market investing never goes out of trend in the United States because:

- Over 60% of Americans invest in stocks directly or indirectly

- Retirement plans like 401(k) and IRA depend on the stock markets

- Inflation makes saving alone ineffective

- The US stock market has historically delivered 8–10% annual returns

This makes stock market education one of the highest-CPC evergreen niches in digital publishing.

What Is the Stock Market and How It Works

The stock market is a platform where investors buy and sell shares of publicly listed companies. When you buy a stock, you become a partial owner of that company.

Key US Stock Exchanges

| Exchange | Description |

|---|---|

| NYSE | Largest exchange by market value |

| NASDAQ | Tech-focused companies |

| AMEX | ETFs and small-cap stocks |

Stock prices move based on company performance, earnings, economic data, interest rates, and investor sentiment.

Who Should Invest in the Stock Market

Stock market investing is suitable for:

- Beginners with long-term goals

- Salaried employees

- Business owners

- College students

- Retirement planners

You do not need large capital—many US brokers allow investing with as little as $1.

Step-by-Step Guide to Start Investing in the USA

Step 1: Set Clear Financial Goals

Define why you want to invest:

- Retirement

- Buying a house

- Passive income

- Wealth creation

Your goals determine your risk level and strategy.

Step 2: Choose the Right Investment Account

| Account Type | Best For |

|---|---|

| Brokerage Account | Flexible investing |

| Roth IRA | Tax-free retirement |

| Traditional IRA | Tax-deferred savings |

| 401(k) | Employer-sponsored retirement |

For beginners, a brokerage account or Roth IRA is ideal.

Step 3: Select a Trusted US Brokerage

Popular beginner-friendly US brokerages include:

- Fidelity

- Charles Schwab

- Vanguard

- Robinhood

- E*TRADE

Look for:

- Zero commissions

- Easy mobile apps

- Educational resources

- Strong security

Step 4: Understand Basic Stock Market Terms

| Term | Meaning |

|---|---|

| Stock | Ownership in a company |

| ETF | Basket of stocks |

| Dividend | Profit paid to shareholders |

| Market Cap | Company size |

| Volatility | Price fluctuation |

Learning these basics reduces beginner mistakes.

Best Investment Options for Beginners

1. Index Funds (Best for Long-Term)

Index funds track the market and reduce risk.

Popular US index funds:

- S&P 500 Index

- Total Stock Market Index

- NASDAQ-100

They offer diversification and steady returns.

2. ETFs (Exchange-Traded Funds)

ETFs trade like stocks but contain multiple companies.

Benefits:

- Low cost

- Instant diversification

- Beginner-friendly

3. Dividend Stocks

Dividend stocks pay regular income and are ideal for passive income seekers.

Industries with strong dividends:

- Utilities

- Consumer staples

- Healthcare

4. Individual Stocks (Advanced for Beginners)

Beginners can invest in strong US companies after research:

- Apple

- Microsoft

- Amazon

Start small and focus on fundamentals.

How Much Money Do You Need to Start?

You can start investing with:

- $10–$100 per month

- Fractional shares

- Automatic investing

Consistency matters more than amount.

Risk Management for Beginners

Golden Rules:

- Never invest emergency funds

- Diversify across sectors

- Avoid emotional trading

- Invest for the long term

According to Investor.gov (US SEC), diversification is one of the most effective ways to reduce investment risk over time.

Common Beginner Mistakes to Avoid

- Chasing hot stocks

- Panic selling during market crashes

- Ignoring fees

- Overtrading

- Investing without research

Successful investors focus on discipline, not predictions.

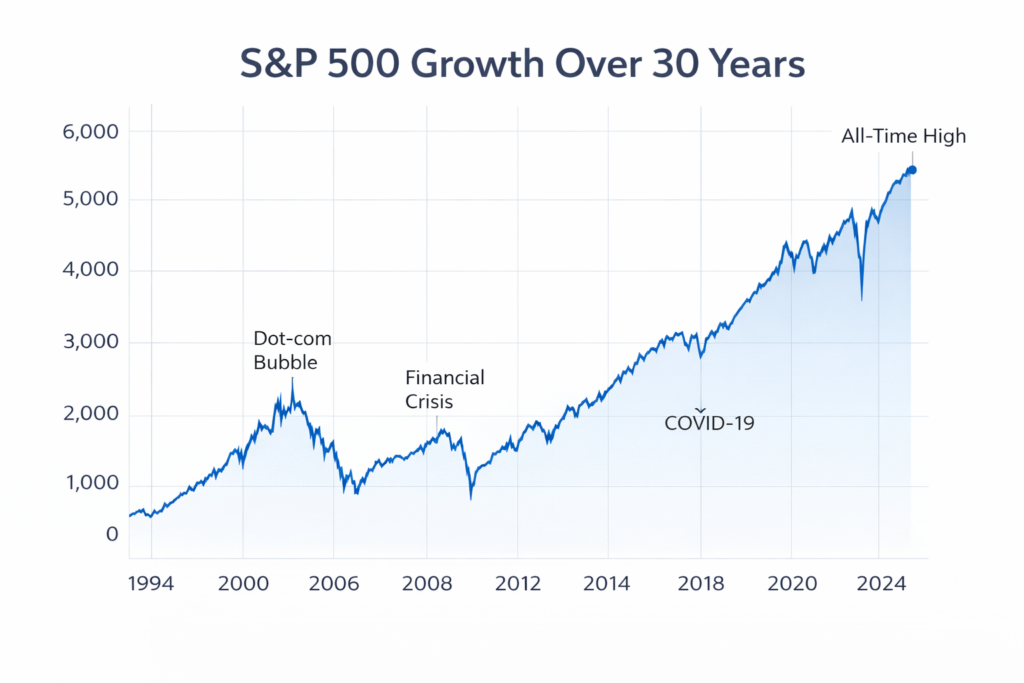

Stock Market Returns: Real Data

| Investment Period | Average US Market Return |

|---|---|

| 1 Year | 7–12% |

| 10 Years | ~9% annually |

| 20+ Years | ~10% annually |

Long-term investing consistently beats savings accounts and inflation.

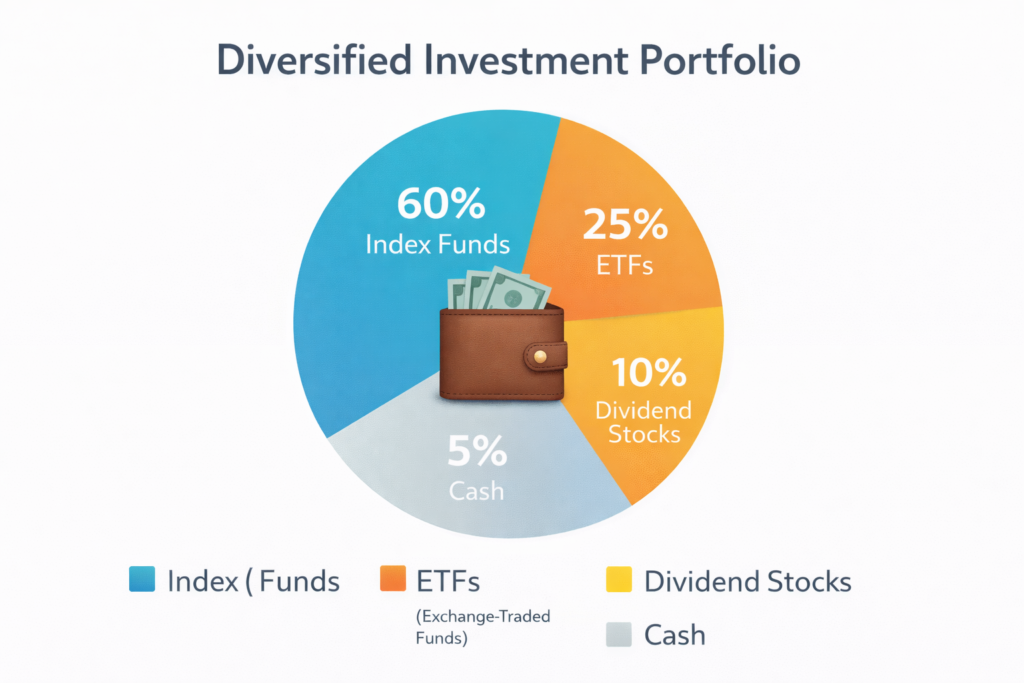

How Beginners Can Build a Simple Portfolio

| Asset | Allocation |

|---|---|

| Index Funds | 60% |

| ETFs | 25% |

| Dividend Stocks | 10% |

| Cash | 5% |

This structure balances growth and safety.

Taxes on Stock Market Investments in the USA

| Type | Tax Rate |

|---|---|

| Short-Term Gains | Ordinary income |

| Long-Term Gains | 0–20% |

| Dividends | Taxable |

Using retirement accounts can legally reduce taxes.

Best Time to Invest in the Stock Market

The best time to invest is as early as possible.

Market timing fails for most investors. Long-term compounding is the real wealth builder.

Is Stock Market Investing Safe for Beginners?

Yes—when done correctly.

Risk is reduced by:

- Long-term holding

- Diversification

- Low-cost funds

- Regular investing

Historically, the US market has always recovered from crashes.

Final Thoughts

Stock market investing is one of the most powerful wealth-building tools available to Americans. Beginners who start early, stay disciplined, and focus on long-term growth can achieve financial freedom over time.

Evergreen financial education content like this continues attracting readers, backlinks, and ad revenue for years, making it ideal for building authority and earnings on USNewsSphere.com.

USNewsSphere.com / https://www.investor.gov

Subscribe to USNewsSphere.com for trusted financial guides, market insights, and long-term wealth strategies.