Trump Tariffs on China: New 50% Hike Could Disrupt Jobs, Inflation, and Global Markets — This controversial proposal from former President Trump could reshape the U.S. economy, pressure small businesses, and shake global financial markets. Here’s what it really means for the American people.

What Is the Trump Tariff Hike and Why It Matters

President Trump announced that unless China removes its 34% retaliatory tariffs, the U.S. will implement a new 50% tariff on Chinese imports, raising the total effective tariff rate to 104%. The goal? To pressure China into negotiating more favorable trade terms.

Why this matters to the USA:

- China supplies nearly 18% of all U.S. imports

- A tariff this large would dramatically raise costs for goods and materials

- Consumers and businesses will feel the immediate pinch

Impact on American Jobs and Manufacturing — Who’s at Risk?

This section explores how the tariff hike could lead to job losses, especially in sectors dependent on Chinese components and materials.

Key Insights:

- Over 300,000 U.S. jobs were lost during the last major tariff wave (source: Oxford Economics)

- Industries at highest risk: Automotive, Tech, Retail, Agriculture

- U.S. manufacturers relying on Chinese inputs may face unsustainable costs

U.S. Industries Most Exposed to Chinese Imports

| Industry | Dependency on Chinese Imports | Jobs at Risk (Est.) |

|---|---|---|

| Consumer Electronics | High | 65,000+ |

| Auto Parts | Medium-High | 50,000+ |

| Furniture | Medium | 28,000+ |

| Agriculture Tools | Medium | 20,000+ |

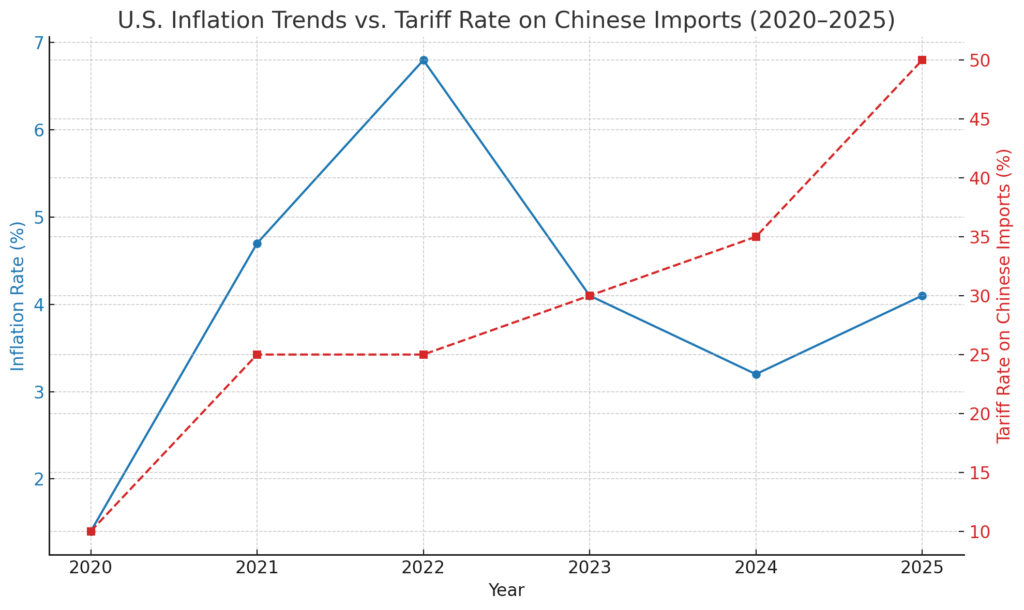

Trump Tariffs on China, Will This Increase Inflation and Cost of Living?

Here, we explain how tariffs function like hidden taxes and why this hike could lead to significantly higher consumer prices.

- U.S. inflation stands at 4.1% as of Q1 2025

- This tariff could add 0.8% to inflation, according to the Brookings Institution

- Products likely to get more expensive: TVs, smartphones, furniture, clothing, toys

Trump Tariffs on China, Global Market Reactions — Will This Shake the World Economy?

Global investors fear a second wave of economic disruption similar to the 2018–2020 trade war. Here’s what’s happening now.

Market Response Snapshot:

- S&P 500 dropped 0.2% after Trump’s tariff announcement

- NASDAQ lost 150 points within hours

- Global commodities like crude oil and steel fell due to demand fears

What This Means:

- U.S. companies exporting to China may suffer

- Global trade alliances may shift away from the U.S.

- America risks long-term isolation if tensions escalate

China’s Reaction and Future Trade Risks for the USA

This section breaks down how China is responding, and what long-term damage this standoff could cause to U.S. economic dominance.

- China refuses to remove its 34% retaliatory tariffs

- Chinese government labeled Trump’s threat as “economic bullying”

- China is increasing trade ties with Europe, Brazil, and Russia

The Domino Effect of Trade War Escalation

Trump’s 50% Tariff Threat

|

---------------------------------

| | |

China Retaliates Market Panic Global Alliances Shift

| |

Costly Imports EU, Brazil Strengthen Trade

|

Consumer Prices Soar

How Will This Affect Everyday Americans?

From grocery shelves to auto dealerships, these tariff hikes could deeply affect the wallets of average American families. Here’s what to watch for:

- Price hikes across electronics, clothes, and daily-use goods

- Potential job instability in trade-heavy states like Michigan, Texas, and California

- Rising inflation that reduces purchasing power

Final Stats:

- 60% of Walmart’s electronics section relies on Chinese imports

- Every 10% increase in tariffs = ~2.5% rise in retail prices

- GDP growth in Q2 2025 may slow by 0.3% if tariffs are implemented

Trump’s 50% tariff proposal could deliver real pain to American consumers and workers, while destabilizing the global economy. Whether you’re in business, finance, or simply trying to stretch your paycheck, this move could hit close to home.

[USnewsSphere.com / apn]