President Donald Trump said at a Jan. 29 Cabinet meeting that he wants to keep U.S. home prices high even as he claims to make housing more affordable — a stance that contradicts earlier promises and has sent shockwaves through the housing market and policymaking circles. According to reports, Trump stated he does not want to “destroy the value” of existing homes to make them cheaper for new buyers.

This matters now because millions of Americans are struggling with housing affordability, and rising home values — combined with high mortgage rates — continue to lock first-time buyers out of the market. Real estate analysts, lawmakers, and economists are closely watching the shift in tone because it may signal long-term policy direction ahead of key elections and economic forecasts.

What Trump Said vs. What He Promised Earlier

In his remarks, Trump doubled down on protecting the value of existing homes rather than pushing for sharp price reductions — claiming that keeping prices high benefits current homeowners’ wealth and rewards “people who worked hard.”

This statement appears to conflict with prior actions:

• Trump announced plans to ban large institutional investors from buying single-family homes, saying this would free up properties for individual buyers.

• His administration ordered $200 billion in mortgage bond purchases designed to lower mortgage rates.

However, lower mortgage rates don’t directly lower home prices, and economists note these dual signals have left the policy direction somewhat unclear.

U.S. Home Prices: Why This Policy Shift Matters Now

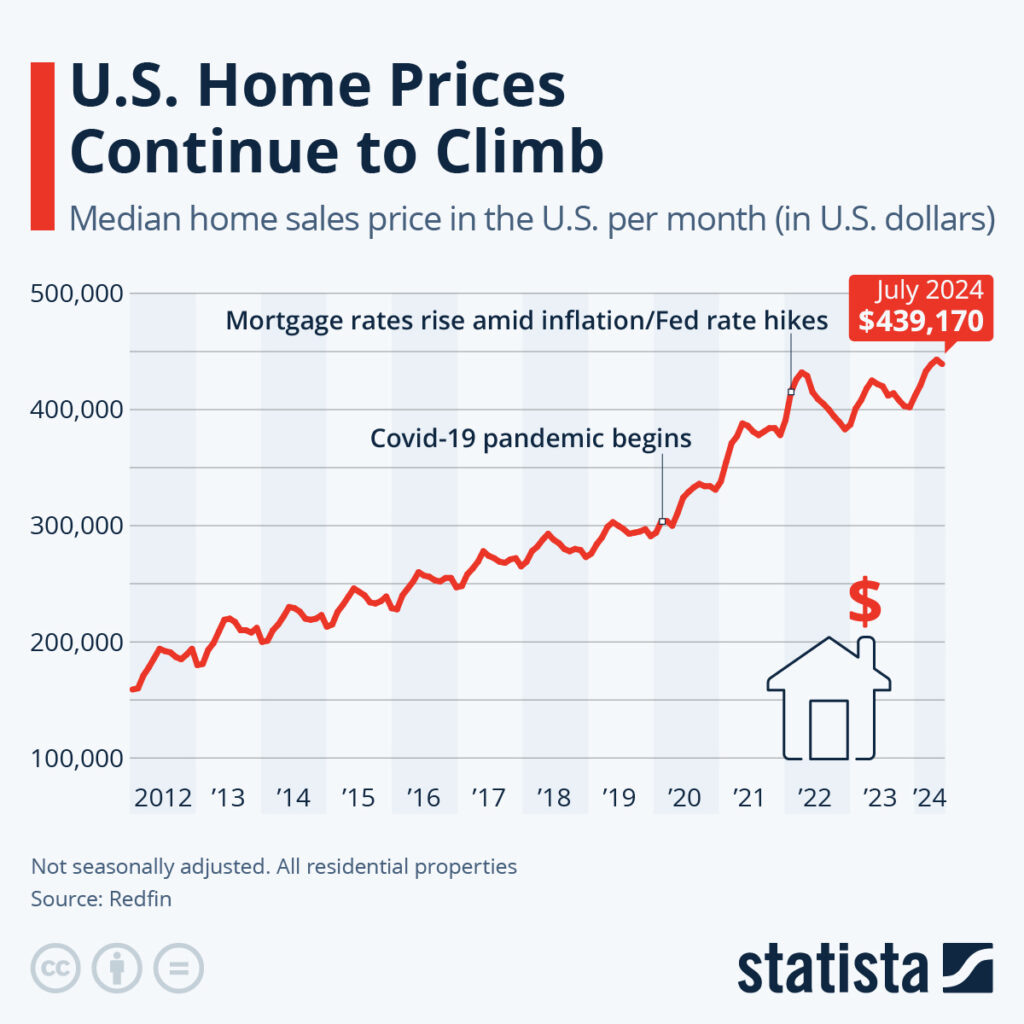

The U.S. housing market remains tight: home prices continue to trend up even as affordability worsens compared to wages and income growth. New data shows home prices rose again recently, intensifying the gap between what buyers can afford and what sellers want.

High home prices paired with elevated mortgage rates mean first-time buyers face the greatest difficulty in decades. Meanwhile, sellers enjoy strong equity gains, and existing homeowners often resist selling because they would have to pay similar or higher prices for replacement homes.

This matters now because if policy tilts toward price preservation rather than price relief, many renters and younger buyers may find it even harder to attain homeownership. Economists warn that policy signals that discourage affordability measures can prolong disparities in wealth and housing access.

The Debate: Affordability vs. Property Value Protection

Experts broadly agree on one key point: supply matters more than policy rhetoric. There is a shortage of housing inventory in many regions, and without building millions more homes, prices will remain high regardless of federal actions.

Senators and housing advocates have criticized recent moves, saying current policies increase costs for builders, drive up material prices through tariffs, and slow the rate of new construction.

Some economists also argue that government interventions — such as restricting institutional investor purchases — may have limited impact on broader pricing unless paired with efforts to boost supply.

How Consumers Are Affected Right Now

If home prices stay high:

• First-time buyers may need larger down payments or face higher monthly costs due to persistently expensive homes.

• Existing homeowners may extract greater home equity, but risk paying a premium for their next home.

• Mortgage rates, while influenced by federal bond purchases, could still stay elevated because of broader economic trends like inflation and labor costs.

Mortgage lenders and housing-related stocks reacted strongly to the administration’s housing announcements, signaling investor belief that these policies will shape market conditions for months.

What Analysts Say About the Policy’s Future Impact

Most independent analysts believe that without significant housing supply increases, pricing pressure will remain strong. Recent modeling suggests home prices might stall in 2026 but will not collapse — meaning high prices are here to stay without major structural reforms.

Experts also warn that measures that fail to address root causes — such as supply shortages, labor constraints in construction, and local zoning rules — will only provide temporary relief or, in some cases, make markets less affordable over time.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.