Trump Accounts Surge Past 500,000 Signups, Signaling a Major Shift in How Americans Build Wealth

In a major development that’s capturing nationwide attention, Treasury Secretary Scott Bessent announced that more than 500,000 American families have already applied for “Trump Accounts” — government-backed investment accounts launched under President Donald Trump’s economic agenda — in just days since the program opened, signaling strong early public interest and bipartisan corporate backing. Who, what, why, and the broader impact are all clear: this initiative could reshape how a generation of Americans builds financial wealth.

As incomes flatten and affordability concerns deepen across the U.S., especially ahead of the 2026 midterm elections, the “Trump Accounts” program represents one of the most talked-about new federal economic policies, designed to expand investment access and encourage long-term savings by making every child a shareholder from birth.

What Are Trump Accounts and How They Work

At its core, “Trump Accounts” are tax-advantaged investment accounts created through the One Big Beautiful Bill Act to provide every child born between January 1, 2025, and December 31, 2028, a federal seed investment — currently $1,000 — directly into a diversified stock index fund such as one that tracks the S&P 500. These accounts are intended to grow tax-deferred, similar to an IRA, until the beneficiary reaches adulthood.

The idea is straightforward: instead of purely savings vehicles like traditional education or retirement accounts, these accounts are invested in equities with the potential for compound growth over decades, giving every young American a financial stake in the market and a head start on long-term wealth building.

Officials say the program is voluntary. Parents can register a child via IRS tax forms, and once enrolled, the accounts accept additional contributions from family, friends, employers, and even state governments, expanding their growth potential.

Bessent’s Announcement: Half a Million Families Already Enrolled

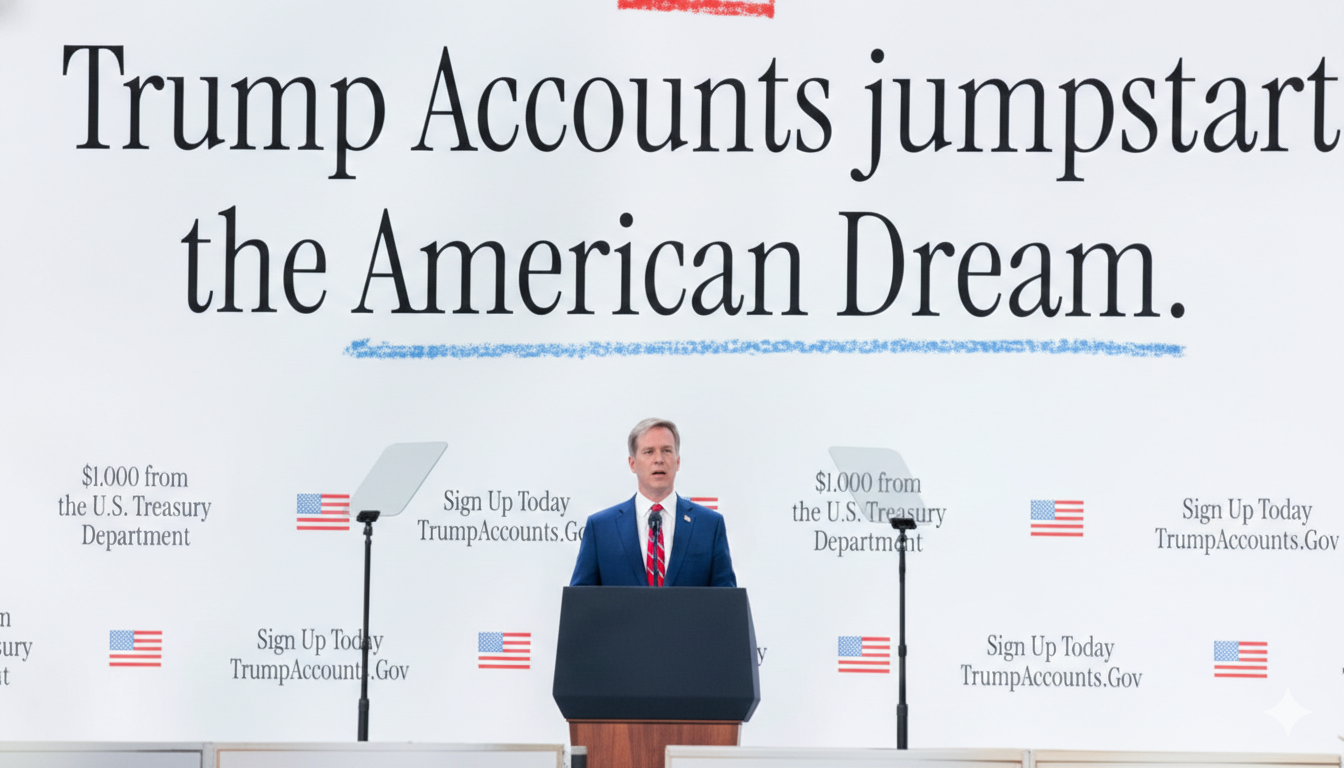

Speaking at a White House-hosted summit focused on Trump Accounts, Treasury Secretary Scott Bessent revealed that over 500,000 families nationwide have applied for these accounts within days of their availability, a figure that surprised many independent analysts.

Bessent emphasized that this early participation reflects both high public interest and confidence among employers and philanthropists who have pledged to match government contributions and encourage widespread participation.

Some of the major companies publicly committed to future contribution matching include financial giants such as Bank of America, JPMorgan Chase, Intel, and others — a notable corporate endorsement for a federal investment program.

Why Trump Accounts Could Change Financial Opportunity in America

The rationale behind Trump Accounts, as officials and proponents explain it, is rooted in expanding financial inclusion: with roughly one-third of Americans historically lacking any stock market exposure, the new program seeks to reduce wealth inequality by giving young Americans automatic access to market growth from birth — a concept some economists describe as democratizing investment.

Analysts suggest that, assuming historical long-term returns are maintained, a $1,000 seed investment at birth could grow into tens or even hundreds of thousands of dollars by adulthood, especially if supplemented with additional contributions over time.

This could influence future economic stability for households across the income spectrum by making ownership and investment more universal, particularly among younger generations who traditionally underinvest.

Political Context: Affordability and 2026 Elections

The Trump Accounts initiative is emerging at a politically charged moment. With inflation, living costs, and affordability fronts dominating public debate, the program is positioned by its supporters as a forward-looking tool that doesn’t just alleviate immediate financial strain but promotes long-term financial empowerment.

Republican leaders have highlighted the program as evidence of proactive economic policy ahead of the 2026 midterms, while critics warn that investing in stock markets carries risks and may benefit higher-income families disproportionately.

Still, the bipartisan corporate support and early enrollment numbers show both public interest and private sector confidence.

Economic Impact: Beyond the Numbers

Financial experts note that the long-term impact of Trump Accounts may go beyond mere account balances: by making investment exposure nearly universal, the policy could influence broader trends in savings habits, homeownership, retirement security, and even entrepreneurship, as younger Americans accumulate market experience earlier in life.

Supporters argue that this early exposure also advances widespread financial literacy, possibly closing critical gaps in understanding investments and long-term financial planning among future generations.

Still, economists emphasize uncertainty: market risk means outcomes vary, and long-term benefits are not guaranteed for every participant. The balance between opportunity and volatility remains a focal point for economists watching the policy rollout.

What Comes Next: Rollout and Public Engagement

The pilot phase of Trump Accounts is slated to expand throughout 2026, with formal enrollment continuing and additional support from states and employers expected. Advocates say continued public outreach, employer matching programs, and educational campaigns will be central to overall program growth.

As the initiative evolves, the combination of government seed capital, private contributions, and corporate partnerships could create a new national savings culture — but public participation and market performance will ultimately determine its long-term success.

Subscribe to trusted news sites like USnewsSphere.com for continuous updates.